Guide To Real Estate Investing

TM

Guide To

REAL ESTATE

INVESTING

GUIDE

TO

REAL ESTATE

INVESTING

GUIDE

TO

REAL ESTATE

INVESTING

DISCLOSURE

This publication and the accompanying materials are designed to provide accurate and authoritative information in

regard to the subject matter covered in it. It is provided with the understanding that the publisher is not engaged in

rendering legal, accounting, or other professional opinions. If legal advice or other expert assistance is required, the

service of a competent professional should be sought. Reproduction or translation of any part of the information contained

herein, in any form or by any means, without the written permission of the owner is unlawful. The educational training

program provided hereunder is not designed or intended to qualify students for employment. It is intended solely for the

avocation, personal enrichment, and enjoyment of students.

All forms contained herein are provided for educational purposes only. The provider does not assert any warranty,

express or implied, as to the legal effect and/or completeness of the forms. The provider hereby disclaims any and

all liability with respect to these forms. The provider suggests that you contact an attorney to ensure that the forms are

modified to meet the laws of your state.

The sample list of website resources contained herein are provided solely for educational purposes and as a convenience,

and does not imply our sponsorship, endorsement or approval of any website or company, its sponsors, products and/

or services offered on its website or otherwise, or any of its advertisers. The publisher does not maintain the website(s)

or assume any responsibility for the accuracy, content and current status of any information provided. Please also note

that the locations on the site(s) can change without notice.

DISCLOSURE FOR FORECLOSURE AND EQUITY SHARING TECHNIQUES

The Foreclosure Training course or foreclosure content presented in Company trainings, products and services are

intended to provide generalized broad-based experiential real estate foreclosure and pre-foreclosure training techniques.

This information is not intended to provide legal advice or detailed guidance on how to properly conduct foreclosure

and/or pre-foreclosure activity in your state. As with any regulated activity, we strongly recommend that you consult with

an attorney.

There are currently a growing number of states that have enacted legislation that could impact how you participate

in foreclosure and/or pre-foreclosure activities in those states. Violations of these laws may result in civil and criminal

penalties, including damages, fines and terms of imprisonment. For more information about these laws, please refer to

the additional information located at the following website: http://richdadeducation.com

RICH DAD™ EDUCATION

1612 E. Cape Coral Parkway Cape Coral, Florida 33904

© 2006-2010 Rich Dad Education All Rights Reserved.

The Rich Dad word mark and logos are owned by Rich Dad Operating Company, LLC. and

any use of such marks by Rich Dad Education is under license.

10RDE0100 v1 7-10

Important Note:

Be sure you contact your local real estate professional or real estate lawyer to research the appropriate documents

that are required for all real estate transactions in your state.

GUIDE TO REAL ESTATE INVESTING

Table Of Contents

GUIDE TO REAL ESTATE INVESTING

introduction:

Investing In Your Future .........................................................1

The Major Benefits Of Real Estate ..........................................2

A Market Full Of Opportunities .............................................5

chapter 1:

The Circle Of Wealth .....................................................................11

Many Property Types and Business Strategies .........................12

The Circle Of Wealth And Multiple Income Streams ................13

Types Of Earned Streams Of Income ....................................14

Types Of Passive Streams Of Income ....................................14

Types Of Portfolio Streams Of Income In Real Estate ................16

An Introduction To Some Key Areas Of Real Estate Investment ...17

Making The Right Income Stream Choices .............................18

Wholesale Buying ............................................................20

Lease Options ..................................................................22

Foreclosures ....................................................................23

It’s A Learning Process .......................................................24

chapter 2:

Understanding Market Analysis & Evaluation ............................ 27

History Is A Great Teacher - And Predictor Of The Future ..........27

How Does That Relate To Today’s Markets .............................30

If Educated Investors Don’t Buy Emotionally, How Do They Buy? 30

You’ve Got to Know When to Hold—and When to Fold!.........32

What This Means To You ..................................................33

chapter 3:

Getting To Know Your Market ............................................ 37

True Market Value .............................................................38

Defining The Area You Will Invest In .....................................38

Segmenting Your Area .......................................................39

Deciding What Area You Want To Focus On .........................41

Determining Property Values Using Comps .............................41

What The Comparables Will Tell You ...................................42

chapter 4:

Selecting A Power Team .................................................... 47

Finding The Right Real Estate Professional ..............................47

Choosing The Right Real Estate Professional ...........................48

Not Too Big, Not Too Small, Just Right!!! ..............................49

Real Estate Professional Interview Script ................................50

Finding The Right Mortgage Broker ......................................52

Mortgage Broker Interview ................................................53

Community Banker ..........................................................54

Contractor Handyman .......................................................55

Tax Professional ................................................................56

Appraiser ........................................................................56

Lawyer ...........................................................................56

Title Company .................................................................56

Home Inspection Professional ..............................................57

Surveyor .........................................................................57

Termite Inspectors .............................................................57

Insurance Agent ...............................................................57

Property Manager ............................................................58

Mentor ...........................................................................58

Government Grant and Loan Specialists................................58

Networking Contacts ........................................................58

chapter 5:

Finding Motivated Sellers .................................................. 63

What Is A Motivated Seller? ...............................................63

How Do We Find Them? ...................................................64

Niche Marketing ..............................................................77

Networking Resources .......................................................81

chapter 6:

Making Quick Cash: Wholesales ........................................ 91

Where To Find Wholesale Deals .........................................92

Driving For Dollars ............................................................93

Assignment Of Contract And Double Closing .........................96

Contingencies ..................................................................97

Title Companies or Closing Attorneys ...................................99

Building A Database Of Buyers .........................................100

Advertise To Find Your Buyer .............................................104

What To Offer ...............................................................105

Negotiating With The Seller .............................................107

Contracts ......................................................................108

Why Wholesaling? ........................................................110

Exit Strategies ................................................................112

chapter 7:

Securing The Financing ................................................... 117

Getting Creative.............................................................117

Working With Mortgage Brokers ......................................118

Calling Mortgage Brokers ................................................119

Pre-Qualified Vs. Pre-Approved..........................................120

Questions To Ask Mortgage Brokers ...................................121

Seller Financing .............................................................126

Other Low Or No Money Down Techniques ........................130

GUIDE TO REAL ESTATE INVESTING

Table Of Contents

chapter 8:

Profiting By Controlling Property: Lease Options ............... 149

Elements Of A Standard Option Contract ............................150

What Is A Lease Option ..................................................151

Benefits Of A Lease Option ..............................................152

Buying And Selling With A Lease Option ............................155

Who And What We Are Looking For? ...............................157

Working With The Motivated Seller ...................................162

Things To Agree On With The Seller ..................................168

Sample Contracts and Documents To Use As The Buyer .........169

Bulletproof Your Option With The Seller ..............................171

Bulletproof Your Option With Your Tenant/Buyer ..................173

Finding Tenant/Buyers For The Deal ...................................175

Meeting With Your Potential Tenant/Buyer ..........................178

How Do I Qualify Them? .................................................179

Sample Contracts and Documents Used by The Seller ...........180

13 Steps To Being Successful In Lease Options ....................188

How To Do A Lease Option..............................................191

Points To Consider ..........................................................193

Sample Car Magnet Ads .................................................194

Sample Newspaper Ads .................................................195

Sample Signs And Flyers ..................................................197

Sample Postcards ...........................................................198

Sample Property Information Sheet .....................................199

Sample Authorization To Release Information Form ................200

Sample Letter Of Instructions To Lender ................................201

Sample Residential Lease With Option ...............................202

G

GUIDE TO REAL ESTATE INVESTING

Table Of Contents

chapter 9:

Becoming A Problem Solver: Foreclosures ......................... 207

What Is Foreclosure? ......................................................208

The Three Phases Of Foreclosure .......................................211

The System For Buying Pre-Foreclosures ...............................216

Sample Authorization To Release Information .......................259

Sample Bill Of Sale ........................................................260

Sample Affadavit And Memorandum Of Agreement ..............261

Sample Car Magnet Ad ..................................................262

Sample Newspaper Ad ...................................................262

Sample Letter And Flyer ...................................................263

chapter 10:

Negotiating With Confidence .......................................... 269

Practice Talking To Get Over Fears ....................................269

Listen To The Seller ..........................................................270

Communication And Salesmanship ....................................270

The Anatomy Of A Presentation .........................................272

chapter 11:

Making An Offer: The Contract ........................................ 279

The Offer Vs. The Contract ...............................................280

Basic Requirements Of A Contract .....................................281

Sample Contract For Purchase And Sale .............................283

Glossary: .................................................................. 309

GUIDE TO REAL ESTATE INVESTING

Introduction

1

hrough real estate investing,

many individuals just like you

have been able to increase their net

worth substantially, obtain the things

they always wanted to have, reached

their financial goals faster than they

thought possible, and preserved their

wealth for their retirement and/or their

families. And many have done so

without much money to start with, or

without any money to start with at all.

The fact is, real estate investing is

a powerful tool for building and

preserving wealth no matter where you

live and no matter who you are. And

unlike some investment opportunities,

real estate investing has “staying

power.”

Demand for real estate in most areas is

constant although there are economic

factors that influence the market and

its demands. The good news is that

when the economy is in a slump,

there are tremendous opportunities for

good real estate deals because the

number of buyers decreases along

with tougher economic times. Now

is just such a time and that makes

investing in real estate more lucrative

than ever. The key to building wealth

through real estate is having the

knowledge to understand the market

swings and pressures and then being

able to capitalize on the opportunities

as you find them. There will always

be a never-ending supply of buyers

T

INTRODUCTION

Investing In

Your Future

1

2

This appreciation rate generally takes

place as part of natural market growth,

essentially, without you doing anything.

To illustrate, consider homeowners who

purchased their homes 20 years ago

and now find themselves with $150,000

in equity in their homes, something they

never thought about at the time they

purchased the home. Beyond that, you

can create situations where you “force”

appreciation, such as through renovations

or cosmetic improvements to a home (we

call this rehabbing properties). This is

where the work you put into a property

makes it instantly more valuable than the

price you paid for it.

• GENERATE POSITIVE CASH FLOW

YOU CAN USE – Some investors will

purchase property in order to rent it out

and create positive monthly cash flow.

Property can sometimes be rented for

more than the total expenses (principal

and interest, taxes and insurance), so

you can make money from the rental,

while someone else is building equity in

your property. Another way to buy and

hold property is to lease it to someone

else with an option for them to purchase

it in the future. This technique creates

excellent positive monthly cash flow since

looking for everything from their first home to

their retirement home—and you will be the

investor who has exactly what these buyers

need.

Before we go into greater detail in

this manual about profiting with real estate,

locating and negotiating deals, evaluating

properties, and making the most out of some

of real estate’s best opportunities, let’s take

a brief look at the real estate investment

market in general to see why it provides so

many avenues for building wealth.

THE MAJOR BENEFITS

OF REAL ESTATE

The benefits of investing in real estate are

many, from creating situations where your

profit potential is up to you, to building a

lifestyle some people only dream of. With

real estate, you can:

• OWN YOUR OWN BUSINESS

Work part-time or full-time, be your own

boss, and time things according to your

schedule and goals.

• TAKE ADVANTAGE OF APPRECIATION

Real estate typically appreciates around

four to five percent annually.

GUIDE TO REAL ESTATE INVESTING

Introduction

3

these tenants are willing to pay more than the average renter will

pay.

• CREATE A HEDGE AGAINST INFLATION – Even in times of

inflation, opportunities abound with real estate. That’s because

inflation tends to force higher real estate prices and because the

underlying asset (your property) can be counted on to be there

through inflation (while some other investments may not survive

economic downturns).

• MAKE MONEY WITH LOW RISK AND LOW STARTUP

COSTS – The market for potential customers is huge and you

can start your business in real estate investing with little or even

no capital of your own. There are always private investors in the

marketplace who have the money to invest but do not know how

(or don’t care to do the work) to do the deals themselves.

• PROFIT FROM EQUITY BUILDUP – You build equity at the

same time as the property is naturally increasing in value due to

market conditions and demand. And you can tap that equity in a

property to finance additional investments.

• ENJOY MULTIPLE CHANNELS FOR PROFIT – There are many

ways to invest in real estate and there is something for everyone,

from the casual or first-time investor to the more experienced or

full-time investor. Once you understand the variety of opportunities

available, you can choose the deals that help you reach your

individual goals faster.

4

many easy ways to find the opportunities

that will help you succeed.

• MARKET YOUR BUSINESS EASILY

Marketing real estate is not complicated.

Everything from a For Sale sign in the front

yard of a home you have renovated to

an ad or direct mail campaign can bring

in customers. Some investors have netted

thousands of dollars in profit on deals

simply because someone called them

from a car magnet ad on the side of their

vehicle or from a flyer they posted on a

community bulletin board at an apartment

complex.

• BUILD A POWER TEAM TO HELP

YOU INCREASE AND EXPEDITE YOUR

PROFITS – To succeed with real estate

investing, you will want to establish solid

relationships throughout your community

and in the business… relationships with

people who can help you build your

business, partner with you in investments,

or be available to buy your properties.

A winning team of contacts would

include people like a good real estate

lawyer, real estate agents or brokers, an

accountant or tax expert, a mortgage

broker, a professional home inspector,

mentors or coaches who can guide

• BENEFIT FROM REAL ESTATE’S

REPEATABILITY – Once you learn the

basics, learning advanced skills is even

easier than you might realize. You can

use the knowledge you build about real

estate investing to repeat the process

over and over again, on multiple types

of properties, increasing your profits

considerably without working harder to

do so.

• BENEFIT FROM TAX BREAKS – When

you invest in real estate, consult with a

tax professional about the opportunities

that may be available to you through

depreciation, in writing off certain business

expenses, and through tax breaks (for

example, deducting the interest portion of

mortgage payments).

• FIND INVESTMENT PROPERTIES

AND OPPORTUNITIES EASILY – With

real estate investing, opportunities are

all around you. You can make a simple

effort, like driving through neighborhoods

looking for For Sale By Owner signs, or

you can do everything from establishing

relationships with real estate professionals

to placing your own ads to generate leads.

What’s nice to know is that regardless of

the time you have available, there are

GUIDE TO REAL ESTATE INVESTING

Introduction

5

you through transactions and help motivate you, and qualified

contractors, builders, and other professionals who can assist you

in rehabbing your properties.

• HELP OTHERS – One great aspect of real estate investing

is you can help others in need. Consider someone who has a

distressed property because they live in another state and they’re

trying to manage it long distance. You could help alleviate that

burden. Or consider someone who is struggling with debt and

now the bank is going to foreclose on their home. You could

help them save their credit. The possibilities for helping others are

endless.

A MARKET FULL OF OPPORTUNITIES

There are not only many benefits associated with real estate, but

also many opportunities for success regardless of your financial

goals, location, or financial situation.

SHORT-TERM AND LONG-TERM STRATEGIES

With real estate, there are both short-term and long-term investment

strategies available to you, giving you the flexibility to make

investment choices that fit your schedule and needs.

As an example, you may wish to hold properties only for the

short-term, so you might purchase a property below fair market

value, fix it up with minor repairs and cosmetic improvements (such

as painting and landscaping), and then turn around and sell it

quickly for profit.

6

OPPORTUNITIES IN ALL AREAS

You can make money with real estate

regardless of the area you live or invest in.

This book will begin helping you to become

knowledgeable about how to analyze and

identify profit potential in real estate markets.

Your future training will take you to the next

level and to those who are committed, the

potential for wealth accumulation will be

unlimited.

Just a few examples of ways to build

wealth follow and illustrate this point. For

example, in low-income areas, you can find

several great opportunities for rehabbing or

wholesaling properties. These opportunities

allow the owner/landlord to provide

affordable, clean housing for low-income

families, while generating positive cash flow

through highly profitable weekly or monthly

rentals. When you act as the intermediary

investor, they provide a way to generate

income through either quick turns after

the rehab or fast cash through wholesale

techniques.

In moderate-income areas, you can

profit from excellent resale values and work

with a large market of first-time homebuyers

who may need special financing options

to purchase their home. Moderate-income

areas can also provide good rental income

opportunities.

You can even purchase or contract for a

distressed property at well below fair market

value, and sell either the property or the right

to buy the property, immediately to another

investor who will do all the work improving

the property. This short-term strategy is known

as “quick-turning” or wholesaling properties.

Individuals have made fast profits of thousands

of dollars on just one deal in wholesaling

a property and you can too! Additionally,

investors have used wholesaling strategies to

make quick cash to pay down their debts,

generate extra income in addition to a full-

time job, start their own business slowly and

with limited risk, and create capital for future

investments.

A long-term strategy might be to buy

a home below fair market value and then

rent it out for any number of years or lease

it to someone else giving them an option to

purchase it in the future. In situations like these,

when you have tenants, they are building

your equity because with every payment they

make to you, you are taking that payment

and decreasing your existing mortgage.

GUIDE TO REAL ESTATE INVESTING

Introduction

7

In just above median home value areas there are currently

great prospects for two techniques: either offering lease options

to potential homebuyers, or buying at substantial discounts due to

distressed seller situations and then holding the properties for short-

term for profits at the time of sale.

And finally, there is tremendous opportunity in some of the best

neighborhoods and school districts in the cities across the U. S. due

to the distress of the sellers who must get out of a property quickly.

While not for the beginning investor, these types of deals can give

experienced investors the opportunity to invest when tax shelters are

the priority.

EVALUATING BUY & HOLD PROPERTIES

If you intend to buy and hold property for cash flow, it is important

that you choose properties that will cash flow—and the United States

has an abundance of properties available that will meet your needs!

Having said that, if you are considering rental housing consider

carefully the benefits of buying houses that have more than one

stream of income coming in each month. For example, if you are

buying a single family house to rent out, if it is vacant for a month,

you are making the entire mortgage payment. However, if instead

of buying single family houses to rent out you focus on duplexes,

triplexes, and quads, if one of the units is empty, you still have the

other(s) to help cover your expenses. That is part of the beauty of

real estate—various tweaks on your buying decisions can make

big differences in the outcome of the deal. And in this scenario, the

price of a duplex is seldom anywhere close to double the price of

the single family. Yet, the rents from each unit are not half as much as

the single family’s rental income price. For that reason, it is unusual

for us to recommend you buy and rent out single family homes in

working class neighborhoods. Go for the duplex!

On the other

8

• SELLER FINANCING – You can take

advantage of seller financing, lease

options, etc., to allow you to purchase

properties with little or no money down.

• SOURCES FOR SEED MONEY

(CAPITAL) TO FINANCE YOUR

INVESTMENT – Even people with poor

credit have still been able to achieve

success in real estate investing; you just

have to know how to look for the creative

financing opportunities. Some examples

include seller financing, wraparound

mortgages, equity financing, partnering

with other investors, etc.

So, for many reasons, real estate provides

people with opportunities to profit and

earn income in ways they never would

have dreamed possible. The more you

learn and the more prepared you are

to take on new opportunities, the better

you’ll succeed in generating amazing

profits and changing your life forever. We

are dedicated to helping you get there.

So let’s get started!

hand, in the upper income neighborhoods,

lease options work beautifully on single

family homes because you will be dealing

with future buyers of the property from the

beginning. Knowing what to buy, where to

buy, and how to hold will move you to your

financial dreams more quickly than you can

imagine—the opportunities are endless!

MULTIPLE FINANCING OPTIONS

Real estate investing can be done virtually

anywhere by anyone—the key is knowledge.

It provides a way for any individual to

get involved and reach their financial

goals, regardless of their current financial

situation. That’s because there are many

creative financing and buying approaches

available. You just have to know where and

how to look for them. For example, you can

find opportunities through:

• GOVERNMENT PROGRAMS – There

are many ways to purchase homes

well below fair market value through

government-sponsored programs, and

there are ways to use government

programs to find opportunities you could

not find anywhere else.

CHAPTER

ONE

9

PORTFOLIO

2-3 Streams

EARNED

3-4 Streams

PASSIVE

3-4 Streams

11

GUIDE TO REAL ESTATE INVESTING

The Circle Of Wealth

CREATING YOUR PERSONAL

BUSINESS ROAD MAP

f you were going to travel from

New York City to San Francisco,

there are such good road signs and

highways systems across the United

States that you could probably find

your way without having a detailed

road map that outlined your journey.

But doing so wouldn’t make much

sense, would it? You would end up

taking a few wrong turns, you’d have

trouble getting started, and ultimately,

you would be sure to get lost a few

times along the way.

The same is true for choosing

to invest in business. Having a clear

idea of the benefits and advantages

of different types of real estate deals,

clearly evaluating where you are in

terms of resources, and moving in the

right direction with the least amount

of wasted time will be a tremendous

asset to you. That is the purpose of

this chapter—to help you begin to

get more clear about where you are,

where you want to go, and the best

way to get there.

One of the first things you should

do is a personal financial evaluation

of where you are at this moment in

time.

Do you have strong or weak

I

THE CIRCLE OF

WEALTH Multiple

Streams Of Income In

Real Estate Investing

12

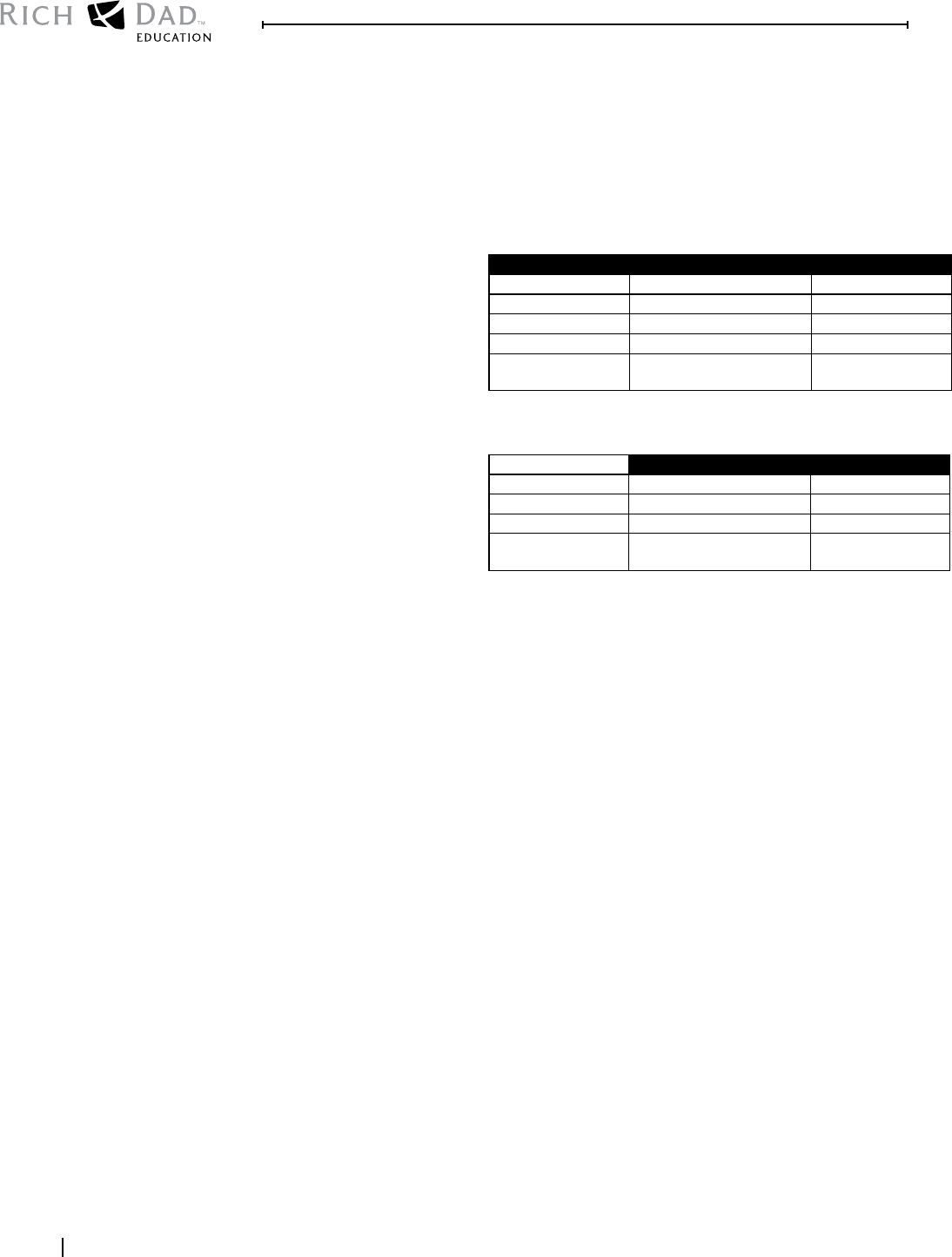

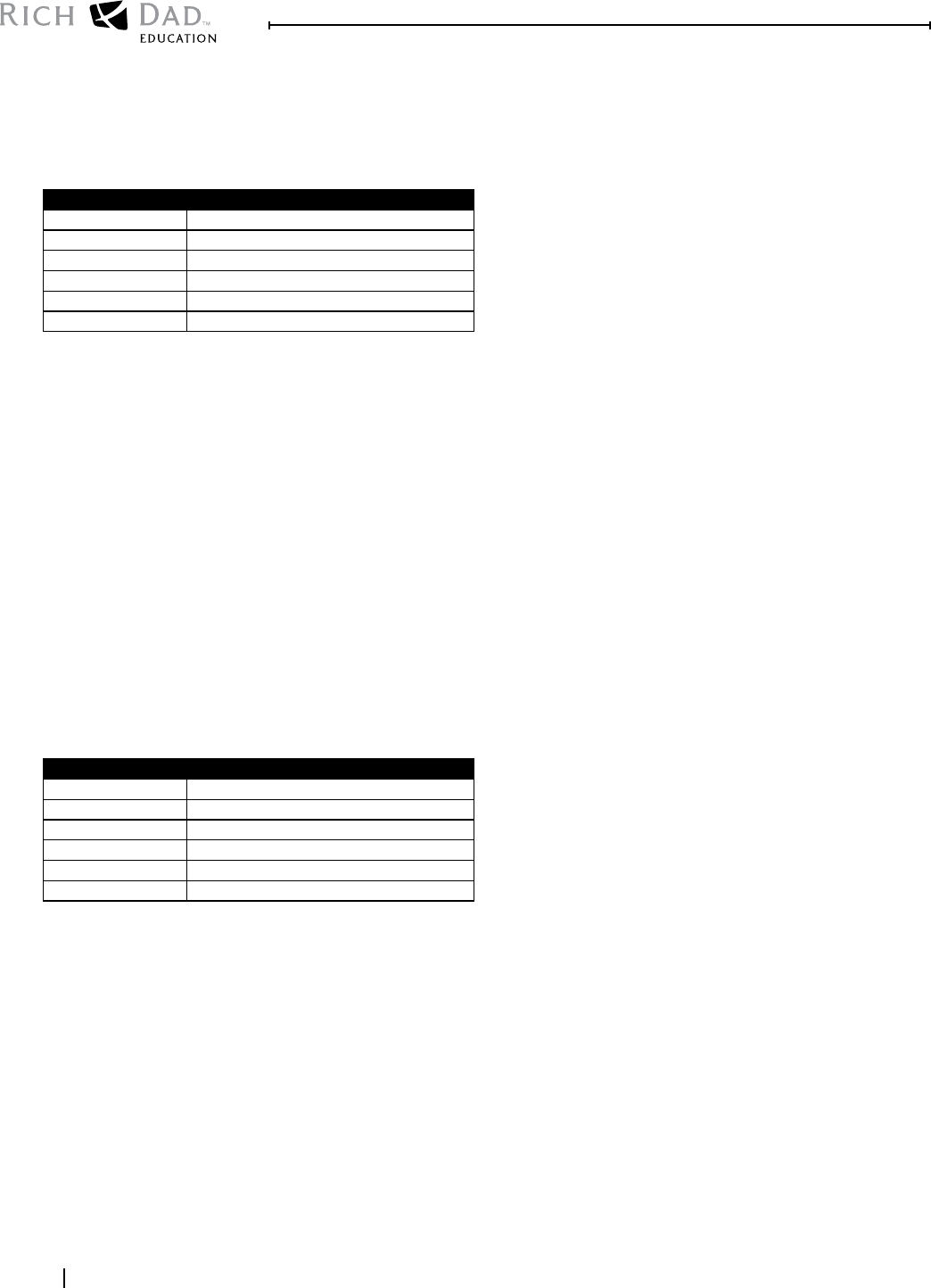

TECHNIQUE/

CIRCUMSTANCE

Wholesale buying

& contract sales

Lease Option

Foreclosure

Rehabbing

Mobile Homes

Tax Liens & Deeds

Property

Management

(Managing other

investors’ property)

BENEFIT

Quick cash

return/low cash

investment

Cash flow,

appreciation/

can be structured

with a low cash

investment

Quick cash

(short-term), needs

some cash to do

Quick cash,

cash flow/needs

cash or credit

investment

Cash flow/low

cash investment

Portfolio income

from interest/

higher cash

investment/little

leverage

Cash flow/

very low cash

investment

needed to begin

credit? Do you have access to money

lending sources? Are they public (lenders,

banks, mortgage brokers) or private

(personal contacts who might be willing to

help you to get started)? Once you have

clearly delineated your current position you

are better able to begin choosing the right

types of deals to move you towards financial

freedom. For example, if you have few

financial or credit resources, you will want

to choose types of real estate deals (at least

in the early stages of your career) that do

not rely on either credit or funding. One of

these types of deals is called “wholesaling.”

So, let’s begin this chapter by outlining the

various ways to make money—and the type

of money it takes to do that kind of deal.

MANY PROPERTY TYPES AND

INVESTMENT STRATEGIES

Real estate investing is attractive because

there are many property types to invest in,

as well as many strategies for what to do

with those properties. And each comes with

its own rewards. The following are some of

the main types of investment opportunities,

with their primary benefits listed.

13

GUIDE TO REAL ESTATE INVESTING

The Circle Of Wealth

Investors consider different options based on the outcome they

want to achieve, the amount of cash they want to invest in the

project, and/or their level of experience with different strategies.

For example, an investor may want to consider quick cash

investment strategies for a variety of reasons, among them being

high consumer debt (generating quick cash to pay down that debt)

or lack of seed capital to work with (using wholesale opportunities

to quickly build more money for future investments).

Of course, with multiple income streams and opportunities

comes the need to obtain the proper knowledge to specialize

in different areas. Because wholesaling, foreclosures, and lease

options are some of the more popular ones in real estate investing,

we have included chapters focused specifically on those strategies

in this manual. This book also introduces you to several other streams

of income in real estate investment and defines the types of income

those strategies can produce. As you grow your business and find

the real estate investment areas and strategies that interest you most,

you can discuss with us more opportunities for advanced training in

those areas so you can maximize your profit potential.

THE CIRCLE OF WEALTH AND

MULTIPLE INCOME STREAMS

You might be wondering how to choose your streams of income

and what factors should influence your decision, so before we go

any deeper into this book, let’s take some time to define the various

types of income and the benefits of choosing one over the other.

14

deals, you collect the rent (or your property

manager collects it for you) every single

month. Another real estate related field of

income that would be considered passive

is when you become a property manager,

have a property management company,

and investors hire you to collect the rents for

them and pay you a fee to do it!

TYPES OF PASSIVE STREAMS

OF INCOME IN REAL ESTATE:

• RENTALS— houses, apartments,

mobile homes, etc.

• LEASES— lease option properties

• PROPERTY MANAGEMENT—

mentioned above

• RECREATIONAL PARKS— where you

rent out spaces

• MOBILE HOME PARKS— where you

rent out lots and others own the

mobile homes

• APARTMENT HOUSES— which bring

you in multiple payments every month

TYPES OF EARNED STREAMS

OF INCOME IN REAL ESTATE:

• Wholesaling

• Foreclosures, Pre-foreclosures, and

Real Estate Owned Properties (Post-

foreclosures)

• Rehabbing

• Probate

• Discount Note Selling

• Remodeling

• Land Development

Basically, anything that you are going to

contract and sell quickly would fall into the

Earned Income category.

PASSIVE INCOME: Passive income is

money that comes to you week after week

or month after month without you going

out and doing another deal. This type of

income is also sometimes called “recurring

income.” In real estate, these would be

your buy and hold properties—your rentals

and leases.

Once you have closed on these

15

GUIDE TO REAL ESTATE INVESTING

The Circle Of Wealth

• COMMERCIAL SPACES— offices, retail establishments,

storage unit facilities, industrial buildings, etc.

Buy and hold properties are where you build long-term wealth and

begin to benefit from appreciation and tax advantages. So, earned

income streams help you generate the cash to move towards buy

and hold long term wealth! The two work hand in hand to help you

achieve your goals.

PORTFOLIO INCOME: Portfolio income is when your money begins

to make money for you—typically through interest. Let’s say you

have $30,000 to invest in some type of real estate related deal but

you do not want to have to do any work or invest any time once

you have made your purchase. In this situation, you might choose to

invest that money in tax liens that earn a return of 18% per year. You

attend the tax lien auction, purchase liens that take the $30,000

investment amount, and then you sit back and wait for them to be

redeemed! Your money begins earning interest at the rate of 18%

per year the day you pay for the liens and the county property tax

office employee does all the monitoring and paperwork! That sure

beats investing in a CD at 1% or 2% interest, doesn’t it?

There are several other ways for you to generate portfolio

income that is real estate related, as well. Most of these streams of

income relate to the investor earning interest on his or her money.

While this book will not go into depth on these techniques, it is

important for you to at least understand the potential and definition

of these income streams.

16

New investors who have a limited

amount of money begin by becoming

knowledgeable in a few earned income

streams such as wholesale, foreclosure, and

rehabbing. Now they have more control

over their ability to generate large amounts of

cash in a short period of time. They then take

that money and begin to invest in buy and

hold properties such as lease option houses.

They have now learned to invest safely, and

once we learn to do it safely, we can do

it quickly!

As the passive income grows or the lease

option properties begin to sell (usually three

years later), the investor has two choices:

either buy another buy and hold property or

invest in a portfolio stream (such as tax liens,

defined above).

Begin to train your mind to

think in terms of The Circle of

Wealth and always ask

yourself what your short

and long term goals are

at any given moment.

Yes, we get rich in buy

and hold situations, so

that is your ultimate goal,

but if you are beginning with

limited resources and need to

generate some cash so you can build a

substantial portfolio in a fairly modest number

of years, earned income can help you do that.

TYPES OF PORTFOLIO STREAMS

OF INCOME IN REAL ESTATE:

• Tax Lien Auction Investments

• Discount Note Buying

• Seller Financing

• Hard Money Lending

• Venture Capital

In real estate, you will often hear others refer

to “The Circle of Wealth.” Real estate can

allow investors to create wealth through a

very systematic process that builds

upon itself. Here’s how it looks

and how it works:

While everyone is

different, with different

goals and demands on

their time, professional

real estate investors will

typically want to have

three to five streams (and

accompanying knowledge

bases) of earned income, three to five

streams of passive income, and two to three

streams of portfolio income.

PORTFOLIO

2-3 Streams

EARNED

3-4 Streams

PASSIVE

3-4 Streams

17

GUIDE TO REAL ESTATE INVESTING

The Circle Of Wealth

AN IMPORTANT CONSIDERATION: As investors, it is crucial for

us to “begin with the end in mind.” Now, I realize that you might

be starting on a shoestring and you probably have immediate

needs that you want real estate to assist you in fulfilling. However,

this business can be one of the best ways for you to become a

millionaire or a multi-millionaire—and on some level you understand

that or you wouldn’t be reading this book. So, set aside your fear

and discouragement from yesterday and ask yourself, “If I could

retire in ten years and own and control 350 apartments in a good

neighborhood that produced $25,000 a month in positive cash

flow, would I feel safe and secure about my financial future and

my golden years?” I believe that most of you would answer this

question with a resounding, “Yes!”

So, let’s begin your investing business with that level of

commitment to your future. The Circle of Wealth can help you

achieve those goals. Consider it carefully and ask yourself what it

could mean to your current lifestyle (and checkbook balance) if you

had 7-10 streams of income and could generate both short and long

term cash flow. Then, commit to your future, to your accumulation of

knowledge, and to having a mentor to guide you along the way.

AN INTRODUCTION TO SOME KEY AREAS OF

REAL ESTATE INVESTMENT COVERED IN THIS BOOK

Before we delve deeper into these subjects, let’s take a moment to

discuss some of the key property and investment types in overview

form to familiarize you with some of your options and prepare you

for what you are about to learn from this material.

18

As professional investors, we weigh each

deal against the ideal and then consider the

benefits of that type of deal versus another

opportunity. We do not always hit each one

of these characteristics—particularly in the

beginning of our investment careers—but we

always evaluate and make informed choices.

When considering a distressed property,

we are looking for the following advantages:

• There is often less competition for

them since the average individual wants

properties in good condition.

• Most market areas offer numerous

distressed properties to choose from.

• You can often purchase distressed

properties under flexible, easy terms

and for prices substantially below

market value, making for a nice profit

margin on a resale or good cash flow

on a rental.

• You have the ability to instantly

increase your property’s value through

minor improvements and rehab

work (forced appreciation).

MAKING THE RIGHT

INCOME STREAM CHOICES

DISTRESSED PROPERTIES VS. DISTRESSED

OR MOTIVATED SELLERS

There is an old maxim when it comes to real

estate investing: “There are only two types of

deals out there—either distressed properties

or distressed sellers.” Regardless of your

investment strategy or targeted property type,

you will find that some properties provide

more ideal investment opportunities than

others. When we refer to a property as

“ideal,” we do so for a reason. The word is

also an acronym for the following:

I = Income (Produces Cash Flow)

D =Depreciable (Offers Tax Advantages)

E =Equity (Equity Build-up Increase Net

Worth)

A =Appreciation (Increases in Value)

L =Leverage (Increases Return on

Investment)

19

GUIDE TO REAL ESTATE INVESTING

The Circle Of Wealth

Some things to think about with distressed properties include:

• Most real estate markets have a sizable number of investors

looking for these types of properties, so your marketing efforts

need to be active, well planned, and effective to find good

deals. It would be wise to investigate different marketing

strategies that have worked well for other real estate

investors, and to find others in the business that are willing to

teach you where to look for opportunities and provide tips

on how to bring opportunities to you.

• To avoid costly mistakes, you’ll need to know how to

effectively evaluate the property and its neighborhood.

• Thorough inspections and repair estimates should be

performed prior to a purchase.

• If the property is in a lower income and/or older

neighborhood, the comparable sales in that area will

not go over a certain amount of money, no matter how much

improvement is made. Repairs are often costly—so in order

to maximize profitability in the older, lower income areas, it

is typically safer to combine a distressed property with a

distressed seller and maximize the profit potential on

each aspect.

20

• You must know what put the seller in the

situation they are currently in and figure

out the best way to help them get out

of it. In order to understand their

problem and solve it, you will need to

develop good listening and negotiating

skills.

• Some distressed sellers present

compelling reasons why they want to

stay in their properties and the

tendency is to want to accommodate

this. If their challenge is for financial

reasons, this can be risky. It is important

to keep your emotions out of it.

WHOLESALE BUYING

Distressed properties make for great

wholesaling candidates. And wholesaling is

an excellent opportunity because it requires

little expertise and typifies the quick cash

type of deal that many beginning investors

are looking for.

Wholesale deals may be one of the

first types of deals you will make in real

estate investing because it’s easy to identify

distressed properties and there is such great

potential for quick cash.

Advantages of working with distressed

sellers include:

• There is seller distress in every price

range.

• You can sometimes purchase

properties under flexible and easy

terms. The seller needs help and, in

many cases, just needs a way out,

but does not know what to do. You

can provide the solution.

• Seller distress is often caused by

property distress, so the chances

of being able to increase property

value through cosmetic improvements

or rehabbing when you can match

a distressed seller with a distressed

property are excellent.

Things to think about with distressed sellers

include:

• Seller distress must be handled

delicately. These sellers are going

through rough personal, professional,

or financial times and they can be

experiencing all kinds of emotions.

21

GUIDE TO REAL ESTATE INVESTING

The Circle Of Wealth

To truly be successful with wholesaling, some of the things you

will need to learn include how to: properly segment your market;

develop a database of potential properties, investors, and buyers;

understand the multiple ways to target and market for wholesale

deals; locate absentee owners; build a network with other investors;

and develop key strategies that will help you close deals.

In addition, you should master several basic aspects of the

wholesaling business, including:

PRESCREENING PROSPECTS – Since distressed properties should

be your primary target, you should learn how to both identify and

evaluate distressed properties. You should also understand that a

distressed property does not necessarily mean a deal is good, but

that it is a good start. So you need to master the techniques to

know when a deal is too good to be true, when it’s time to move

forward, and when the deal needs to be left on the table. It will

also help to know how to identify a motivated seller, because the

combination of a motivated seller and a distressed property will

make this opportunity far more advantageous.

DETERMINING MARKET VALUE – You need to understand the

importance of determining fair market value after repairs to be a

successful wholesaler. The real estate professionals on your power

team will be key assets for getting this information. Also, using

comparable sales of homes in the same market area will help you

determine fair market value.

ESTIMATING REPAIRS – This won’t be a successful venture if you

do not estimate repairs correctly. Learn how to analyze deals to

ensure you make an offer that will result in the most profit. There are

22

LEASE OPTIONS

Lease options represent one of the most

attractive real estate investment opportunities

for both new and experienced investors

particularly because they can generate

multiple streams of income within a single

deal. The following offers a few general

points about using lease options to invest in

real estate:

If you buy property with a lease option, you

can:

• Gain control of a property without

taking ownership of the property –

You have no obligation to buy, but

you have established the right to buy.

• Work with distressed sellers, not

with distressed properties – Seller

circumstances create the deal. What

you need to do is find the problem

owners.

• Live in or control nice homes in

nice areas – In these cases, the seller

needs to get out and investors want

to get in (an excellent match!).

Desirable neighborhoods create

demand.

also strategies you can learn that will save

you money on rehab projects and maximize

your profits.

MA

KING OFFERS AND COUNTER-

OFFERS – You need to become familiar with

good negotiating and communication skills,

learn how to make offers and counteroffers

effectively without compromising your goals,

and learn how to work with contracts.

Knowing how to properly evaluate properties

will be critical to determining not only what to

offer, but if you should make an offer at all.

LINING UP BUYERS – Wholesaling is actually

only partially complete if you can find and

negotiate deals, but you have nobody lined

up to readily assign contracts to. Building a

sizable investor database to tap regardless

of the type of deal you are working on will

help you move things forward quickly and

preserve your profit margins.

CLOSING EFFECTIVELY – You need to

learn the strategies necessary to close

without cash, including how to do contract

assignments and simultaneous closings.

23

GUIDE TO REAL ESTATE INVESTING

The Circle Of Wealth

• HELP SOMEONE ELSE IN MANY CASES – The determining

factor in lease options is often debt relief. You are usually

working with people who may not necessarily want to

sell their property, but who must sell it because of financial

problems. You can help someone else reach a solution

quickly. Meanwhile, you can do it with little or no money out-

of-pocket.

If you sell property with a lease option, you can:

• Benefit from a large market of motivated buyers – Lease

options can be very attractive to people who are just starting

out or who are starting over. And lease options may be the

only option available to some people based on their credit

circumstances.

• Find multiple profit centers through lease options – You can

create positive monthly cash flow for yourself, collect a non-

refundable option consideration, and profit from the

difference between what you paid for the property and what

price you set for your tenant/buyer.

FORECLOSURES

The foreclosure market can also provide a great avenue for profit

for the beginning to experienced investor. Foreclosures, while

unfortunate, are an everyday occurrence, and this can be your

opportunity to not only make a wise investment, but also to help

someone in need.

24

and opportunities that will afford you the

most profit. You can learn how to line up

investors before you buy properties to limit

your risk and how to line up potential buyers

before you move forward on deals. You can

become adept at finding motivated sellers

simply by knowing what to look for in their

ads and more successful with your sales

simply by knowing what to write in yours.

You can learn how to rehab properties to

maximize profits with minimal investment,

including what to look for and what to

avoid, as well as how to make money by

wholesaling properties without ever having

to fix them up. And you can master the

negotiating strategies necessary to get the

best deal or know when to walk away from

the table.

Remember that foreclosures can happen

for any number of reasons, and this is an

area where you can really create a win-win

situation and do something that benefits both

you and the person who might be in trouble.

Investors must be able to effectively negotiate

with both lenders and homeowners to

optimize profits on these deals.

IT’S A LEARNING PROCESS

With so many strategies to employ and ways

to make money in real estate, knowledge

will be key to your success.

By investigating the opportunities

available in real estate investing, you have

taken your first important step towards

obtaining financial independence. Now,

it’s time to move on to the next level with the

guidance and knowledge you can receive

through our program and this manual. Every

part of this program has been designed

to help you achieve increasing levels of

knowledge and success as a real estate

investor.

You’ll soon see that with the material

presented here, you can easily learn how to

spot distressed properties, motivated sellers,

CHAPTER

TWO

25

nvesting Is About Supply and

Demand: One of the most

important things you can learn when

it comes to real estate investing is

market analysis—having the ability to

evaluate a market, whether your own

or one in another part of the United

States, and determine if the values are

going up, going down, or are flat.

This is where amateur investors fall

short in their knowledge and this lack

of understanding creates problems for

them when they buy, hold, and sell.

HISTORY IS A GREAT

TEACHER—AND

PREDICTOR OF THE FUTURE:

A little bit of history from the past ten

years will illustrate our points as we

begin to increase our understanding

of market analysis. In 2000, the stock

market was in a self-correction process

and investors who typically put their

money in stock were worried about

their earnings and profit potential in

the short term. In any investment there

will be periodic self-corrections in a

market, whether it is real estate, stock,

or even in gold. Prices and values go

I

UNDERSTANDING

MARKET ANALYSIS

& EVALUATION

27

GUIDE TO REAL ESTATE INVESTING

Understanding Market Analysis & Evaluation

28

So, with the stock market in a state of

stagnation or self-correction, average home

interest rates lower than they had been in

over thirty years, and lending guidelines more

lenient than we had seen in decades, people

began to take their accessible investment

money and purchase homes and land.

In essence, we had a “blue light

special” or buying frenzy kick into full gear

and real estate became the investment

strategy of choice for many people who had

never owned real estate, at all! Adding to

that, investors who were disillusioned with

the performance of the stock market began

pulling available revenue from this type of

investing and move it to real estate.

On top of the stimulus of low interest rates

and extremely relaxed lending qualifications,

the first waves of baby-boomers were within

a few years of retiring. As they saw the

opportunity to invest (and also saw the

non-performance of their stock portfolios),

they began visiting retirement states and

purchasing their homes or condominiums

earlier than they had planned. This was

typically a wise move on their part—but it

created an increased demand on real estate

that was unexpected.

When opportunities to make money

abound, builders will rise to the occasion.

up, they hit a peak, they stabilize, and if

they are not in line with what the market

will bear, they will go back down until they

reach the point that buyers will once again

make purchases.

To add to the situation with stock

investments, in late 2001 we experienced

the trauma of September 11th and there

was more emotional fear generated by this

event than our population has seen on a

collective level in our entire lifetimes. The

natural reaction of people in the grips of

uncertainty is to do nothing—to “batten

down the hatches” until the storm is over.

The problem with this reaction is the paper

currency that we operate on in the United

States. The way our economy flourishes is

for the paper to keep moving. When the

flow of money stops, the economy stalls.

To encourage the American people to

buy/spend their money and keep the paper

moving, the Federal Reserve dropped

interest rates—which allowed people to buy

property with far less interest expense than

historic levels had demanded. Additionally,

loan programs were rolled out with much

more lenient lending guidelines so many

more people were able to qualify for loans

than historic guidelines in the past had

provided.

29

GUIDE TO REAL ESTATE INVESTING

Understanding Market Analysis & Evaluation

Since there were not enough houses available to purchase,

pre-construction plans became the norm. The mantra across the

United States became, “Pay a 20% non-refundable deposit, contract

for us to build a home or condo at a pre-agreed upon price, and

when construction is complete, you can close.” That accomplished

two different things: people were working (construction picked up

dramatically, jobs were in abundance, and building materials were

flying off the shelves), and paper was moving! For the potential

investor, a feeling of “locking in a price” was of utmost importance.

If the investor was “buying” in a 20% appreciation rate market, and

if the condo was going to take two years to complete, life seemed

golden! The condo would theoretically be worth 40% more upon

completion (and closing) that the contract price! Talk about getting

rich quick—it sure felt as if the goose was laying a golden basket

of eggs!

However, depending upon where an investor was in the

market cycle of self-correction, was there going to be a buyer

for the property to do a quick turn? In 2002, the answer was

a resounding, “You Betcha’!” However, by 2005 and 2006, the

buyers had exhausted their buying ability (run out of money) and the

markets began to stall.

Since real estate revolves around supply and demand, if there

are not buyers that match sellers, the market will stall—which is what

happened. What a concept—ultimately, there must be someone to

live in a house or condo once it is built.

30

else is afraid, be greedy.” In essence, the

professional investor will typically do the

opposite of what the general population of

amateur investors is doing.

IF EDUCATED INVESTORS

DON’T BUY EMOTIONALLY,

HOW DO THEY KNOW

WHEN (AND WHERE) TO BUY?

Several factors in real estate drive real

estate prices. For example (and this is

simply common sense), if a market has high

unemployment rates, the local economic

conditions are dismal, and interest rates are

high, the real estate market will stall along

with sales of other goods and services

Let’

s take a moment and list the factors

that influence and drive the real estate

market and prices:

HOW DOES THAT RELATE

TO TODAY’S MARKETS?

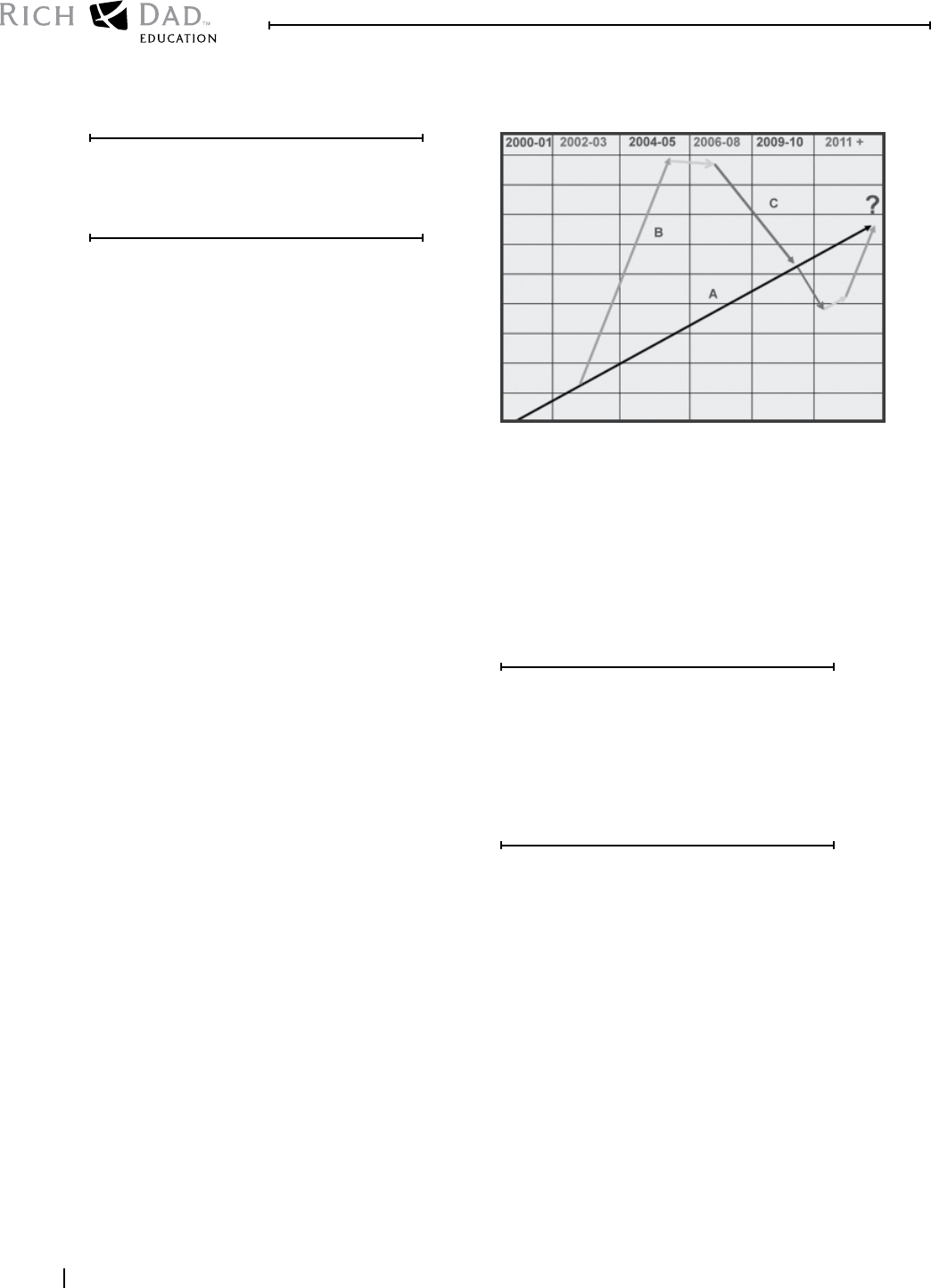

The following diagram provides a graphic

view of what happened, where we are right

now, and what to expect based upon historical

data, in the future. The solid diagonal line

(A) indicates where we should have been

in terms of appreciation. The vertical line

(B) in 2002-05 shows what happens when

demand skyrockets. The declining line (C)

illustrates what is happening across much of

the country as prices self-correct to get back

to the markets’ “normal” line of appreciation.

Do you notice that when we have an

upward self-correction, the prices will tend

to rise too high and too fast for the market

to bear (for a period of time) and then

come down too much and too fast on the

downward side? That is due to the tendency

for people to live and make decisions

based upon recency bias! If everyone else

is buying, they hear about it, jump on the

band wagon, and they buy! If everyone

else is afraid to buy, they jump on the

band wagon, and they are afraid to buy!

Warren Buffet has a saying that comes to

mind in these situations, and to paraphrase

him, it comes down to, “When everyone

else is greedy, be afraid. When everyone

31

GUIDE TO REAL ESTATE INVESTING

Understanding Market Analysis & Evaluation

• Interest rates & inflation

• Lending qualifications

• Availability of housing

• Tourism

• Job growth and stability

• Industry & Manufacturing

• Population growth

• Demographic changes

Every city has historic numbers for appreciation rates—how much per

year, on a fairly long-term basis, the value of real estate increased,

on average.

In most areas of the country, real estate goes up approximately

4-5% per year. Now, some years there may be little change in

prices, and then in other years there will be a jump to correct the

lack of growth in previous years—but when we take a 25 year

average of the median home prices, we see what the city’s average

growth has been in percentage points. That percentage tells us

what to expect for an area’s overall growth rate, prior to factoring

in anomalies such as a new factory moving into the area that brings

in thousands of new jobs.

So now we have an annual average and can base our decisions

and projections for appreciation on numbers, rather than feelings.

This is a key point!

Human beings who are not knowledgeable

32

changes. What should they have done? A

knowledgeable investor would have been

researching markets for areas that were

under-valued prior to the drop in interest

rates and lending qualifications. Then, the

investor could target areas based upon his

or her knowledge of the upcoming baby-

boomers who would be moving into certain

areas of the country when they retired. And

finally, the investor would have worked

closely with professionals in that area and

found out how many homes were on the

market, how long listings were taking to

move, and if any changes were taking place

within the community to signal a change in

expectations for that market.

So, a savvy investor in an under-valued

city like Bradenton, FL. would have been

buying property in 2002, 2003, and 2004,

but would have seen that prices were no

longer in line with the economy of that city

by early in 2004 and begun to sell before

things got out of control in terms of the price

of houses. Always remember, houses in any

city are there for people to actually live in

(what a concept)! If the average person

does not make enough to live in a house

or apartment (either buy or rent), there are

going to be vacancies! Real estate is like a

finely tuned instrument—it will self-correct or

“retune” itself whenever the prices get too

far out of line with the economy of the area.

about a topic tend to make decisions on an

emotional level—and then to compound the

problem, they have what I refer to as “recency

bias.” Whatever is happening today, sure

feels as if it will always be happening. That

is not a good place to make decisions from!

Think about this for a few minutes—if real

estate is dramatically increasing in value at a

rapid rate, it sure feels as if you’d better jump

on the bandwagon and buy real estate in

that area!

This is what happened to many investors

between 2003 and 2006. The news came

on at 6 p.m. and the announcer conveyed

the new NAR (National Association of

Realtors

®

) Quarterly appreciation rates for

the largest 125 cities in the country and

Bradenton/Sarasota, FL. was #1 in the

nation! What did uneducated investors do?

They jumped on an airplane for Bradenton

and bought four houses—and they had

no understanding of the above factors that

influence demand on real estate in the long

term scheme of things!

YOU’VE GOT TO KNOW WHEN

TO HOLD—AND WHEN TO FOLD!

What was wrong with that picture? They

bought AFTER the market had emerged

and grown—not before or during the

33

GUIDE TO REAL ESTATE INVESTING

Understanding Market Analysis & Evaluation

The educated and knowledgeable investor would have been selling

by 2004 and 2005—not buying! And, the people he or she would

have been selling to would, in large part, have been the people

who were buying airplane tickets and flying into the area to buy

property that they didn’t have the correct knowledge to buy.

WHAT THIS MEANS TO YOU

At this point you might ask yourself, “How do I find undervalued areas

to invest in? How do I evaluate where those areas are in terms of the

market cycle?” One of the best things you can do as you begin your

real estate investing business is have a mentor to guide you through

the process. He or she will know and understand the intricacies of

investing and market analysis. As well, your mentor will work with you

to identify new market trends that are taking place in the area under

investigation, the number of days on market, the sub-areas within the

overall city that are most likely to appreciate the most quickly, and

those that are most likely to stall and begin self-correcting first.

Now, in a market that is already stalled, where do investors

begin? Start by identifying the sub-neighborhoods that are moving

the most quickly! Working with your real estate professional, do a zip

code search for the areas that have the properties that are moving

with the most frequency. And then, begin looking for distressed sellers

that are highly motivated to sell in those zip codes. If one of your

streams of income is going to be foreclosures, you could target all

sellers within a certain zip code who are in pre-foreclosure status.

If one of your investment strategies is to buy and hold using lease

option techniques, you could then buy the pre-foreclosure, hold it for

three years using a lease option technique, and realize the benefits

of the appreciation that the city’s otherwise stalled market is not

experiencing.

34

SELF-CORRECTING MARKETS: Areas

that have either gone up too quickly

or too much due to dabblers investing

and creating artificial demand that was

not filled by actual long term buyers or

tenants, or areas that are undervalued

that need to adjust upward to change

the pricing for that physical location’s

proximity to nearby, higher priced areas.

DEPRECIATING MARKETS: Areas where

industry, manufacturing, or tourism has

declined, decreasing the demand on

the existing available housing and new

structures or sources of revenue are not

yet in place to create a new demand.

Based upon these definitions and categories

of markets, where would you categorize

your city, overall?

Many new investors, as they evaluate

their local markets, believe that property is

depreciating when it is actually self-correcting.

As well, they buy based upon price, rather

than buying based upon market potential.

Most new investors lean towards buying in

the low or middle income areas because they

feel the risk is lower. However, when market

analysis is a part of your knowledge base,

buying decisions are made based upon exit

and holding strategies, not on fear of risk

(bigger numbers).

The key concept in this chapter is for

new investors to understand the magnitude

of analyzing a real estate market prior to

buying property. If you are buying in a

stalled real estate area, and you understand

that from the beginning, you will know to

buy at a large discount to cover and build in

the lack of appreciation that you understand

is going to be a part of that deal.

If you know where you are in a market

cycle, you can buy, hold, or sell accordingly,

as well as change or modify your exit

strategy to complement the part of the cycle

you are in. The cycles or conditions of a real

market are as follows:

APPRECIATING MARKETS: Areas where

there is not enough housing, high demand,

or a shortage of land. Areas where an

increase in population is placing pressure

on the housing market. Neighborhoods

that are in high demand due to location,

school districts, or other influences are

cause the area to be considered “choice.”

FLAT MARKETS: Areas that have an

adequate amount of housing for the

population and housing demands. Areas

that have an abundance of land for future

development and few restrictions on

building new houses.

CHAPTER

THREE

35

s we learned in the previous

chapter, real estate investors

must know how to analyze an overall

market to determine what is happening

within it at any given time. In addition,

they must use their knowledge to identify

the most profitable neighborhoods

within that market for their various

streams of income. Now, with that

knowledge we can begin to look at

ways to make wise buying decisions

in the right places.

The most important thing you will

do in real estate investing is buy right

(in other words, make the best deal

possible when buying a property).

This is where you will really make

your money in real estate.

In fact, you

may have heard people say it before:

you make your money when you buy;

you just realize it when you sell your

property and make a profit, or when

you start getting positive cash flow

from an income-producing property.

And it’s true. So, it’s imperative you

buy right, meaning you never pay too

much for a property.

To do this, you need to get to

know and understand the market

you’re buying in. After all, the only

way you can calculate the after-repair

value of a property is by knowing the

fair market value of houses in the area

you choose to concentrate in. It is a

crucial part of the evaluation process.

A

GETTING TO

KNOW YOUR

MARKET

37

GUIDE TO REAL ESTATE INVESTING

Getting To Know Your Market

38

DEFINING THE AREA

YOU WILL INVEST IN

Start by looking in a low- to moderate-income

neighborhood, where you will find a large

inventory of properties. If you want to buy,

fix, and sell, look for decent neighborhoods

where it is clear neighbors care about their

property and the community (these are often

termed “We Care” neighborhoods).

If you want to wholesale properties

(quick-turn properties to other investors – a

popular and profitable strategy you will

learn about in greater detail later), you will

be looking more toward extremely distressed

properties or neighborhoods.

Of course, in order to define your target

area in relation to your goals, you need to

know where each of these areas is in your

city. If you are not sure where these areas

are, you will need to segment your city with

the help of your real estate agent. If you do

not already have a real estate professional

or need to know what to look for in a good

real estate agent, please refer to Chapter

Two.

TRUE MARKET VALUE

Some people think the true market value is

what they see advertised in the classified

section of the newspaper or in flyers they

have pulled out of a box on a real estate

agent’s sign. But that is a “wish list” – what

the seller hopes to get. The true market value

is not what people are asking for. It is what

someone is willing to pay and someone else

is willing to accept. And more specifically,

it is the sales prices of houses that have sold

within the last six months (not what they were

listed for, but what they actually sold for).

No matter what type of real estate

investing you do (buy, fix, and sell;

wholesale; foreclosure; lease option; income

property; etc.), you will need to understand

your market. Understanding your market

will help you know what to offer, how to

recognize a good deal when you see one,

and how to act quickly. And as you develop

your knowledge of the market, you will be

spending less time looking at properties that

aren’t worthwhile investments.

39

GUIDE TO REAL ESTATE INVESTING

Getting To Know Your Market

SEGMENTING YOUR AREA

Ask the real estate professional what the average price of a three

bedroom, two bath, single family home is in your city. You also want

the agent to pull up a one-line MLS (multiple listing service) list of

single family homes. Sometimes they call this a “short form.” Have the

agent start at $0 and go to 120% of the average home price.

With this information, you can now identify which areas are

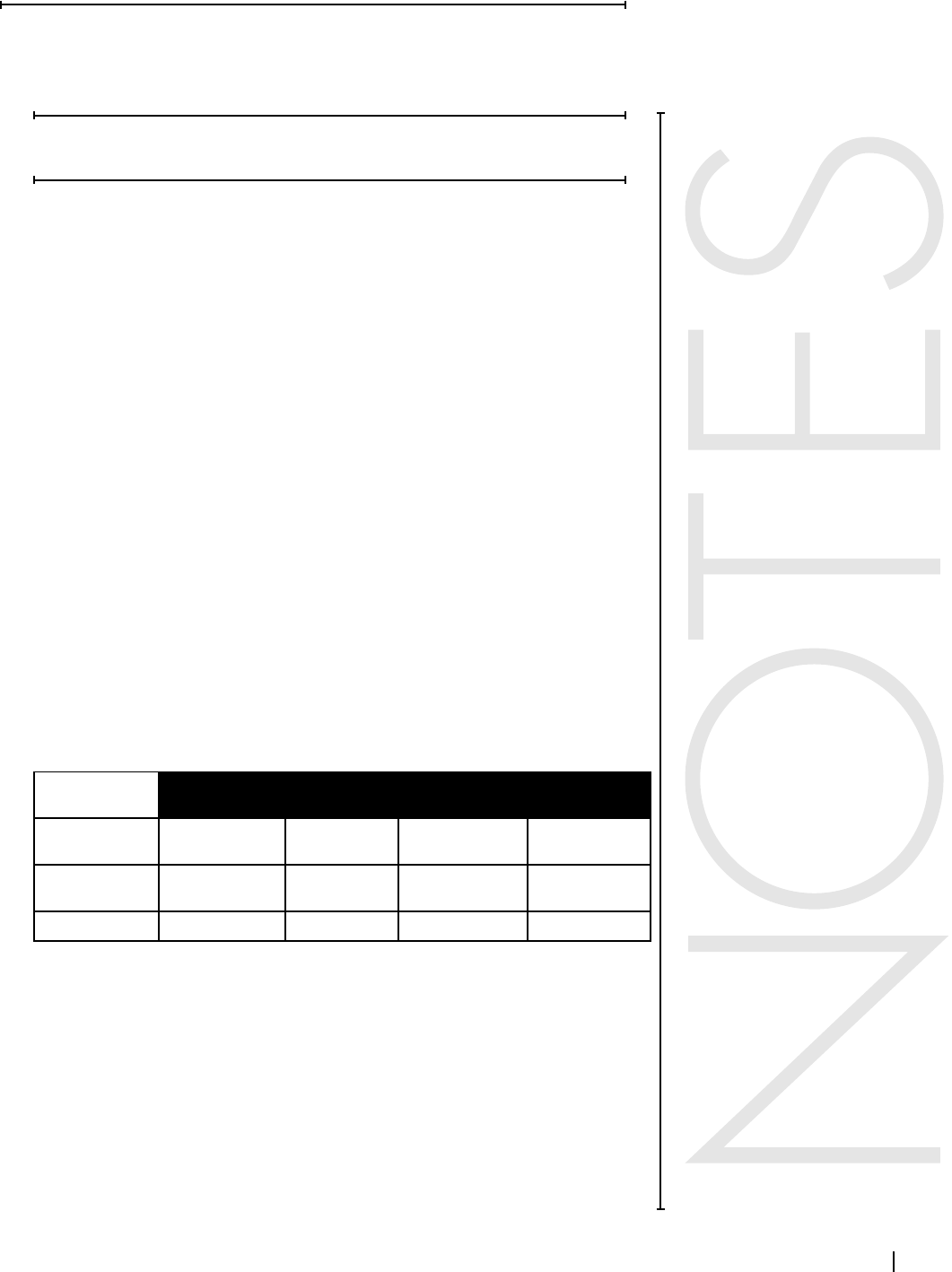

low-income, working class, middle-income, and higher-income

neighborhoods. Next, take the average price of a home in your

city and multiply it by 70% and by 110%.

For example:

$100,000 = average price

70% = $70,000

110% = $110,000

EXAMPLE

Below 70% of

Average

70% of

Average

Average

Home Price

110% of Aver-

age

110%+ of

Average

Low Income

Neighborhood

Working Class

Neighborhood

Working Class

Neighborhood

Middle Income

Neighborhood

$70,000 $70,000 $100,000 $110,000 $110,000

Once you have this information, you will need to get a map of your

city, which you can usually obtain directly from your city, purchase

from a store, or find on the Internet. You will need to make at least

two copies of this map. Have one copy enlarged to a size that

allows you to easily see the streets and get this copy laminated. If

you live in a large city, begin by concentrating on about a one-mile

square area or on a 20 to 40-block square; you can gradually

expand your area.

40

neighborhoods more appropriate for

wholesaling opportunities. If you don’t know

where these areas are, talk to someone who

is knowledgeable about your area. You can

contact property management companies,

appraisers, postal carriers, cable workers,

or your local police.

These maps will also help you

understand what homes are selling for in

different segments of your city.

The second map should be on an

8 ½ x 11 inch sheet of paper that you can

put in a notebook and carry with you in the

car (you may need to use several sheets,

depending on the size of your city). Write

on the map where the low-income, working

class, and the middle-income areas are