From 0 to 130 Properties in 3.5 Years

Table of Contents

Cover

WHAT’S NEW IN THIS EDITION

Readers’ comments

Title page

Copyright page

Acknowledgements

Epigraph

Preface

G’DAY!

MY ORIGINAL MASTER PLAN FOR FINANCIAL FREEDOM

Part I: The Steve McKnight story

1 Humble beginnings

DANGEROUS ASSUMPTIONS

MY WAKE-UP CALL

THE ‘ALL-HYPE, NO-SUBSTANCE’ SEMINAR

A NEW DIRECTION

2 Making a start

FINDING THE NEEDLE IN A HAYSTACK

IT’S ALL ABOUT APPLICATION

3 Ramping it up

A CHANCE MEETING WITH A FRIENDLY CANADIAN

TURNING AN IDEA INTO AN INVESTING SYSTEM

AN URGENT SHIFT IN FOCUS

NEW ZEALAND — HERE WE COME

MULTIPLICATION BY DIVISION

THE CURRENT ENVIRONMENT

HOW TO CREATE A MULTI-PROPERTY PORTFOLIO TODAY

4 Achieving financial freedom

WILL YOU BE HAPPIER?

A DAY IN THE LIFE OF STEVE

DAVE AND STEVE PART WAYS

WHAT’S NEXT FOR STEVE?

Part II: Property investing home truths

5 The truth about creating wealth

THE SECRET TO BECOMING RICH

LIVING BEYOND HER MEANS

SOLVING YOUR MONEY PROBLEM

I’VE NEVER BEEN MORE ADAMANT!

6 The truth about property investing

WHY INVEST IN PROPERTY?

DECISION TIME

PASSIVE INCOME AND PROPERTY INVESTING

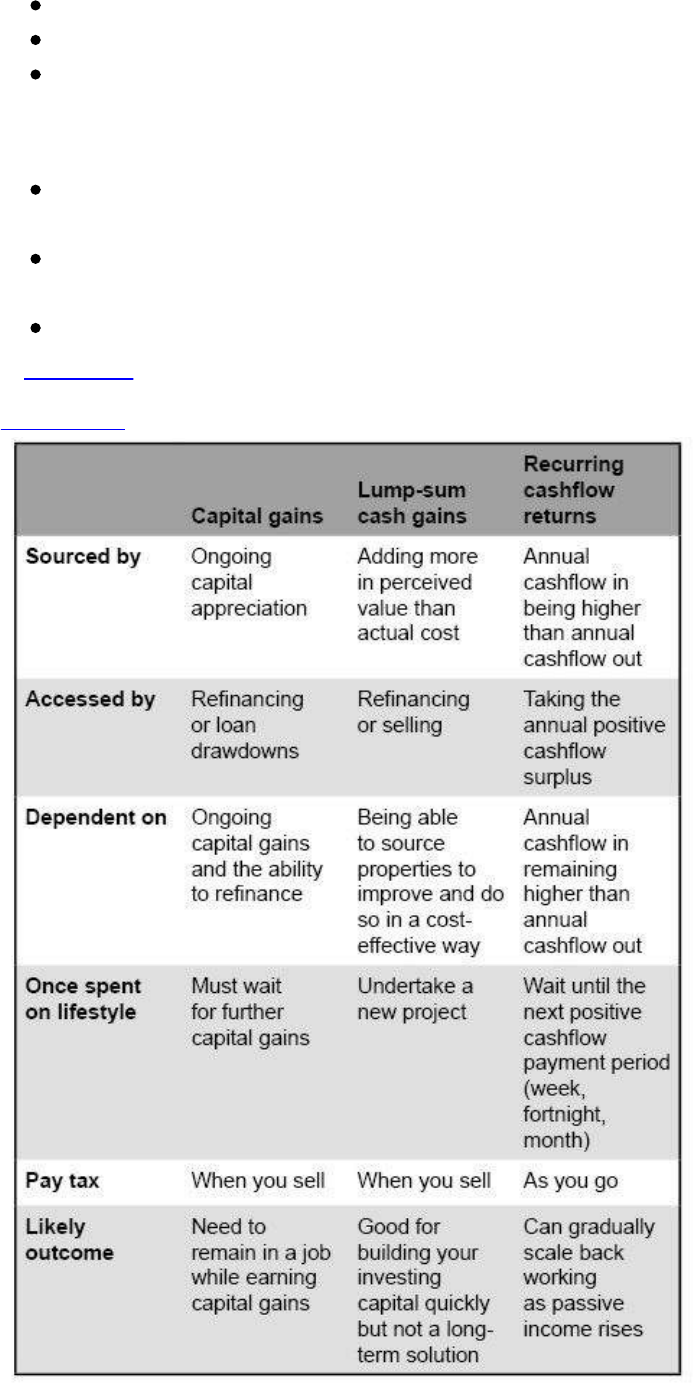

WHICH IS BETTER, CAPITAL GAINS OR POSITIVE CASHFLOW RETURNS?

MEET CRACKERS

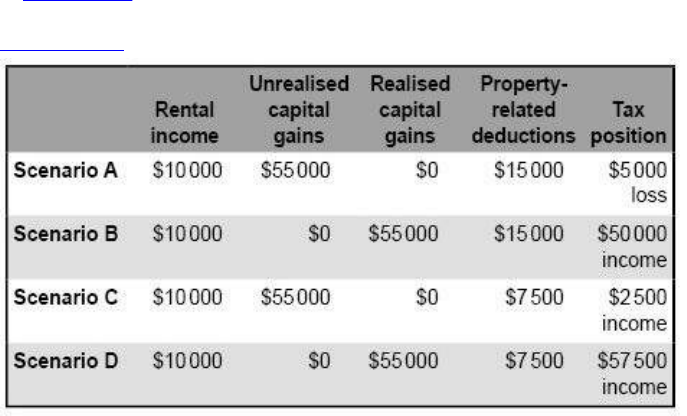

7 The truth about negative gearing

WHY IS NEGATIVE GEARING SO POPULAR?

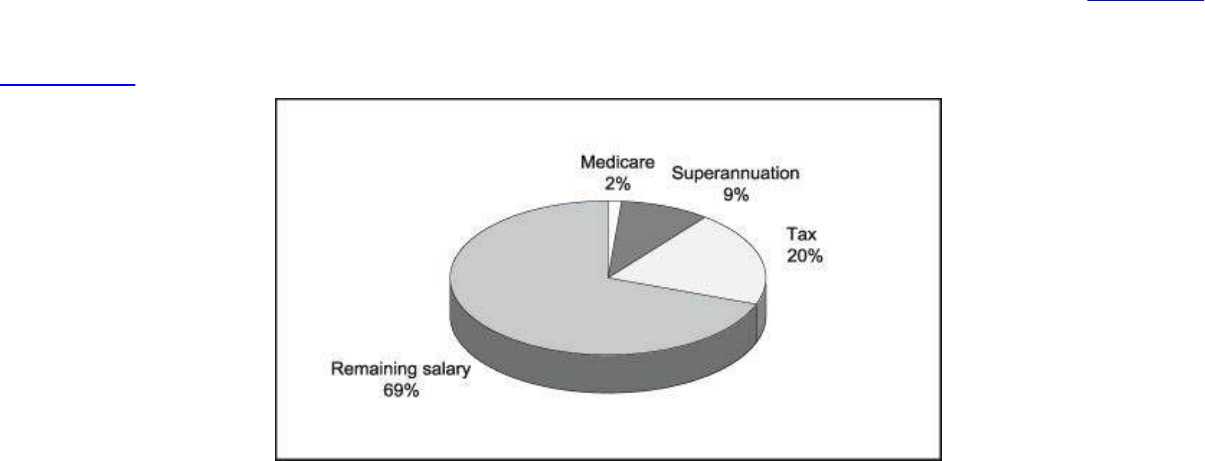

PROPERTY AND TAXATION

CAN YOU RELY ON CAPITAL GAINS?

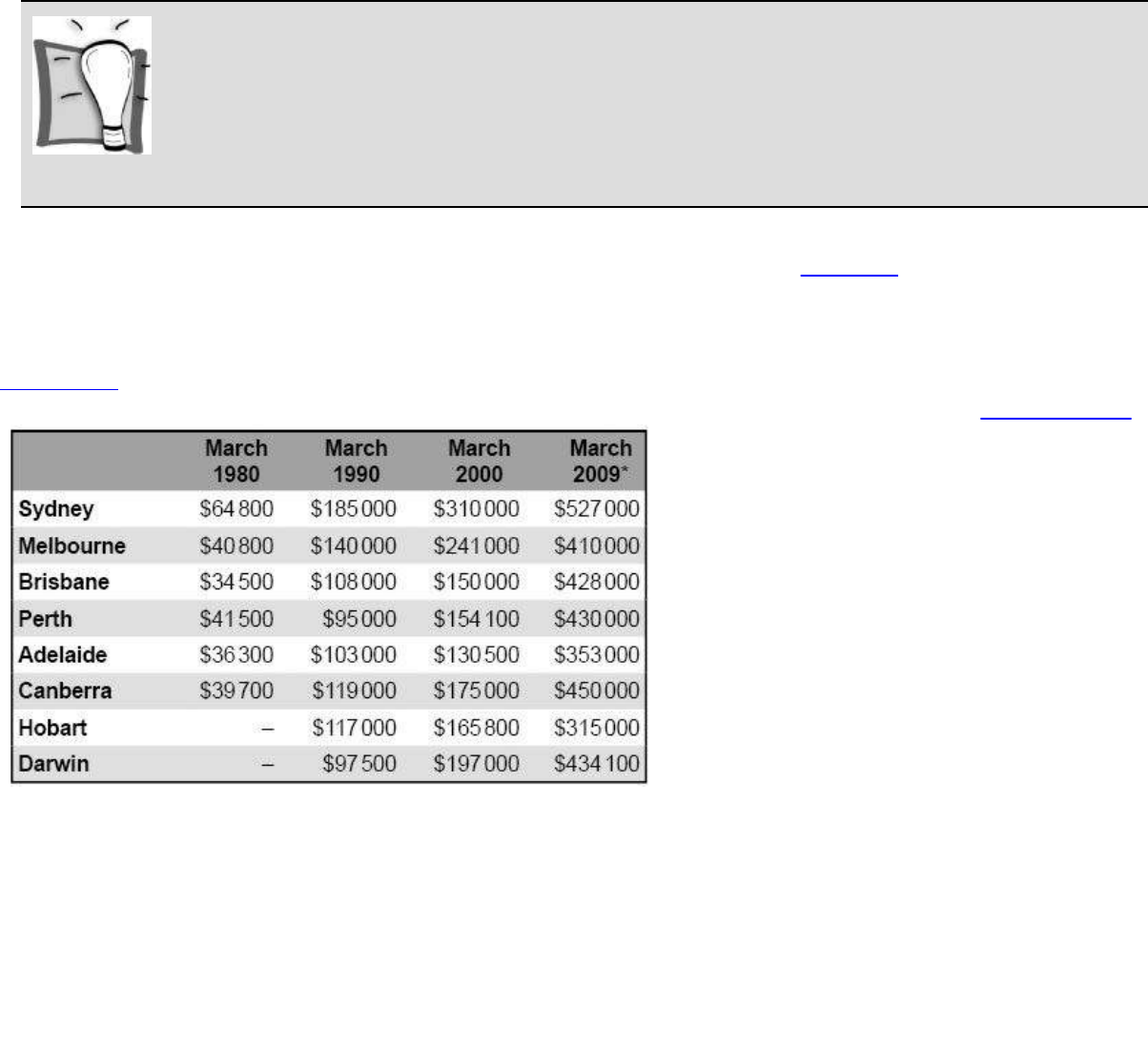

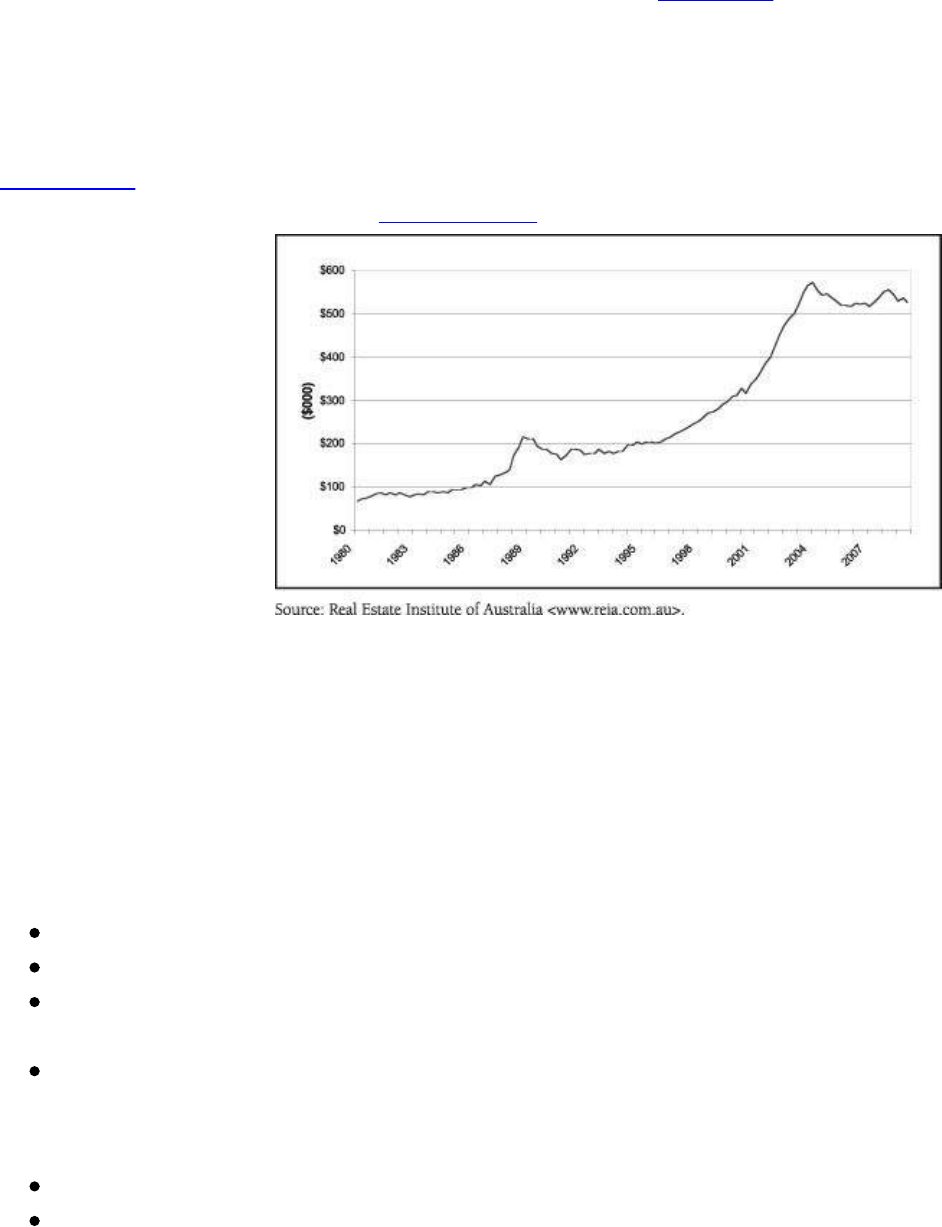

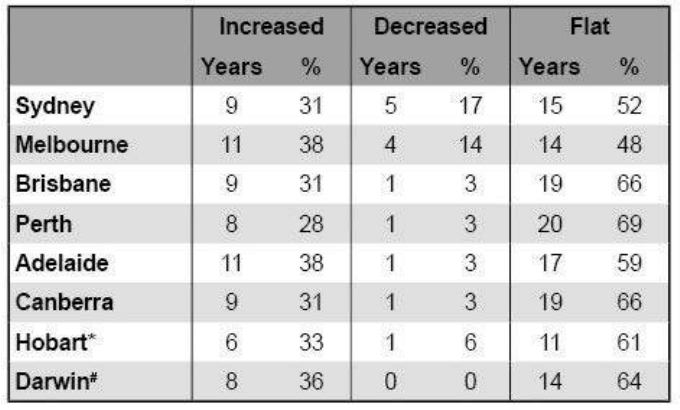

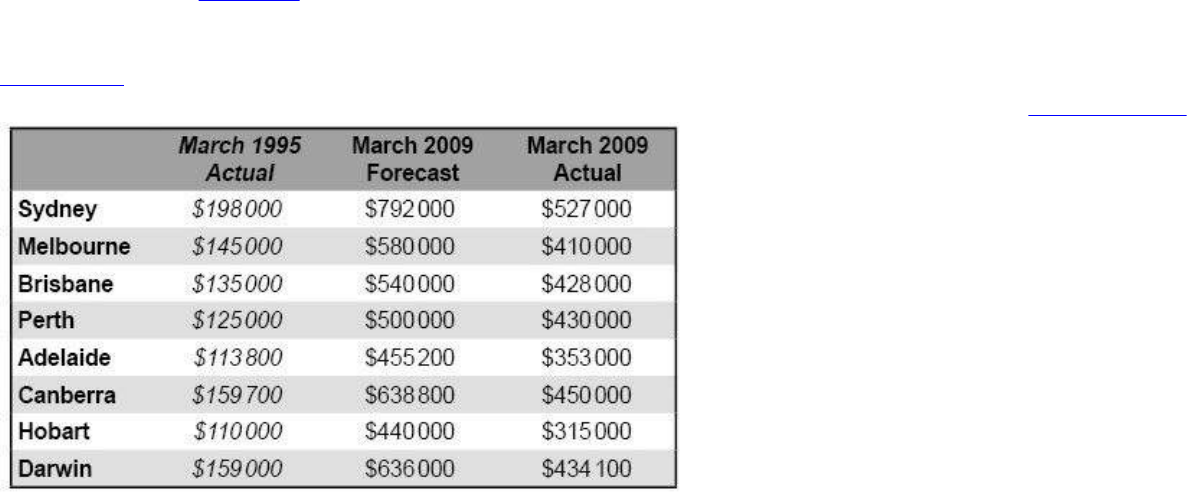

DO PROPERTY PRICES REALLY DOUBLE EVERY SEVEN YEARS?

FALLING TAX RATES

INFLATION

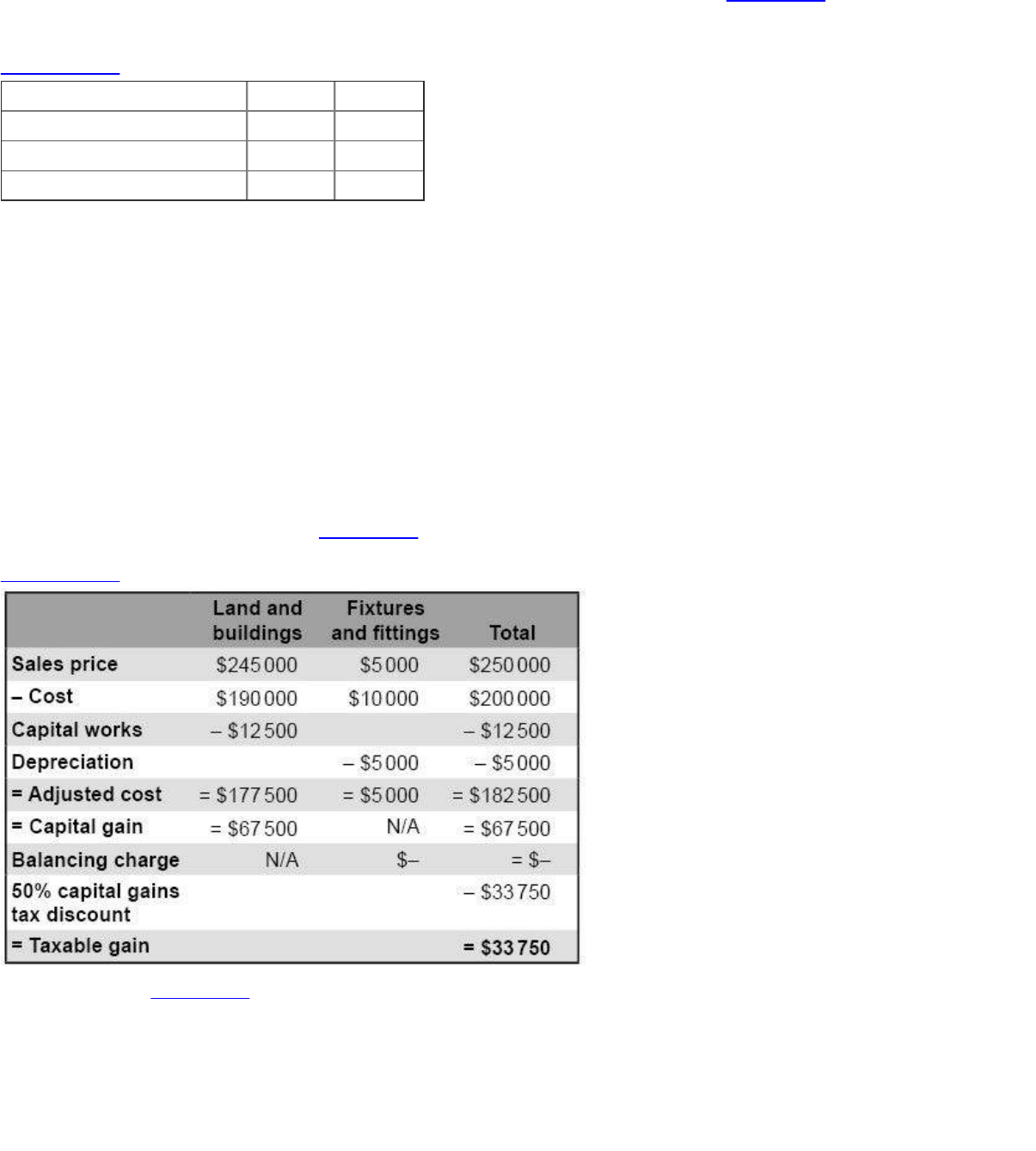

CAPITAL GAINS TAX

THE BOTTOM LINE ON NEGATIVE GEARING

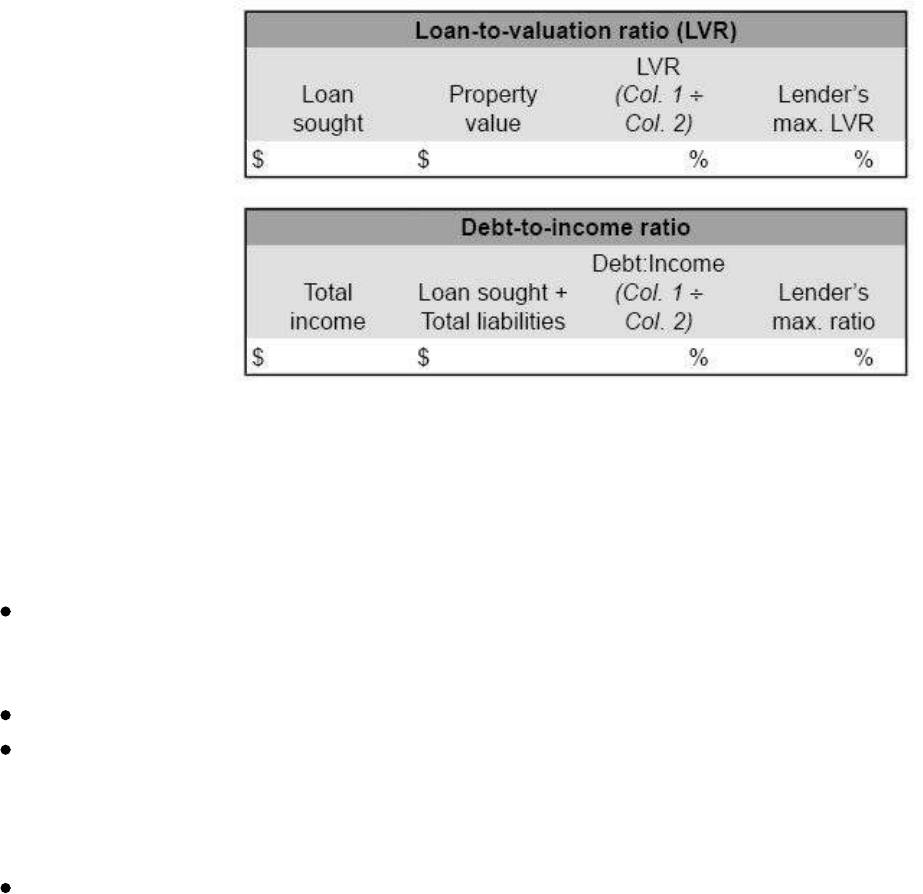

8 The truth about financing

WHAT IS LEVERAGE?

GETTING A LOAN

LEARN THE INDUSTRY

OBTAIN PRE-APPROVAL

SUSTAINABLE INVESTING

LOAN APPLICATION CHECKLIST

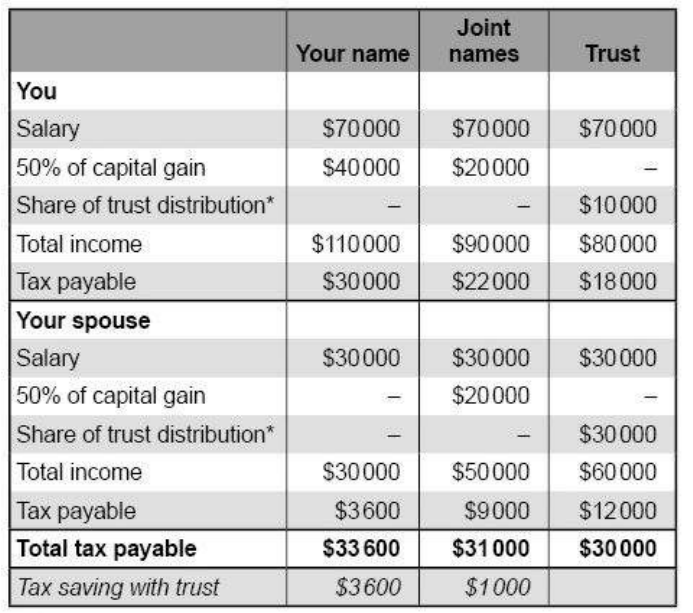

9 The truth about structuring

LIFESTYLE AND FINANCIAL ASSETS

WHAT IS STRUCTURING?

WHAT ENTITY SHOULD YOU BUY IN?

WHY YOU SHOULDN’T BUY PROPERTY IN YOUR OWN NAME

THE STRUCTURE STEVE USES

WANT MORE INFORMATION?

10 The truth about depreciation

WHAT IS DEPRECIATION?

DOES REAL ESTATE DEPRECIATE?

TAX AND DEPRECIATION

TURNING NEGATIVE CASHFLOW INTO POSITIVE CASHFLOW

TAX DEFERRAL, NOT TAX SAVING

FINAL THOUGHTS ON DEPRECIATION

11 The truth about selling

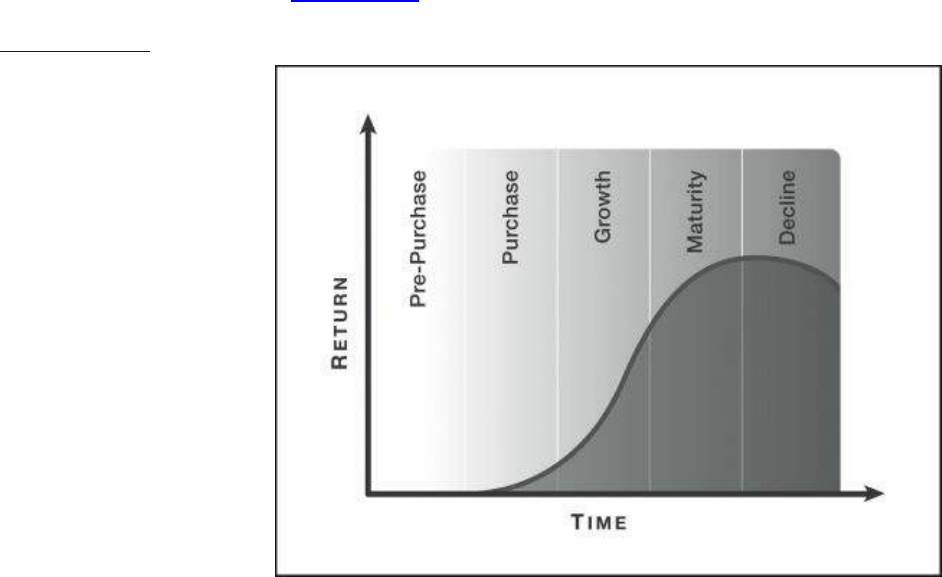

PROPERTY LIFECYCLE

FAST-TRACKING USING COMPOUNDING RETURNS

REASONS WHY YOU WOULDN’T SELL

REASONS WHY YOU WOULD SELL

CAN’T BORROW ANY MORE MONEY?

Part III: Strategies for making money in property

12 Buy and hold (rentals)

TYPES OF BUY AND HOLD PROPERTIES

HOW YOU CAN MAKE A PROFIT

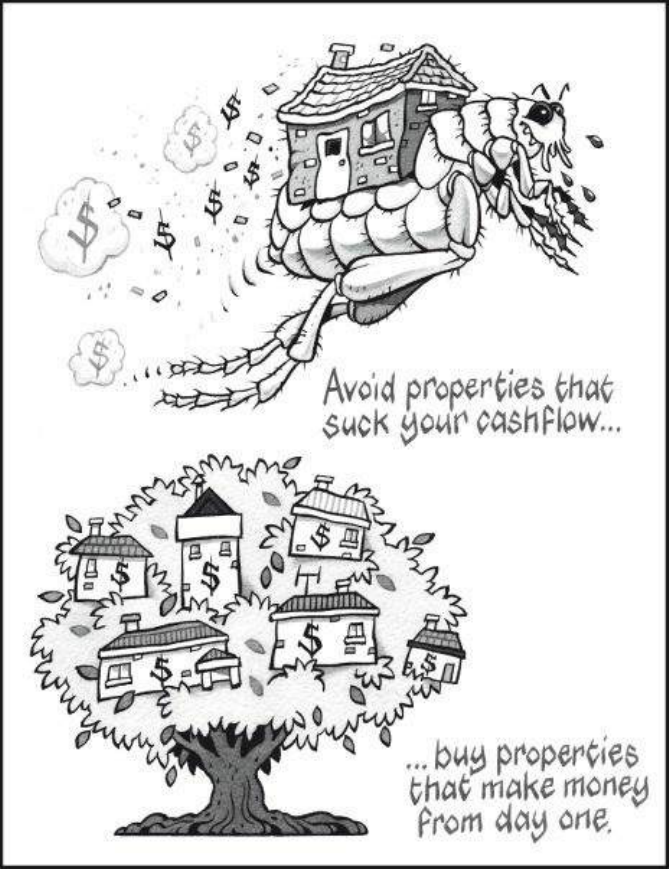

CREATING POSITIVE CASHFLOW PROPERTIES

IDENTIFYING THE REAL ASSET

PARTNERS IN WEALTH (THE STEVE MCKNIGHT APPROACH TO

LANDLORDING)

SOLUTIONS

13 Vendor’s finance sales

WHAT IS A VENDOR’S FINANCE SALE?

THE FOUR PHASES OF A VENDOR’S FINANCE TRANSACTION

THE HUMAN NATURE OF A VENDOR’S FINANCE SALE

VENDOR FINANCING IN TODAY’S PROPERTY MARKET

THE CRITICAL SUCCESS FACTORS IN A VENDOR’S FINANCE SALE

THE ARGUMENTS FOR VENDOR’S FINANCE

THE ARGUMENTS AGAINST VENDOR’S FINANCE

THE FINAL WORD ON VENDOR’S FINANCE SALES

14 Lease options

MY ‘HOMESTARTER’ APPROACH

THE MORE FORMAL LEASE OPTION MODEL

A CONTRIBUTION BY LEASE OPTION EXPERT TONY BARTON

THE DIFFERENCE BETWEEN A VENDOR’S FINANCE SALE AND A LEASE

OPTION

CRITICAL SUCCESS FACTORS IN A LEASE OPTION

KNOW THE LAWS!

WHO WOULD BE INTERESTED IN A LEASE OPTION?

LEASE OPTIONING IN TODAY’S PROPERTY MARKET

SANDWICH LEASE OPTIONS

THE FINAL WORD ON LEASE OPTIONS

15 Simultaneous settlements

WHAT IS A SIMULTANEOUS SETTLEMENT?

CRITICAL SUCCESS FACTORS IN A SIMULTANEOUS SETTLEMENT

TRANSACTION

THE FINAL WORD ON SIMULTANEOUS SETTLEMENTS

16 Subdivisions

A SUBDIVISION DEAL

THE ART OF SUBDIVIDING

17 Renovations

MY FIRST RENO DEAL

THE RENO FORMULA FOR SUCCESS

ARE YOU AN INVESTOR OR A RENOVATOR?

18 Developing

NAIVE THINKING

THE 6 Ps OF PROPERTY DEVELOPING

CRUNCHING THE NUMBERS

SMALL DEAL: $77 000 PROFIT IN 12 MONTHS

NINE TIPS FOR FIRST-TIME DEVELOPERS

Part IV: Your next purchase

19 Planning for success

THE PATH OF LEAST RESISTANCE

YOUR PERSONAL WEALTH-CREATION PLAN AND PATH OF LEAST

RESISTANCE

MAKING THE NECESSARY SACRIFICE

HOW LONG WILL IT TAKE?

THE PLATEAU EFFECT

THE NEXT STEP

20 The Asset Zoo

THE CHICKEN OR THE NEST EGG?

THE ASSET ZOO

MIXING UP THE ANIMALS

THE FINAL WORD ON THE ASSET ZOO

21 Finding the money to begin investing

YOUR SAVINGS

YOUR EQUITY

THE MONEY RAISED FROM A PUBLIC OR PRIVATE FINANCIER

HOW MUCH MONEY DO I NEED TO GET STARTED?

HOW TO BUY PROPERTY WITH LITTLE OR NO MONEY DOWN

22 Where, what and how to buy

LOCATION . . . BAH HUMBUG!

BECOME AN AREA EXPERT

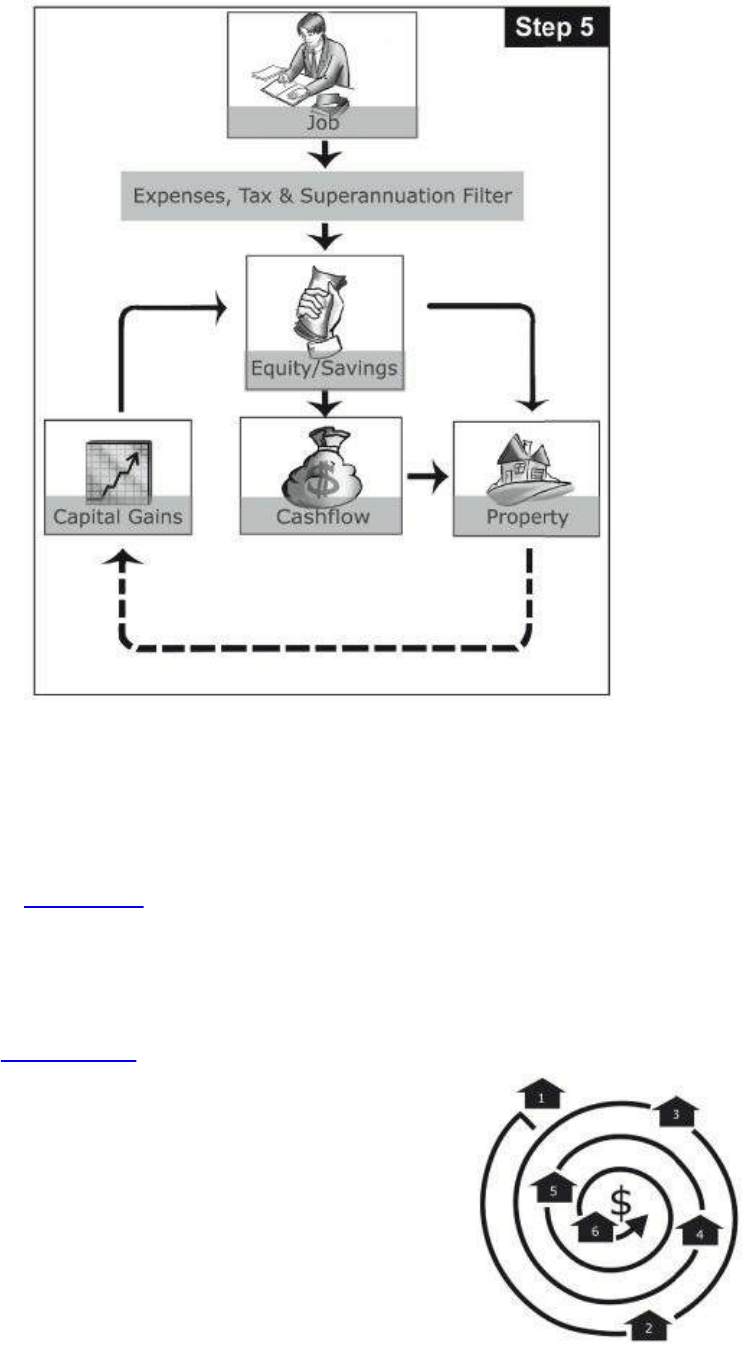

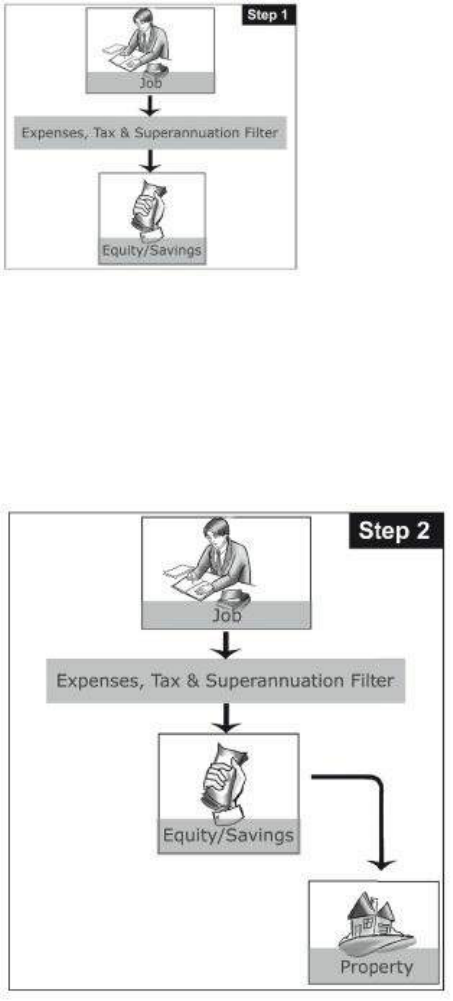

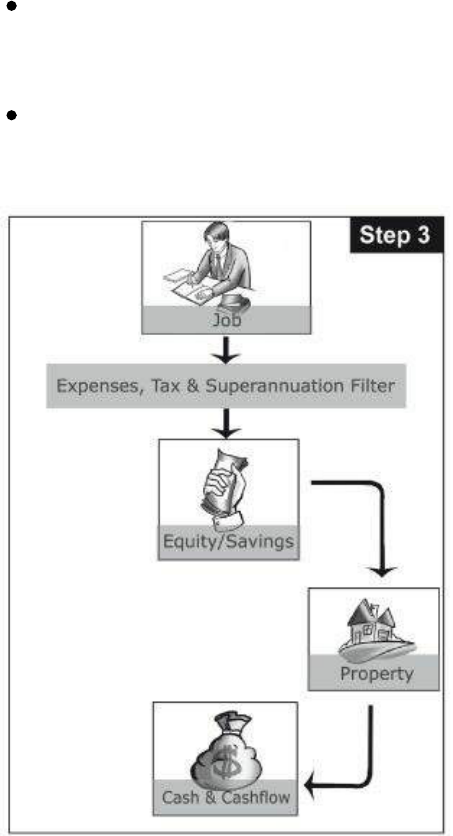

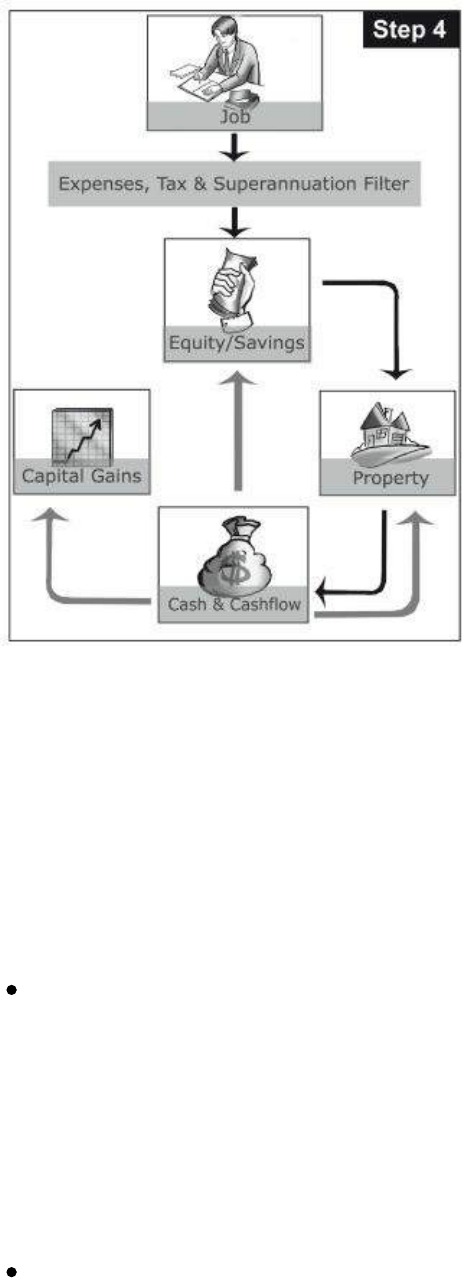

MY SIX-STEP PROCESS

A WORD ABOUT DEPOSITS

Part V: Real deals, real people

23 Peter and Jackie from Tassie

PETE AND JACKIE’S DEAL

24 Sue from South Australia

A BIG, SCARY DECISION

SUE’S DEAL

THE FUTURE

25 Matt from Queensland

MATT’S DEAL

THE FUTURE

26 Scotty from Sydney

CARAVAN LIVING

BECOMING AN INVESTOR

A MAJOR MISTAKE

SCOTTY’S DEAL: GARNHAM DVE

27 Jenny from Western Australia

JENNY’S DEAL

THE FUTURE

28 Dean and Elise from Victoria

DEAN AND ELISE’S DEAL

THE FUTURE

29 What’s your next move?

CRISIS

COMFORTABLE

CHAMPION

SELECT YOUR SETTING

YOUR CHOICE

THE WORST-CASE SCENARIO

THE ANSWER

YOUR JOURNEY

What to do next . . .

Index

WHAT’S NEW IN THIS EDITION

Already Australia’s #1 best-selling real estate book with over 160 000 copies sold, From 0 to 130

Properties in 3.5 Years just became even better!

Completely rewritten, revised and updated to take into account the latest trends and investing

techniques, this book includes everything you need to know to achieve financial freedom using

positive cashflow real estate, as well as 16 brand new chapters that explore many new topics,

including:

How to get the most finance possible for your property projects.

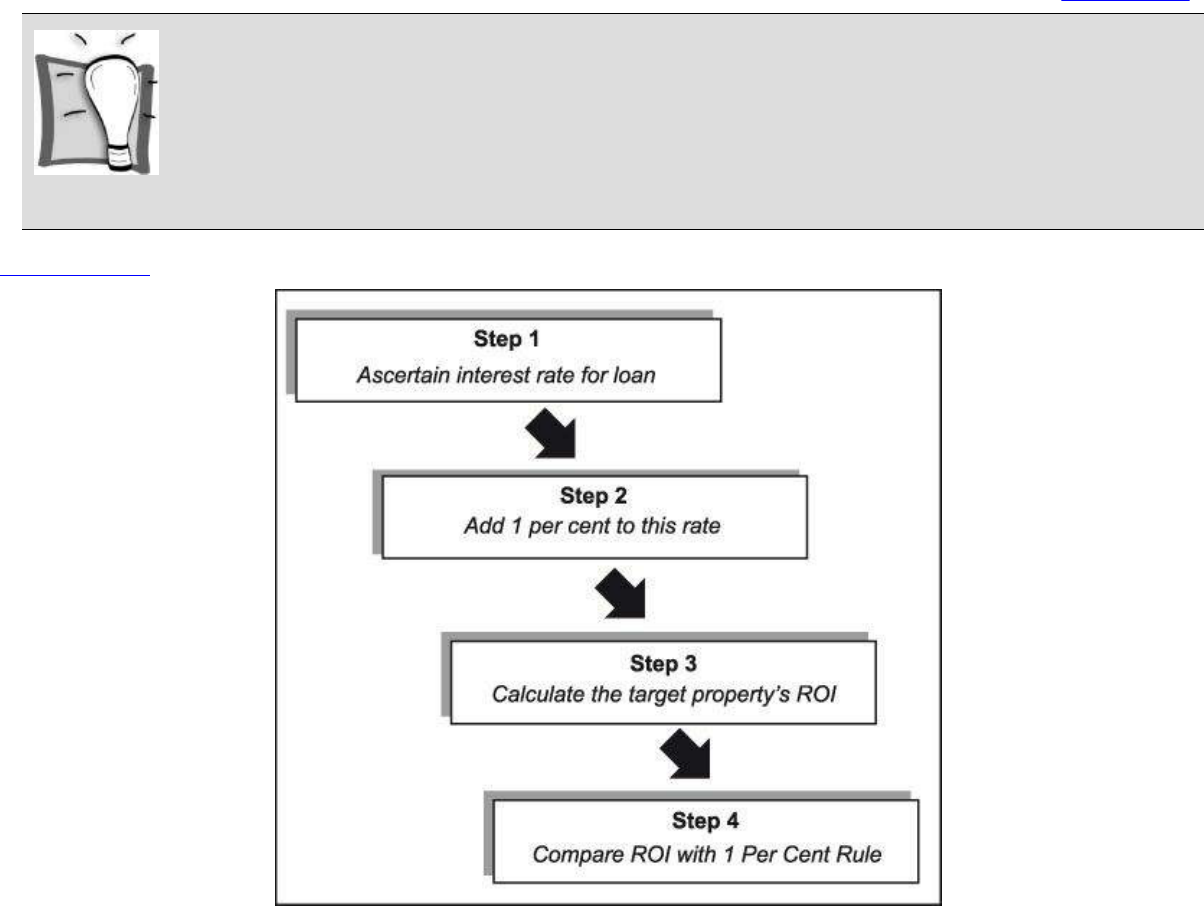

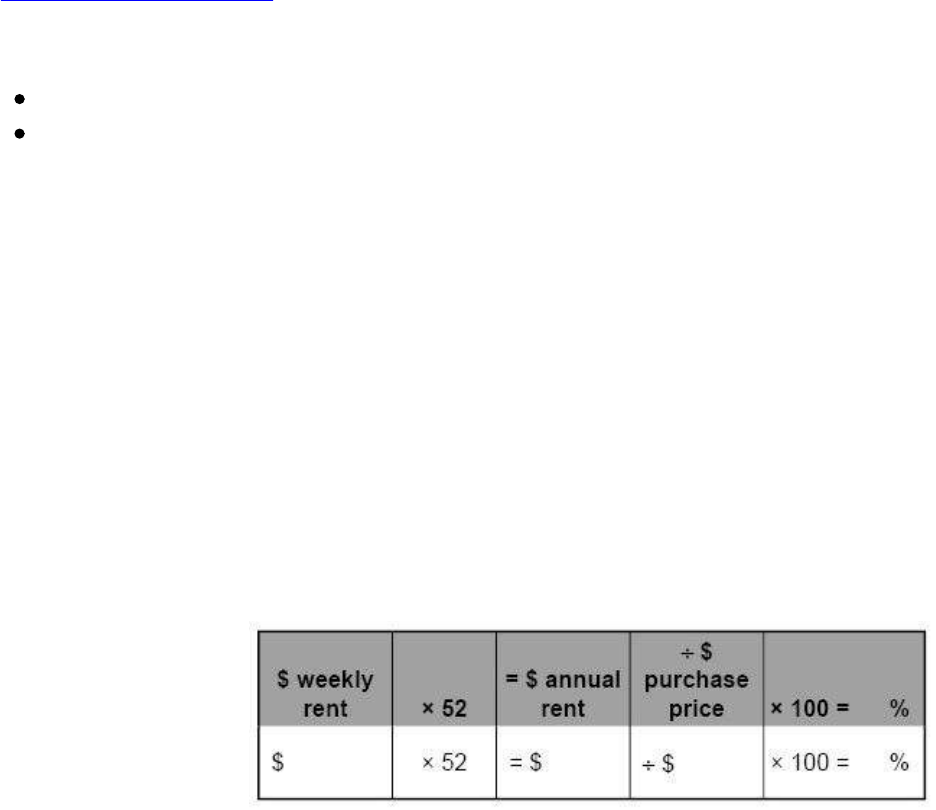

Steve’s fantastic new 1 Per Cent Rule for finding positive cashflow property.

How to gain maximum asset protection while also paying the least income tax legally possible on

your profits.

When is the best time to buy, hold and sell.

Specific guidance about what and where to buy for your next highly profitable investment

property.

The Asset Zoo — a new way to review your portfolio that will explain whether or not you have

the right mix of assets to achieve your wealth-creation dreams.

A detailed explanation of how you can make quick and attractive lump-sum cash gains from

subdividing and property developing.

New case studies to provide additional insights and ideas.

Feature contributions that reveal how those who have read and applied this book have

profited — and how you can too.

And much more!

If you bought the first edition then you’ll enjoy this edition even more as you’ll find the expanded

content informative, practical and profitable.

Alternatively, if you are buying this book for the first time you have a proven and powerful resource

that will show you exactly how to use real estate to achieve your financial dreams.

Readers’ comments

‘I’d rate this book a 10 out of 10, with the most practical, do-able and sensible advice I’ve read on

property investment. And I would like to thank you because for the first time I have HOPE that not

only is this possible, it is possible for us, and possible even in this difficult housing market.’

Karen S (ACT)

‘From 0 to 130 Properties in 3.5 Years is simply the best property investing book I have read so far.

Thanks!’

Shane M (NSW)

‘Having finished this book I’d have to say I love it. It’s written very simply yet practically. There

are a number of tips that I will be implementing in my endeavours to purchase property.’

Diana E (Vic.)

‘I’m halfway through this book and WOW! I can understand it! Thanks for keeping it simple and

plain. I’m excited about possessing it and your principles. An extra bonus was to find your website

and newsletters.’

Christine McL (Qld)

‘This book is truly amazing! I have been carrying it with me to work and even quoting from it to

family and friends! Will we act on the information? We already have! We have now developed a

strategy for positive cashflow properties thanks to this book.’

Con V (NSW)

‘This is a wonderful book. It’s the first book I’ve ever started to read and finish. I’m one of those

kids that hates reading but I couldn’t help but to finish your book because I know knowledge is power.

I have told countless friends about your book and the strategy of positive gearing and they all seem to

say I’m nuts, but I don’t care what anyone else thinks.’

Peter K (SA)

First published 2010 by Wrightbooks

an imprint of John Wiley & Sons Australia, Ltd

42 McDougall Street, Milton Qld 4064

Office also in Melbourne

© Steve McKnight 2010

The moral rights of the author have been asserted

Reprinted January 2010

National Library of Australia Cataloguing-in-Publication data:

Author: McKnight, Steve.

Title: From 0 to 130 properties in 3.5 years / Steve McKnight.

Edition: 2nd ed.

ISBN: 9781742169675 (pbk.)

Notes: Includes index.

Subjects: Real estate investment. Real estate business.

Dewey Number: 332.6324

All rights reserved. Except as permitted under the Australian Copyright Act 1968 (for example, a fair

dealing for the purposes of study, research, criticism or review), no part of this book may be

reproduced, stored in a retrieval system, communicated or transmitted in any form or by any means

without prior written permission. All inquiries should be made to the publisher at the address above.

Original cover design by Alister Cameron

Illustrated by Paul Lennon

Cover image © iStockphoto/deanna

Disclaimer

The material in this publication is of the nature of general comment only, and does not represent

professional advice. It is not intended to provide specific guidance for particular circumstances and it

should not be relied on as the basis for any decision to take action or not take action on any matter

which it covers. Readers should obtain professional advice where appropriate, before making any such

decision. To the maximum extent permitted by law, the author and publisher disclaim all

responsibility and liability to any person, arising directly or indirectly from any person taking or not

taking action based upon the information in this publication.

Acknowledgements

While I offer sincere thanks to everyone who has had a hand in making this book possible, I’d like to

make several specific acknowledgements.

First and foremost, I’d like to recognise my belief and faith in Jesus Christ, my personal Lord and

Saviour who said, ‘All things are possible for the one who believes’ — Mark 9:23.

To my family, and in particular my wife and daughters — thank you for your love, support and

understanding.

To the office team: Jeremy, Emy, Norm, Renee, Tony and David — I greatly appreciate your

encouragement and assistance. To Lesley Williams and Michael Hanrahan — thanks for your help

with the editing and proofing.

Thank you also to those who contributed, including: Katrina Maes, Martin Ayles, Tony Barton, Peter

and Jackie, Sue, Matt, Scotty, Jenny and Dean and Elise.

Thank you to the Real Estate Institute of Australia for providing data and other information, to Dave

Bradley for partnering me in the early years of my property investing and Robert G Allen for his

valuable advice about real estate investing.

And finally to you the reader — I’m delighted that you chose to invest in this book. It’s now time

for you to take advantage of the information I’ve provided by using it to transform your life.

Proverbs 3, verses 13 and 14

‘Blessed is the one who finds wisdom, and the one who obtains understanding. For her benefit is more

profitable than silver, and her gain is better than gold.’

Preface

Right now, as you read this book, someone in the suburb or city where you live is closing a property

deal that will make more profit in one lump sum than you’ll earn from your job over the next 12

months.

And if you’re worried about the effects (or after-effects) of the global financial crisis, let me

reassure you that more money is made as economies recover from downturns than at any other time in

the economic cycle. This is because during the gloom assets are oversold to the point that values

become artificially low. Once the economic climate improves, values bounce back, and those who

took action at the right time become substantially richer.

We are in a time of unprecedented opportunity. Yesterday I signed the contract to sell a subdivision

deal that will make a very handy pre-tax profit of $130 643. Property transactions such as this are

happening every day of every week, and unquestionably prove that you can still make a lot of money

from real estate.

It begs the question then: why are you working so hard for so little pay, when you could be investing

in property and taking life a lot easier? If you think it’s because you’re not smart enough, or that you

need to be a brilliant investor to find and profit from the best deals, you’re wrong.

As I’ve outlined in chapter 16, the subdivision deal that released this impressive lump-sum profit

wasn’t particularly tricky or complicated. In fact, after reading this book you’ll be able to do deals just

like it with your eyes closed.

The answer as to why you are not making a financial killing from property investing right now is

because an experienced investor, who knows what he or she is doing, hasn’t shown you how. But don’t

worry. That’s all about to change, because in this book I’ve documented the proven knowledge and

experience that has seen me purchase well over 130 properties and achieve financial freedom.

Today, my family and I live the lifestyle we’d always dreamed of. My goal in writing this book is to

provide you with the knowledge, confidence and motivation so you can too.

G’DAY!

My name is Steve McKnight and I’m a 30-something ex-accountant. My wife, Julie (whom I met

while on holiday at Ayres Rock — how about that?), and I live in the eastern suburbs of Melbourne

and have two gorgeous little princesses.

You’d pass me on the street and not look twice. Why? Because I’m just a normal-looking guy who

got average grades at school, is average at sport (except maybe table tennis, where I routinely thrash

my older brother), and, like many approaching-middle-age men, I am gradually becoming more and

more ‘folically challenged’.

In fact, life for me would have been decidedly normal, except for one fateful day in May 1999 when,

pushed to the brink of an early mid-life crisis and desperate to try something new, I bought my first

investment property. Far from being the Taj Mahal, it was a three-bedroom house in West Wendouree,

which is a suburb of Ballarat, a regional Victorian town about an hour’s drive west of Melbourne.

It’s hard to imagine given what has happened to property prices since, but all I paid to buy that

property was $44 000. You have to understand, though, that West Wendouree is no Toorak, Vaucluse,

Balmoral or Mossman Park.

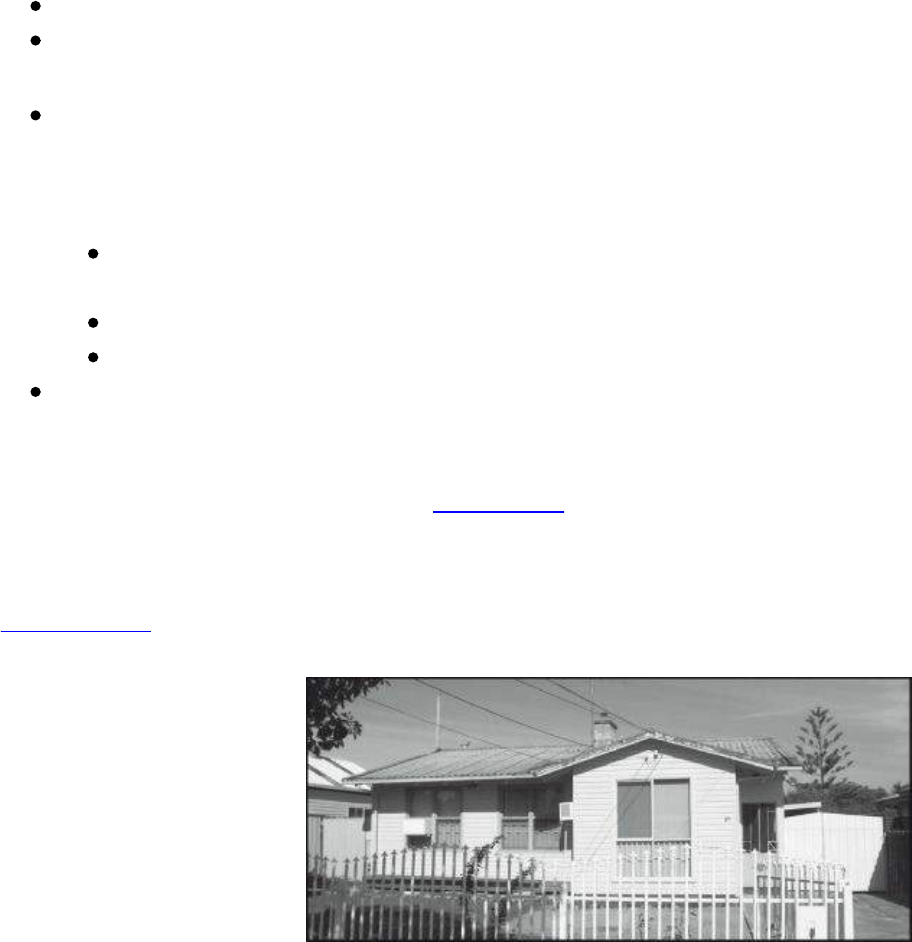

My first investment property

As you can see in the photo, it’s a normal-looking home. However, looks can be deceiving. I later

found out that these types of houses were trucked in as two halves, assembled, patched up and then

rented out as cheap government housing to people who needed subsidised rent.

If you look closely you’ll see that the chimney is painted. If you’re wondering why, it’s because

letterboxes were a non-essential luxury at the time these types of houses were built, and a cheap

solution was to spray-paint the house numbers on the chimney.

Over time these houses became privately owned, and modesty prevailed. Letterboxes were installed,

chimneys were painted to hide the crude street numbering, paling fences were erected and gardens

planted.

Although it looks fairly basic, this property was still one of the better homes in the neighbourhood.

Properties across the road had front yards full of weeds, cars (many in different stages of disassembly

or decay) and shopping trolleys.

Given this property is not the sort of investment you’d show off to your family and friends as an

example of your investing brilliance, you might be wondering why on earth I bought it.

I know it’s early on in the book, but this property demonstrates one of my essential real estate

investing rules.

Steve’s investing tip

When investing, only ever buy houses for other people to live in.

Without wanting to sound like a snob, there’s no way I wanted to live in that property, but that

didn’t matter. My only concern was whether or not I could earn my desired financial return.

This is an important point, because the minimum standard of some property investors is whether or

not they could live in the house. This attitude is a mistake, because once you become emotionally

involved with your investments, you’ll make decisions based on how you feel rather than the financial

facts. The fact is that often, after deducting all expenses from the rent, there is a surplus left over. That

is, the property is cashflow positive.

Let’s do a little exercise to test your financial IQ. I’ll help you by giving you the first answer.

Bricklayers work with … bricks

Stone masons work with …

Woodcutters work with …

Property investors work with …

I’m assuming you said stone masons work with stone, and woodcutters work with wood, but did you

say that property investors work with property? If so, you’re mistaken. Property investors work with

money, not property.

When you strip away all the emotion, the only decision worth considering is how much money your

investment will make, compared to how long it will take to earn it and how much risk there is that you

will lose some of your capital. Anything else is an afterthought. Who really cares whether the

dwelling is made of brick or weatherboard, or whether the curtains are pulled together or pulled down?

If all this sounds a little strange, let me ask you a question. Is your current home better, or worse,

than the house you previously lived in?

Irrespective of whether you rent or own, as we get older and have more money, it’s usual for us to

improve the quality of the houses we live in. However, what I’ve found is that increases in rent don’t

keep pace with appreciation in value. Talking investor-speak for a moment, as value increases, return

diminishes. That’s why income-focused investors are better off buying more basic houses as opposed

to fewer elaborate homes. That is, you’ll get a better income return by owning two $250 000

properties than one $500 000 property.

In summary, as we age we gain a bias away from the sorts of properties that are the best

investments. This means that relying on emotion, rather than financial skill, will cost you money.

Don’t worry if you’re confused by what I just said. We’ve got the whole book ahead of us and by the

end you’ll be much more advanced than you are now. The key point is not to get emotional about the

property you purchase.

MY ORIGINAL MASTER PLAN FOR FINANCIAL FREEDOM

Owning one or two West Wendouree–type investment properties wasn’t ever going to put me on the

BRW Rich List, but that was never my aim. My master plan was to own enough houses that I could

substitute the salary I was making as an accountant with the rental income earned from the property. If

I could do this then I’d have an income for life and never have to work again.

It took five years of hard work and sacrifice, but with the help of my wife and my business partner at

the time (Dave Bradley), on 9 May 2004 I achieved the goal of having $200 000 in annual passive

income and a million dollars in the business bank account. I was financially free.

‘That’s great Steve’, I hear you say. ‘But $44 000 properties don’t exist anymore, so can you still

apply your strategies today?’

I concede the game has changed. Property prices are a lot higher and the effectiveness of individual

strategies ebbs and flows. But one thing is certain: as long as people need to live in houses, you’ll be

able to make a profit from real estate investing, provided you buy problems and sell solutions.

Steve’s investing tip

As long as people live in houses you’ll be able to make a profit from property.

And that’s what this book is all about — how you can identify the right investing solution to

transform everyday property problems into enough profit to become financially free forever.

Along the way we’ll debunk many of the myths that are kneecapping your potential, and by the end

of chapter 29 you’ll be well on the way to a brighter financial future.

But enough of the chitchat, it’s time to make a start. Let’s jump in our time machines and travel

back to 1998 when I was contemplating life beyond working 9 to 5. I have a feeling that it’s probably

a lot like what you’re going through at the moment.

Thanks for buying this book. I encourage you to treat it badly, which means highlighting your

favourite passages, writing in the margins and dog-earing the pages. It’s great to see a well-loved

book!

I hope we get the chance to meet up. Until then, remember that success comes from doing things

differently!

PS It’s reasonable to expect that the economic climate will change over time. To ensure you remain

fully up to date, readers of this book can register their copy and receive periodic updates, which I’ll

write and email to you free of charge. Visit <www.PropertyInvesting.com> for more information.

Part I

The Steve McKnight story

1

Humble beginnings

A few months ago I received an invitation to attend my 20-year high school reunion. On one hand I

was interested in going along and seeing what my old high school friends were up to, and on the other

hand perhaps it is better to leave the past in the past.

I wonder, what would you do?

My high school years weren’t particularly happy. I was overweight and an academic underachiever;

my year 10 maths teacher summed up my potential when he wrote on my end-of-year report: ‘Always

pleasant and amiable, Stephen has much difficulty with even the most basic of maths problems’.

It’s lucky that high school isn’t always the best indicator of future success.

Today, at age 37, I’m involved in more than $13.5 million worth of property projects that span all

types of real estate (residential homes, units, commercial property, land and so on), have multi-

million-dollar business interests, and am the author of Australia’s most successful real estate book

ever (which you happen to be reading right now).

On reflection, I’d have to say that the kid who struggled with algebra managed to at least gain a

good appreciation of the maths involved in making money!

Steve’s investing tip

While your past doesn’t determine your future, if you want something other than what you’ve got at the moment, you’re

going to need to make some changes!

Please don’t think this is a rags-to-riches story, or that I have some supernatural ability that only the

truly blessed receive. Neither is the case. My upbringing was decidedly middle-class, neither flush

with money nor crying poor.

Working hard in the one job selling trucks for 40 years, my father abandoned a lot of his own

ambition so that his wife and children would never go without food, shelter and the occasional luxury.

For this I love and respect him deeply. Mum never worked in a paid, full-time position, instead she

showered her children with delicious home cooking and cuddles. As a gifted musician, Mum would

teach piano after school for extra housekeeping money when time allowed.

DANGEROUS ASSUMPTIONS

My life was decidedly normal and uneventful until the end of high school. Previously a strictly pass

and occasional credit student, I discovered a rote learning strategy that allowed me to achieve a

respectable year 12 score — I even got a C for English; a miracle for sure!

Looking back it’s clear that I was never shown how to study effectively. Instead, it was just assumed

that everyone could do it — like reading and counting to 10. A similar problem exists today in that

property investors are never taught how to invest profitably. It’s just assumed that all of us will be

able to invest successfully once we have the finances to start, but no-one ever explains how we should

go about it.

Having languished at the bottom of the social and academic pecking order for most of high school, I

feel compelled today to do what I can to right the wrongs caused by dangerous assumptions. In terms

of property investing I will show you how to make a profit from day one. But more on that later.

My choice of career was made with little forethought. I always wanted to be a physiotherapist, but I

was deemed too mathematically challenged and my high school forbade me to do maths in year

12 — a prerequisite for the course of my dreams.

So, what does someone who is hopeless at maths do? I became an accountant, of course! Now,

please don’t make the mistake of thinking that accountants need to be savvy with maths — that’s what

they invented calculators for. All that’s needed is a solid grasp of how to push buttons, a callused

index finger and a good understanding of your times tables.

I managed to graduate from my RMIT accounting degree without dropping a subject and somehow

talked my way into a job in the midst of the early 1990s recession. Turning up for work in a suit that

looked uncomfortably like plush-pile carpet, with a pink shirt and tie that I’d be embarrassed to give

away today, I began my accounting apprenticeship completing simple tax returns and running errands.

Still, much to my Dad’s surprise, I never had to make the coffee.

Before long my career took a turn for the better and I secured a job with one of the big six (now big

four) international accounting firms. The only cause for concern was that I worked in audit.

Unfortunately, audit is not the most exciting of fields, especially at the junior level. But I had a bout

of late-onset work ethic (inherited from my father) and worked exceptionally hard. I was regularly

promoted and, having already completed the prerequisites, I began to study to become a chartered

accountant. This was not an easy thing to do as the postgraduate exams are notoriously difficult to

pass. I’d work long hours during the day and then come home to many long nights of study. You could

accurately say that I had absolutely no social life. Such was my lot until I succeeded in gaining the

status of a chartered accountant — at which point I immediately suffered a massive meltdown.

Disillusioned with my chosen career, I tried in vain to study physiotherapy at Sydney University. It

was the only course that would even consider me, and I did exceptionally well to get number 17 on the

second-round offers, but the cold, hard fact was that I was not offered a place.

Shattered, I realised I needed a change, and I made a career blunder by accepting a job in industry

(as opposed to public accounting), more because I felt wanted than because it was a match to my skill

set. In between roles I took a holiday and met a woman, Julie, who captured my attention, and my

heart. The only problem was I lived in Melbourne and she lived in Mackay — 2500 kilometres away.

Lasting only two months in the new job, I used the excuse of moving to Mackay to be closer to Julie to

save face when resigning. Luckily, accounting skills are portable and I had no trouble finding yet

another position as an audit manager, with yet another firm of chartered accountants.

By this point in my life I was certain that I’d shaken off the shackles of my high school limitations.

I’d gone to Weight Watchers and lost 16 kilos, I’d worked hard and achieved membership to what

many regard as the peak accounting body in Australia, and I’d found a woman whom I loved. Yet this

new-found self-confidence was to come crumbling down when I was sacked after nine months, and

told I was someone who overpromises and underdelivers. This left my confidence savagely beaten and

those nasty self-doubts that I thought I’d buried began to resurface.

Luckily, Julie was a rock of stability. We became engaged and then moved back to Melbourne. Once

again, I found work in a small accounting firm, again as an audit manager, and soon I was working

harder than ever in an effort to resurrect my career.

I remember my office well. It was long and oddly shaped. A glass partition separated me from the

only other manager, Dave Bradley, with black venetian blinds providing limited privacy. What I

remember best were the thick iron bars on the windows, which I’d regularly joke were there to keep

the employees in rather than the burglars out.

By late 1998 Julie and I were married and I was still working, working, working. I’d regained my

confidence and was beginning to branch out into teaching, too. I’d taken on a lecturing role at my old

stomping ground, RMIT, and was also, ironically, mentoring other aspiring chartered accountants to

manage the art of studying effectively.

I wouldn’t say that I ever felt truly settled though. I’d dread Sunday nights and having to iron five

work shirts for the week ahead. I was certainly someone working five days to fund two days off. I was

a rat taking my place in the race.

MY WAKE-UP CALL

You might be able to ignore the warning signs, but when you’re not happy your body will eventually

give you a wake-up call you can’t ignore. Some people are unlucky and suffer crippling or fatal

events, such as heart attacks or strokes. For me it was ulcers on … well, ‘unusual’ body parts.

I raced off to see the doctor, who happened to have a surgery next door, and I was lucky to get an

immediate appointment. The doctor was perplexed at my condition and suggested I needed some time

off work. Later that afternoon after returning from a walk, I found a piece of paper in the letterbox. It

was a photocopy from a medical journal explaining my condition. The doctor had written in large

print ‘Take a holiday!’ and also highlighted some text outlining that the ulcers were caused by stress.

It was my wake-up call telling me to change my lifestyle or suffer the consequences. The lack of

career planning and job satisfaction had chipped away over the course of several years and had finally

caused my health to suffer.

I talked over my situation with friends and was surprised to learn that other people felt the same

way. The obvious common theme was that while we all wanted to be wealthy, what we wanted more

was to be free from the obligation to have to work — a concept that someone called ‘financial

independence’.

I spent some quiet time reflecting and decided one thing was for certain: when I looked up the

corporate ladder all I could see was the backside of the guy in front of me, and I didn’t like the view.

So, when I received a flyer in the letterbox outlining how I could discover the secrets to retiring a

multi-millionaire in five years, you could say that it looked like the opportunity I’d been searching

for — the chance to exit the rat race forever. The flyer was an A4 photocopy on white paper and it

promised (in large print) to show me the way to a lifetime of riches through the power of the tenant

and the taxman. It concluded with a 1800 number for me to call and book my strictly limited seat at an

upcoming no-cost, no-obligation ‘wealth-creation extravaganza’. Since the event was free, and since I

might have actually discovered some amazing secret that only the rich knew, I booked two

tickets — one for me and the other for Julie.

THE ‘ALL-HYPE, NO-SUBSTANCE’ SEMINAR

The seminar was held the following week at a local motel conference centre. The room was quite

professionally arranged with 100 seats neatly set out in rows of 10 by 10. There was a data projector

and a large screen to cater for a computer slideshow presentation. We arrived early and were among

the first in the room. By the time the presenter — a 40-something balding executive wearing a power

suit and matching tie — was ready to begin, the room was three-quarters full with a good cross-

section of the community. Most were young or middle-aged workers, tired after a long day at the

office. Others were tradespeople — as evident from their overalls. The remainder appeared to be

retirees, or soon-to-be retirees. They seemed the best prepared as they brought pens and pads to write

down ideas.

A hush came over the audience as the presenter indicated he was ready to begin. ‘Raise your right

hand if you think you pay too much tax’, he said. There was a shuffle as the entire room raised their

right hands.

‘Good. Later I’ll show you how you can eliminate your tax bill. Now raise your left hand if you want

to be rich.’ There was more noise as pads and pens were placed on the floor, followed by more hand

raising.

‘Excellent’, the presenter said with a beaming smile. ‘You folks are in the right place at the right

time because I’m going to reveal how the tenant will make you rich, and the taxman will fund your

financial independence.’

Over the next hour or so we were shown slides of graphs and tables outlining how property only

increases in value, and why now was an excellent time to buy. The presentation was a carefully

scripted and much practised sales pitch leading to a critical question.

‘Now, who’d like to discover where the great growth properties are located and how to purchase

them at a bargain price?’ A large number of hands went into the air.

‘Wonderful!’ the presenter exclaimed. ‘In that case, let’s take a short break, and when we come back

I’ll outline an exciting opportunity to buy property below cost.’

My wife and I, sensing that this was a sham marketing scheme selling overpriced out-of-town

property to unwitting investors, decided to leave, and I couldn’t help but wonder whose best interests

the presenter had in mind. Being an auditor, I was highly suspicious of the presenter’s lack of

independence as it turned out he was being paid a commission for each property sold to a person

attending the seminar.

Steve’s investing tip

A good rule of thumb is to always be on guard when your adviser — whether a sales agent, a financial planner or

otherwise — is paid a commission for his or her recommendation.

I only lasted a few more months in my job before failing health and continuing frustration forced yet

another career move. This time I thought I’d try a different take on the old accounting theme. Instead

of being an employee for someone else, I joined forces with the other manager I worked with — Dave

Bradley. We were both disillusioned with our managerial roles and decided that we could work less

and earn the same amount of money by going into business for ourselves.

In January 1999, the chartered accounting firm of Bradley McKnight opened its doors for business.

In an attempt to keep overheads as low as possible, we worked from our respective homes and met a

couple of times a week to talk through issues and to ensure we remained focused.

Still not settled, by April I’d finally decided a more substantial change was needed. While enjoying

the flexibility of not having to travel far to my desk, I came to the conclusion that I hated working in

accounting. With some reflection I realised that all I’d managed to do was to trade in those bars on the

windows of my old office for invisible handcuffs to my new clients.

A NEW DIRECTION

At our next meeting I dropped a bombshell by telling Dave that I didn’t want to be an accountant any

more. ‘That’s great,’ he said, ‘but what do you plan to do in our accounting partnership then?’

‘I don’t know,’ I replied, ‘but something other than accounting … give me some time to think about

it’.

A week or so later I attended an introductory event that contained a good mix of information about

alternative wealth-creation ideas. I was impressed with the speaker (Robert Kiyosaki) and was eager

to hear more about his upcoming two-day intensive training seminar. Even the price tag — $2000 per

seat — didn’t seem completely unreasonable. The intro event finished at 10 pm and, as there was only

a strictly limited number of seats left and the real possibility of the upcoming seminar being sold out

quickly, I immediately phoned Dave to convince him that we both had to attend. I was understandably

hyped up after coming straight from the introductory seminar, while Dave was preparing for bed.

After I gave him my best pitch, Dave replied with a sleepy, ‘Mate, that’s great, but at $2000 a pop, the

presenter gets rich off people like you’.

‘No, no’, I said. ‘We really have to go!’

Wanting to go to sleep, Dave said, ‘Look, go home, cool down and we’ll talk about it in the

morning. Bye’. As I began to frame a counter-argument, I heard the phone hang up. Not to be put off, I

called him straight back.

‘Look,’ I said, ‘we don’t want to miss out on this opportunity’.

‘Steve. We’ve only been in business three months’, Dave said. ‘We can’t afford to go. First you say

you don’t want to be an accountant and now you want to spend money we don’t have going to a

seminar in Sydney. Mate, get a grip and we’ll talk tomorrow. Good night.’ Click — down went the

phone again.

Still undaunted, I rang back, only to find that Dave had taken his phone off the hook. Ah ha! A

challenge. I called him on his mobile. Expecting him to be irritated, I tried to head him off at the pass

by saying, ‘Do you trust me?’

‘Of course I trust you’, Dave replied.

‘Well then, trust me on this. We won’t be disappointed.’

That night I booked and paid for two seats to the impending Sydney wealth-creation seminar. It was

a decision that Dave and I have never regretted, not so much because of the mind-blowing content but

because we gleaned one revelation. We found that some of the attendees were investing in property in

such a way as to earn immediate passive income. This could then be used as a replacement for salary,

allowing the recipient to work less without taking a lifestyle cut. This discovery was to change our

lives, and our career prospects, forever.

Oh, and by the way, I did end up going to my high school reunion. I’m glad I went because many of

the ‘cool boys’ had high-earning yet time-intensive and extremely stressful jobs. It reinforced what a

great decision I’d made to leave my career, and how success really does come from doing things

differently!

CHAPTER 1 INSIGHTS

Insight #1

We all have our own story of where we’ve come from. The truth is your history isn’t as important as your future, and

your future is what you make of it.

Insight #2

Don’t fall into the trap of thinking that because I have an accounting background I’m better qualified than you to invest.

You can pay a good accountant to be on your team and access the same skill set that I have.

Insight #3

You need to expect to pay for your education, either directly by attending seminars or indirectly through making

mistakes and paying to fix them. I recommend attending seminars provided you’re committed to implementing what you

discover — otherwise they’re a waste of valuable time and money.

Insight #4

Financial independence is not just a dream that only a select few can achieve. It’s a matter of making a series of choices

that are consistent with moving you closer to your goal.

Insight #5

When it comes to high school reunions, there’s nothing to be afraid of!

2

Making a start

I understand if you think that owning a multi-property portfolio and becoming financially independent

seems almost impossible. That’s how I felt coming home from the Robert Kiyosaki seminar. Desire is

something, but how on earth do you make a start when you have precious little money in the bank and

know next to nothing about how to invest in real estate?

Steve’s investing tip

The first step to becoming a more successful investor is gaining clarity on what you are looking for from your investments.

Instead of focusing on what you don’t know or what you don’t have, which can be daunting and

overwhelming, a better place to start is to gain clarity on what you do know, or, at the very least, what

you don’t want (for example, you don’t want to work five days a week, or you don’t want to keep

driving around in a hunk of junk).

A trap many inexperienced investors fall into is simply saying they want to find a property that will

make money. At any one point in time, there are about 950 000 properties for sale in Australia, and if

you ask the agents who listed them, I’m sure every single one of them would tell you that their

property could potentially turn a profit.

Steve’s investing tip

You only have a limited amount of time and money, so casting the net far and wide will waste precious hours and leave you

confused about which deal is best.

Remembering that property investors work with money (and use property to get it), your first

important decision is what kind of profit you would like from your investment. You only have two

choices: cashflow or capital appreciation.

In my case capital appreciation was great, but a higher priority was finding a source of regular and

reliable cashflow that I could substitute for my salary. It was decided then: all I had to do was find

positive cashflow properties and I was well on my way to becoming financially free.

FINDING THE NEEDLE IN A HAYSTACK

It seemed to me that the logical place to start looking for positive cashflow properties was in the

suburbs in and around where I lived. At the time, my wife and I were leasing a two-bedroom unit in

Box Hill, Victoria, and were paying $200 per week in rent. The property was worth about $200 000.

On the back of an envelope I worked out that the annual rent ($10 400) would be less than the interest

on the loan ($16 000 assuming a loan of 80 per cent of the purchase price at an interest rate of 8 per

cent per annum). If passive income properties did exist, then it wasn’t anywhere close to where I

lived!

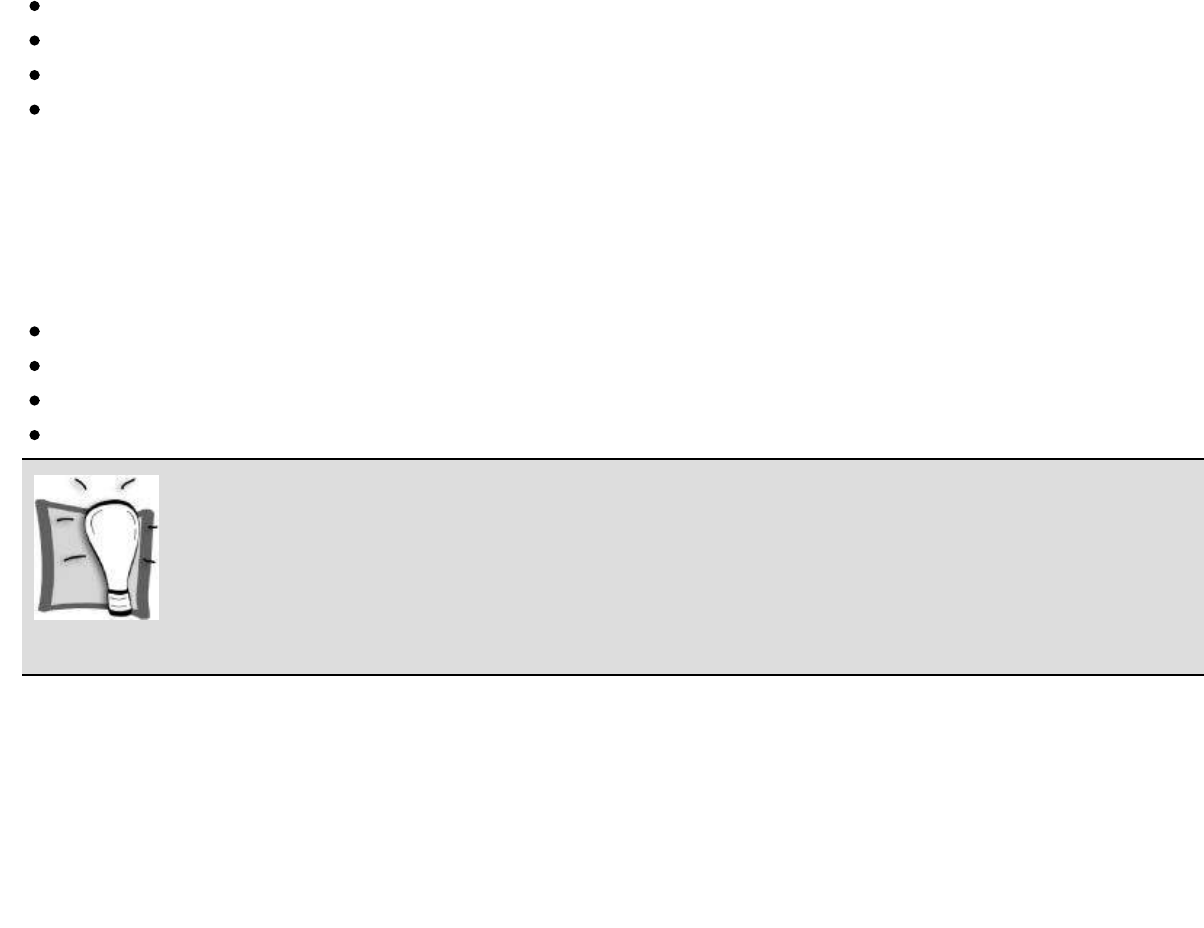

A little less enthusiastic but still determined to keep looking, I started searching among houses that

were for sale on the internet using a simple formula that took the likely weekly rent and worked

backwards to calculate a maximum purchase price (see page 215 for more information on this

formula). Provided the property was within these price guidelines I could reasonably expect it to

produce passive income.

What about country areas?

I must have analysed hundreds of properties within the Melbourne metropolitan area, and I couldn’t

find a single one that would provide a positive cashflow outcome.

Rather than giving up though, I somehow recalled a conversation I’d had with a colleague, Alina, a

few years earlier about how her family members were looking into buying an investment property in

Ballarat for the seemingly cheap price of $60 000.

‘Ballarat?’ I remember saying incredulously. ‘Why would you want to invest there? You’ll never get

capital growth in the country. Forget it.’

I encounter a lot of people who say they have serious reservations about investing in rural areas.

However, when pressed on the issue, these same people generally own no property and work very hard

in a job that’s making someone else rich. Their ignorance about the opportunities on offer is literally

keeping them poor. Consider this: what difference does it make if your property achieves little or no

capital growth if it, nevertheless, delivers enough reliable cashflow for you to never have to work

again?

So it was then that Ballarat, the place where Alina had mentioned that cheap real estate existed a few

years earlier, became the centre of my focus on the quest to find positive cashflow property.

Early in the morning a few days later, Dave picked me up and we ventured up the Western Highway.

Feeling that it was important to look the part, we wore our finest business suits and packed clipboards

and business cards to show the world that we were professional investors from Melbourne.

It was still early when we arrived at the city limits, so we decided to stop for a hot chocolate and to

formalise our plan of attack. As we cruised up Sturt Street, Ballarat’s major thoroughfare, it was still

dark and quite cold outside. Not many shops were open, and few looked even close to opening, which

provided a sleepy atmosphere. I had to check with Dave to make sure that it was, in fact, a weekday

and not a Sunday morning.

Eventually, though, we came across a cafe which seemed to be open judging by the fact the lights

were on inside. Dave didn’t have any trouble finding a park as there wasn’t another car parked within

100 metres anywhere on the street. I held the cafe door open as we entered and escaped the biting chill

of the wind. The only person in the cafe was a waiter — a young guy who was genuinely surprised to

see customers so early.

‘Ah … I’ve only just opened’, he said. ‘The grill’s not warmed up yet so all I can do is toast.’

‘No problem’, I replied. ‘We’ll have some toast and two hot chocolates then.’

Sitting down at a table near the service counter, I unfolded a map and tried to gain a feeling for the

layout of Ballarat, including the major streets and landmarks. Dave picked up the local paper and

began to flick through the property section. A few minutes later the waiter brought over our hot

chocolates. Offering thanks, I thought I’d try to start up a conversation to glean some local knowledge

of the area.

‘We’re new in town’, I said, at which the waiter looked us up and down and shot a glance that said

no kidding!

‘Where’s a good place to live?’ I enquired.

Leaning over the map the waiter said, ‘Here’, pointing to a spot on the map I now know as

Alfredton. ‘Oh, and anything central too’, he added, waving his finger in a wide circle around the Sturt

Street area. ‘And if you’re rich then you live by the lake.’

Dave and I exchanged shrugs and smiles. ‘Okay, and where wouldn’t you want to live?’ I asked.

The waiter considered his response and then pointed to the map and said emphatically, ‘Here’, as he

pointed out the area of West Wendouree.

‘Why not?’ I asked.

‘Oh, it’s a rough area with lots of commission houses’, the waiter replied before hurrying off to

investigate a noise coming from the kitchen. He returned a few minutes later with a plate of hot toast.

‘So, who are you guys?’ he asked.

Dave replied, ‘We’re professional investors from Melbourne’.

With one eyebrow raised the waiter walked off muttering something under his breath about strange

city people.

It was 8:30 am by the time we left the cafe. I wouldn’t say that the streets were crowded, but there

was certainly more activity with people going about their early morning tasks. Dave and I were keen

to begin looking for houses as soon as possible. We decided that talking with several local real estate

agents would be a good place to start. While this seemed like a good idea, none were open as yet, so

instead we just drove around for about half an hour to see what the houses in Ballarat looked like.

I’m not sure what I expected, but I was certainly pleasantly surprised with the majority of

houses — mostly old weatherboard period homes. Occasionally there would be a more modern

dwelling or maybe a home made of brick but, all in all, the houses seemed relatively normal and what

you would expect in some suburbs of Melbourne.

One thing we did notice though was the large number of properties that had ‘For Sale’ signs out the

front. It seemed the property boom that had hit the Melbourne market hadn’t quite made it all the way

to Ballarat.

Steve’s investing tip

Often the best way to discover information about an area is to ask a local.

My first encounter with a real estate agent

Having no idea what the houses were worth, Dave and I began to write down the addresses and pencil

in what we thought their asking prices might be. Later, once we had a better understanding of the

market, we discovered that we weren’t too far wrong with our initial guesses. After driving around for

nearly half an hour, we headed back to Sturt Street and finally found a real estate agent that was open.

As I opened the door, a bell rang announcing our arrival. The interior was modern and well kept,

giving a professional ambience to the office. There was only one person on duty and he was a young

guy who, by the look of him, should have been in a year 10 science class rather than acting as the front

person for a real estate agency. The name tag on his shirt read ‘Hi, I’m Tom’.

‘Can I help you?’ he asked.

‘Yes’, I replied. ‘We’re from Melbourne and are interested in buying some investment property.’

Now, Tom’s boss had no doubt promised that a day like this would eventually occur, when a couple

of chumps, as green as green could be, would walk in off the street and want to buy something without

any idea of what they were really doing.

‘Oh’, Tom said thoughtfully. ‘Investors from Melbourne. Hmmm, right’, he said with a hint of a

smile. ‘Well then, what exactly are you looking for?’

My initial thought was, ‘Come on! Money trees, show me the money trees! How hard can it be?’ But

to be honest, I hadn’t thought this far ahead. I didn’t think to work out a budget, or to use our available

deposit to work backwards to a possible purchase price. I didn’t even think to start with properties that

were for sale and came with tenants.

A little lost for words, but not wanting to sound cheap or look like a fool, I asked if he had any

blocks of units for sale. After all, that’s the sort of thing a professional investor from Melbourne

would say, right? Tom switched the phones over to answering machine mode and ushered us into one

of the several client meeting rooms, following us in and closing the door behind him. He pulled out a

large, bound, blue book that contained all the properties they had listed for sale and flicked to a tab

that said ‘Units’. Scanning through his list he asked, ‘How much do you want to spend?’

Dave answered, ‘We have an open budget, provided we like the property’.

Tom scribbled down a few details on a pad, closed the book, looked up, clasped his hands and then

told us that he only had one property that he thought might be suitable. It was a block of eight units in

a brick complex just a few blocks from the middle of town. He invited us to immediately inspect the

property, since he could show us through a few of the units that were currently vacant, as well as one

that was occupied as he was on good terms with one of the tenants who was home nearly all the time.

Since we didn’t know the way, Tom suggested that he drive us. Dave and I happily accepted and we

headed out of the office backdoor to a carpark. The only car in the lot was Tom’s — an early model

Ford Falcon that had quite a few dents and scratches.

Accepting a ride from Tom was one of the bigger mistakes I’ve made in my investing career. He

drove fast — 90 kilometres per hour through the back streets. He overtook a truck turning right on the

inside lane of a roundabout, and all the while loud doof-doof music belted out from two huge rear sub-

woofer speakers.

Our first property inspection

The only saving grace of the car ride was that it lasted just five minutes. We parked out the front of

the property and walked down the side driveway. The complex was built with four units on the ground

level and four units on the first level. It was a brick structure and you didn’t have to be a builder to see

that the exterior needed some urgent cosmetic repair. Tom warned us that the interior wasn’t exactly

Buckingham Palace either. But no amount of preparation could have helped me to mentally prepare

for what was about to happen.

The first unit Tom showed us through was the one rented to his friendly tenant who didn’t mind

showing us through at a moment’s notice. It was still quite early, about 9:30 am, so when Tom

knocked on the door it took a few minutes before it was opened by a sleepy looking middle-aged

woman. Tom enquired as to whether it was okay to come through. The tenant agreed and opened the

door allowing us to walk inside. Well, I was totally speechless.

The entire unit was covered in wall-to-wall crochet. Truly, it was like someone had placed a thick

rug, like the one your grandma might have knitted, on just about everything — the walls, ceiling,

floor, over the furniture, over the light stand, over the toilet seat … everywhere. The only other object

of any note was a suspicious-looking incense burner on the coffee table with two strange cylindrical

openings … but that’s another story.

Apart from inspecting a few properties as a tenant when Julie and I were looking for a place to live,

I’d had precious little education about what to look for when walking through a potential investment.

Undaunted by my lack of experience, I left the crocheted lounge room — stepping over the crocheted

rug — and ventured into the hallway to inspect the remainder of the apartment. The few visible

fixtures that weren’t covered by crochet were quite basic, and the interior was of very late 1970s

design — right down to the brown kitchen tiles and orange kitchen bench.

In what would become known as our ‘good cop, bad cop routine’, Dave took Tom aside to ask

questions about the sale terms, while I returned to the lounge room and spoke to the tenant, Connie,

who was already smoking her second ‘herbal’ cigarette since we’d arrived.

‘Connie’, I asked. ‘Do you like living here?’

I’ll never forget her response, because it taught me a critical investing lesson. Connie was

thoughtful for a few seconds and then replied, ‘Yeah. I love being here. I love hearing the sound of the

traffic all night long, it helps me to go to sleep’.

Personally I doubted if Connie needed anything to help her sleep since she seemed quite calm as it

was. I don’t know about you, but I’ve lived on a main road before and I vowed never to do it again.

The sound of the cars and trucks didn’t put me to sleep — it kept me wide awake all night! But Connie

didn’t just tolerate the noise, she enjoyed it. This reinforces the lesson I mentioned in the preface that

you buy investment properties for other people — not yourself — to live in.

I didn’t know what else to ask Connie, partly because I was totally speechless. However, after

composing myself I did manage to ascertain that she had lived in the property for a number of years,

and there wasn’t a major problem with crime or hard drugs in the area, although a few of the tenants

had been evicted for disruptive behaviour. When Tom and Dave reappeared, they indicated that it was

time to move on to the next unit. I thanked Connie for allowing us to look through her home and bid

her a good day.

The next unit we inspected was one that Tom hadn’t been through before since this was the unit that

the rowdy tenants had been evicted from a week or so earlier. He warned us that tenants sometimes

leave surprises, but what was in store for us was something completely out of the ordinary. Taking a

key from his trouser pocket, Tom inserted it into the lock and pushed firmly on the door. With a little

pressure it gave way to reveal a very sparse unit. No sign of crochet here — quite the opposite; there

was no carpet, no curtains, no stove, no light globes and no smell. We walked through a small hallway

into a combined lounge and kitchen area. The floorboards were bare timber, revealing that the carpet

had been recently ripped up.

And there it was, in the middle of the lounge room — a homicide-style outline of a life-sized body

that had been spray-painted on the floor. This was the previous tenant’s idea of a parting joke and, I

must confess, Dave and I thought it was pretty funny. Even Tom had a chuckle.

We had a brief look through the rest of the unit, and aside from the spray-painted homicide body

there wasn’t much else to see or note so we moved on to inspecting the exterior of the property. The

carport area where the tenants parked their cars needed repairs, and the grounds were generally

overgrown with long grass and weeds.

Was this a good deal? Was it a diamond in the rough that we could polish up and turn into positive

cashflow? Even though Dave and I didn’t have enough money to pay a deposit, we nevertheless

submitted an offer for about $100 000 less than the asking price. We justified this by saying that we’d

have to spend about this amount of money bringing the property back to its former glory. This offer

was submitted to the vendor but it was rejected because the seller needed full price to settle other

debts.

A few weeks later we learned that the property did sell, to another investor (from Melbourne) who

paid full price sight-unseen on the basis that it provided an excellent negatively geared return.

Not making the same mistake

Tom dropped us back at his office and, sensing that we were serious (perhaps because we submitted an

offer on the spot), he made a more determined effort to sell us something else. He reopened his blue

book of property listings and wrote down several more addresses — this time mainly single family

homes.

He explained that he could only show us through one of the properties as the others were tenanted

and would require 24 hours notice to arrange inspections. Tom offered to drive us out to look at the

property we could inspect, but we didn’t want to risk our lives a second time, so we politely declined.

I suggested that we follow him instead.

It was one of the funniest experiences of my life sitting in the passenger seat as Dave tried to follow

Tom to the property. Instead of driving sedately and making it easy for us to stay on his tail, Tom

seemed to go out of his way to lose us. He’d accelerate through orange lights, make hard right turns

without indicating, and he drove at excessive speeds. Dave did his best and tried to keep up, but to no

avail. It was a good thing that I’d kept the piece of paper Tom had written down the address on, as

well as my trusty map, otherwise there’s no way we could have found the place. When we finally

arrived at the property Tom gave the impression that he’d been waiting around for hours.

We didn’t end up buying any properties through Tom. In fact, a few weeks later we called into his

office only to discover that he’d moved on to another job in a different field of expertise. Perhaps it

was for the best.

The lesson we learned

Dave and I spent the rest of the day with various other real estate agents looking through 14 other

properties located all over Ballarat. While it was time consuming and we didn’t really know what we

were doing, talking face to face with agents and inspecting properties pushed us well beyond our

comfort zones and provided the practical context for us to learn and grow as investors. This

experience was more valuable than any seminar or any book, as there’s simply no substitute for taking

action.

We decided to call it a day at about 4 pm and drove back to Melbourne. Although Dave and I

returned from our first trip without signing any contracts, we had discovered a valuable property

investing lesson: that there was one price for locals and another higher price for investors from out of

town.

By dressing in suits and trying to give a professional image we were, in fact, providing the real

estate agents with a sign that said, ‘These guys are from out of town’. This meant that the asking price

was often inflated since we seemed to have money and didn’t know the market or the value of what we

were buying.

Steve’s investing tip

When you look like you’re from out of town, you will get treated like you’re from out of town, too.

This point was best demonstrated a few months later when Dave and I were sitting in a real estate

agent’s office negotiating to buy three houses from the one vendor. The first question the seller asked

the agent was, ‘Are they wearing suits? People in suits will pay more’. We learned the lesson and

switched our attire to mainly tracksuit pants. Occasionally, if it was going to be really cold, I’d also

wear a beanie.

By the time we arrived home, Dave and I were exhausted. Yet we were also encouraged by our

experience and we agreed to return to Ballarat the following week to keep looking.

Determined to be better prepared the second time around, I spent several hours over the next week

searching for potential deals in the local Ballarat paper and on the internet. I even created a profile of

my ‘ideal’ investment, since a lot of agents needed a specific description of the sort of property I

wanted — apparently our initial answer of ‘anything that’s positive cashflow’ was too vague. The

profile we created was of a three (or more) bedroom home, in a neat and tidy condition, priced at up to

$60 000 that could be expected to rent for about $120 per week.

Steve’s investing tip

The more specific you can be with what you’re looking for, the more chance you have of finding it.

On the morning of our second trip to Ballarat, Dave again dropped by to collect me at a reasonably

early hour so as to avoid the Melbourne peak-hour traffic. This time I met him in more informal

attire — old jeans and a casual t-shirt. Dave wore what became his ‘house-buying pants’ — tracksuit

pants that were well worn after many years of use.

By the time of our first appointment, Dave and I were starting to feel like we knew the Ballarat area

reasonably well — and certainly much, much better than we had on our first visit just one week

earlier. The lesson in all of this is that if you plan to invest in an area that you don’t live in you’ll find

it next to impossible to pick up a feel for properties unless you spend time ‘on the ground’ there

yourself.

Steve’s investing tip

If you don’t know an area like a local, don’t invest there.

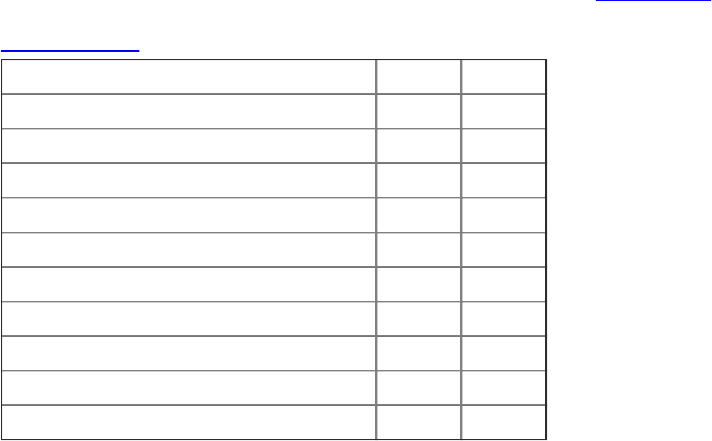

The importance of due diligence

After looking through so many properties on our first visit, I knew that unless I implemented a

standard way of inspecting properties there was a huge risk that I’d forget something important. When

you look through multiple properties in an afternoon, unless you have a photographic memory they all

start to blur into one.

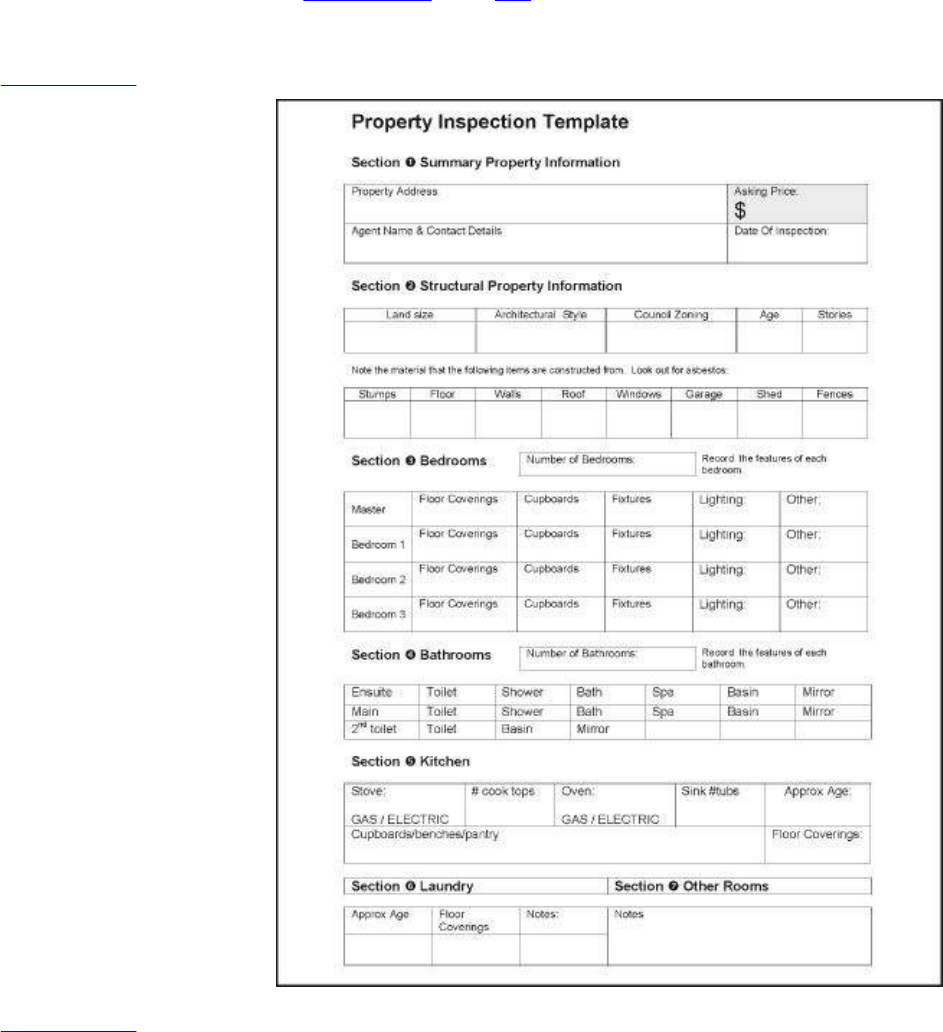

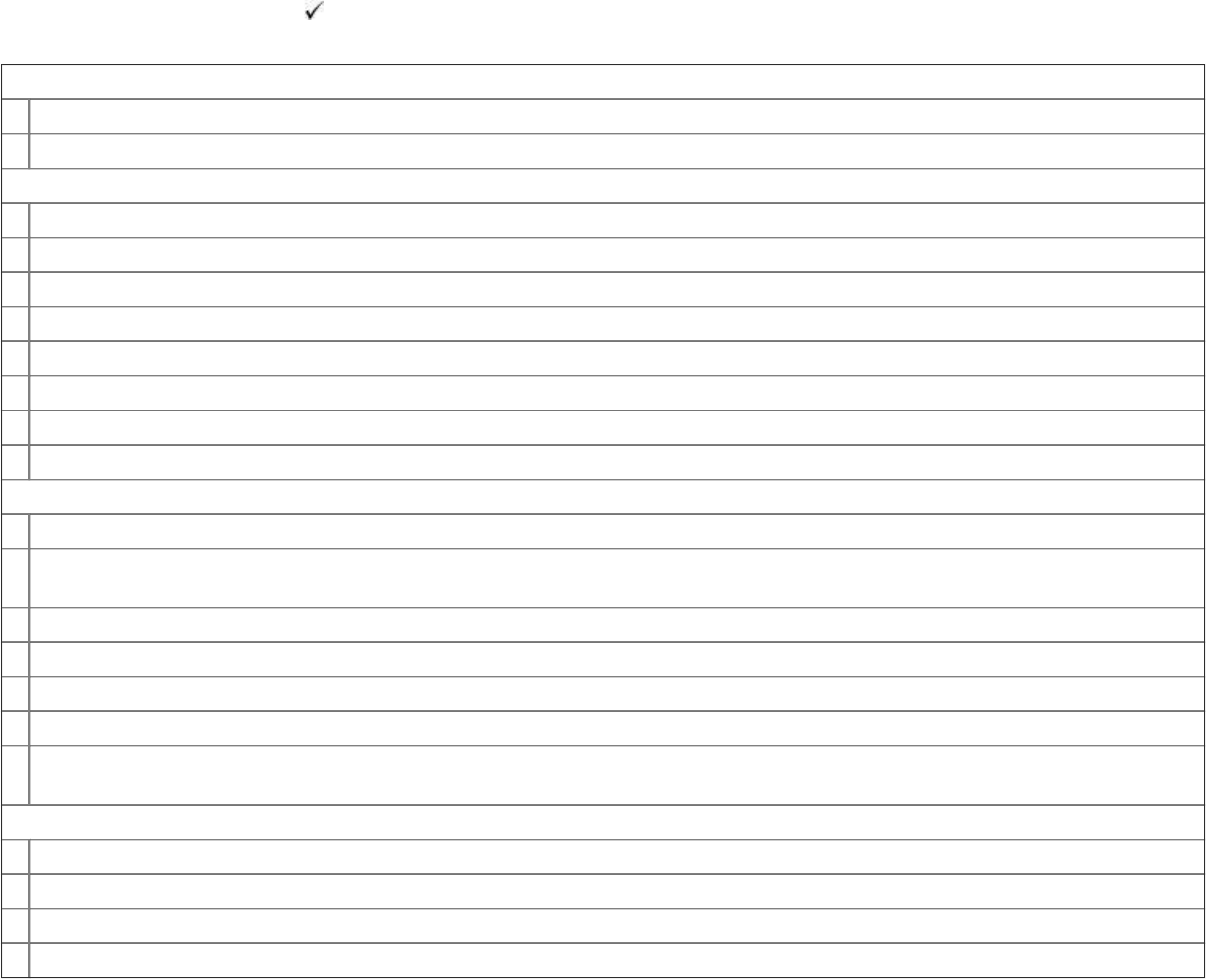

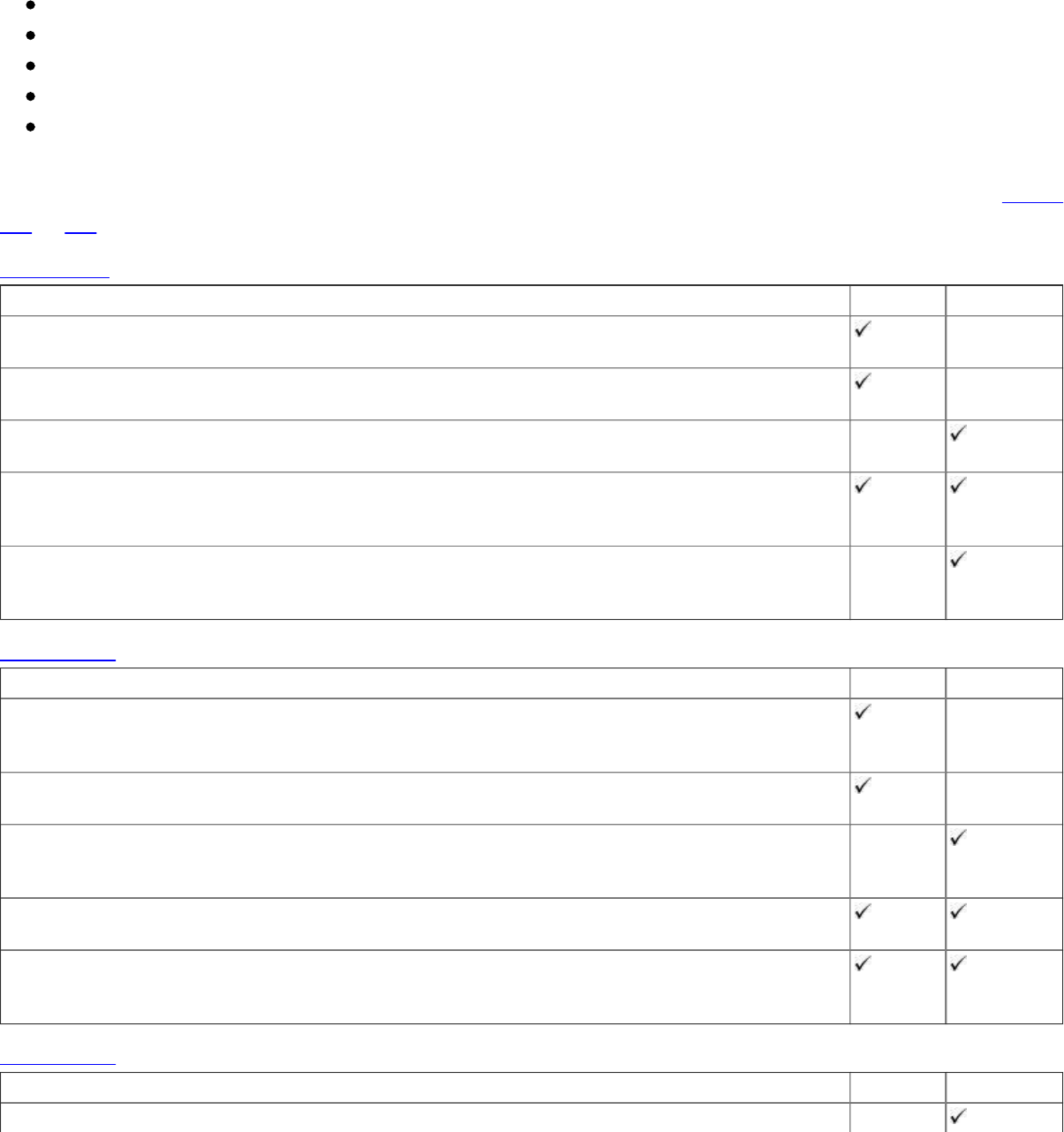

To jolt my memory I created a series of templates that ensured every property I inspected was given

the same thorough once-over. It wasn’t a substitute for a proper builder’s report, but it was an

excellent first glance over a property that forced me to pay closer attention to details that I might

otherwise have glossed over or missed entirely. Later I’d come to know that real estate agents are

experts at showing you the things they want you to see, while subtly deflecting your attention away

from potential problem areas. To ensure I was as thorough as possible, I created a two-page ‘tick the

box’ style template (see figures 2.1 and 2.2 on pages 29 and 30), and this allowed me to focus on

issues that might cost thousands to fix if there was a problem.

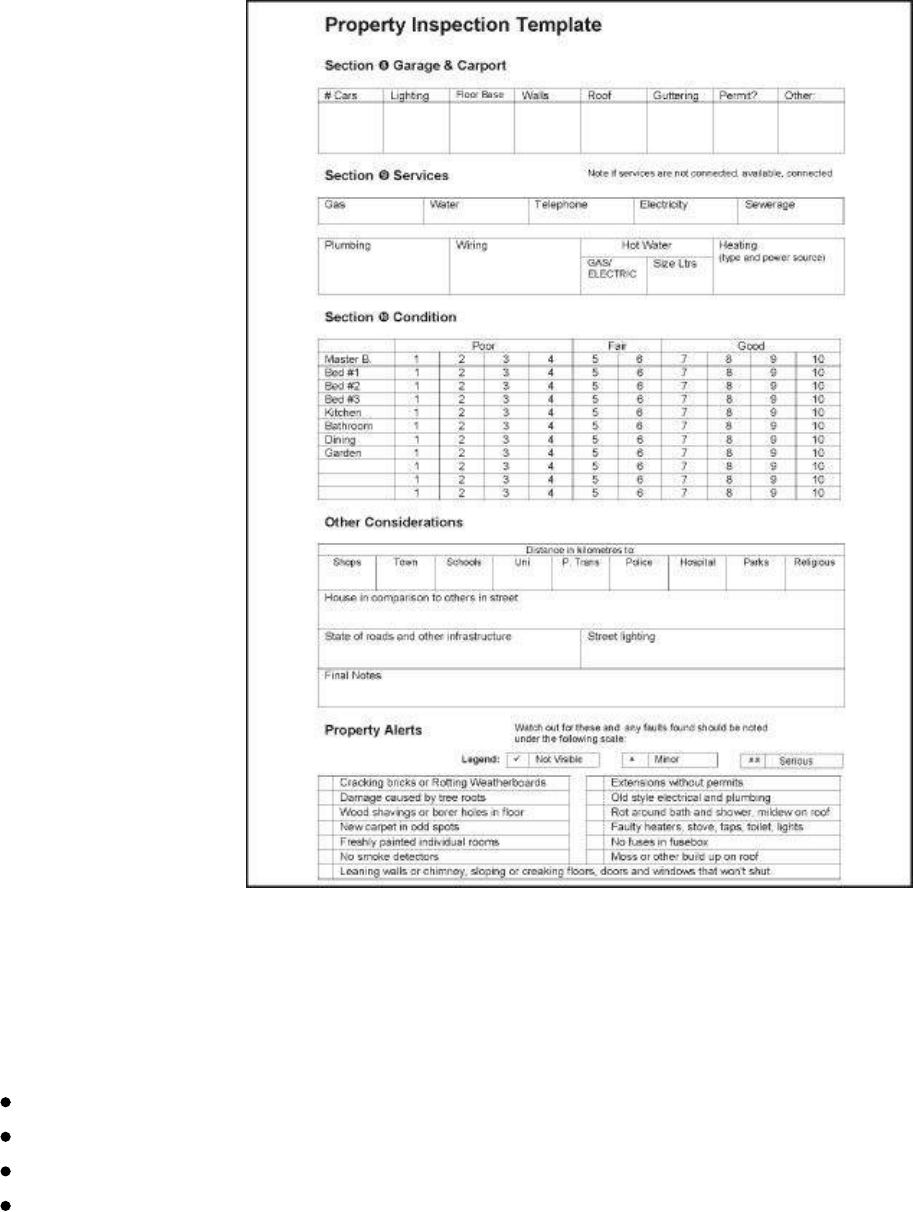

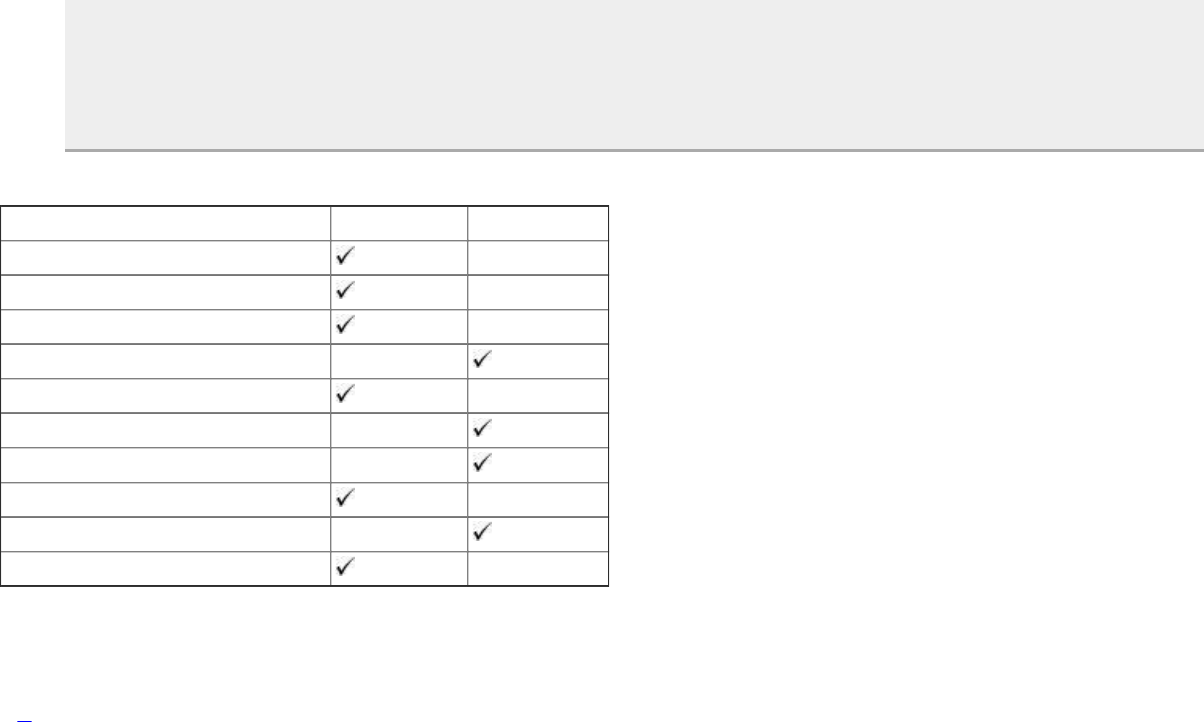

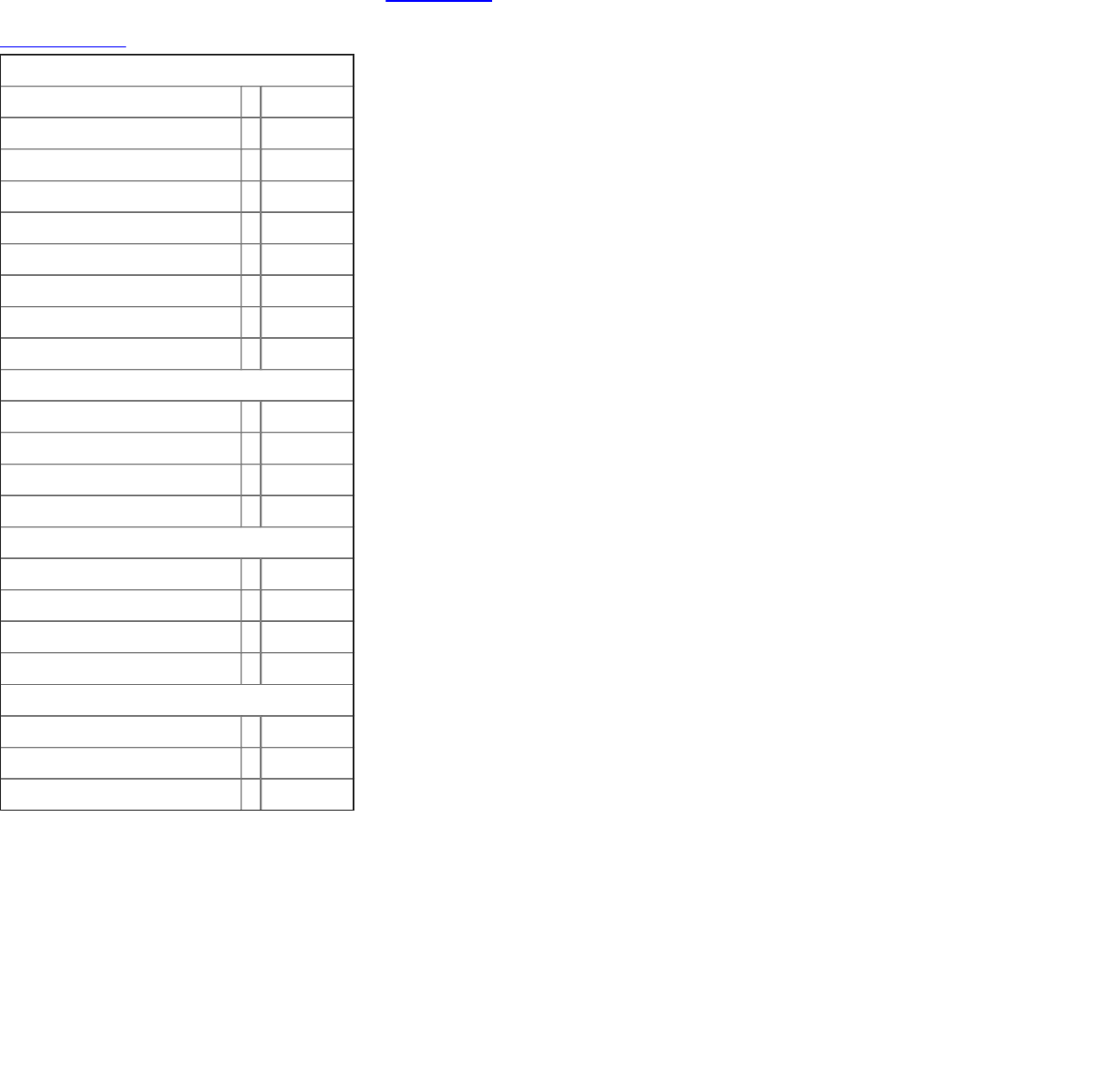

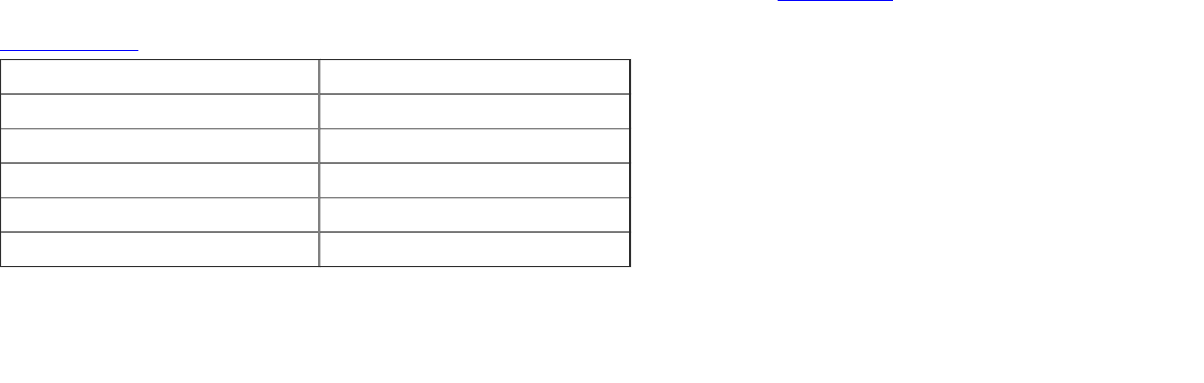

Figure 2.1: inspection template (page 1)

Figure 2.2: inspection template (page 2)

For example, one property I inspected featured a central heating system that was turned off on the day

of my inspection. When I asked for it to be switched on it sounded like an aeroplane taking off down a

runway. When I looked over the unit it was clearly old and would probably have been difficult to find

parts for. This meant that it was more of a potential problem than a benefit.

Other issues I watch out for include:

old-style wiring (easy to tell by whether or not the fuse box has been rewired)

the condition of the floorboards under the carpet (pull up a corner of the carpet)

illegal sheds out the back (if they don’t have downpipes then they’re probably illegal)

the age of the hot water service (have a look at the compliance plate on the unit).

Whereas the tools of an accountant are a pen and a calculator, the tools a property investor needs are

a spirit level and due diligence templates. While using the template allowed me to identify potential

issues, of equal value was the agent’s perception that I was a serious investor because I used a form

and looked organised with my clipboard and pencil. Apparently, next to no-one else bothered, so I

looked like a veteran when in truth I was just a beginner.

This inflated perception was very valuable at negotiation time. On more than one occasion I

overheard the agent tell the vendor (on the phone) that there was no point trying to eke out a few

thousand dollars extra since the interested buyer was a professional investor.

Meet Micky G

The last agent we were scheduled to meet was Michael Golding, or Micky G as we later affectionately

called him. Micky G is a great guy — a real character and a true country lad.

Michael is a smart agent. I’m not sure whether he’d ever admit it, but I’m certain he used a trick

right out of the agent’s ‘How to Sell Property’ manual the first time he met us. The trick is simple;

show the purchaser through a few houses which you know are not suitable and then, like magic,

present the most appealing house as the final property on the inspection list.

It was late afternoon when Mick drove us into West Wendouree — the area the waiter in the cafe on

our first trip had warned us to stay away from. ‘It’s a rough area’, he’d said, and judging by the look

of some of the houses and a few of the people walking the streets, that was no exaggeration!

Steve’s investing tip

If you want to find out more about the due diligence templates I use (which can potentially save you thousands of dollars)

then please visit <www.PropertyInvesting.com/HomeInspectionSpy>.

There were several upcoming auctions of Ministry of Housing properties to be held by Michael’s

agency and he had the keys to show us through many of the houses. We began by looking through

some properties in Violet Grove, a particularly rough part of West Wendouree that was apparently

dubbed ‘Violent Grove’ — perhaps a fair title judging by the disaster of a place we inspected first.

Micky G simply opened the door and said, ‘I’ll let you boys wander through this one by

yourself — just watch out for holes in the floorboards’.

Most ex-commission properties have a similar layout. Built after the end of World War II, they were

constructed offsite and trucked in as two rectangular halves and then joined together. There’s not a lot

of architectural finesse, but they’re solid homes that are built to last.

Anyway, the first ex-commission house that we looked through made the unit with the spray-painted

homicide body on the floor look like a palace. There was thick black graffiti on the walls, the entire

kitchen was burnt out, and where the stove once stood there were blackened walls and small clumps of

charcoal — evidence of a small fire close to where the gas pipe came up to service the stove. As Dave

and I walked around the house we noted that many floorboards were missing and any chattels of worth

had been either vandalised or ripped out. Most of the walls had several holes where someone had

punched into them and there was a constant smell of stale urine emanating from the half-intact carpet.

In all respects this house was a disgrace, but Micky G was optimistically cheerful, winking at me

while he told Dave that the property was ‘a renovator’s delight if ever he’d seen one’.

Our first deal

Things were looking grim as the sun started to set on another day in Ballarat. We had been through

three more houses and there was only one more property that Michael had us down to

inspect — another ex-commission house in The West. Our prospects weren’t looking good if the

hovels we’d inspected so far were any indication of what was to come.

As we drove to our final inspection Mick said, ‘This one’s different to the others we’ve just been

through. It’s been privately owned for several years and is in good condition’.

In fading light, Micky G, Dave and I walked up and knocked on the front door. Despite the generally

positive external appearance of the place, I left my clipboard and evaluation form in the car, having

long since abandoned the idea of buying a property in this area.

If the exterior of the property was well kept, then the interior was immaculate with a real homely

feel about it. While I raced back to the car to get my clipboard, Dave started to quiz Mick about the

house.

It turned out the owners, who were watching television as we completed our inspection, were a

retired couple who needed to sell due to poor health. Interestingly, the property had been almost sold

twice before (for $54 000 and $52 000), however both times the sale had fallen over because the

purchasers couldn’t secure finance. With the owners now becoming more determined to sell, they had

dropped the asking price to ‘offers above $50 000’.

As I completed my due diligence form it was clear that the property didn’t need any money spent on

it to make it appealing to a future tenant. Dave asked Michael to estimate how much it would rent for,

and he replied ‘at least $110 per week’.

Doing some quick calculations in our heads, Dave and I knew that, finally, we’d found the sort of

property we were looking for. We thanked the owners for allowing us to tramp through their home

before walking out the door and through the front gate with Micky G in step behind us.

‘Well boys,’ Mick said, ‘what do you think? Is this the sort of thing you’re after?’

As the last rays of afternoon sun touched the nature strip, Dave and I requested a few minutes to talk

it over in private. We both quickly agreed that this house was exactly the sort of property we wanted,

but how much should we offer? Without any science or method, we just pulled a number out of the air.

Returning to Mick, who had walked a dozen or so paces further down the nature strip, I said, ‘We’d

like to submit an offer of $40 000’.

Michael smiled as he replied that he’d submit the offer immediately, although he wasn’t sure

whether or not it would be accepted since it was a little on the low side. My heart was thump-thump-

thumping as Dave and I waited by the car while Micky G disappeared inside to put our offer to the

owners.

Dave and I used the time while Mick was inside to chat about what we’d do if our offer was rejected.

We concluded that we were happy to go a few thousand higher, but we agreed to wait and see what the

agent came back with before upping our offer.

Micky G returned a few minutes later. ‘They won’t go below $48k guys’, he countered with a

concerned look on his face. We were now at the final stages of negotiating. Dave and I again moved

away for a few moments to confirm our next step. When we rejoined Mick on the nature strip, this

time Dave (bad cop) spoke. ‘All right. Last offer. We’ll meet you half way at $44 000.’

Although this was less than the figure that Mick had said was the minimum the vendors would

accept, he went back inside with a hopeful look upon his face. After what seemed an eternity but was

in fact about five minutes, Mick came back outside and said, ‘It’s a deal’. We’d bought our first

property!

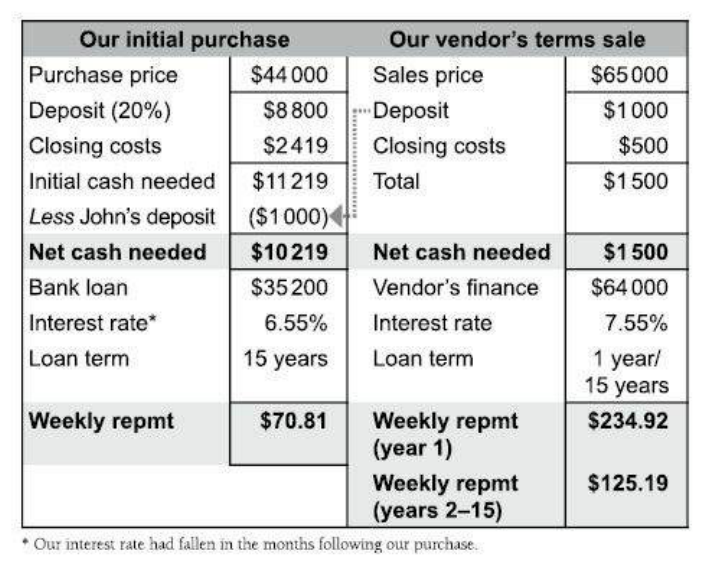

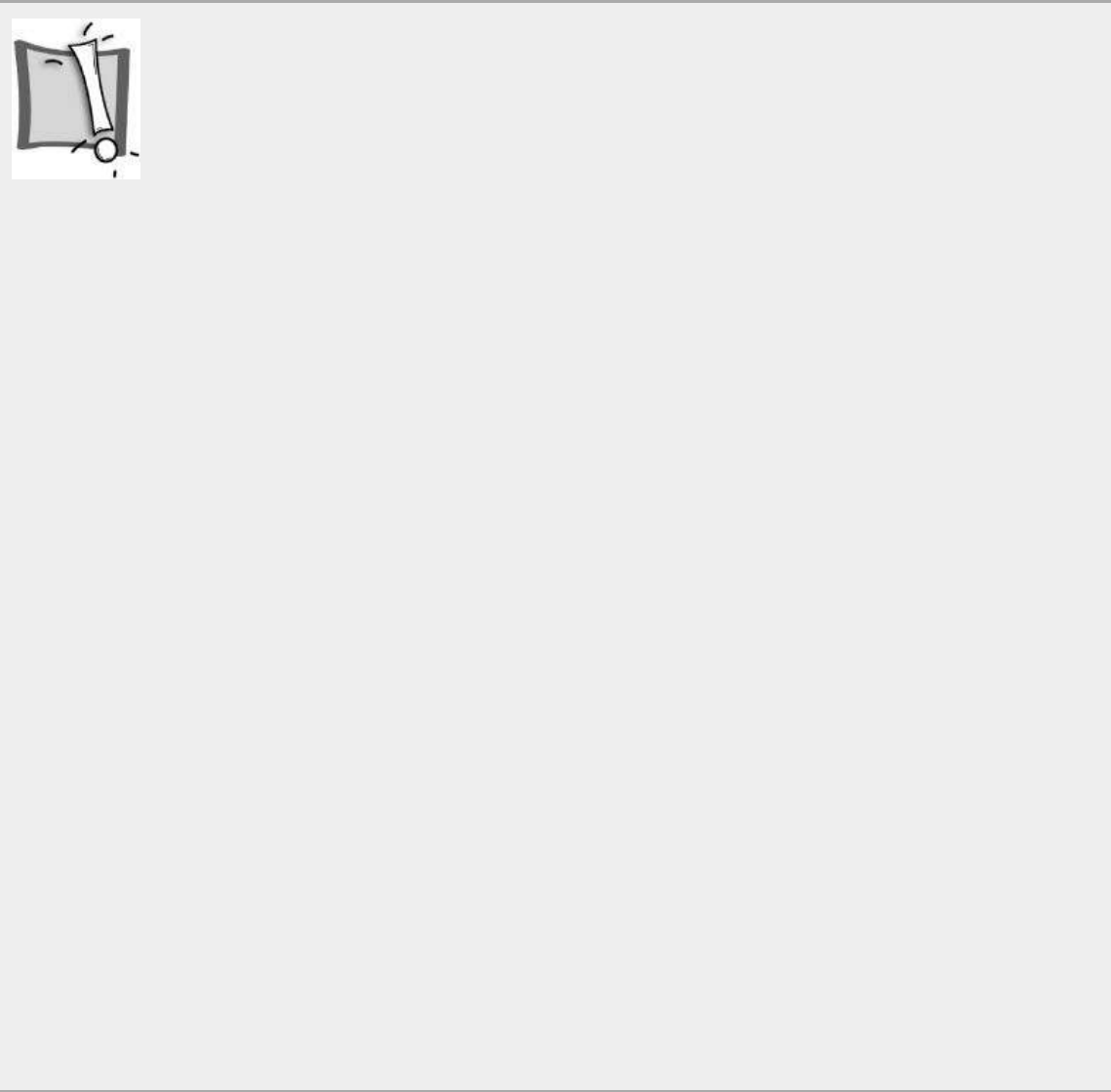

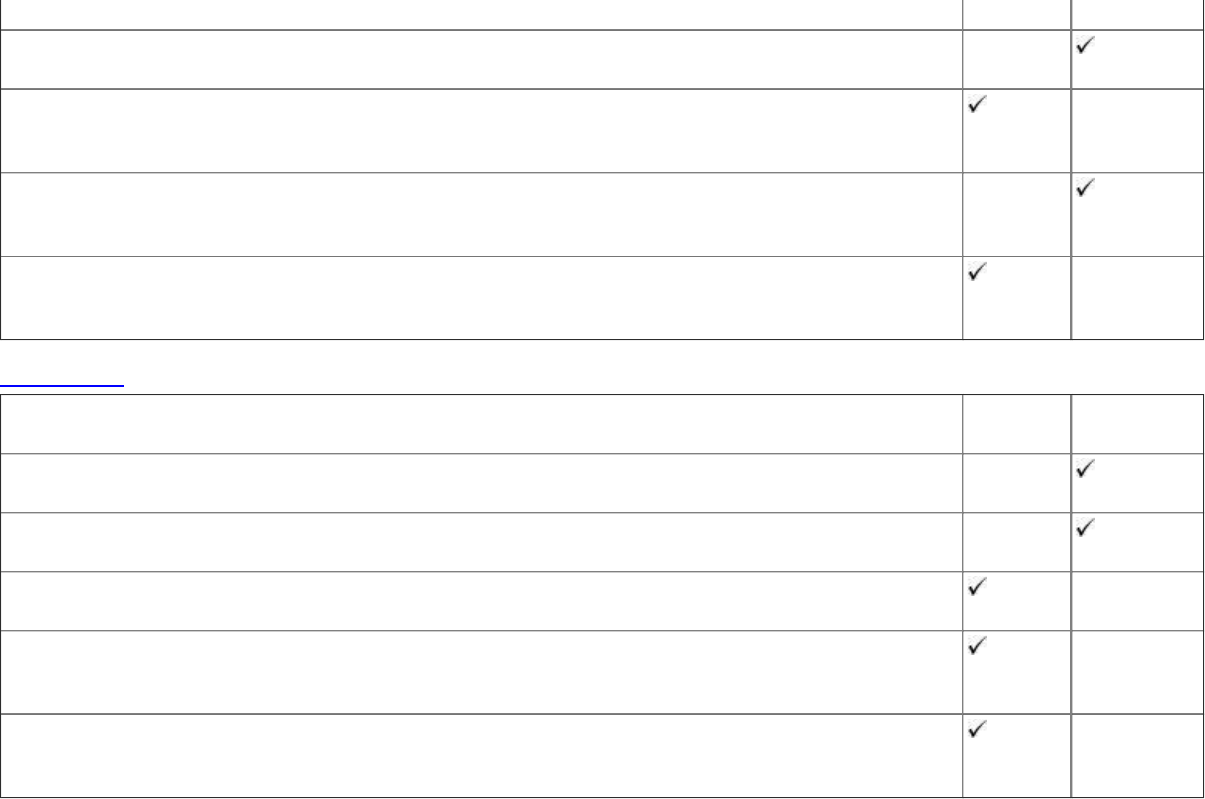

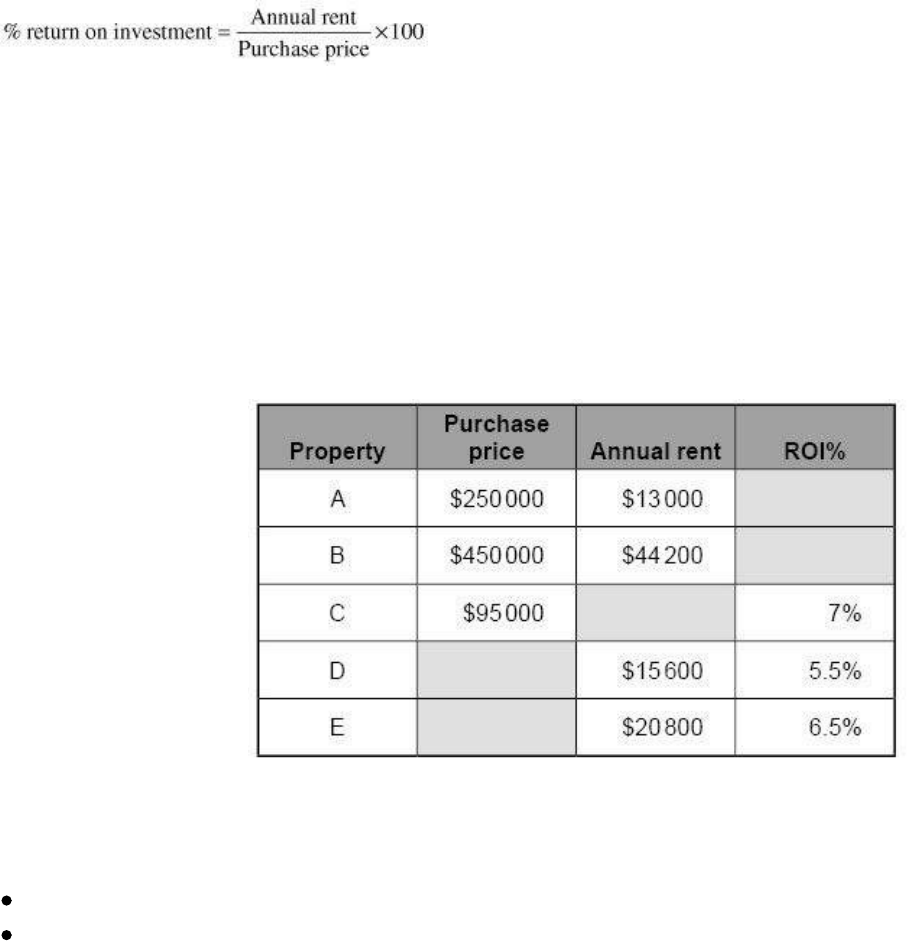

The following tables give the figures for the deal. Even if you struggle with numbers, it would be

wise to spend a minute or two becoming familiar with tables 2.1 and 2.2. I’ve included extra detail so

you can see the sorts of additional costs you’ll pay, as well as how I crunch the numbers to calculate

the return.

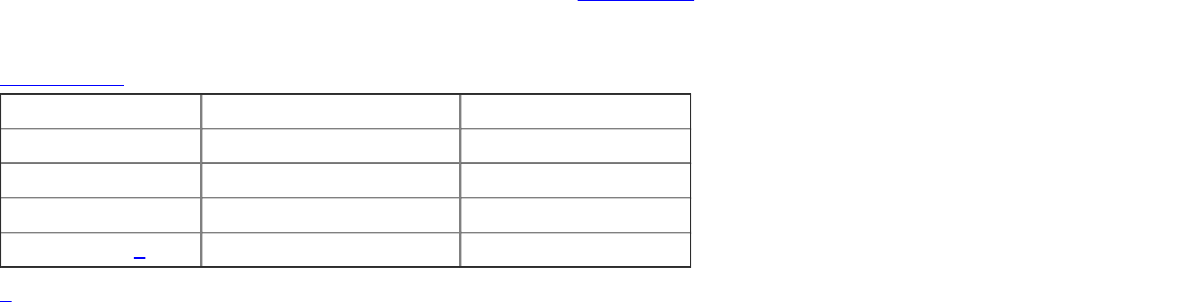

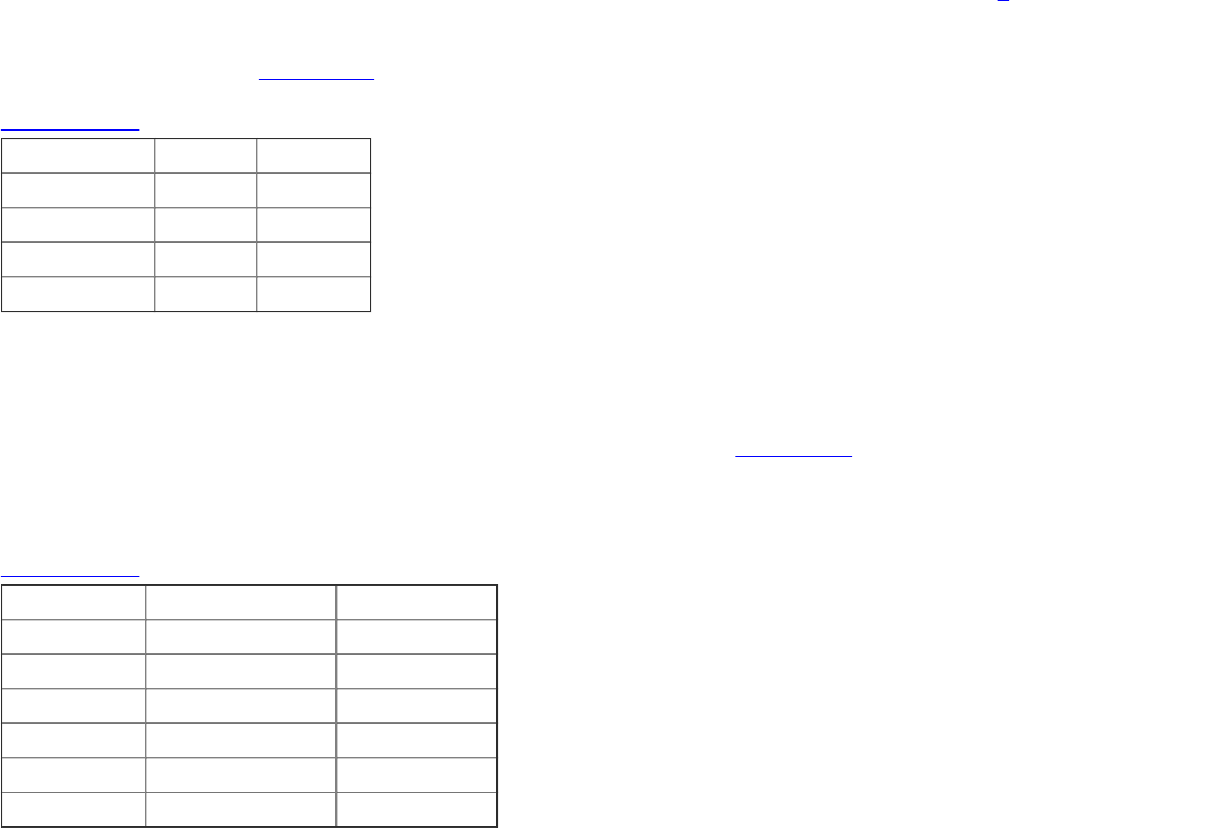

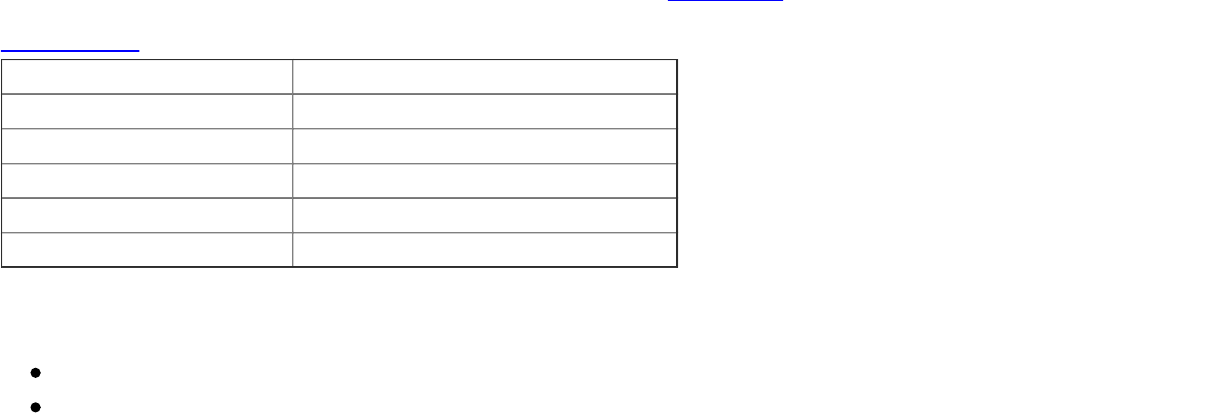

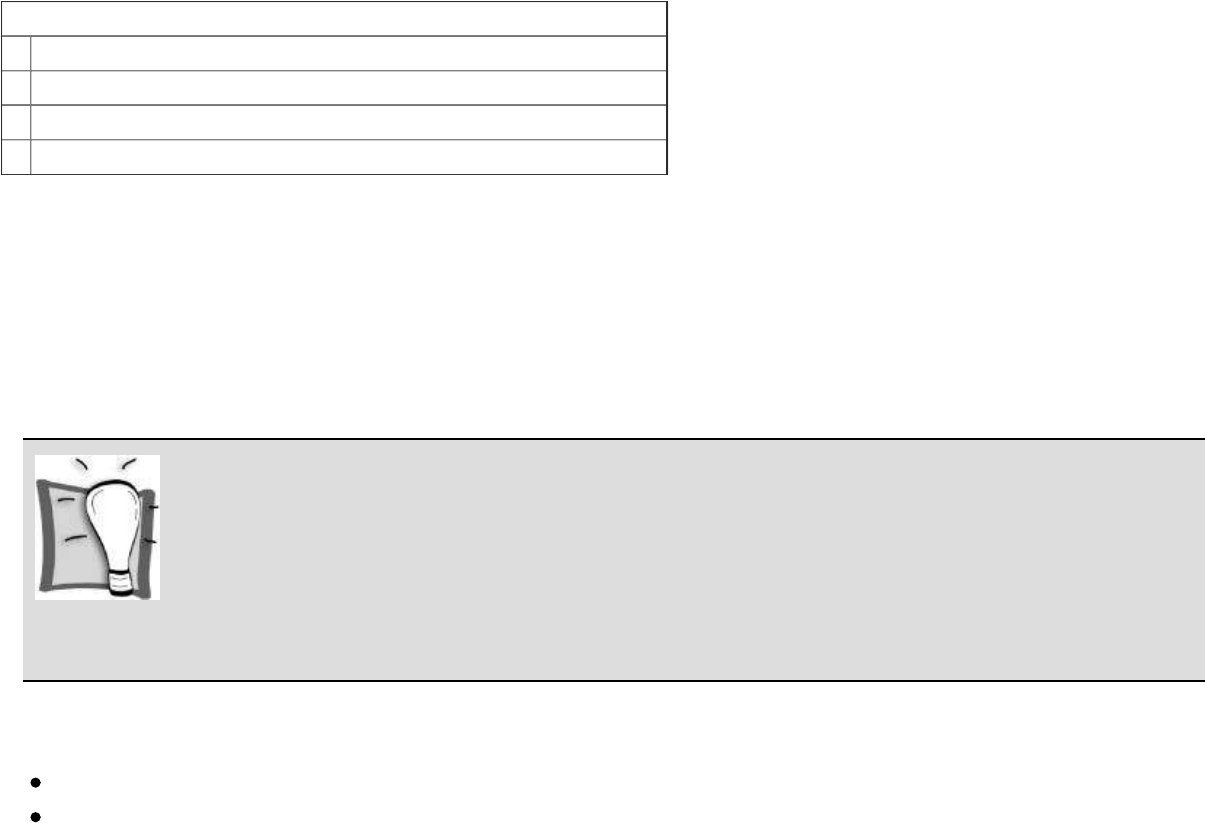

Table 2.1: purchaser’s settlement statement

To: Purchase price $44000.00

To: Purchaser’s solicitor costs & disbursements (current bill) $375.55

To: Purchaser’s solicitor costs & disbursements (prior bill) $200.00

To: Bank cheque fees $18.00

To: Rate adjustment $14.46

To: Stamp duty fee - transfer $856.00

To: Titles office fee - transfer $204.00

To: Misc. transaction charges $36.77

By: Deposit paid $4400.00

By: Balance required to settle: $41304.78

Total: $45704.78 $45704.78

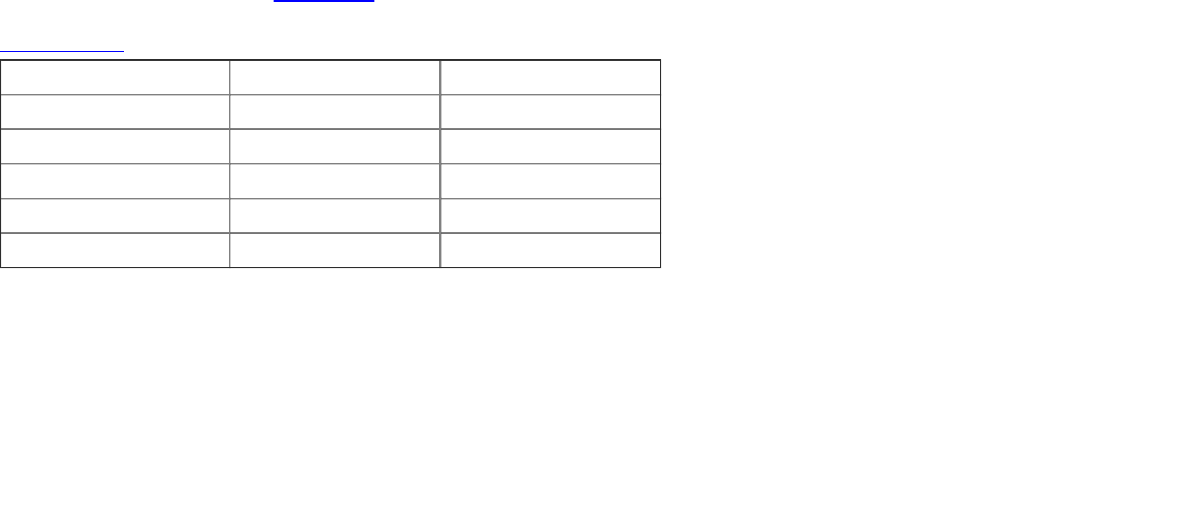

Table 2.2: return calculation

Purchase price $44 000

Initial cash spent to acquire the deal

Deposit (20%) $8 800

Closing costs $1 705

Loan establishment $714

Initial cash needed $11 219

Our loan

Principal $35 200

Type Principal & interest

Term 25 years

Initial interest rate 8.05%

Weekly repayment $62.82

Annual cashflow received

Rent per week $120

Annual cashflow received $6 240

Annual cashflow out

Loan repayment $3 267

Management costs $840

Rates $690

Insurance $200

Repairs budget $200

Total cashflow out $5 197

Annual net cashflow $1 043

Cash-on-cash return

Annual net cashflow $1 043

÷ Initial cash needed $11 219

Cash-on-cash return 9.30%

We also had to contribute a further $713.80 in mortgage application, legal and registration costs,

together with another $4400 as a deposit since we were only borrowing 80 per cent of the purchase

price. Our cash-on-cash return is shown in table 2.2.

The car ride home

Eureka! In partnership with Dave Bradley, I’d finally bought my first investment property. Had you

met us that afternoon you might have mistaken us for investors who had just negotiated a $44 million

deal, rather than a $44 000 property in the backblocks of Ballarat. There was no shortage of high fives

and talk about how easy it was to find good opportunities. Sure, we’d spent two full days looking for

the property, but now we’d found one, others were sure to follow.

IT’S ALL ABOUT APPLICATION

Property investing is a lot like a rollercoaster in a fun park — there are lots of highs and lows. You

also meet all sorts of characters spruiking for your business.

My hope in sharing the story of my first property purchase is that it demonstrates just how hard it is

to make a start. You’re kidding yourself if you think you’re just going to call an agent and find the

deal of a lifetime. However, as one opportunity comes to a dead end, another opens. For example, it’s

common that the property you are most interested in doesn’t quite stack up, but in the course of

driving around or chatting with agents a better deal appears.

Steve’s investing tip

Failing to try means you’re trying to fail.

I’m willing to bet that the main reason you can’t find great property deals is because you’re too busy

not looking for them. Your financial future is worth a hundred times more than the inconvenience of

looking like a fool or trying something new.

CHAPTER 2 INSIGHTS

Insight #1

You’ll only ever do your first deal once. From then, as your experience broadens, you’ll become more and more