IRS Tax Returns Publication 527 Residential Rental Property

Contents

Reminders ................... 1

Introduction .................. 2

Chapter 1. Rental Income and

Expenses (If No Personal Use

of Dwelling) ............... 2

Rental Income .............. 2

Rental Expenses .............3

Chapter 2. Depreciation of Rental

Property

................. 5

The Basics ................ 5

Special Depreciation Allowance ....8

MACRS Depreciation .......... 8

Claiming the Correct Amount of

Depreciation

............ 12

Chapter 3. Reporting Rental

Income, Expenses, and

Losses

................. 12

Which Forms To Use ......... 12

Limits on Rental Losses ........ 13

At-Risk Rules ........... 13

Passive Activity Limits ...... 13

Casualties and Thefts ......... 14

Example ................. 14

Chapter 4. Special Situations ...... 15

Condominiums ............. 15

Cooperatives .............. 15

Property Changed to Rental

Use

................. 15

Renting Part of Property ........ 16

Not Rented for Profit .......... 16

Example—Property Changed to

Rental Use

............. 17

Chapter 5. Personal Use of

Dwelling Unit (Including

Vacation Home)

............ 17

Dividing Expenses ........... 17

Dwelling Unit Used as a Home .... 18

Reporting Income and

Deductions

............. 19

Worksheet 5-1. Worksheet for

Figuring Rental Deductions

for a Dwelling Unit Used as a

Home

................ 20

Chapter 6. How To Get Tax Help .... 21

Index ..................... 23

Future Developments

For the latest information about developments

related to Pub. 527, such as legislation enacted

after it was published, go to IRS.gov/pub527.

Reminders

Net Investment Income Tax (NIIT). You may

be subject to the Net Investment Income Tax

(NIIT). NIIT is a 3.8% tax on the lesser of net in-

vestment income or the excess of modified

Department

of the

Treasury

Internal

Revenue

Service

Publication 527

Cat. No. 15052W

Residential

Rental

Property

(Including Rental of

Vacation Homes)

For use in preparing

2016 Returns

Get forms and other information faster and easier at:

• IRS.gov (English)

• IRS.gov/Spanish (Español)

•

IRS.gov/Chinese (中文)

•

IRS.gov/Korean (한국어)

• IRS.gov/Russian (Pусский)

• IRS.gov/Vietnamese (TiếngViệt)

Userid: CPM Schema: tipx Leadpct: 100% Pt. size: 8

Draft Ok to Print

AH XSL/XML

Fileid: … tions/P527/2016/A/XML/Cycle04/source (Init. & Date) _______

Page 1 of 24 15:55 - 29-Nov-2016

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Nov 29, 2016

adjusted gross income (MAGI) over the thresh-

old amount. Net investment income may in-

clude rental income and other income from pas-

sive activities. Use Form 8960, Net Investment

Income Tax, to figure this tax. For more infor-

mation on NIIT, go to IRS.gov and enter “Net In-

vestment Income Tax” in the search box.

Photographs of missing children. The Inter-

nal Revenue Service is a proud partner with the

National Center for Missing and Exploited Chil-

dren. Photographs of missing children selected

by the Center may appear in this publication on

pages that would otherwise be blank. You can

help bring these children home by looking at the

photographs and calling 1-800-THE-LOST

(1-800-843-5678) if you recognize a child.

Introduction

Do you own a second house that you rent out

all the time? Do you own a vacation home that

you rent out when you or your family isn't using

it?

These are two common types of residential

rental activities discussed in this publication. In

most cases, all rental income must be reported

on your tax return, but there are differences in

the expenses you are allowed to deduct and in

the way the rental activity is reported on your re-

turn.

Chapter 1 discusses rental-for-profit activity

in which there is no personal use of the prop-

erty. It examines some common types of rental

income and when each is reported, as well as

some common types of expenses and which

are deductible.

Chapter 2 discusses depreciation as it ap-

plies to your rental real estate activity—what

property can be depreciated and how much it

can be depreciated.

Chapter 3 covers the reporting of your rental

income and deductions, including casualties

and thefts, limitations on losses, and claiming

the correct amount of depreciation.

Chapter 4 discusses special rental situa-

tions. These include condominiums, coopera-

tives, property changed to rental use, renting

only part of your property, and a not-for-profit

rental activity.

Chapter 5 discusses the rules for rental in-

come and expenses when there is also per-

sonal use of the dwelling unit, such as a vaca-

tion home.

Finally, chapter 6 explains how to get tax

help from the IRS.

Sale or exchange of rental property. For in-

formation on how to figure and report any gain

or loss from the sale, exchange or other dispo-

sition of your rental property, see Pub. 544,

Sales and Other Dispositions of Assets.

Sale of main home used as rental prop

erty. For information on how to figure and re-

port any gain or loss from the sale or other dis-

position of your main home that you also used

as rental property, see Pub. 523, Selling Your

Home.

Taxfree exchange of rental property oc

casionally used for personal purposes. If

you meet certain qualifying use standards, you

may qualify for a tax-free exchange (a like-kind

or section 1031 exchange) of one piece of

rental property you own for a similar piece of

rental property, even if you have used the rental

property for personal purposes.

For information on the qualifying use stand-

ards, see Rev. Proc. 2008–16, 2008 I.R.B. 547,

at IRS.gov/irb/2008-10_IRB/ar12.html. For

more information on like-kind exchanges, see

chapter 1 of Pub. 544.

Comments and suggestions. We welcome

your comments about this publication and your

suggestions for future editions.

You can send us comments from IRS.gov/

forms. Click on “More Information” and then on

“Give us feedback.”

Or you can write to:

Internal Revenue Service

Tax Forms and Publications

1111 Constitution Ave. NW, IR-6526

Washington, DC 20224

We respond to many letters by telephone.

Therefore, it would be helpful if you would in-

clude your daytime phone number, including

the area code, in your correspondence.

Although we cannot respond individually to

each comment received, we do appreciate your

feedback and will consider your comments as

we revise our tax products.

Ordering forms and publications. Visit

IRS.gov/forms to download forms and publica-

tions. Otherwise, you can go to IRS.gov/

orderforms to order current and prior-year forms

and instructions. Your order should arrive within

10 business days.

Tax questions. If you have a tax question

not answered by this publication, check

IRS.gov and How To Get Tax Help at the end of

this publication.

Useful Items

You may want to see:

Publication

Travel, Entertainment, Gift, and Car

Expenses

Selling Your Home

Depreciating Property Placed in

Service Before 1987

Business Expenses

Sales and Other Dispositions of

Assets

Casualties, Disasters, and Thefts

Basis of Assets

Passive Activity and At-Risk Rules

How To Depreciate Property

Form (and Instructions)

Depreciation and Amortization

Election To Postpone Determination

as To Whether the Presumption

Applies That an Activity Is Engaged

in for Profit

Passive Activity Loss Limitations

463

523

534

535

544

547

551

925

946

4562

5213

8582

Supplemental

Income and Loss

1.

Rental Income

and Expenses (If

No Personal Use

of Dwelling)

This chapter discusses the various types of

rental income and expenses for a residential

rental activity with no personal use of the dwell-

ing. Generally, each year you will report all in-

come and deduct all out-of-pocket expenses in

full. The deduction to recover the cost of your

rental property—depreciation—is taken over a

prescribed number of years, and is discussed in

chapter 2, Depreciation of Rental Property.

If your rental income is from property

you also use personally or rent to

someone at less than a fair rental price,

first read chapter 5, Personal Use of Dwelling

Unit (Including Vacation Home).

Rental Income

In most cases, you must include in your gross

income all amounts you receive as rent. Rental

income is any payment you receive for the use

or occupation of property. It is not limited to

amounts you receive as normal rental pay-

ments.

When To Report

When you report rental income on your tax re-

turn generally depends on whether you are a

cash or an accrual basis taxpayer. Most individ-

ual taxpayers use the cash method.

Cash method. You are a cash basis taxpayer

if you report income on your return in the year

you actually or constructively receive it, regard-

less of when it was earned. You constructively

receive income when it is made available to

you, for example, by being credited to your

bank account.

Accrual method. If you are an accrual basis

taxpayer, you generally report income when

you earn it, rather than when you receive it. You

generally deduct your expenses when you incur

them, rather than when you pay them.

More information. See Pub. 538, Accounting

Periods and Methods, for more information

about when you constructively receive income

and accrual methods of accounting.

Schedule E (Form 1040)

CAUTION

!

Page 2 of 24 Fileid: … tions/P527/2016/A/XML/Cycle04/source 15:55 - 29-Nov-2016

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Page 2 Chapter 1 Rental Income and Expenses (If No Personal Use of Dwelling)

Types of Income

The following are common types of rental in-

come.

Advance rent. Advance rent is any amount

you receive before the period that it covers. In-

clude advance rent in your rental income in the

year you receive it regardless of the period cov-

ered or the method of accounting you use.

Example. On March 18, 2016, you signed

a 10-year lease to rent your property. During

2016, you received $9,600 for the first year's

rent and $9,600 as rent for the last year of the

lease. You must include $19,200 in your rental

income in 2016.

Canceling a lease. If your tenant pays you to

cancel a lease, the amount you receive is rent.

Include the payment in your rental income in the

year you receive it regardless of your method of

accounting.

Expenses paid by tenant. If your tenant pays

any of your expenses, those payments are

rental income. Because you must include this

amount in income, you can also deduct the ex-

penses if they are deductible rental expenses.

For more information, see Rental Expenses,

later.

Example 1. Your tenant pays the water and

sewage bill for your rental property and deducts

the amount from the normal rent payment. Un-

der the terms of the lease, your tenant does not

have to pay this bill. Include the utility bill paid

by the tenant and any amount received as a

rent payment in your rental income. You can de-

duct the utility payment made by your tenant as

a rental expense.

Example 2. While you are out of town, the

furnace in your rental property stops working.

Your tenant pays for the necessary repairs and

deducts the repair bill from the rent payment. In-

clude the repair bill paid by the tenant and any

amount received as a rent payment in your

rental income. You can deduct the repair pay-

ment made by your tenant as a rental expense.

Property or services. If you receive property

or services as rent, instead of money, include

the fair market value of the property or services

in your rental income.

If the services are provided at an agreed

upon or specified price, that price is the fair

market value unless there is evidence to the

contrary.

Example. Your tenant is a house painter.

He offers to paint your rental property instead of

paying 2 months rent. You accept his offer.

Include in your rental income the amount the

tenant would have paid for 2 months rent. You

can deduct that same amount as a rental ex-

pense for painting your property.

Security deposits. Do not include a security

deposit in your income when you receive it if

you plan to return it to your tenant at the end of

the lease. But if you keep part or all of the se-

curity deposit during any year because your

tenant does not live up to the terms of the lease,

include the amount you keep in your income in

that year.

If an amount called a security deposit is to

be used as a final payment of rent, it is advance

rent. Include it in your income when you receive

it.

Other Sources of Rental Income

Lease with option to buy. If the rental agree-

ment gives your tenant the right to buy your

rental property, the payments you receive under

the agreement are generally rental income. If

your tenant exercises the right to buy the prop-

erty, the payments you receive for the period af-

ter the date of sale are considered part of the

selling price.

Part interest. If you own a part interest in

rental property, you must report your part of the

rental income from the property.

Rental of property also used as your home.

If you rent property that you also use as your

home and you rent it less than 15 days during

the tax year, do not include the rent you receive

in your income and do not deduct rental expen-

ses. However, you can deduct on Schedule A

(Form 1040), Itemized Deductions, the interest,

taxes, and casualty and theft losses that are al-

lowed for nonrental property. See chapter 5,

Personal Use of Dwelling Unit (Including Vaca-

tion Home).

Rental Expenses

In most cases, the expenses of renting your

property, such as maintenance, insurance,

taxes, and interest, can be deducted from your

rental income.

Personal use of rental property. If you

sometimes use your rental property for personal

purposes, you must divide your expenses be-

tween rental and personal use. Also, your rental

expense deductions may be limited. See chap-

ter 5, Personal Use of Dwelling Unit (Including

Vacation Home).

Part interest. If you own a part interest in

rental property, you can deduct expenses you

paid according to your percentage of owner-

ship.

Example. Roger owns a one-half undivided

interest in a rental house. Last year he paid

$968 for necessary repairs on the property.

Roger can deduct $484 (50% × $968) as a

rental expense. He is entitled to reimbursement

for the remaining half from the co-owner.

When To Deduct

You generally deduct your rental expenses in

the year you pay them.

If you use the accrual method, see Pub. 538

for more information.

Types of Expenses

Listed below are the most common rental ex-

penses.

Advertising.

Auto and travel expenses.

Cleaning and maintenance.

Commissions.

Depreciation.

Insurance.

Interest (other).

Legal and other professional fees.

Local transportation expenses.

Management fees.

Mortgage interest paid to banks, etc.

Points.

Rental payments.

Repairs.

Taxes.

Utilities.

Some of these expenses, as well as other less

common ones, are discussed below.

Depreciation. Depreciation is a capital ex-

pense. It is the mechanism for recovering your

cost in an income producing property and must

be taken over the expected life of the property.

You can begin to depreciate rental property

when it is ready and available for rent. See

Placed in Service under When Does Deprecia-

tion Begin and End in chapter 2.

Insurance premiums paid in advance. If you

pay an insurance premium for more than one

year in advance, you cannot deduct the total

premium in the year you pay it. For each year of

coverage, you can deduct only the part of the

premium payment that applies to that year. See

chapter 6 of Pub. 535 for information on deduc-

tible premiums.

Interest expense. You can deduct mortgage

interest you pay on your rental property. When

you refinance a rental property for more than

the previous outstanding balance, the portion of

the interest allocable to loan proceeds not rela-

ted to rental use generally cannot be deducted

as a rental expense. Chapter 4 of Pub. 535 ex-

plains mortgage interest in detail.

Expenses paid to obtain a mortgage.

Certain expenses you pay to obtain a mortgage

on your rental property cannot be deducted as

interest. These expenses, which include mort-

gage commissions, abstract fees, and record-

ing fees, are capital expenses that are part of

your basis in the property.

Form 1098, Mortgage Interest State

ment. If you paid $600 or more of mortgage in-

terest on your rental property to any one per-

son, you should receive a Form 1098 or similar

statement showing the interest you paid for the

year. If you and at least one other person (other

than your spouse if you file a joint return) were

liable for, and paid interest on, the mortgage,

and the other person received the Form 1098,

report your share of the interest on Schedule E

(Form 1040), line 13. Attach a statement to your

return showing the name and address of the

other person. On the dotted line next to line 13,

enter “See attached.”

Page 3 of 24 Fileid: … tions/P527/2016/A/XML/Cycle04/source 15:55 - 29-Nov-2016

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Chapter 1 Rental Income and Expenses (If No Personal Use of Dwelling) Page 3

Legal and other professional fees. You can

deduct, as a rental expense, legal and other

professional expenses such as tax return prep-

aration fees you paid to prepare Schedule E,

Part I. For example, on your 2016 Schedule E

you can deduct fees paid in 2016 to prepare

Part I of your 2015 Schedule E. You can also

deduct, as a rental expense, any expense

(other than federal taxes and penalties) you

paid to resolve a tax underpayment related to

your rental activities.

Local benefit taxes. In most cases, you can-

not deduct charges for local benefits that in-

crease the value of your property, such as

charges for putting in streets, sidewalks, or wa-

ter and sewer systems. These charges are non-

depreciable capital expenditures and must be

added to the basis of your property. However,

you can deduct local benefit taxes that are for

maintaining, repairing, or paying interest

charges for the benefits.

Local transportation expenses. You may be

able to deduct your ordinary and necessary lo-

cal transportation expenses if you incur them to

collect rental income or to manage, conserve,

or maintain your rental property. However,

transportation expenses incurred to travel be-

tween your home and a rental property gener-

ally constitute nondeductible commuting costs

unless you use your home as your principal

place of business. See Pub. 587, Business Use

of Your Home, for information on determining if

your home office qualifies as a principal place of

business.

Generally, if you use your personal car,

pickup truck, or light van for rental activities, you

can deduct the expenses using one of two

methods: actual expenses or the standard mile-

age rate. For 2016, the standard mileage rate

for business use is 54 cents per mile. For more

information, see chapter 4 of Pub. 463.

To deduct car expenses under either

method, you must keep records that

follow the rules in chapter 5 of Pub.

463. In addition, you must complete Form 4562,

Part V, and attach it to your tax return.

Pre-rental expenses. You can deduct your or-

dinary and necessary expenses for managing,

conserving, or maintaining rental property from

the time you make it available for rent.

Rental of equipment. You can deduct the rent

you pay for equipment that you use for rental

purposes. However, in some cases, lease con-

tracts are actually purchase contracts. If so, you

cannot deduct these payments. You can re-

cover the cost of purchased equipment through

depreciation.

Rental of property. You can deduct the rent

you pay for property that you use for rental pur-

poses. If you buy a leasehold for rental purpo-

ses, you can deduct an equal part of the cost

each year over the term of the lease.

Travel expenses. You can deduct the ordi-

nary and necessary expenses of traveling away

from home if the primary purpose of the trip is to

collect rental income or to manage, conserve,

or maintain your rental property. You must prop-

RECORDS

erly allocate your expenses between rental and

nonrental activities. You cannot deduct the cost

of traveling away from home if the primary pur-

pose of the trip is to improve the property. The

cost of improvements is recovered by taking

depreciation. For information on travel expen-

ses, see chapter 1 of Pub. 463.

To deduct travel expenses, you must

keep records that follow the rules in

chapter 5 of Pub. 463.

Uncollected rent. If you are a cash basis tax-

payer, do not deduct uncollected rent. Because

you have not included it in your income, it is not

deductible.

If you use an accrual method, report income

when you earn it. If you are unable to collect the

rent, you may be able to deduct it as a business

bad debt. See chapter 10 of Pub. 535 for more

information about business bad debts.

Vacant rental property. If you hold property

for rental purposes, you may be able to deduct

your ordinary and necessary expenses (includ-

ing depreciation) for managing, conserving, or

maintaining the property while the property is

vacant. However, you cannot deduct any loss of

rental income for the period the property is va-

cant.

Vacant while listed for sale. If you sell

property you held for rental purposes, you can

deduct the ordinary and necessary expenses

for managing, conserving, or maintaining the

property until it is sold. If the property is not held

out and available for rent while listed for sale,

the expenses are not deductible rental expen-

ses.

Points

The term “points” is often used to describe

some of the charges paid, or treated as paid, by

a borrower to take out a loan or a mortgage.

These charges are also called loan origination

fees, maximum loan charges, or premium

charges. Any of these charges (points) that are

solely for the use of money are interest. Be-

cause points are prepaid interest, you generally

cannot deduct the full amount in the year paid,

but must deduct the interest over the term of the

loan.

The method used to figure the amount of

points you can deduct each year follows the

original issue discount (OID) rules. In this case,

points are equivalent to OID, which is the differ-

ence between:

The amount borrowed (redemption price at

maturity, or principal), and

The proceeds (issue price).

The first step is to determine whether your

total OID (which you may have on bonds or

other investments in addition to the mortgage

loan), including the OID resulting from the

points, is insignificant or de minimis. If the OID

is not de minimis, you must use the con-

stant-yield method to figure how much you can

deduct.

De minimis OID. The OID is de minimis if it is

less than one-fourth of 1% (0.0025) of the sta-

RECORDS

ted redemption price at maturity (principal

amount of the loan) multiplied by the number of

full years from the date of original issue to ma-

turity (term of the loan).

If the OID is de minimis, you can choose one

of the following ways to figure the amount of

points you can deduct each year.

On a constant-yield basis over the term of

the loan.

On a straight line basis over the term of the

loan.

In proportion to stated interest payments.

In its entirety at maturity of the loan.

You make this choice by deducting the OID

(points) in a manner consistent with the method

chosen on your timely filed tax return for the tax

year in which the loan is issued.

Example. Carol took out a $100,000 mort-

gage loan on January 1, 2016, to buy a house

she will use as a rental during 2016. The loan is

to be repaid over 30 years. During 2016, Carol

paid $10,000 of mortgage interest (stated inter-

est) to the lender. When the loan was made,

she paid $1,500 in points to the lender. The

points reduced the principal amount of the loan

from $100,000 to $98,500, resulting in $1,500

of OID. Carol determines that the points (OID)

she paid are de minimis based on the following

computation.

Redemption price at maturity (principal

amount of the loan)

............... $100,000

Multiplied by: The term of the

loan in complete years ............ × 30

Multiplied by ..................... × 0.0025

De minimis amount ............

$ 7,500

The points (OID) she paid ($1,500) are less

than the de minimis amount ($7,500). There-

fore, Carol has de minimis OID and she can

choose one of the four ways discussed earlier

to figure the amount she can deduct each year.

Under the straight line method, she can deduct

$50 each year for 30 years.

Constant-yield method. If the OID is not de

minimis, you must use the constant-yield

method to figure how much you can deduct

each year.

You figure your deduction for the first year in

the following manner.

1. Determine the issue price of the loan. If

you paid points on the loan, the issue price

generally is the difference between the

principal and the points.

2. Multiply the result in (1) by the yield to ma-

turity (defined later).

3. Subtract any qualified stated interest pay-

ments (defined later) from the result in (2).

This is the OID you can deduct in the first

year.

Yield to maturity (YTM). This rate is gen-

erally shown in the literature you receive from

your lender. If you do not have this information,

consult your lender or tax advisor. In general,

the YTM is the discount rate that, when used in

computing the present value of all principal and

interest payments, produces an amount equal

to the principal amount of the loan.

Page 4 of 24 Fileid: … tions/P527/2016/A/XML/Cycle04/source 15:55 - 29-Nov-2016

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Page 4 Chapter 1 Rental Income and Expenses (If No Personal Use of Dwelling)

Qualified stated interest (QSI). In gen-

eral, this is the stated interest that is uncondi-

tionally payable in cash or property (other than

another loan of the issuer) at least annually over

the term of the loan at a fixed rate.

Example—Year 1. The facts are the same

as in the previous example. The yield to matur-

ity on Carol's loan is 10.2467%, compounded

annually.

She figured the amount of points (OID) she

could deduct in 2016 as follows.

Principal amount of the loan .......... $100,000

Minus: Points (OID) ................ – 1,500

Issue price of the loan .............. $ 98,500

Multiplied by: YTM ................ × 0.102467

Total .......................... 10,093

Minus: QSI ...................... –10,000

Points (OID) deductible in 2016 ....

$ 93

To figure your deduction in any subsequent

year, you start with the adjusted issue price. To

get the adjusted issue price, add to the issue

price figured in Year 1 any OID previously de-

ducted. Then follow steps (2) and (3), earlier.

Example—Year 2. Carol figured the de-

duction for 2017 as follows.

Issue price

...................... $98,500

Plus: Points (OID) deducted

in 2016 .......................

+ 93

Adjusted issue price ............... $98,593

Multiplied by: YTM ................ × 0.102467

Total .......................... 10,103

Minus: QSI ...................... –10,000

Points (OID) deductible in 2017 ....

$ 103

Loan or mortgage ends. If your loan or mort-

gage ends, you may be able to deduct any re-

maining points (OID) in the tax year in which the

loan or mortgage ends. A loan or mortgage may

end due to a refinancing, prepayment, foreclo-

sure, or similar event. However, if the refinanc-

ing is with the same lender, the remaining

points (OID) generally are not deductible in the

year in which the refinancing occurs, but may

be deductible over the term of the new mort-

gage or loan.

Points when loan refinance is more than

the previous outstanding balance. When

you refinance a rental property for more than

the previous outstanding balance, the portion of

the points allocable to loan proceeds

not rela-

ted to rental use generally cannot be deducted

as a rental expense.

Example. Charles refinanced a loan with a

balance of $100,000. The amount of the new

loan was $120,000. Charles used the additional

$20,000 to purchase a car. The points allocable

to the $20,000 would be treated as nondeducti-

ble personal interest.

Repairs and Improvements

Generally, an expense for repairing or maintain-

ing your rental property may be deducted if you

are not required to capitalize the expense.

Improvements. You must capitalize any ex-

pense you pay to improve your rental property.

An expense is for an improvement if it results in

a betterment to your property, restores your

property, or adapts your property to a new or

different use.

Table 1-1 shows examples of

many improvements.

Betterments. Expenses that may result in

a betterment to your property include expenses

for fixing a pre-existing defect or condition, en-

larging or expanding your property, or increas-

ing the capacity, strength, or quality of your

property.

Restoration. Expenses that may be for re-

storation include expenses for replacing a sub-

stantial structural part of your property, repairing

damage to your property after you properly ad-

justed the basis of your property as a result of a

casualty loss, or rebuilding your property to a

like-new condition.

Adaptation. Expenses that may be for

adaptation include expenses for altering your

property to a use that is not consistent with the

intended ordinary use of your property when

you began renting the property.

Separate the costs of repairs and im-

provements, and keep accurate re-

cords. You will need to know the cost

of improvements when you sell or depreciate

your property.

The expenses you capitalize for improving

your property can generally be depreciated as if

the improvement were separate property.

2.

Depreciation of

Rental Property

You recover the cost of income-producing prop-

erty through yearly tax deductions. You do this

RECORDS

by depreciating the property; that is, by deduct-

ing some of the cost each year on your tax re-

turn.

Three factors determine how much depreciation

you can deduct each year: (1) your basis in the

property, (2) the recovery period for the prop-

erty, and (3) the depreciation method used. You

cannot simply deduct your mortgage or princi-

pal payments, or the cost of furniture, fixtures,

and equipment, as an expense.

You can deduct depreciation only on the part of

your property used for rental purposes. Depre-

ciation reduces your basis for figuring gain or

loss on a later sale or exchange.

You may have to use Form 4562 to figure and

report your depreciation. See Which Forms To

Use in chapter 3. Also see Pub. 946.

Section 179 deduction. The section 179 de-

duction is a means of recovering part or all of

the cost of certain qualifying property in the year

you place the property in service. This deduc-

tion is not allowed for property used in connec-

tion with residential rental property. See chap-

ter 2 of Pub. 946.

Alternative minimum tax (AMT). If you use

accelerated depreciation, you may be subject to

the AMT. Accelerated depreciation allows you

to deduct more depreciation earlier in the recov-

ery period than you could deduct using a

straight line method (same deduction each

year).

The prescribed depreciation methods for

rental real estate are not accelerated, so the de-

preciation deduction is not adjusted for the

AMT. However, accelerated methods are gen-

erally used for other property connected with

rental activities (for example, appliances and

wall-to-wall carpeting).

To find out if you are subject to the AMT,

see the Instructions for Form 6251.

The Basics

The following section discusses the information

you will need to have about the rental property

and the decisions to be made before figuring

your depreciation deduction.

Examples of Improvements

Additions

Bedroom

Bathroom

Deck

Garage

Porch

Patio

Lawn & Grounds

Landscaping

Driveway

Walkway

Fence

Retaining wall

Sprinkler system

Swimming pool

Miscellaneous

Storm windows, doors

New roof

Central vacuum

Wiring upgrades

Satellite dish

Security system

Heating & Air Conditioning

Heating system

Central air conditioning

Furnace

Duct work

Central humidifier

Filtration system

Plumbing

Septic system

Water heater

Soft water system

Filtration system

Interior Improvements

Built-in appliances

Kitchen modernization

Flooring

Wall-to-wall carpeting

Insulation

Attic

Walls, floor

Pipes, duct work

Table 1-1.

Page 5 of 24 Fileid: … tions/P527/2016/A/XML/Cycle04/source 15:55 - 29-Nov-2016

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Chapter 2 Depreciation of Rental Property Page 5

What Rental Property

Can Be Depreciated?

You can depreciate your property if it meets all

the following requirements.

You own the property.

You use the property in your business or

income-producing activity (such as rental

property).

The property has a determinable useful

life.

The property is expected to last more than

one year.

Property you own. To claim depreciation, you

usually must be the owner of the property. You

are considered to be the owner of property

even if it is subject to a debt.

Rented property. Generally, if you pay rent

for property, you cannot depreciate that prop-

erty. Usually, only the owner can depreciate it.

However, if you make permanent improvements

to leased property, you may be able to depreci-

ate the improvements. See Additions or im-

provements to property, later in this chapter un-

der Recovery Periods Under GDS.

Cooperative apartments. If you are a ten-

ant-stockholder in a cooperative housing corpo-

ration and rent your cooperative apartment to

others, you can depreciate your stock in the

corporation. See chapter 4, Special Situations.

Property having a determinable useful life.

To be depreciable, your property must have a

determinable useful life. This means that it must

be something that wears out, decays, gets used

up, becomes obsolete, or loses its value from

natural causes.

What Rental Property

Cannot Be Depreciated?

Certain property cannot be depreciated. This in-

cludes land and certain excepted property.

Land. You cannot depreciate the cost of land

because land generally does not wear out, be-

come obsolete, or get used up. But if it does,

the loss is accounted for upon disposition. The

costs of clearing, grading, planting, and land-

scaping are usually all part of the cost of land

and cannot be depreciated. You may, however,

be able to depreciate certain land preparation

costs if the costs are so closely associated with

other depreciable property that you can deter-

mine a life for them along with the life of the as-

sociated property.

Example. You built a new house to use as

a rental and paid for grading, clearing, seeding,

and planting bushes and trees. Some of the

bushes and trees were planted right next to the

house, while others were planted around the

outer border of the lot. If you replace the house,

you would have to destroy the bushes and trees

right next to it. These bushes and trees are

closely associated with the house, so they have

a determinable useful life. Therefore, you can

depreciate them. Add your other land prepara-

tion costs to the basis of your land because

they have no determinable life and you cannot

depreciate them.

Excepted property. Even if the property

meets all the requirements listed earlier under

What Rental Property Can Be Depreciated, you

cannot depreciate the following property.

Property placed in service and disposed of

(or taken out of business use) in the same

year.

Equipment used to build capital improve-

ments. You must add otherwise allowable

depreciation on the equipment during the

period of construction to the basis of your

improvements.

For more information, see chapter 1 of Pub.

946.

When Does Depreciation

Begin and End?

You begin to depreciate your rental property

when you place it in service for the production

of income. You stop depreciating it either when

you have fully recovered your cost or other ba-

sis, or when you retire it from service, whichever

happens first.

Placed in Service

You place property in service in a rental activity

when it is ready and available for a specific use

in that activity. Even if you are not using the

property, it is in service when it is ready and

available for its specific use.

Example 1. On November 22 of last year,

you purchased a dishwasher for your rental

property. The appliance was delivered on De-

cember 7, but was not installed and ready for

use until January 3 of this year. Because the

dishwasher was not ready for use last year, it is

not considered placed in service until this year.

If the appliance had been installed and

ready for use when it was delivered in Decem-

ber of last year, it would have been considered

placed in service in December, even if it was

not actually used until this year.

Example 2. On April 6, you purchased a

house to use as residential rental property. You

made extensive repairs to the house and had it

ready for rent on July 5. You began to advertise

the house for rent in July and actually rented it

beginning September 1. The house is consid-

ered placed in service in July when it was ready

and available for rent. You can begin to depreci-

ate the house in July.

Example 3. You moved from your home in

July. During August and September you made

several repairs to the house. On October 1, you

listed the property for rent with a real estate

company, which rented it on December 1. The

property is considered placed in service on Oc-

tober 1, the date when it was available for rent.

Conversion to business use. If you place

property in service in a personal activity, you

cannot claim depreciation. However, if you

change the property's use to business or the

production of income, you can begin to depreci-

ate it at the time of the change. You place the

property in service for business or income-pro-

ducing use on the date of the change.

Example. You bought a house and used it

as your personal home several years before

you converted it to rental property. Although its

specific use was personal and no depreciation

was allowable, you placed the home in service

when you began using it as your home. You can

begin to claim depreciation in the year you con-

verted it to rental property because at that time

its use changed to the production of income.

Idle Property

Continue to claim a deduction for depreciation

on property used in your rental activity even if it

is temporarily idle (not in use). For example, if

you must make repairs after a tenant moves

out, you still depreciate the rental property dur-

ing the time it is not available for rent.

Cost or Other Basis

Fully Recovered

You must stop depreciating property when the

total of your yearly depreciation deductions

equals your cost or other basis of your property.

For this purpose, your yearly depreciation de-

ductions include any depreciation that you were

allowed to claim, even if you did not claim it.

See Basis of Depreciable Property, later.

Retired From Service

You stop depreciating property when you retire

it from service, even if you have not fully recov-

ered its cost or other basis. You retire property

from service when you permanently withdraw it

from use in a trade or business or from use in

the production of income because of any of the

following events.

You sell or exchange the property.

You convert the property to personal use.

You abandon the property.

The property is destroyed.

Depreciation Methods

Generally, you must use the Modified Acceler-

ated Cost Recovery System (MACRS) to de-

preciate residential rental property placed in

service after 1986.

If you placed rental property in service be-

fore 1987, you are using one of the following

methods.

Accelerated Cost Recovery System–

(ACRS) for property placed in service after

1980 but before 1987.

Straight line or declining balance method

over the useful life of property placed in

service before 1981.

See MACRS Depreciation, later, for more infor-

mation.

Rental property placed in service before

2016. Continue to use the same method of fig-

uring depreciation that you used in the past.

Use of real property changed. Generally,

you must use MACRS to depreciate real prop-

erty that you acquired for personal use before

1987 and changed to business or income-pro-

ducing use after 1986. This includes your

residence that you changed to rental use. See

Page 6 of 24 Fileid: … tions/P527/2016/A/XML/Cycle04/source 15:55 - 29-Nov-2016

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Page 6 Chapter 2 Depreciation of Rental Property

Property Owned or Used in 1986 in Pub. 946,

chapter 1, for those situations in which MACRS

is not allowed.

Improvements made after 1986. Treat an im-

provement made after 1986 to property you

placed in service before 1987 as separate de-

preciable property. As a result, you can depreci-

ate that improvement as separate property un-

der MACRS if it is the type of property that

otherwise qualifies for MACRS depreciation.

For more information about improvements, see

Additions or improvements to property, later in

this chapter under Recovery Periods Under

GDS.

This publication discusses MACRS de-

preciation only. If you need information

about depreciating property placed in

service before 1987, see Pub. 534.

Basis of Depreciable

Property

The basis of property used in a rental activity is

generally its adjusted basis when you place it in

service in that activity. This is its cost or other

basis when you acquired it, adjusted for certain

items occurring before you place it in service in

the rental activity.

If you depreciate your property under

MACRS, you may also have to reduce your ba-

sis by certain deductions and credits with re-

spect to the property.

Basis and adjusted basis are explained in

the following discussions.

If you used the property for personal

purposes before changing it to rental

use, its basis for depreciation is the

lesser of its adjusted basis or its fair market

value when you change it to rental use. See Ba-

sis of Property Changed to Rental Use in chap-

ter 4.

Cost Basis

The basis of property you buy is usually its cost.

The cost is the amount you pay for it in cash, in

debt obligation, in other property, or in services.

Your cost also includes amounts you pay for:

Sales tax charged on the purchase (but

see Exception next),

Freight charges to obtain the property, and

Installation and testing charges.

Exception. If you deducted state and local

general sales taxes as an itemized deduction

on Schedule A (Form 1040), do not include

those sales taxes as part of your cost basis.

Such taxes were deductible before 1987 and

after 2003.

Loans with low or no interest. If you buy

property on any payment plan that charges little

or no interest, the basis of your property is your

stated purchase price, less the amount consid-

ered to be unstated interest. See Unstated In-

terest and Original Issue Discount (OID) in Pub.

537, Installment Sales.

Real property. If you buy real property, such

as a building and land, certain fees and other

CAUTION

!

CAUTION

!

expenses you pay are part of your cost basis in

the property.

Real estate taxes. If you buy real property

and agree to pay real estate taxes on it that

were owed by the seller and the seller does not

reimburse you, the taxes you pay are treated as

part of your basis in the property. You cannot

deduct them as taxes paid.

If you reimburse the seller for real estate

taxes the seller paid for you, you can usually

deduct that amount. Do not include that amount

in your basis in the property.

Settlement fees and other costs. The fol-

lowing settlement fees and closing costs for

buying the property are part of your basis in the

property.

Abstract fees.

Charges for installing utility services.

Legal fees.

Recording fees.

Surveys.

Transfer taxes.

Title insurance.

Any amounts the seller owes that you

agree to pay, such as back taxes or inter-

est, recording or mortgage fees, charges

for improvements or repairs, and sales

commissions.

The following are settlement fees and clos-

ing costs you cannot include in your basis in the

property.

1. Fire insurance premiums.

2. Rent or other charges relating to occu-

pancy of the property before closing.

3. Charges connected with getting or refi-

nancing a loan, such as:

a. Points (discount points, loan origina-

tion fees),

b. Mortgage insurance premiums,

c. Loan assumption fees,

d. Cost of a credit report, and

e. Fees for an appraisal required by a

lender.

Also, do not include amounts placed in es-

crow for the future payment of items such as

taxes and insurance.

Assumption of a mortgage. If you buy

property and become liable for an existing mort-

gage on the property, your basis is the amount

you pay for the property plus the amount re-

maining to be paid on the mortgage.

Example. You buy a building for $60,000

cash and assume a mortgage of $240,000 on it.

Your basis is $300,000.

Separating cost of land and buildings. If

you buy buildings and your cost includes the

cost of the land on which they stand, you must

divide the cost between the land and the build-

ings to figure the basis for depreciation of the

buildings. The part of the cost that you allocate

to each asset is the ratio of the fair market value

of that asset to the fair market value of the

whole property at the time you buy it.

If you are not certain of the fair market val-

ues of the land and the buildings, you can di-

vide the cost between them based on their as-

sessed values for real estate tax purposes.

Example. You buy a house and land for

$200,000. The purchase contract does not

specify how much of the purchase price is for

the house and how much is for the land.

The latest real estate tax assessment on the

property was based on an assessed value of

$160,000, of which $136,000 was for the house

and $24,000 was for the land.

You can allocate 85% ($136,000 ÷

$160,000) of the purchase price to the house

and 15% ($24,000 ÷ $160,000) of the purchase

price to the land.

Your basis in the house is $170,000 (85% of

$200,000) and your basis in the land is $30,000

(15% of $200,000).

Basis Other Than Cost

You cannot use cost as a basis for property that

you received:

In return for services you performed;

In an exchange for other property;

As a gift;

From your spouse, or from your former

spouse as the result of a divorce; or

As an inheritance.

If you received property in one of these

ways, see Pub. 551 for information on how to

figure your basis.

Adjusted Basis

To figure your property's basis for depreciation,

you may have to make certain adjustments (in-

creases and decreases) to the basis of the

property for events occurring between the time

you acquired the property and the time you

placed it in service for business or the produc-

tion of income. The result of these adjustments

to the basis is the adjusted basis.

Increases to basis. You must increase the

basis of any property by the cost of all items

properly added to a capital account. These in-

clude the following.

The cost of any additions or improvements

made before placing your property into

service as a rental that have a useful life of

more than 1 year.

Amounts spent after a casualty to restore

the damaged property.

The cost of extending utility service lines to

the property.

Legal fees, such as the cost of defending

and perfecting title, or settling zoning is-

sues.

Additions or improvements. Add to the

basis of your property the amount an addition or

improvement actually cost you, including any

amount you borrowed to make the addition or

improvement. This includes all direct costs,

such as material and labor, but does not include

your own labor. It also includes all expenses re-

lated to the addition or improvement.

For example, if you had an architect draw up

plans for remodeling your property, the archi-

tect's fee is a part of the cost of the remodeling.

Page 7 of 24 Fileid: … tions/P527/2016/A/XML/Cycle04/source 15:55 - 29-Nov-2016

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Chapter 2 Depreciation of Rental Property Page 7

Or, if you had your lot surveyed to put up a

fence, the cost of the survey is a part of the cost

of the fence.

Keep separate accounts for depreciable ad-

ditions or improvements made after you place

the property in service in your rental activity. For

information on depreciating additions or im-

provements, see Additions or improvements to

property, later in this chapter under Recovery

Periods Under GDS.

The cost of landscaping improvements

is usually treated as an addition to the

basis of the land, which is not depreci-

able. However, see What Rental Property Can-

not Be Depreciated, earlier.

Assessments for local improvements.

Assessments for items which tend to increase

the value of property, such as streets and side-

walks, must be added to the basis of the prop-

erty. For example, if your city installs curbing on

the street in front of your house, and assesses

you and your neighbors for its cost, you must

add the assessment to the basis of your prop-

erty. Also add the cost of legal fees paid to ob-

tain a decrease in an assessment levied against

property to pay for local improvements. You

cannot deduct these items as taxes or depreci-

ate them.

However, you can deduct assessments for

the purpose of maintenance or repairs or for the

purpose of meeting interest charges related to

the improvements. Do not add them to your ba-

sis in the property.

Deducting vs. capitalizing costs. Do not

add to your basis costs you can deduct as cur-

rent expenses. However, there are certain costs

you can choose either to deduct or to capitalize.

If you capitalize these costs, include them in

your basis. If you deduct them, do not include

them in your basis.

The costs you may choose to deduct or cap-

italize include carrying charges, such as interest

and taxes, that you must pay to own property.

For more information about deducting or

capitalizing costs and how to make the election,

see Carrying Charges in Pub. 535, chapter 7.

Decreases to basis. You must decrease the

basis of your property by any items that repre-

sent a return of your cost. These include the fol-

lowing.

Insurance or other payment you receive as

the result of a casualty or theft loss.

Casualty loss not covered by insurance for

which you took a deduction.

Amount(s) you receive for granting an

easement.

Residential energy credits you were al-

lowed before 1986, or after 2005, if you

added the cost of the energy items to the

basis of your home.

Exclusion from income of subsidies for en-

ergy conservation measures.

Special depreciation allowance claimed on

qualified property.

Depreciation you deducted, or could have

deducted, on your tax returns under the

method of depreciation you chose. If you

did not deduct enough or deducted too

much in any year, see Depreciation under

Decreases to Basis in Pub. 551.

CAUTION

!

If your rental property was previously used

as your main home, you must also decrease the

basis by the following.

Gain you postponed from the sale of your

main home before May 7, 1997, if the re-

placement home was converted to your

rental property.

District of Columbia first-time homebuyer

credit allowed on the purchase of your

main home after August 4, 1997 and be-

fore January 1, 2012.

Amount of qualified principal residence in-

debtedness discharged on or after January

1, 2007.

Special Depreciation

Allowance

For 2016, some properties used in connection

with residential real property activities may

qualify for a special depreciation allowance.

This allowance is figured before you figure your

regular depreciation deduction. See Pub. 946,

chapter 3, for details. Also see the instructions

for Form 4562, line 14.

If you qualify for, but choose not to take, a

special depreciation allowance, you must attach

a statement to your return. The details of this

election are in Pub. 946, chapter 3, and the in-

structions for Form 4562, line 14.

MACRS Depreciation

Most business and investment property placed

in service after 1986 is depreciated using

MACRS.

This section explains how to determine

which MACRS depreciation system applies to

your property. It also discusses other informa-

tion you need to know before you can figure de-

preciation under MACRS. This information in-

cludes the property's:

Recovery class,

Applicable recovery period,

Convention,

Placed-in-service date,

Basis for depreciation, and

Depreciation method.

Depreciation Systems

MACRS consists of two systems that determine

how you depreciate your property—the General

Depreciation System (GDS) and the Alternative

Depreciation System (ADS). You must use

GDS unless you are specifically required by law

to use ADS or you elect to use ADS.

Excluded Property

You cannot use MACRS for certain personal

property (such as furniture or appliances)

placed in service in your rental property in 2016

if it had been previously placed in service be-

fore 1987, when MACRS became effective.

In most cases, personal property is exclu-

ded from MACRS if you (or a person related to

you) owned or used it in 1986 or if your tenant is

a person (or someone related to the person)

who owned or used it in 1986. However, the

property is not excluded if your 2016 deduction

under MACRS (using a half-year convention) is

less than the deduction you would have under

ACRS. For more information, see

What Method

Can You Use To Depreciate Your Property? in

Pub. 946, chapter 1.

Electing ADS

If you choose, you can use the ADS method for

most property. Under ADS, you use the straight

line method of depreciation.

The election of ADS for one item in a class

of property generally applies to all property in

that class placed in service during the tax year

of the election. However, the election applies on

a property-by-property basis for residential

rental property and nonresidential real property.

If you choose to use ADS for your residential

rental property, the election must be made in

the first year the property is placed in service.

Once you make this election, you can never re-

voke it.

For property placed in service during 2016,

you make the election to use ADS by entering

the depreciation on Form 4562, Part III, Sec-

tion C, line 20c.

Property Classes Under GDS

Each item of property that can be depreciated

under MACRS is assigned to a property class,

determined by its class life. The property class

generally determines the depreciation method,

recovery period, and convention.

The property classes under GDS are:

3-year property,

5-year property,

7-year property,

10-year property,

15-year property,

20-year property,

Nonresidential real property, and

Residential rental property.

Under MACRS, property that you placed in

service during 2016 in your rental activities gen-

erally falls into one of the following classes.

5year property. This class includes com-

puters and peripheral equipment, office

machinery (typewriters, calculators, cop-

iers, etc.), automobiles, and light trucks.

This class also includes appliances,

carpeting, and furniture used in a residen-

tial rental real estate activity.

Depreciation is limited on automobiles

and other property used for transportation;

computers and related peripheral equip-

ment; and property of a type generally

used for entertainment, recreation, or

amusement. See chapter 5 of Pub. 946.

7year property. This class includes of-

fice furniture and equipment (desks, file

cabinets, and similar items). This class

also includes any property that does not

have a class life and that has not been

Page 8 of 24 Fileid: … tions/P527/2016/A/XML/Cycle04/source 15:55 - 29-Nov-2016

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Page 8 Chapter 2 Depreciation of Rental Property

designated by law as being in any other

class.

15year property. This class includes

roads, fences, and shrubbery (if deprecia-

ble).

Residential rental property. This class

includes any real property that is a rental

building or structure (including a mobile

home) for which 80% or more of the gross

rental income for the tax year is from dwell-

ing units. It does not include a unit in a ho-

tel, motel, inn, or other establishment

where more than half of the units are used

on a transient basis. If you live in any part

of the building or structure, the gross rental

income includes the fair rental value of the

part you live in.

The other property classes do not gen-

erally apply to property used in rental

activities. These classes are not dis-

cussed in this publication. See Pub. 946 for

more information.

Recovery Periods

Under GDS

The recovery period of property is the number

of years over which you recover its cost or other

basis. The recovery periods are generally lon-

ger under ADS than GDS.

The recovery period of property depends on

its property class. Under GDS, the recovery pe-

riod of an asset is generally the same as its

property class.

Class lives and recovery periods for most

assets are listed in Appendix B of Pub. 946.

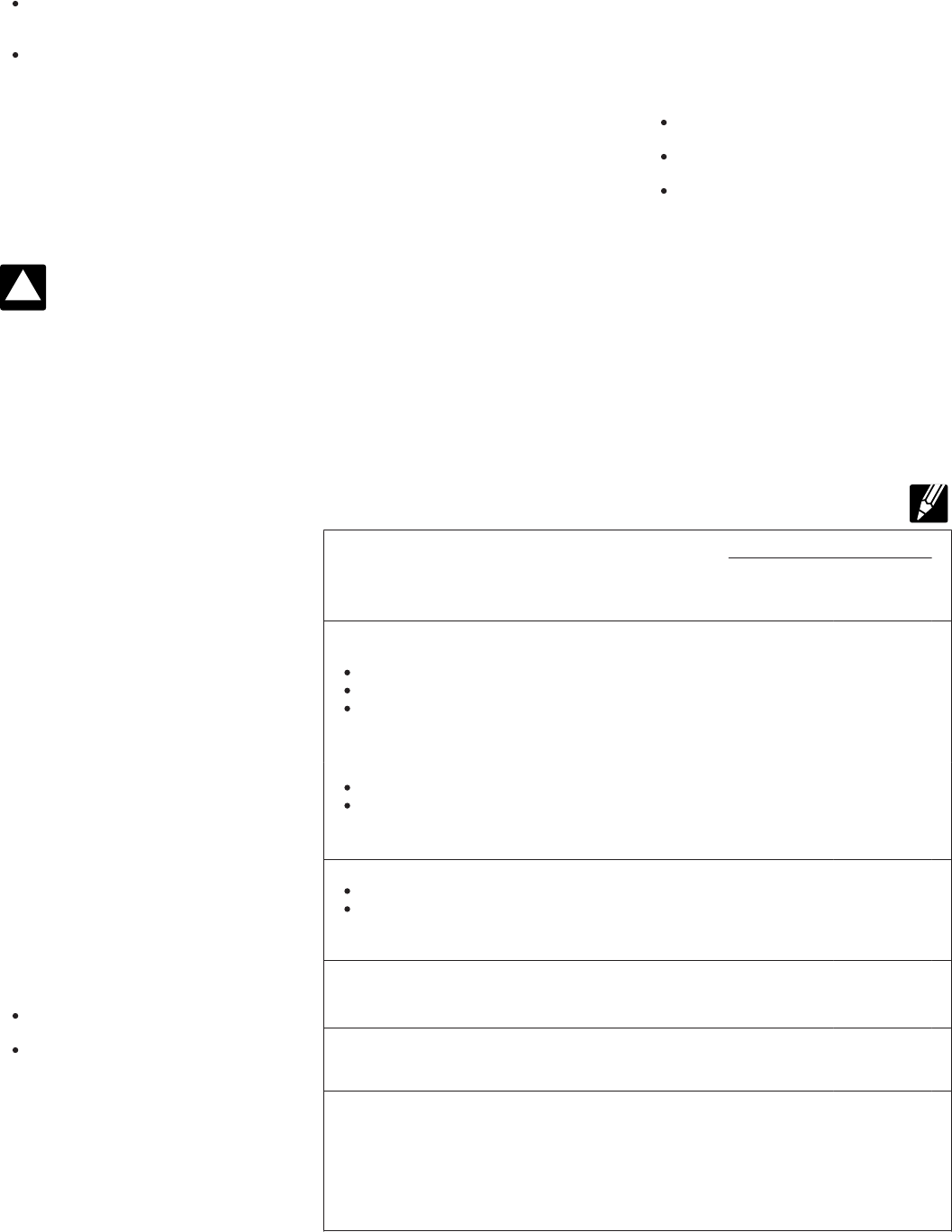

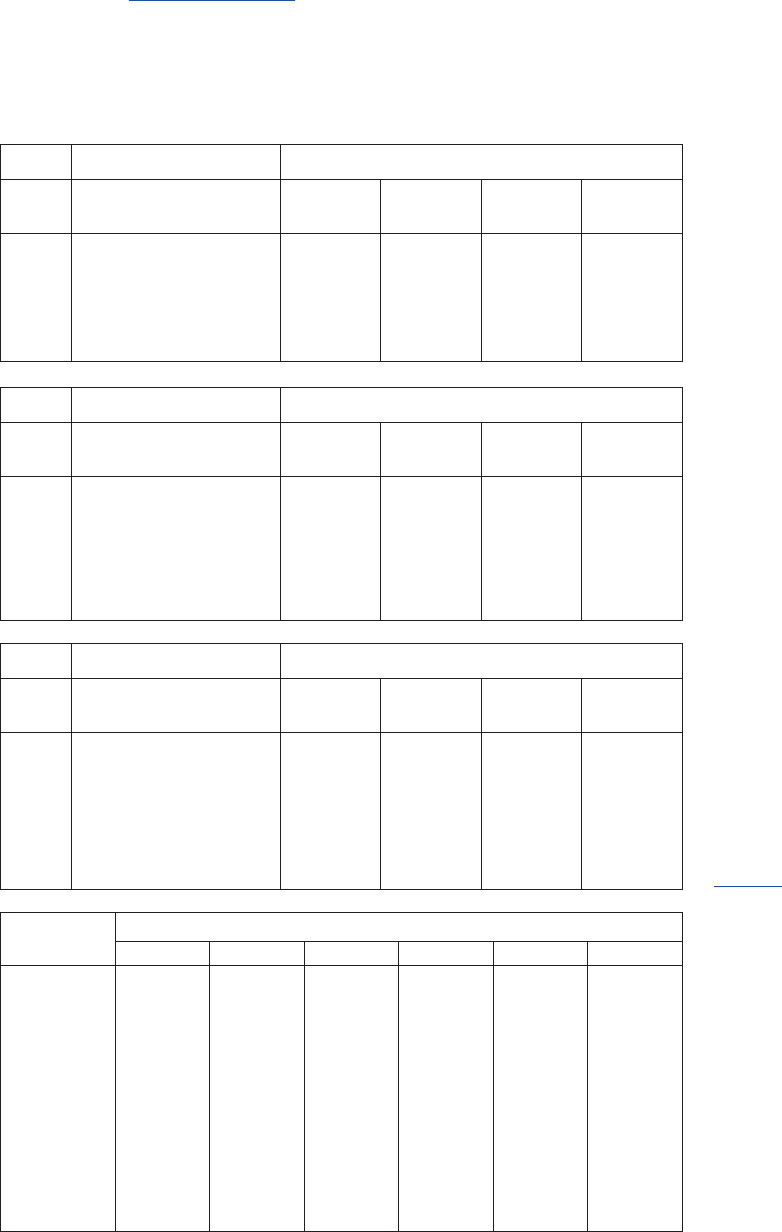

See Table 2-1 for recovery periods of property

commonly used in residential rental activities.

Qualified Indian reservation property.

Shorter recovery periods are provided under

MACRS for qualified Indian reservation prop-

erty placed in service on Indian reservations.

For more information, see chapter 4 of Pub.

946.

Additions or improvements to property.

Treat additions or improvements you make to

your depreciable rental property as separate

property items for depreciation purposes.

The property class and recovery period of

the addition or improvement is the one that

would apply to the original property if you had

placed it in service at the same time as the ad-

dition or improvement.

The recovery period for an addition or im-

provement to property begins on the later of:

The date the addition or improvement is

placed in service, or

The date the property to which the addition

or improvement was made is placed in

service.

Example. You own a residential rental

house that you have been renting since 1986

and depreciating under ACRS. You built an ad-

dition onto the house and placed it in service in

2016. You must use MACRS for the addition.

Under GDS, the addition is depreciated as resi-

dential rental property over 27.5 years.

CAUTION

!

Conventions

A convention is a method established under

MACRS to set the beginning and end of the re-

covery period. The convention you use deter-

mines the number of months for which you can

claim depreciation in the year you place prop-

erty in service and in the year you dispose of

the property.

Mid-month convention. A mid-month conven-

tion is used for all residential rental property and

nonresidential real property. Under this conven-

tion, you treat all property placed in service, or

disposed of, during any month as placed in

service, or disposed of, at the midpoint of that

month.

Mid-quarter convention. A mid-quarter con-

vention must be used if the mid-month conven-

tion does not apply and the total depreciable

basis of MACRS property placed in service in

the last 3 months of a tax year (excluding non-

residential real property, residential rental prop-

erty, and property placed in service and dis-

posed of in the same year) is more than 40% of

the total basis of all such property you place in

service during the year.

Under this convention, you treat all property

placed in service, or disposed of, during any

quarter of a tax year as placed in service, or dis-

posed of, at the midpoint of the quarter.

Example. During the tax year, Tom pur-

chased the following items to use in his rental

property. He elects not to claim the special de-

preciation allowance discussed earlier.

A dishwasher for $400 that he placed in

service in January.

Used furniture for $100 that he placed in

service in September.

A refrigerator for $800 that he placed in

service in October.

Tom uses the calendar year as his tax year.

The total basis of all property placed in service

that year is $1,300. The $800 basis of the refrig-

erator placed in service during the last 3 months

of his tax year exceeds $520 (40% × $1,300).

Tom must use the mid-quarter convention in-

stead of the half-year convention for all three

items.

Half-year convention. The half-year conven-

tion is used if neither the mid-quarter conven-

tion nor the mid-month convention applies. Un-

der this convention, you treat all property

MACRS Recovery Periods for

Property Used in

Rental Activities

Table 2-1.

Keep for Your Records

MACRS Recovery Period

Type of Property

General

Depreciation

System

Alternative

Depreciation

System

Computers and their peripheral equipment ............. 5 years 5 years

Office machinery, such as:

Typewriters

Calculators

Copiers .................................... 5 years 6 years

Automobiles ................................... 5 years 5 years

Light trucks .................................... 5 years 5 years

Appliances, such as:

Stoves

Refrigerators ................................ 5 years 9 years

Carpets ....................................... 5 years 9 years

Furniture used in rental property ..................... 5 years 9 years

Office furniture and equipment, such as:

Desks

Files ...................................... 7 years 10 years

Any property that does not have a class life and that has not

been designated by law as being in any other class

....... 7 years 12 years

Roads ........................................ 15 years 20 years

Shrubbery ..................................... 15 years 20 years

Fences ....................................... 15 years 20 years

Residential rental property (buildings or structures) and

structural components such as furnaces, waterpipes, venting,

etc.

.......................................... 27.5 years 40 years

Additions and improvements, such as a new roof ........ The same recovery period as

that of the property to which

the addition or improvement is

made, determined as if the

property were placed in

service at the same time as

the addition or improvement.

Page 9 of 24 Fileid: … tions/P527/2016/A/XML/Cycle04/source 15:55 - 29-Nov-2016

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Chapter 2 Depreciation of Rental Property Page 9

placed in service, or disposed of, during a tax

year as placed in service, or disposed of, at the

midpoint of that tax year.

If this convention applies, you deduct a half

year of depreciation for the first year and the

last year that you depreciate the property. You

deduct a full year of depreciation for any other

year during the recovery period.

Figuring Your Depreciation

Deduction

You can figure your MACRS depreciation de-

duction in one of two ways. The deduction is

substantially the same both ways. You can fig-

ure the deduction using either:

The depreciation method and convention

that apply over the recovery period of the

property, or

The percentage from the MACRS percent-

age tables.

In this publication we will use the percent-

age tables. For instructions on how to compute

the deduction, see chapter 4 of Pub. 946.

Residential rental property. You must use

the straight line method and a mid-month con-

vention for residential rental property. In the first

year that you claim depreciation for residential

rental property, you can claim depreciation only

for the number of months the property is in use.

Use the mid-month convention (explained un-

der Conventions, earlier).

5-, 7-, or 15-year property. For property in the

5- or 7-year class, use the 200% declining bal-

ance method and a half-year convention. How-

ever, in limited cases you must use the

mid-quarter convention, if it applies. For prop-

erty in the 15-year class, use the 150% declin-

ing balance method and a half-year convention.

You can also choose to use the 150% de-

clining balance method for property in the 5- or

7-year class. The choice to use the 150%

method for one item in a class of property ap-

plies to all property in that class that is placed in

service during the tax year of the election. You

make this election on Form 4562. In Part III, col-

umn (f), enter “150 DB.” Once you make this

election, you cannot change to another method.

If you use either the 200% or 150% declin-

ing balance method, figure your deduction us-

ing the straight line method in the first tax year

that the straight line method gives you an equal

or larger deduction.

You can also choose to use the straight line

method with a half-year or mid-quarter conven-

tion for 5-, 7-, or 15-year property. The choice to

use the straight line method for one item in a

class of property applies to all property in that

class that is placed in service during the tax

year of the election. You elect the straight line

method on Form 4562. In Part III, column (f),

enter “S/L.” Once you make this election, you

cannot change to another method.

MACRS Percentage Tables

You can use the percentages in Table 2-2 to

compute annual depreciation under MACRS.

The tables show the percentages for the first

few years or until the change to the straight line

method is made. See Appendix A of Pub. 946

for complete tables. The percentages in Tables

2-2a, 2-2b, and 2-2c make the change from de-

clining balance to straight line in the year that

straight line will give a larger deduction.

If you elect to use the straight line method

for 5-, 7-, or 15-year property, or the 150% de-

clining balance method for 5- or 7-year prop-

erty, use the tables in Appendix A of Pub. 946.

How to use the percentage tables. You must

apply the table rates to your property's

unadjus-

ted basis (defined below) each year of the re-

covery period.

Once you begin using a percentage table to

figure depreciation, you must continue to use it

for the entire recovery period unless there is an

adjustment to the basis of your property for a

reason other than:

1. Depreciation allowed or allowable, or

2. An addition or improvement that is depre-

ciated as a separate item of property.

If there is an adjustment for any reason

other than (1) or (2), for example, because of a

deductible casualty loss, you can no longer use

the table. For the year of the adjustment and for

the remaining recovery period, figure deprecia-

tion using the property's adjusted basis at the

end of the year and the appropriate deprecia-

tion method, as explained earlier under Figuring

Your Depreciation Deduction. See Figuring the

Deduction Without Using the Tables in Pub.

946, chapter 4.

Unadjusted basis. This is the same basis

you would use to figure gain on a sale (see Ba-

sis of Depreciable Property, earlier), but without

reducing your original basis by any MACRS de-

preciation taken in earlier years.

However, you do reduce your original basis

by other amounts claimed on the property, in-

cluding:

Any amortization,

Any section 179 deduction, and

Any special depreciation allowance.

For more information, see chapter 4 of Pub.

946.

Page 10 of 24 Fileid: … tions/P527/2016/A/XML/Cycle04/source 15:55 - 29-Nov-2016

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Page 10 Chapter 2 Depreciation of Rental Property

Tables 2-2a, 2-2b, and 2-2c. The percen-

tages in these tables take into account the

half-year and mid-quarter conventions. Use Ta-

ble 2-2a for 5-year property, Table 2-2b for

7-year property, and Table 2-2c for 15-year

property. Use the percentage in the second col-

umn (half-year convention) unless you are re-

quired to use the mid-quarter convention (ex-

plained earlier). If you must use the mid-quarter

convention, use the column that corresponds to

the calendar year quarter in which you placed

the property in service.

Example 1. You purchased a stove and re-

frigerator and placed them in service in June.

Your basis in the stove is $600 and your basis

in the refrigerator is $1,000. Both are 5-year

property. Using the half-year convention col-

umn in Table 2-2a, the depreciation percentage

for Year 1 is 20%. For that year your deprecia-

tion deduction is $120 ($600 × 0.20) for the

stove and $200 ($1,000 × 0.20) for the refriger-

ator.

For Year 2, the depreciation percentage is

32%. That year's depreciation deduction will be

$192 ($600 × 0.32) for the stove and $320

($1,000 × 0.32) for the refrigerator.

Example 2. Assume the same facts as in

Example 1, except you buy the refrigerator in

October instead of June. Since the refrigerator

was placed in service in the last 3 months of the

tax year, and its basis ($1,000) is more than

40% of the total basis of all property placed in

service during the year ($1,600 × 0.40 = $640),

you are required to use the mid-quarter conven-

tion to figure depreciation on both the stove and