Nolos How to Write a Business Plan

N O L O

“ An essential book to help entrepreneurs.”

DALLAS MORNING NEWS

Mike McKeever

10TH EDITION

How to Write a

Business

• Write a winning proposal

• Prepare cash fl ow and profi t & loss forecasts

• Get backers to invest

Plan

25

Y E A R S

THE LEADING

BUSINESS PLAN

BOOK FOR

A

L

L

F

O

R

M

S

O

N

C

D

-

R

O

M

L

L

F

O

R

M

C

D

-

R

O

M

Free Legal Updates at Nolo.com

®

e Story

Dear friends,

Founded in 1971, and based in an old clock factory in

Berkeley, California, Nolo has always strived to off er clear

legal information and solutions. Today we are proud to

off er a full range of plain-English law books, legal forms,

software and an award-winning website.

Everything we publish is relentlessly researched and

tested by a dedicated group of in-house legal editors,

who together have more than 150 years’ experience. And

when legal changes occur after publication, we promptly

post free updates at Nolo.com.

Tens of millions of Americans have looked to Nolo to

help solve their legal and business problems. We work

every day to be worthy of this trust.

Ralph Warner

Nolo co-founder

Emma Cofod

Books & Software

Get in-depth information. Nolo publishes hundreds of great books

and software programs for consumers and business owners. ey’re all

available in print or as downloads at Nolo.com.

Legal Encyclopedia

Free at Nolo.com. Here are more than 1,400 free articles and answers to

common questions about everyday legal issues including wills, bankruptcy,

small business formation, divorce, patents, employment and much more.

Plain-English Legal Dictionary

Free at Nolo.com. Stumped by jargon? Look it up in America’s most

up-to-date source for defi nitions of legal terms.

Online Legal Documents

Create documents at your computer. Go online to make a will or living

trust, form an LLC or corporation or obtain a trademark or provisional

patent at Nolo.com. For simpler matters, download one of our hundreds

of high-quality legal forms, including bills of sale, promissory notes,

nondisclosure agreements and many more.

Lawyer Directory

Find an attorney at Nolo.com. Nolo’s unique lawyer directory provides

in-depth profi les of lawyers all over America. From fees and experience

to legal philosophy, education and special expertise, you’ll fi nd all the

information you need to pick a lawyer who’s a good fi t.

Free Legal Updates

Keep up to date. Check for free updates at Nolo.com. Under “Products,”

fi nd this book and click “Legal Updates.” You can also sign up for our free

e-newsletters at Nolo.com/newsletters/index.html.

Products

&

Services

“ In Nolo you can trust.”

THE NEW YORK TIMES

“ Nolo is always there in a jam as the nation’s premier publisher

of do-it-yourself legal books.”

NEWSWEEK

“ Nolo publications…guide people simply through the how,

when, where and why of the law.”

THE WASHINGTON POST

“ [Nolo’s]…material is developed by experienced attorneys who

have a knack for making complicated material accessible.”

LIBRARY JOURNAL

“ When it comes to self-help legal stuff , nobody does a better job

than Nolo…”

USA TODAY

“ e most prominent U.S. publisher of self-help legal aids.”

TIME MAGAZINE

“ Nolo is a pioneer in both consumer and business self-help

books and software.”

LOS ANGELES TIMES

e Trusted Name

(but don’t take our word for it)

TENTH EDITION JANUARY 2011

Editor RICHARD STIM

Cover Design SUSAN PUTNEY

Production MARGARET LIVINGSTON

Proofreading CATHY CAPUTO

CD-ROM Preparation ELLEN BITTER

Index MEDEA MINNICH

Printing DELTA PRINTING SOLUTIONS, INC.

McKeever, Mike P.

How to write a business plan / by Mike McKeever. -- 10th ed.

p. cm.

Includes index.

Summary: “Contains the detailed forms and step-by-step instructions needed to prepare a well-thought-out, well-

organized business plan. e 10th edition has been completely updated with the laws, banking regulations, and

resources”--Provided by publisher.

ISBN-13: 978-1-4133-1280-5 (pbk.)

ISBN-10: 1-4133-1280-2 (pbk.)

ISBN-13: 978-1-4133-1297-3 (e-book)

ISBN-10: 1-4133-1297-7 (e-book)

1. Business planning. 2. New business enterprises--Planning. 3. New business enterprises--Finance. 4. Small

business--Planning. 5. Small business--Finance. I. Title.

HD30.28.M3839 2010

658.15’224--dc22

2010021162

Copyright © 1984, 1986, 1988, 1992, 1999, 2002, 2004, 2007, 2008, and 2010 by Mike McKeever.

All rights reserved. e NOLO trademark is registered in the U.S. Patent and Trademark Offi ce.

Printed in the U.S.A.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by

any means, electronic, mechanical, photocopying, recording, or otherwise without prior written permission.

Reproduction prohibitions do not apply to the forms contained in this product when reproduced for personal use.

For information on bulk purchases or corporate premium sales, please contact the Special Sales Department. Call

800-955-4775 or write to Nolo, 950 Parker Street, Berkeley, California 94710.

Please note

We believe accurate, plain-English legal information should help you solve many of your own

legal problems. But this text is not a substitute for personalized advice from a knowledgeable

lawyer. If you want the help of a trained professional—and we’ll always point out situations in

which we think that’s a good idea—consult an attorney licensed to practice in your state.

Dedication

is book is dedicated to the memory of my late grandmother,

Elizabeth Eudora Woodall Darby, whose inuence I acknowledged only

recently.

Acknowledgments

After more than a decade of working with many people, I am amazed at the

uniform spirit of goodwill and cooperation.

My rst editor, Ralph “Jake” Warner, showed patience working with a

rst-time author. My second editor, Lisa Goldoftas,

challenged the grammar

while gracefully deferring to my knowledge about the subject.

Also at Nolo: Steve Elias designed many charts; Adam Stanhope

educated me about computers; Mark Stuhr tuned sections on computer-

related material; Stephanie Harolde worked her word processing

wonders on the manuscript; Terri Hearsh designed the book; Eddie

Warner gave helpful suggestions on online information; and many more

folks at Nolo improved the book greatly.

A special thanks to a number of generous individuals, each of whom

knows a great deal about starting and operating a small business. Peg

Moran, Terri Hearsh, Roger Pritchard, Jason Wallach, Harry Keller,

Dan Peters, Sharyn Simmons, Larry Healy, and nally, Hugh Codding

and Leroy Knibb of Codding Investments. For these and all my readers,

clients, and students who have shared their hopes, dreams, and problems

with me over the years, thank you for your help. e best parts are

yours—all the mistakes are mine. Many of your stories and suggestions

appear here in disguised form. I hope all the readers will prot from

your wisdom and generosity.

Mike P. McKeever

Santa Rosa, California

About the Author

Mike P. McKeever’s education, work experience, business ownership,

writing, and teaching careers give him a broad and unique perspective

on business planning. He has a BA in Economics from Whittier College

and a Master’s in Economics from the London (England) School of

Economics, and has done postgraduate work in nancial analysis at the

USC Business School. Mike has taught classes at numerous community

colleges in entrepreneurship and small business management. He has

published articles on entrepreneurship for Dow Jones publications,

the Sloan Publications Business Journal, and numerous newspapers and

periodicals.

Mike has successfully purchased, expanded, and sold a number of

businesses, including a manufacturing company, tune-up shop, gas

station, retail store, and commercial building. He has worked for a

variety of companies ranging from small groceries to multimillion-dollar

manufacturers. As an independent business broker, he

assessed the

strengths and weaknesses of hundreds of companies. As senior nancial

analyst for a Fortune 500 company, he wrote and analyzed nearly 500

business plans.

Currently, Mike enjoys email correspondence with a few readers

relating to business plan issues. He also acts as consulting controller and

nancial advisor to an online retail business. You can contact him at

mckeever.mp@gmail.com.

Downloading Forms and Other Materials

e printed version of this book comes with a CD-ROM that contains

legal forms and other material. You can download that material by going to

www.nolo.com/back-of-book/sbs.html. You’ll get editable versions of the

forms, which you can ll in or modify and then print.

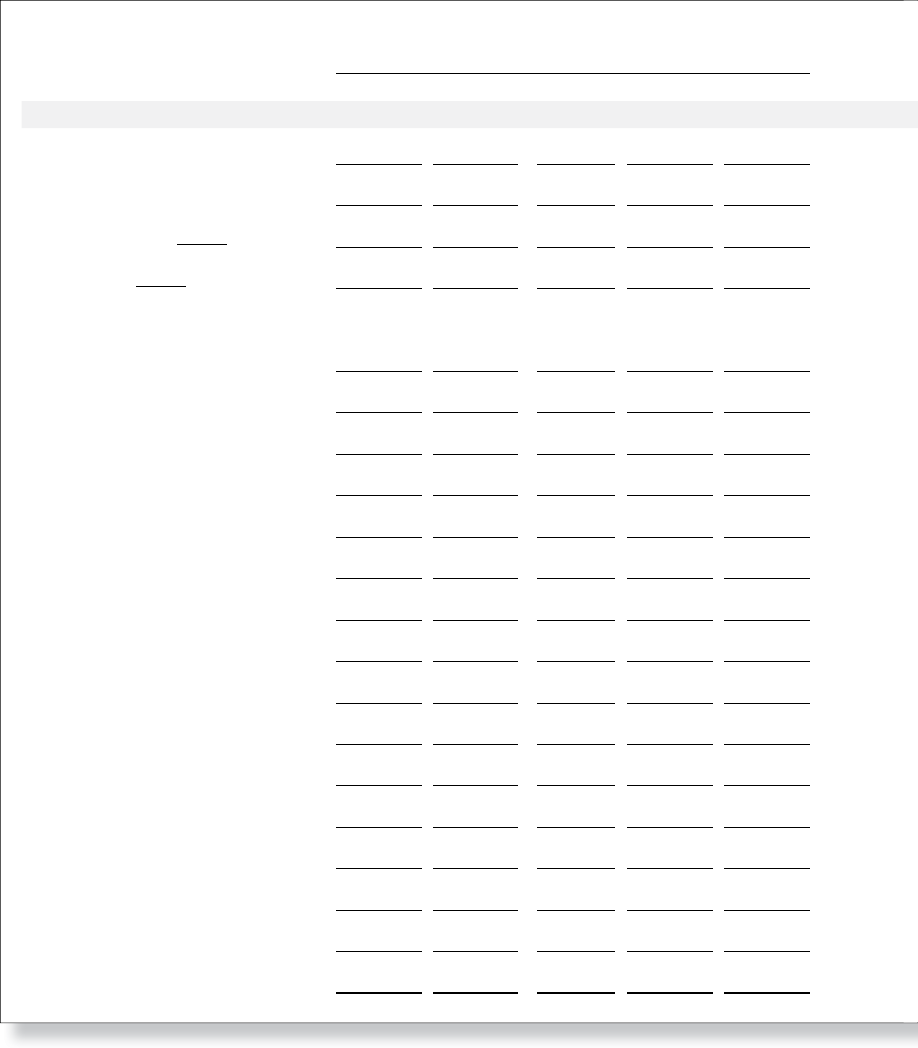

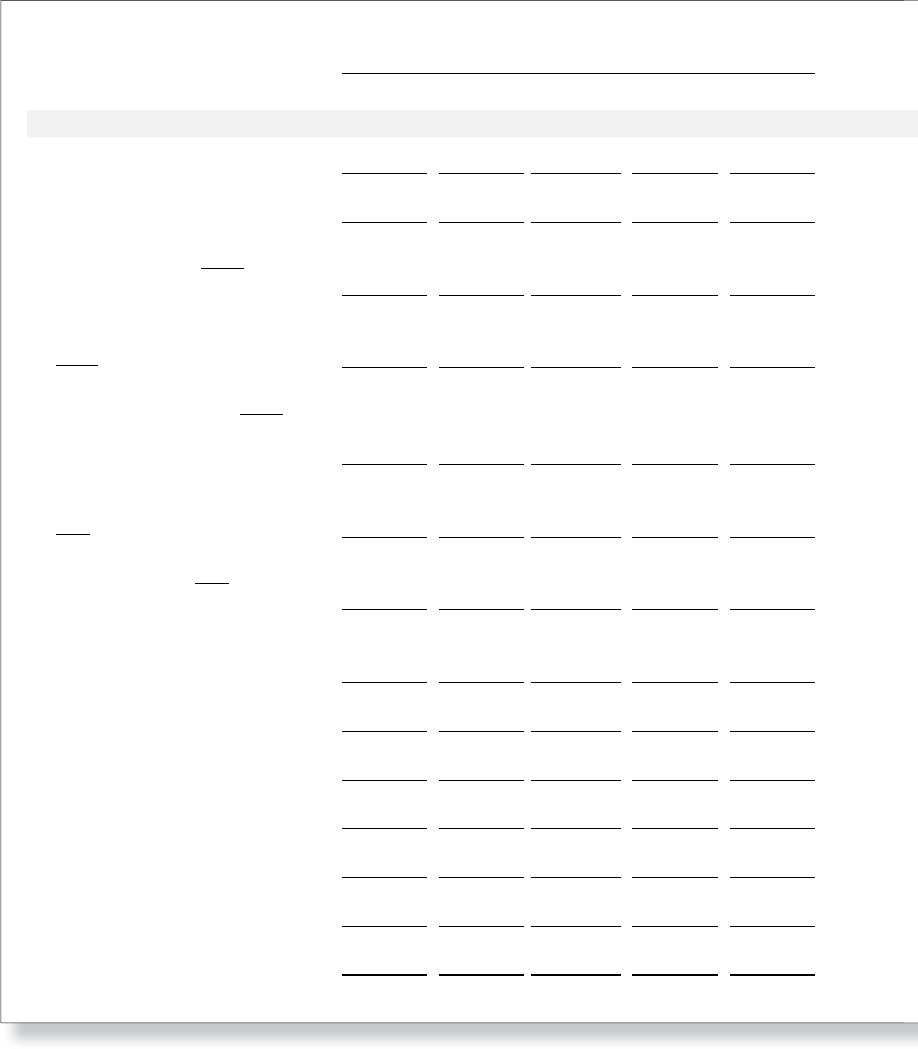

Table of Contents

Your Legal Companion ..................................................................................................................1

1

Benefits of Writing a Business Plan ..................................................................................5

What Is a Business Plan? ................................................................................................................... 6

Why Write a Business Plan? ............................................................................................................ 6

Issues Beyond the Plan ...................................................................................................................... 8

2

Do You Really Want to Own a Business? ..................................................................11

Introduction ..........................................................................................................................................12

Self-Evaluation Exercises .................................................................................................................13

How to Use the Self-Evaluation Lists .......................................................................................17

Reality Check: Banker’s Analysis .................................................................................................17

3

Choosing the Right Business ..................................................................................................21

Introduction ..........................................................................................................................................22

Know Your Business ..........................................................................................................................22

Be Sure You Like Your Business ..................................................................................................24

Describe Your Business ...................................................................................................................24

Taste, Trends, and Technology: How Will the Future Affect Your Business? ........30

Break-Even Analysis: Will Your Business Make Money? ................................................34

What You Have Accomplished ...................................................................................................47

4

Potential Sources of Money to Start or

Expand Your Small Business ...................................................................................................49

Introduction ..........................................................................................................................................51

Ways to Raise Money .......................................................................................................................51

Common Money Sources to Start or Expand a Business .............................................59

Additional Money Sources for an Existing Business .......................................................68

If No One Will Finance Your Business, Try Again .............................................................70

Secondary Sources of Financing for Start-Ups or Expansions ...................................72

Conclusion .............................................................................................................................................75

5

Your Resume and Financial Statement ......................................................................77

Introduction ..........................................................................................................................................78

Draft Your Business Accomplishment Resume .................................................................78

Draft Your Personal Financial Statement ..............................................................................85

6

Your Profit and Loss Forecast ............................................................................................101

Introduction .......................................................................................................................................102

What Is a Profit and Loss Forecast? .......................................................................................102

Determine Your Average Cost of Sales ...............................................................................103

Complete Your Profit and Loss Forecast ............................................................................106

Review Your Profit and Loss Forecast ..................................................................................119

7

Your Cash Flow Forecast and Capital Spending Plan ..............................121

Introduction .......................................................................................................................................122

Prepare Your Capital Spending Plan .....................................................................................123

Prepare Your Cash Flow Forecast ...........................................................................................125

Required Investment for Your Business ..............................................................................135

Check for Trouble ...........................................................................................................................136

8

Write Your Marketing and Personnel Plans .......................................................139

Introduction .......................................................................................................................................140

Marketing Plan .................................................................................................................................140

Personnel Plan ...................................................................................................................................152

9

Editing and Finalizing Your Business Plan ............................................................157

Introduction .......................................................................................................................................158

Decide How to Organize Your Plan ......................................................................................158

Write Final Portions of Your Plan ...........................................................................................159

Create the Appendix .....................................................................................................................165

Create Title Page and Table of Contents ............................................................................166

Complete Your Final Edit ............................................................................................................166

Consider Using a Business Consultant ................................................................................168

10

Selling Your Business Plan .....................................................................................................171

How to Ask for the Money You Need .................................................................................172

How to Approach Different Backers.....................................................................................174

What to Do When Someone Says “Yes” ............................................................................178

Plan in Advance for Legal Details ...........................................................................................179

11

After You Open—Keeping on the Path to Success ....................................183

Introduction .......................................................................................................................................184

Watch Out for Problem Areas .................................................................................................184

Getting Out of Business ...............................................................................................................189

12

Good Resources for Small Businesses .......................................................................193

Introduction .......................................................................................................................................194

Business Consultants .....................................................................................................................194

Books .....................................................................................................................................................196

Pamphlets............................................................................................................................................203

Magazines—Continuing Small Business Help .................................................................203

Computers and Business .............................................................................................................203

Online Business Resources ........................................................................................................206

Formal Education ............................................................................................................................209

Appendixes

A

Business Plan for a Small Service Business ..........................................................211

B

Business Plan for a Manufacturing Business .....................................................227

C

Business Plan for Project Development .................................................................245

D

How to Use the CD-ROM .......................................................................................................255

Installing the Files Onto Your Computer ...........................................................................256

Using the Business Plan Files .....................................................................................................257

Using the Spreadsheets ................................................................................................................258

Forms on the CD-ROM ................................................................................................................260

Index

“Nine to five ain’t takin’ me where I’m

bound.”

—Neil Diamond, from “ank the Lord for the

Nighttime”

“You’ve got to be careful if you don’t

know where you’re going because you

might not get there.”

—Yogi Berra

A

re you concerned about whether

you can put together a first-rate

business plan and loan appli-

cation? Don’t worry.

How to Write a Business Plan contains

detailed forms and step-by-step instruc-

tions designed to help you prepare a well-

thought-out, well-organized plan. Coupled

with your positive energy and will to

succeed, you’ll be able to design a business

plan and loan package that you will be

proud to show to the loan officer at your

bank, the Small Business Administration,

or your Uncle Harry.

After working with hundreds of business

owners, I have observed an almost

universal truth about business planning:

Writing a plan is a journey through the

mind of one person. Even in partnerships

and corporations, usually one person has

the vision and energy to take an idea and

turn it into a business by writing a business

plan. For that reason, I have addressed this

book to the business owner as a single

individual rather than a husband-and-wife

team, group, committee, partnership, or

corporation. And you’ll find that the same

financial and analytical tools necessary to

convince potential lenders and investors

that your business idea is sound can also

help you decide whether your idea is the

right business for you.

What Kind of Plan Do You Need?

You can use How to Write a Business

Plan to write whatever type of plan best

suits your needs:

•Complete business plan. A complete

business plan is especially helpful

for people who are starting a new

business. This form of plan is also

excellent for convincing prospective

Your Legal Companion

2 | HOW TO WRITE A BUSINESS PLAN

backers to support your business.

You’ll be more successful in raising

the money you need if you answer all

of your potential backers’ questions.

A complete plan should include the

following elements: Title Page, Plan

Summary, Table of Contents, Problem

Statement, Business Description,

Business Accomplishments, Marketing

Plan, Sales Revenue Forecast, Profit and

Loss Forecast, Capital Spending Plan,

Cash Flow Forecast, Future Trends,

Risks Facing Your Business, Personnel

Plan, Business Personality, Staffing

Schedule, Job Descriptions, Specific

Business Goals, Personal Financial

Statement, Personal Background,

Appendix, and Supporting Documents.

•Quick plan (one-day plan). If you

know your business, are familiar with

and able to make financial projections,

and have done the necessary research,

you may be able to create a plan in

one day. But understand that a quick

plan is a stripped-down version of

a business plan. It won’t convince

either you or your prospective backers

that your business idea is sound. It is

appropriate only if your business idea

is very simple or someone has already

committed to backing your venture. A

stripped-down quick plan has these

few components: Title Page, Plan

Summary, Table of Contents, Problem

Statement, Business Description,

Business Accomplishments, Sales

Revenue Forecast, Profit and Loss

Forecast, Capital Spending Plan,

Cash Flow Forecast, Appendix, and

Supporting Documents.

QUICK PLAN

e “quick plan” icon appears at the

beginning of each chapter containing quick plan

components and guides you to the sections

you’ll need.

•Customized plan. You can start with a

quick plan and add components from

the complete business plan to suit your

needs. When deciding what to include

and what to exclude, ask yourself:

n Which of my statements are the

strongest?

n Which statements do my backers

want to see?

Note that the appendixes contain blank

forms as well as business plans for a small

service business, a manufacturing business,

and a project development. All the forms

(except for the Loan Interest Calculation

Chart) and business plans are included on

the CD-ROM located at the back of the

book. The forms—for calculating sales

forecasts, personal financial information,

profit and loss forecasts, and cash flow

forecasts—are provided in Microsoft Excel

spreadsheet format and include helpful

formulas for making calculations. The “CD”

icon appears whenever forms or business

plans are reproduced on the CD. (Note:

YOUR LEGAL COMPANION | 3

If a series of #### symbols appear in a

box in a spreadsheet, that means that you

will need to widen the column in order to

display the numbers.)

Meet Antoinette

In an effort to make sense out of the

thousands of types of small businesses,

I have roughly divided them into five

main ones: retail, wholesale, service,

manufacturing, and project development.

All the financial tools I present can be

used by all five. However, for the sake of

simplicity, I follow one particular retail

business—a dress shop. In so doing, I

illustrate most of the planning concepts

and techniques necessary to understand

and raise money for any business.

As you read through the text you’ll

meet Antoinette Gorzak, a friend of mine.

Antoinette wants to open a dress shop,

and she has allowed me to use her plans

and thought processes as an example of

a complete and well-prepared business

plan for a retail store. You’ll find parts of

her plan presented in different chapters as

we discuss the various components of a

complete business plan.

Getting Started

Before you sit down to write your plan,

you’ll want to gather together these

essentials:

•awordprocessor

•acalculatororcomputerspreadsheet

program

•agoodsupplyof8½"by11"paper

•severalpencilsandagooderaser,and

•accesstoaphotocopymachine.

Now, here’s a word about revisions and

changing your plan. I firmly believe in

writing your first thoughts on paper and

letting them rest for a day or two. Then

you can edit, expand, and revise later to

get a more perfect statement. In this book,

I show examples of Antoinette’s writing

process. (I’m grateful she’s such a good

sport.)

Most people discover about halfway

through writing their plan that they want

to change either their assumptions or some

of the plan they’ve already written. My

best advice is this: Complete the plan all

the way through on your original set of

assumptions. That way you can see the

financial impact of your ideas, and it will

be much easier to make the right changes

in the second draft. If you start revising

individual parts of the plan before you

have the complete picture, you’ll waste

a lot of energy. If you’re like me, you’ll

rewrite and edit your plan several times

once you’ve finished the first run through.

4 | HOW TO WRITE A BUSINESS PLAN

And a Few More Words

As I write this, the book has been in print

for over 25 years and has sold more than

150,000copies.Ihaveheardthatithasbeen

pirated in some parts of the former Soviet

Union. Since it first came out I have taught,

lectured, and consulted on business plans in

a wide variety of forums. I have taken that

experience and reformulated the exercises

in the book to make them more effective as

well as easier and quicker to use.

I remain friends with many of the people

I met through the book and occasionally

help them over rough spots in their

planning, which is the most gratifying part

of the experience for me. My business is

helping people write business plans that

find money for their businesses. Call me at

415-816-2982andI’lllistenorhelpifIcan.

You can also email me at mckeever.mp@

gmail.com. Please mention “Nolo Busi-

ness Plan Book” in the subject line of your

email, otherwise I might delete it as a spam

message. Finally, to avoid always using the

pronoun “he” when referring to individuals

in general, and to further avoid clumsy

neologisms like “s/he” and awkward

phraseologies like “he/she” and “he or

she,” I have compromised by the random

use of “he” in some instances and “she”

in others. I hope I have arrived at a fair

balance. Also, keep in mind that wherever

possible, this book uses plain language, not

jargon. As a result, you may find that I have

often substituted simple terminology for

traditional business plan lingo.

●

1

C h A p t e r

Benefits of Writing a

Business Plan

What Is a Business Plan? ........................................................................................................................................... 6

Why Write a Business Plan? ....................................................................................................................................6

Helps You Get Money .....................................................................................................................................6

Helps You Decide to Proceed or Stop .................................................................................................... 6

Lets You Improve Your Business Concept ...........................................................................................7

Improves Your Odds of Success ................................................................................................................ 7

Helps You Keep on Track .............................................................................................................................. 8

Issues Beyond the Plan .............................................................................................................................................. 8

Bookkeeping and Accounting ................................................................................................................... 8

Taxes ......................................................................................................................................................................... 8

Securities Laws .................................................................................................................................................... 9

Your Management Skill ..................................................................................................................................9

Issues Specific to Your Business ................................................................................................................ 9

6 | HOW TO WRITE A BUSINESS PLAN

“Marry in haste, repent at leisure.”

(proverb)

“A stitch in time saves nine.”

(proverb)

What Is a Business Plan?

A business plan is a written statement that

describes and analyzes your business and

gives detailed projections about its future.

A business plan also covers the financial

aspects of starting or expanding your

business—how much money you need and

how you’ll pay it back.

Writing a business plan is a lot of work.

So why take the time to write one? The

best answer is the wisdom gained by

literally millions of business owners just

like you. Almost without exception, each

business owner with a plan is pleased she

has one, and each owner without a plan

wishes he had written one.

Why Write a Business Plan?

Here are some of the specific and

immediate benefits you will derive from

writing your business plan.

Helps You Get Money

Most lenders or investors require a written

business plan before they will consider

your proposal seriously. Even some

landlords require a sound business plan

before they will lease you space. Before

making a commitment to you, they want to

see that you have thought through critical

issues facing you as a business owner and

that you really understand your business.

They also want to make sure your business

has a good chance of succeeding.

Inmyexperience,about35%to40%

of the people currently in business do

not know how money flows through their

business. Writing a business plan with this

book teaches you where money comes

from and where it goes. Is it any wonder

that your backers want to see your plan

before they consider your financial request?

There are as many potential lenders and

investors as there are prospective business

owners. If you have a thoroughly thought-

out business and financial plan that

demonstrates a good likelihood of success

and you are persistent, you will find

the money you need. Of course, it may

take longer than you expect and require

more work than you expect, but you will

ultimately be successful if you believe in

your business.

Helps You Decide to Proceed or Stop

One major theme of the book may surprise

you. It’s as simple as it is important. You,

as the prospective business owner, are the

most important person you must convince

of the soundness of your proposal. There-

fore, much of the work you are asked to do

ChApter 1 | BENEFITS OF WRITING A BUSINESS PLAN | 7

here serves a dual purpose. It is designed

to provide answers to all the questions that

prospective lenders and investors will ask.

But it will also teach you how money flows

through your business, what the strengths

and weaknesses in your business concept

are, and what your realistic chances of

success are.

The detailed planning process described

in this book is not infallible—nothing is

in a small business—but it should help you

uncover and correct flaws in your business

concept. If this analysis demonstrates that

your idea won’t work, you’ll be able to avoid

starting or expanding your business. This is

extremely important. It should go without

saying that a great many businesspeople

owe their ultimate success to an earlier

decision not to start a business with built-in

problems.

Lets You Improve Your

Business

Concept

Writing a plan allows you to see how

changing parts of the plan increases profits

or accomplishes other goals. You can tinker

with individual parts of your business with

no cash outlay. If you’re using a computer

spreadsheet to make financial projections,

you can try out different alternatives even

more quickly. This ability to fine-tune your

plans and business design increases your

chances of success.

For example, let’s say that your idea is to

start a business importing Korean leather

jackets. Everything looks great on the first

pass through your plan. Then you read an

article about the declining exchange ratio

of U.S. dollars to Korean currency. After

doing some homework about exchange

rate fluctuations, you decide to increase

your profit margin on the jackets to cover

anticipated declines in dollar purchasing

power. This change shows you that your

prices are still competitive with other

jackets and that your average profits will

increase. And you are now covered for any

likely decline in exchange rates.

Improves Your Odds of Success

One way of looking at business is that

it’s a gamble. You open or expand a

business and gamble your and the bank’s

or investor’s money. If you’re right, you

make a profit and pay back the loans and

everyone’s happy. But if your estimate is

wrong, you and the bank or investors can

lose money and experience the discomfort

that comes from failure. (Of course, a bank

probably is protected because it has title

to the collateral you put up to get the loan.

See Chapter 4 for a complete discussion.)

Writing a business plan helps beat the

odds. Most new, small businesses don’t

last very long. And, most small businesses

don’t have a business plan. Is that only

a coincidence, or is there a connection

between these two seemingly unconnected

facts? My suggestion is this: Let someone

else prove the connection wrong. Why

not be prudent and improve your odds by

writing a plan?

8 | HOW TO WRITE A BUSINESS PLAN

Helps You Keep on Track

Many business owners spend countless

hours handling emergencies, simply

because they haven’t learned how to plan

ahead. This book helps you anticipate

problems and solve them before they

become disasters.

A written business plan gives you a clear

course toward the future and makes your

decision making easier. Some problems

and opportunities may represent a change

of direction worth following, while others

may be distractions that referring to your

business plan will enable you to avoid. The

black and white of your written business

plan will help you face facts if things don’t

work out as expected. For example, if

you planned to be making a living three

months after start-up, and six months later

you’re going into the hole at the rate of

$100perday,yourbusinessplanshould

help you see that changes are necessary.

It’s all too easy to delude yourself into

keeping a business going that will never

meet its goals if you approach things with

a “just another month or two and I’ll be

there” attitude, rather than comparing your

results to your goals.

Issues Beyond the Plan

I have written this book to provide

you with an overview of the issues that

determine success or failure in a small

business. Experienced lenders, investors,

and entre preneurs want a plan that takes

these issues into account. Of course, this

book can’t cover everything. Here are

some of the key business components that

are left out of this initial planning process.

Bookkeeping and Accounting

This book discusses the numbers and

concepts you as the business owner need

in order to open and manage your small

business. You have the responsibility

to create bookkeeping and accounting

systems and make sure they function

adequately. (Some suggestions for setting

upasystemarecontainedinChapter6.)

One of the items generated by your

accounting system will be a balance

sheet. A balance sheet is a snapshot at a

particular moment in time that lists the

money value of everything you own and

everything you owe to someone else.

Taxes

While there are a few mentions of tax

issues throughout the book, most of the

planning information doesn’t discuss how

taxes will be calculated or paid. The book

focuses its efforts on making a profit and

a positive cash flow. If you make a profit,

you’ll pay taxes and if you don’t make a

profit, you’ll pay fewer taxes. A CPA or tax

advisor can help you with tax strategies.

ChApter 1 | BENEFITS OF WRITING A BUSINESS PLAN | 9

Securities Laws

If you plan to raise money by selling

shares in a corporation or limited

partnership, you’ll fall under state or

federal securities regulations. You can,

however, borrow money or take in a

general partner without being affected by

securities laws. A complete discussion of

these issues is beyond the scope of this

book. For now, take note that you must

comply with securities regulations after you

complete your plan and before you take

any money into your business from selling

shares or partnership interests.

Your Management Skill

This book shows you how to write a very

good business plan and loan application.

However, your ultimate success rests on

your ability to implement your plans—on

your management skills. If you have any

doubts about your management ability,

checkouttheresourcesinChapter12.Also

seeChapter11forathought-stimulating

discussion of management.

Issues Specific to Your Business

How successfully your business relates

to the market, the business environment,

and the competition may be affected by

patents, franchises, foreign competition,

location, and the like. Of necessity, this

book focuses on principles common

to all businesses and does not discuss

the specific items that distinguish your

business from other businesses. For

example, this book doesn’t discuss how

to price your products to meet your

competition; I assume that you have

enough knowledge about your chosen

business to answer that question.

●

2

C h A p t e r

Do You Really Want to

Own a Business?

Introduction .................................................................................................................................................................12

Self-Evaluation Exercises ........................................................................................................................................13

Your Strong and Weak Points ...................................................................................................................14

General and Specific Skills Your Business Needs ............................................................................15

Your Likes and Dislikes..................................................................................................................................15

Specific Business Goals .................................................................................................................................16

How to Use the Self-Evaluation Lists...............................................................................................................17

Reality Check: Banker’s Analysis ........................................................................................................................17

Banker’s Ideal .....................................................................................................................................................17

Measuring Up to the Banker’s Ideal ......................................................................................................18

Use the Banker’s Ideal ...................................................................................................................................18

12 | HOW TO WRITE A BUSINESS PLAN

Introduction

“Hope springs eternal in the human

breast,” said English poet and essayist

Alexander Pope several centuries ago.

He wasn’t describing people expanding

or starting a business, but he may as

well have been. Everyone who goes into

business for themselves hopes to meet

or surpass a set of personal goals. While

your particular configuration is sure to

be unique, perhaps you will agree with

some of the ones I have compiled over the

years from talking to hundreds of budding

entrepreneurs.

Independence. A search for freedom and

independence is the driving force behind

many businesspeople. Wasn’t it Johnny

Paycheck who wrote the song “Take This

Job and Shove It?”

Personal Fulfillment. For many people,

owning a business is a genuinely fulfilling

experience, one that lifetime employees

never know.

Lifestyle Change. Many people find that

while they can make a good income

working for other people, they are missing

some of life’s precious moments. With the

flexibility of small business ownership, you

can take time to stop and smell the roses.

Respect. Successful small business

owners are respected, both by themselves

and their peers.

Money. You can get rich in a small

business, or at least do very well

financially. Most entrepreneurs don’t get

wealthy, but some do. If money is your

motivator, admit it.

Power. When it is your business, you can

have your employees do it your way. There

is a little Ghengis Khan in us all, so don’t

be surprised if power is one of your goals.

If it is, think about how to use this goal in

a constructive way.

Right Livelihood. From natural foods

to solar power to many types of service

businesses, a great many cause-driven

small businesses have done very well by

doing good.

If owning a small business can help

a person accomplish these goals, it’s

small wonder that so many are started.

Unfortunately, while the potential for great

success exists, so do many risks. Running

a small business may require that you

sacrifice some short-term comforts for

long-term benefits. It is hard, demanding

work that requires a wide variety of skills

few people are born with. But even if you

possess (or more likely acquire) the skills

and determination you need to successfully

run a business, your business will need

one more critical ingredient: Money.

You need money to start your business,

money to keep it running, and money to

make it grow. This is not the same thing

as saying you can guarantee success in

your small business if you begin with

a fat wallet. Now, let me confess to one

major bias here. I believe that most

small business owners and founders are

better off starting small and borrowing,

or otherwise raising, as little money as

possible. Put another way, there is no such

thing as “raising plenty of capital to ensure

ChApter 2 | DO YOU REALLY WANT TO OWN A BUSINESS? | 13

success.” Unless you, as the prospective

business founder, learn to get the most

mileage out of every dollar, you may go

broke and will surely spend more than

you need to. But that doesn’t mean that

you should try to save money by selling

cheap merchandise or providing marginal

services. In today’s competitive economy,

your customers want the best you can give

them at the best price. They will remember

the quality of what they get from you long

after they have forgotten how much they

paid.

In practical terms, that means you

must buy only the best goods for your

customers. Anything that affects the image

your business has in your customer’s mind

should be first-rate. It also means that you

shouldn’t spend money on things that don’t

affect the customer. For example, unless

you’re a real estate broker your customers

probably won’t care if you drive an old,

beat-up car to an office in a converted

broom closet, as long as you provide them

an honest product or service for an honest

price. Save the nice car and fancy office,

until after your business is a success.

Self-Evaluation Exercises

Here’s a question to ponder: Are you the

right person for your business? Because

running a business is a very demanding

endeavor that can take most of your time

and energy, your business probably will

suffer if you’re unhappy. Your business can

become an albatross around your neck if

you don’t have the skills and temperament

to run it. Simply put, I’ve learned that

no business, whether or not it has sound

financial backing, is likely to succeed

unless you, as the prospective owner,

make two decisions correctly:

•Youmusthonestlyevaluateyourselfto

decide whether you possess the skills

and personality needed to succeed in a

small business.

•Youmustchoosetherightbusiness.

(How to select the right business is

covered extensively in Chapter 3.)

A small business is a very personal

endeavor. It will honestly reflect your

opinions and attitudes, whether or not you

design it that way. Think of it this way: The

shadow your business casts will be your

shadow. If you are sloppy, rude, or naively

trusting, your business will mirror these

attributes. If your personal characteristics

are more positive than those, your business

will be more positive, too. To put this

concretely, suppose you go out for the

Sunday paper and are met by a store

clerk who is groggy from a hangover and

badmouths his girlfriend in front of you.

Chances are that next Sunday will find you

at a different newsstand.

I’m not saying you need to be psycho-

logically perfect to run a small business.

But to succeed, you must ask people

for their money every day and convince

a substantial number of them to give it

to you. While providing your goods or

services, you will create intimate personal

relationships with a number of people. It

14 | HOW TO WRITE A BUSINESS PLAN

makes no difference whether you refer to

people who give you money as clients,

customers, patients, members, students,

or disciples. It makes a great deal of

difference to your chances of ultimate

success if you understand that these

people are exchanging their money for the

conviction that you are giving them their

money’s worth.

The following self-evaluation exercises

will help you assess whether you have

what it takes to successfully run a small

business. Take out a blank sheet of paper

or open a computer fi le.

Your Strong and Weak Points

Take a few minutes to list your personal

and business strengths and weaknesses.

Include everything you can think of, even

if it doesn’t appear to be related to your

business. For instance, your strong points

may include the mastery of a hobby, your

positive personality traits, and your sexual

charisma, as well as your specifi c business

skills. Take your time and be generous.

To provide you with a little help, I

include a sample list for Antoinette Gorzak,

a personal friend who has what she hopes

is a good business idea: a slightly different

approach to selling women’s clothing.

You’ll get to know her better as we go

along. Her strengths, weaknesses, fantasies,

and fears are surely different from yours.

So, too, almost certainly, is the business

she wants to start. So be sure to make your

own lists—don’t copy Antoinette’s.

Antoinette Gorzak:

My Strong and Weak Points

Strong Points (in no particular order)

1. Knowledge of all aspects of women’s

fashion business

2. Ability to translate abstract objectives

into concrete steps

3. Good cook

4. Faithful friend and kind to animals

5. When I set a goal, I can be relentless in

achieving it

6. Ability to make and keep good

business friends—I have had many

repeat customers at other jobs.

Weak Points

1. Impatience

2. Dislike of repetitive detail

3. Romantic (is this a weak point in

business?)

4. Tendency to postpone working on

problems

5. Tendency to lose patience with fools

(sometimes I carry this too far—

especially when I’m tired).

Your list of strong and weak points

will help you see any obvious confl icts

between your personality and the business

you’re in or want to start. For example,

if you don’t like being around people

but plan to start a life insurance agency

with you as the primary salesperson, you

may have a personality clash with your

business. The solution might be to fi nd

ChApter 2 | DO YOU REALLY WANT TO OWN A BUSINESS? | 15

another part of the insurance business that

doesn’t require as much people contact.

Unfortunately, many people don’t

realize that their personalities will have a

direct bearing on their business success.

An example close to the experience of

folks at Nolo involves bookstores. In the

years since Nolo began publishing, they

have seen all sorts of people, from retired

librarians to unemployed Ph.D.s, open

bookstores. A large percentage of these

stores have failed because the skills needed

to run a successful bookstore involve more

than a love of books.

General and Specifi c Skills

Your Business Needs

Businesses need two kinds of skills to

survive and prosper: Skills for business in

general and skills specifi c to the particular

business. For example, every business

needs someone to keep good fi nancial

records. On the other hand, the tender

touch and manual dexterity needed by

glassblowers are not skills needed by the

average paving contractor.

Next, take a few minutes and list the

skills your business needs. Don’t worry

about making an exhaustively complete

list, just jot down the fi rst things that come

to mind. Make sure you have some general

business skills as well as some of the more

important skills specifi c to your particular

business.

If you don’t have all the skills your

business needs, your backers will want

to know how you will make up for the

defi ciency. For example, let’s say you want

to start a trucking business. You have a

good background in maintenance, truck

repair, and long distance driving, and you

know how to sell and get work. Sounds

good so far—but, let’s say you don’t know

the fi rst thing about bookkeeping or cash

fl ow management and the thought of using

a computer makes you nervous. Because

some trucking businesses work on large

dollar volumes, small profi t margins, and

slow-paying customers, your backers will

expect you to learn cash fl ow management

or hire someone qualifi ed to handle that

part of the business.

Antoinette Gorzak: General and Specifi c

Skills My Business Needs

1. How to motivate employees

2. How to keep decent records

3. How to make customers and

employees think the business is special

4. How to know what the customers

want—today and, more important in

the clothing business, to keep half-a-

step ahead

5. How to sell

6. How to manage inventory

7. How to judge people.

Your Likes and Dislikes

Take a few minutes and make a list of the

things you really like doing and those you

don’t enjoy. Write this list without thinking

16 | HOW TO WRITE A BUSINESS PLAN

about the business—simply concentrate on

what makes you happy or unhappy.

If you enjoy talking to new people,

keeping books, or working with comput-

ers, be sure to include those. Put down all

the activities you can think of that give you

pleasure. Antoinette’s list is shown as an

example.

As a business owner, you will spend

most of your waking hours in the business,

and if it doesn’t make you happy, you

probably won’t be very good at it. If this

list creates doubts about whether you’re

pursuing the right business, I suggest

you let your unconscious mind work on

the problem. Most likely, you’ll know the

answer after one or two good nights’ sleep.

Antoinette Gorzak:

My Likes and Dislikes

ings I Like to Do

1. Be independent and make my own

decisions

2. Keep things orderly. I am almost

compulsive about this

3. Take skiing trips

4. Work with good, intelligent people

5. Cook with Jack

6. Care about my work.

ings I Don’t Like to Do

1. Work for a dimwit boss

2. Feel like I have a dead-end job

3. Make people unhappy.

CAUTION

If your list contains several things you

really don’t like doing and nothing at all that

you like doing, it may be a sign that you have

a negative attitude at this time in your life. If

so, you may wish to think carefully about your

decision to enter or expand a business at this

time. Chances are your negative attitude will

reduce your chances of business success.

Specifi c Business Goals

Finally, list your specifi c business goals.

Exactly what do you want your business

toaccomplishforyou?Freedomfrom9

to 5? Money—and if so, how much? More

time with the children? Making the world

or your little part of it a better place? It’s

your wish list, so be specifi c and enjoy

writing it.

Antoinette Gorzak:

My Specifi c Business Goals

1. Have my own business that gives

me a decent living and fi nancial

independence

2. Work with and sell to my friends

and acquaintances as well as new

customers

3. Introduce clothing presently

unavailable in my city and provide a

real service for working women

4. Be part of the growing network of

successful businesswomen

5. Be respected for my success.

ChApter 2 | DO YOU REALLY WANT TO OWN A BUSINESS? | 17

How to Use the Self-

Evaluation Lists

After you’ve completed the four self-

evaluation lists, spend some time reading

them over. Take a moment to compare the

skills needed in your business to the list of

skills you have. Do you have what it takes?

Show them to your family and, if you’re

brave, to your friends or anyone who

knows you well and can be objective.

Of course, before showing the lists to

anyone, you may choose to delete any

private information that isn’t critical to your

business. If you show your lists to someone

who knows the tough realities of running

a successful small business, so much the

better. You may want to find a former

teacher, a fellow employee, or someone

else whose judgment you respect.

What do they think? Do they point out

any obvious inconsistencies between your

personality or skills and what you want

to accomplish? If so, pay attention. Treat

this exercise seriously and you will know

yourself better. Oh, and don’t destroy your

lists. Assuming you go ahead with your

business and write your business plan, the

lists can serve as background material or

even become part of the final plan.

You have accomplished several things if

you have followed these steps. You have

looked inside and asked yourself some

basic questions about who you are and

what you are realistically qualified to do.

As a result, you should now have a better

idea of whether you are willing to pay the

price required to be successful as a small

businessperson. If you are still eager to

have a business, you have said, “Yes, I

am willing to make short-term sacrifices

to achieve long-term benefits and to do

whatever is necessary—no matter the

inconvenience—to reach my goals.”

Reality Check: Banker’s Analysis

Banks and institutions that lend money

have a lot of knowledge about the success

rate of small businesses. Bankers are often

overly cautious in making loans to small

businesses. For that very reason it makes

sense to study their approach, even though

it may seem discouraging at first glance.

Banker’s Ideal

Bankers look for an ideal loan applicant,

who typically meets these requirements:

•Foranexistingbusiness,acashow

sufficient to make the loan payments.

•Foranewbusiness,anownerwhohas

a track record of profitably owning and

operating the same sort of business.

•Anownerwithasound,well-thought-

out business plan.

•Anownerwithnancialreserves

and personal collateral sufficient to

solve the unexpected problems and

fluctuations that affect all businesses.

Why does such a person need a loan,

you ask? He or she probably doesn’t,

which, of course, is the point. People

who lend money are most comfortable

18 | HOW TO WRITE A BUSINESS PLAN

with people so close to their ideal loan

candidate that they don’t need to borrow.

However, to stay in business themselves,

banks and other lenders must lend out the

money deposited with them. To do this,

they must lend to at least some people

whose creditworthiness is less than perfect.

Measuring Up to the Banker’s Ideal

Who are these ordinary mortals who slip

through bankers’ fine screens of approval?

And more to the point, how can you

qualify as one of them? Your job is to show

how your situation is similar to the banker’s

ideal.

A good bet is the person who has

worked for, or preferably managed, a

successful business in the same field as

the proposed new business. For example,

if you have profitably run a clothing store

for an absentee owner for a year or two,

a lender may believe you are ready to do

it on your own. All you need is a good

location, a sound business plan, and a little

capital. Then, watch out Neiman-Marcus!

Further away from a lender’s ideal is

the person who has sound experience

managing one type of business, but

proposes to start one in a different field.

Let’s say you ran the most profitable hot

dog stand in the Squaw Valley ski resort,

and now you want to market computer

software in the Silicon Valley of California.

In your favor is your experience running a

successful business. On the negative side is

the fact that computer software marketing

has no relationship to hot dog selling. In

this situation, you might be able to get a

loan if you hire people who make up for

your lack of experience. At the very least,

you would need someone with a strong

software marketing background, as well as

a person with experience managing retail

sales and service businesses. Naturally,

both of those people are most desirable

if they have many years of successful

experience in the software marketing

business, preferably in California.

Use the Banker’s Ideal

It’s helpful to use the bankers’ model

in your decision-making process. Use a

skeptical attitude as a counterweight to

your optimism to get a balanced view of

your prospects. What is it that makes you

think you will be one of the minority of

small business owners who will succeed? If

you don’t have some specific answers, you

are in trouble. Most new businesses fail,

and the large majority of survivors do not

genuinely prosper.

Many people start their own business

because they can’t stand working for

others. They don’t have a choice. They

must be either boss or bum. They are

more than willing to trade security for

the chance to call the shots. They meet a

good chunk of their goals when they leave

their paycheck behind. This is fine as far

as it goes, but in my experience, the more

successful small business owners have

other goals as well.

ChApter 2 | DO YOU REALLY WANT TO OWN A BUSINESS? | 19

A small distributor we know has a well-

thought-out business and a sound business

plan for the future. Still, he believes that

his own personal commitment is the most

important thing he has going for him.

He puts it this way: “I break my tail to

live up to the commitments I make to my

customers. If a supplier doesn’t perform for

me, I’ll still do everything I can to keep my

promise to my customer, even if it costs me

money.” This sort of personal commitment

enables this successful business owner to

make short-term adjustments to meet his

long-range goals. And while it would be

an exaggeration to say he pays this price

gladly, he does pay it.

●

3

C h A p t e r

Choosing the Right Business

Introduction .................................................................................................................................................................22

Know Your Business .................................................................................................................................................22

Be Sure You Like Your Business ..........................................................................................................................24

Describe Your Business ...........................................................................................................................................24

Identify Your Type of Business .................................................................................................................25

Problem Statement ........................................................................................................................................27

Business Description ......................................................................................................................................27

Taste, Trends, and Technology: How Will the Future Affect Your Business? ...............................30

Taste ........................................................................................................................................................................31

Trends ....................................................................................................................................................................31

Technology ..........................................................................................................................................................32

Write a Future Trends Statement ...........................................................................................................34

Break-Even Analysis: Will Your Business Make Money? ........................................................................34

Forecast Sales Revenue .................................................................................................................................36

Forecast Fixed Costs ......................................................................................................................................40

Forecast Gross Profit for Each Sales Dollar ........................................................................................41

Forecast Your Break-Even Sales Revenue ............................................................................................43

What You Have Accomplished ..........................................................................................................................47

22 | HOW TO WRITE A BUSINESS PLAN

QUICK PLAN

If you’ve chosen the quick plan

method to prepare a business plan (see Intro-

duction), you need to read and complete only

these sections of Chapter 3:

• “ProblemStatement”

• “Business

Description”

• “Forecast

SalesRevenue.”

Introduction

This chapter helps you determine whether

you have chosen the “right” business for

you—one that you know, like, and will

work hard for and that makes economic

sense. Most experienced businesspeople

complete several steps as a rough and

ready template to decide whether to

complete a plan. If your business passes all

these steps with flying colors, it means it’s

a good idea to write a full business plan

(although it doesn’t guarantee success).

On the other hand, if your proposal doesn’t

pass, you’ll probably want to modify or

change your plans altogether.

If you’re like most people, chances are

your business will pass some tests easily

and fail some of the others. Antoinette

faces just that problem in this chapter. Pay

careful attention to how she approaches

that dilemma; her method of proceeding

may help you in your decision.

Know Your Business

One of the most common questions people

ask me is this: What business should I start?

My answer is always the same—start a

venture that you know intimately already.

I don’t believe any business exists that is

so foolproof that anyone can enter and

make a sure profit. On the other hand, a

skilled, dedicated owner often can make

a venture successful when others have

failed.

Remember, your potential customers

will exchange their money only for the

conviction that you are giving them their

money’s worth. And that means you’ll need

to know what you’re doing. While this

point should appear obvious, sadly—it isn’t.

Many people enter businesses they

know little or nothing about. I did it once

myself. I opened an automobile tune-up

shop at a time when, seemingly, they

couldn’t miss. I knew a good deal about

running a small business, had a personality

well suited for it, and could borrow enough

money to begin. The end of what turned

out to be a very sad story is that it took

metwoyearsand$30,000togetridofthe

business. Why? Because in my hurry to

make a profit, I overlooked several crucial

facts. The most important of these was that

I knew virtually nothing about cars and I

didn’t really want to learn. Not only was I

unable to roll up my sleeves and pitch in

when it was needed, I didn’t even know

enough to properly hire and supervise

mechanics. In short, I made a classic

mistake—I started a business in a “hot”

field because someone was foolish enough

to lend me the money.

How can you apply my lesson to your

situation? Let’s say you’ve heard pasta

ChApter 3 | CHOOSING THE RIGHT BUSINESS | 23

shops make lots of money and you want

to start one. First, if at all possible, get a

job working in one, even if you work for

free. Learn everything you can about every

aspect of the business. After a few months,

you should be an expert in every aspect

of pasta making, from mixing eggs and

flour, flattening the dough, and slicing it

into strips. Ask yourself whether you enjoy

the work and whether you are good at it.

If you answer “Yes,” go on to the second

important question: Is the business a

potential money maker? You should have

a pretty good answer to this question after

working in the field for a few months.

If you’re unable to find employment

in the pasta business, make a tour of

delicatessens and shops that make their

own pasta. Interview the owners. To get

reliable answers, it’s best to do this in a

different locale from the one in which

you plan to locate. Small business owners

are often quite willing to share their

knowledge once they are sure you will not

compete with them.

I remember reading a management

philosophy that said that a good manager

doesn’t have to know every job, only

how to get other people to do them.

That approach may work well in a large

corporation, but for a small business, it’s

dangerously naive. In short, don’t start your

small venture until you know it from the

ground up. I mean this literally. If you’re

opening a print shop, you should be able

to run the presses and do paste-up and

layout, as well as keep a coherent set of

books. If it’s your elegant little restaurant

and the food isn’t perfect, you’re the one

who either improves it in a hurry or goes

broke. If you don’t like getting your hands

dirty, choose a clean business.

Are You Choosing a Risky Business?

When considering the businesses you know,

it is helpful to know how well they typically

fare. For instance, these businesses have

higher than average failure rates:

• computerstores

• laundriesanddrycleaners

• orists

• usedcardealerships

• gasstations

• localtruckingrms

• restaurants

• infantclothingstores

• bakeries

• machineshops

• carwashes

• e-commerce

• groceryandmeatstores.

If your business idea is on this list, it

doesn’t mean you should abandon it

automatically. However, it should remind

you to be extra critical and careful when

preparing your plan. I’ve known successful

businesspeople in every category listed, just

as I have known people who have failed in

each of them.

24 | HOW TO WRITE A BUSINESS PLAN

Be Sure You Like Your Business

Does the business you want to own

require skills and talents you already

possess? If you have the necessary skills,

do you enjoy exercising them? Think about

this for a good long time. The average

small busi ness owner spends more time

with his venture than with his family. This

being so, it makes sense to be at least as

careful about choosing your endeavor

as you are about picking your mate. A

few of us are sufficiently blessed that we

can meet someone on a blind date, settle

down a week later, and have it work out

wonderfully. However, in relationships,

as in business, most of us make better

decisions if we approach them with a little

more care.

Be sure you aren’t so blinded by one

part of a small business that you overlook

all others. For example, suppose you love

music and making musical instruments.

Running your own guitar shop sounds like

it would be great fun. Maybe it would be,

but if you see yourself contentedly making

guitars all day in a cozy little workroom,

you’d better think again. Who is going to

meet customers, keep the books, answer

the phone, and let potential customers

know you are in business? If you hate all

these activities, you either have to work

with someone who can handle them, or do

something else.

Here’s one last thing to think about when

considering how much you like your busi-

ness idea. In fact, it’s a danger that threatens

almost every potential entre preneur. Precisely

because your business idea is yours, you

have an emotional attachment to it. You

should. Your belief in your idea will help

you wade through all the unavoidable muck

and mire that lies between a good idea

and a profitable business. However, your

ego involve ment can also entail a loss of

perspec tive. I’ve seen people start hopeless

endeavors and lose small fortunes because

they were so enamored with their “brilliant

ideas” that they never examined honestly the

negative factors that doomed their ventures

from the start.

Describe Your Business

What is your good idea? What business

do you want to be in? It’s time to look at

the specifics. Let’s say you want to open

a restaurant. What will you serve? What

will your sample menu look like? What

equipment will you need? Note that

including french fries means you’ll have

to install french-fryers, grease traps in the

sewer line, hoods and fire extinguishing

systems. On the other hand, by not serving

fried foods you will save a lot of money

in the kitchen, but maybe you’ll go broke

when all the grease addicts go next door.

Or suppose you want to sell DVDs,

games, or digital cameras. Do you plan to

have a service department? If so, will you

make house calls, or only accept repairs

at your store? What sort of security system

will you install to protect your inventory?

What about selling component sound

systems or home entertainment centers?

ChApter 3 | CHOOSING THE RIGHT BUSINESS | 25

What about competition from nearby

retailers?

Answers to these types of questions will

be crucial to the success of your venture

and to writing your business plan. Let me

tell you from hard, personal experience

that you need a written document—even

if you’re sure you know exactly what your

business will do.

With this foundation document to refer

to, you are less likely to forget your good