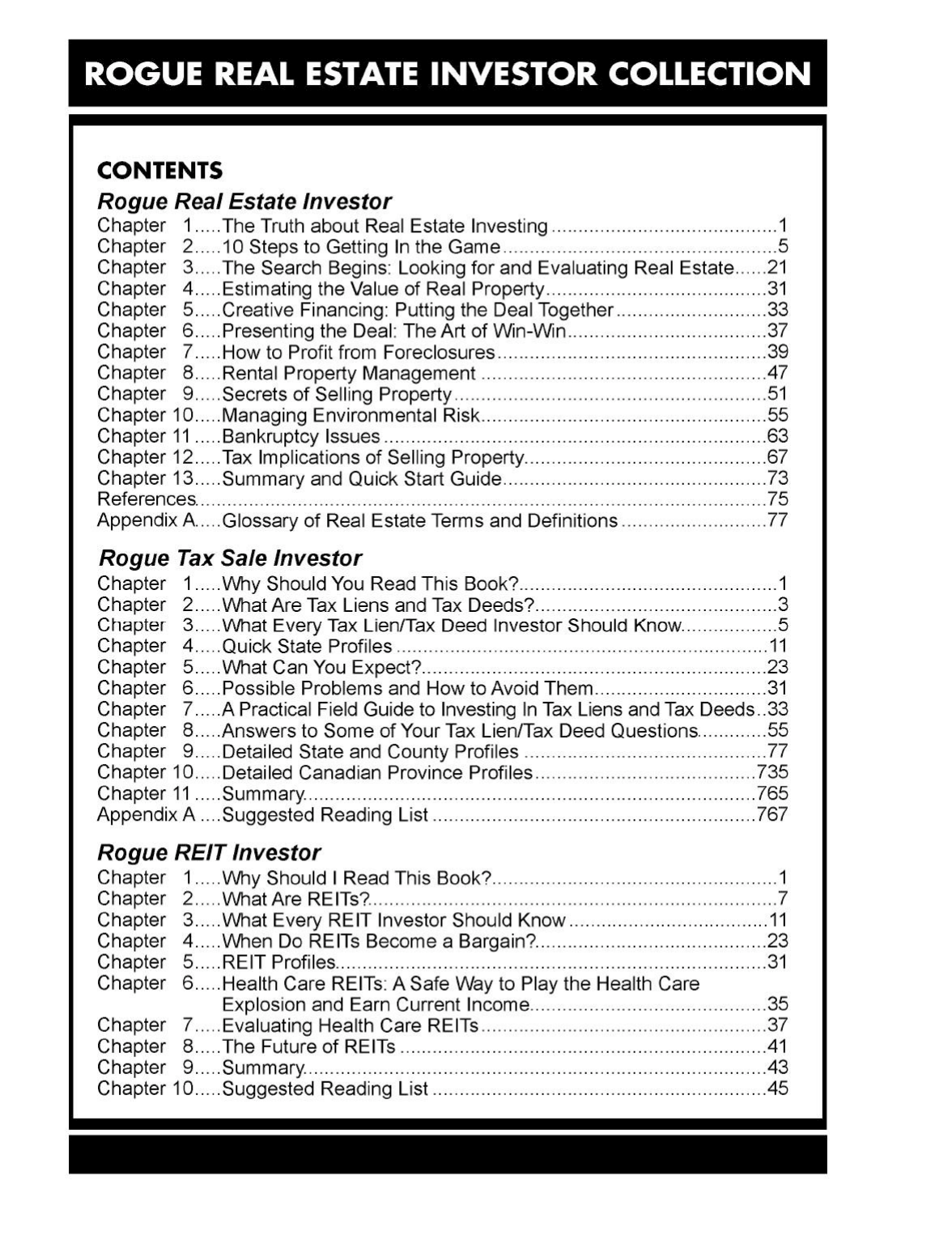

Rogue Real Estate Investor Collection

Rogue Real Estate Investor

-

1

-

ONE

The Truth about Real Estate Investing

“Some people handle the truth carelessly;

others never touch it at all.”

–

a

nonymous

So, you are thinking of investing in real estate or you own a house and would like to buy some

rental property.

Doe

sthe

phrase

"caveat emptor" sound familiar?

Let the buyer beware!

Real

estate investing, including owning your own hom e, is a great way to enjoy a piece of the

American Dream, but it comes with a price.

Rarely have I seen a realistic portrayal of both t

he good and the bad sides of real estate

investing.

Many late night infomercials and countless books would have you believe that "no

money down" and creative financing techniques can take you fr om rags to riches with little more

than the classified adverti

sements, a phone and a quick appointment to consummate the deal.

On the other hand, friends, family and even the Wall Street gurus will tell you t hat real estate

investing is just not a good idea. It’s not a liquid investment.

The tax advantages were tak

en

away in 1986.

Renters are all low

-

life, societal rejects who are intent on destroying your property

and living in your rental house for free.

As is usually the case, the truth lies somewhere in between.

Few people will argue that owning

your own home

is a bad idea.

After all, it is a forced method of investing in a financial instrument

that you can see and feel, and the taxes and insurance are even deductible.

What about all the other ways to invest in real estate?

Contrary to what most people t hi

nk, there are many different ways to invest in real estate:

x

If you are a passive investor who desires a low

-

risk investment with almost no hassles

that consistently returns about 15 percent per year, Real Estate Investment Trusts

(REITs) might be your t ic

ket.

x

If you do not

mind doing a little research, making some phone calls and possibl y going to

an auction, t hen tax lien certificates might interest you.

x

If you are ready to get your hands dirty, but loathe the prospect of dealing with renters,

then yo

umightlikebuyingundervaluedrealestate

that you c an fix

up for a tidy profit.

x

Finally, if you have enough courage to deal with renters, consider letting someone else

pay down a m ortgage and leave you with a handsome nest egg.

As you can see, I’ve on

ly presented a few options for investing in real estate. I t is m y opinion

that real estate should be an important part of an investor’s portfolio.

Why?

First, land i s a

Rogue Real Estate Investor

-

2

-

precious commodity that is m ore or less finite during our lifetime.

The population of t

he world is

growing and we will need more land t o support the voracious demands of the human species.

Second, natural resources such as lumber and building supplies are dwindling.

With fewer

supplies, prices are rising and existing homes are becoming more

valuable.

Finally, real estate

is one of the few investments

where

you can use a little of your money and a lot of someone

else’s money (i.e., a mortgage company) to control a large investment.

Now, let’s get back to the truth about real estate investing

.

As a real estate investor, I have read

many books on the subject.

Ihaveattendedseminarsandclasses,andIhavepurchasedmore

than one of the infomercial programs.

There is a lot of good inf

ormation to be learned from

these

material

s

;however,mostr

eal estate courses come at a hefty price. In the end, nothing

works better than learning it on your own.

What are the benefits of real estate investing?

First, you make money through net cash flow, principal or equity, appreciation, and tax

advantages.

If you choose to be a landlord, your net cash flow is the difference between what

you charge for rent and the monthly mortgage payment, including principal, interest, taxes and

insurance. Unless you

purchase

the property at well below market value, it is

agoodruleof

thumb to make at least $100 p er month to offset the occasional repairs, fix

-

up costs, and move

-

in/move

-

out costs.

Equity is the amount of the original purchase price that you are actually paying off each month.

The shorter the mortgage ter

mandthelowertheinterestrate,themoreequityyouwill

accumulate.

Appreciation is by far the best part of real estate investing. Time is your f riend. By investing in

"bread and butter" houses (a t erm I picked up from R obert Allen [1990]) in good loc

ations, the

value of your house will rise each year. The better the location is, given a good economy, the

higher the appreciation. In my area of Johnson County, Kansas (a suburb of Kansas C ity,

Missouri), houses have appreciated

an average of

7percentpe

ryearfor

many

years. Although

that may not sound spectacular to those of you in markets such as Los Angeles, Phoenix, Las

Vegas or Miami, it has been very consistent with

minimal

downturns.

As of 2008, the

se same

markets that many investors thought could

never go down are experiencing severe corrections.

Finally, tax advantages include the following deductible items: depreciation of the property and

other equipment, taxes and insurance, repairs and supplies, mileage, and office supplies used

for the pro

perty.

That sounds pretty good so far. Are there any disadvantages?

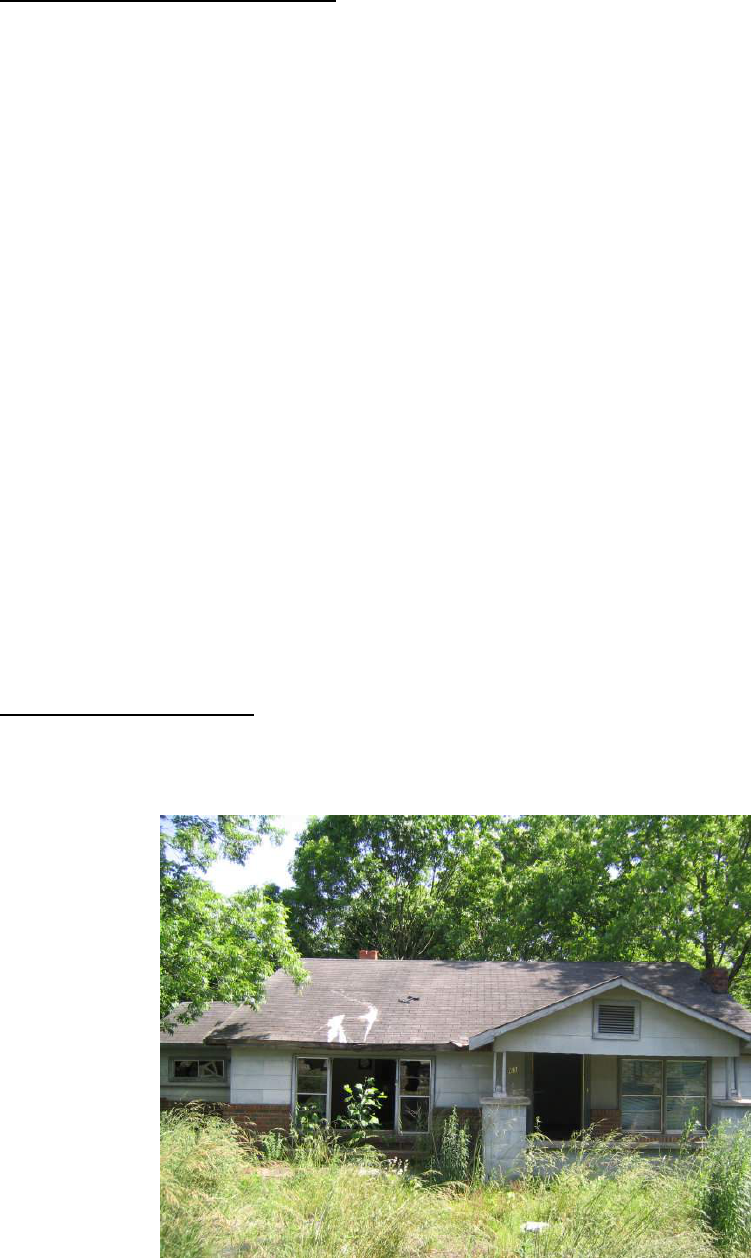

You bet! First, if you buy a house using creative financing or if you buy a repossessed home,

you are in for some fun times. Get ready for cleaning, painting, replacing carpeting, remov

ing

trash, mowing, raking, repairing plumbing, in stalling fixtures, replacing furnaces or air

conditioners, and whatever else is needed to get the property sold or rented.

IrecallaVeteran’sAdministration(VA)repossessedhomethatmywifeandIbough

tinJanuary

1996. While f ixing it up, we heard several loud creaking sounds that eventually were followed by

water spewing from broken copper pipes. Had we not been working when the water pipes

thawed, the house would have been flooded. Luckily, the VA pa

id the plumbing bill because the

pipes were apparently f rozen when we bought the house.

Rogue Real Estate Investor

-

3

-

Next, advertising f or and securing a decent renter can be expensive and time consuming. The

screening process for renters is often an arduous process of phone calls, s

creening, and

crossing your fingers. If you are not nervous about renting your property, I suggest watching the

movie

Pacific Heights

.Regardlessofwhatyourleasesays,rentershaveinherentrightsand,in

the unfortunate event of eviction, you often los

e.

Repairs are the Achilles heel of the rental game. After purchasing m y first rental property, a

continuously clogged sewer line led to installing a new line. Thank you very much

–

there went

all of m y annual net cash flow (approximately $1,200) in one f

ell swoop.

Finally, if you think t hat selling a property is as easy as a classified advertisement and a sign in

the yard, you are wrong. O nce a property has been labeled a rental house, its inherent value is

slightly low

er than owner

-

occupied houses. And

e

ven in a good market most buyers use a real

estate agent. Why not? It’s free after all.

The seller has to pay the realtor fees, right?

In

actuality, the fees come from the real estate transaction and it may appear to be free, but really

both the buyer and

seller are paying the fees.

If I haven’t scared you away, then let’s get starte

dwiththe

“

10 Steps to Getting

i

n

the Game.

”

Rogue Real Estate Investor

-

5

-

TWO

10 Steps to Getting i

n the Game

“If you fail to plan, you plan to fail.”

–

old saying

Step 1: Goals

What a

re goals? Goals are plans that we intend to achieve. Goals m ay change t hroughout our

lives as our values change. Although you may not r ealize it, everyone has goals. F or mos t

people, goals are unwritten. Your daily goals may be to wake up on time, m ake it

through work,

and spend time with your f amily or f riends.

Short

-

term goals for a real estate investor may include calling at least five property owners per

week or making at least one offer on a property this month. Long

-

range goals may be to own

and op

erate 10 rental properties, invest in one REIT mutual fund

,

or attend one foreclosure or

tax lien auction. You may aspire to

long

-

term goals

such as owning a company, writing a book,

or traveling around the world. These goals may seem unattainable, but

you

can begin

by

achieving small

er

goals.

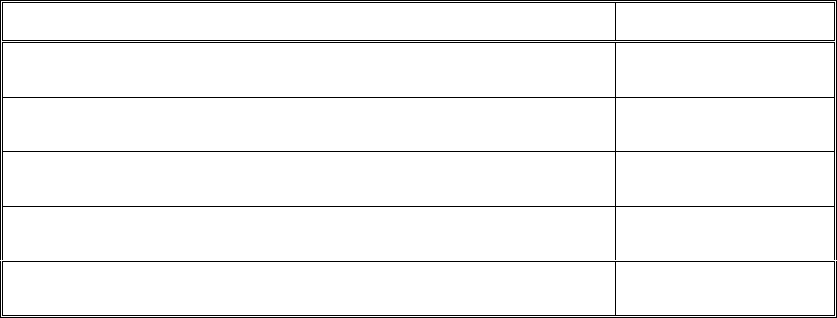

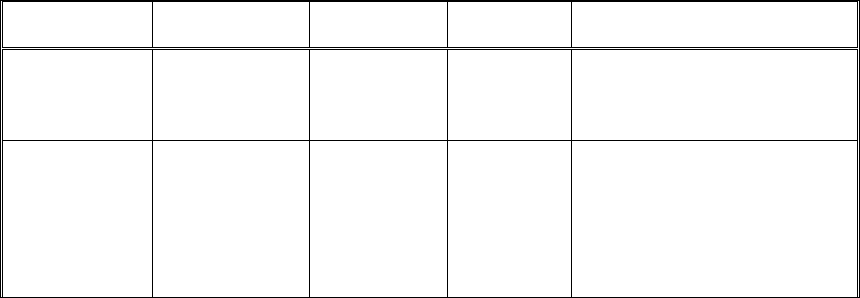

Stop for a few minutes and think about your

long

-

range

goals. Now write them down in the

space provided below. Make sure that your goals are specific and measurable. Notice that a

column is provided for a date by whi

ch you wish to achieve the goal.

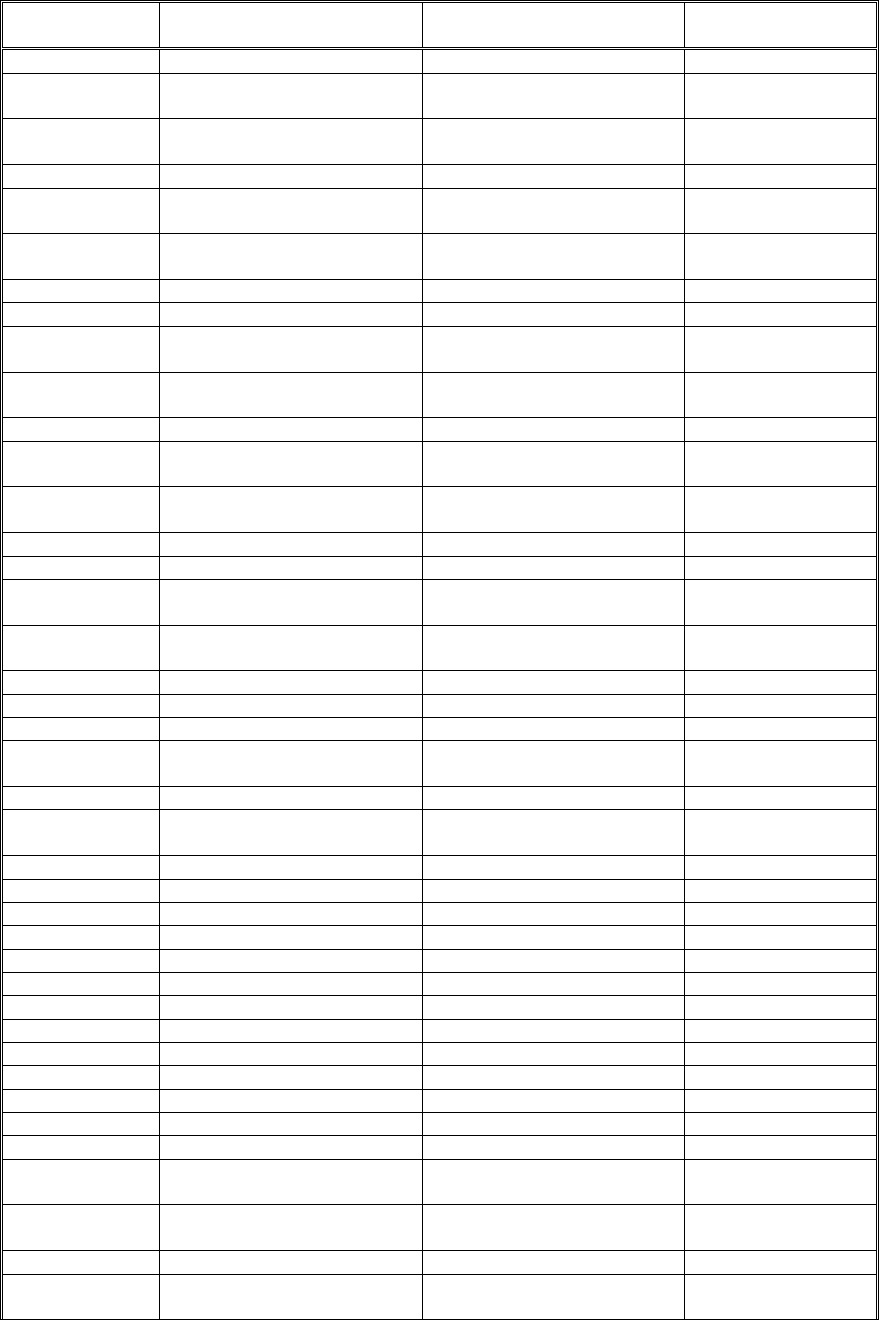

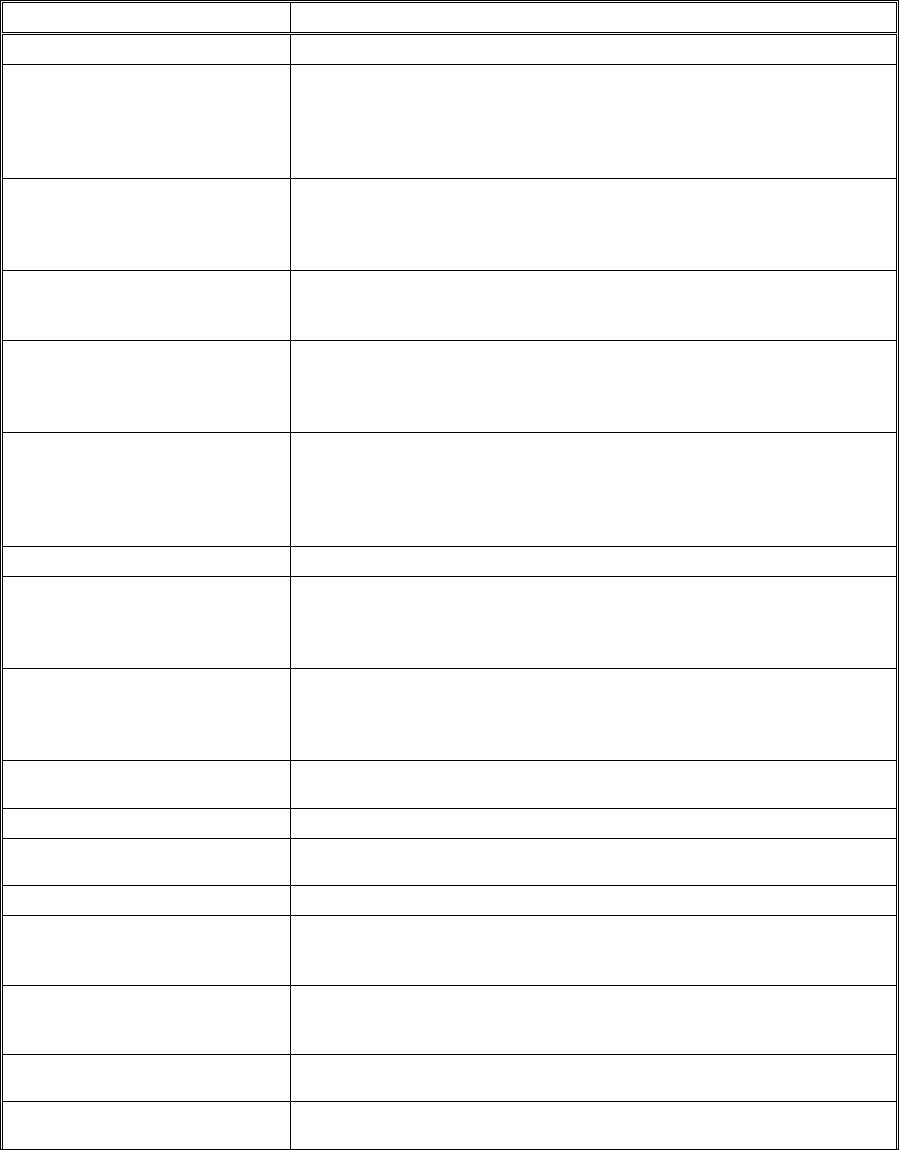

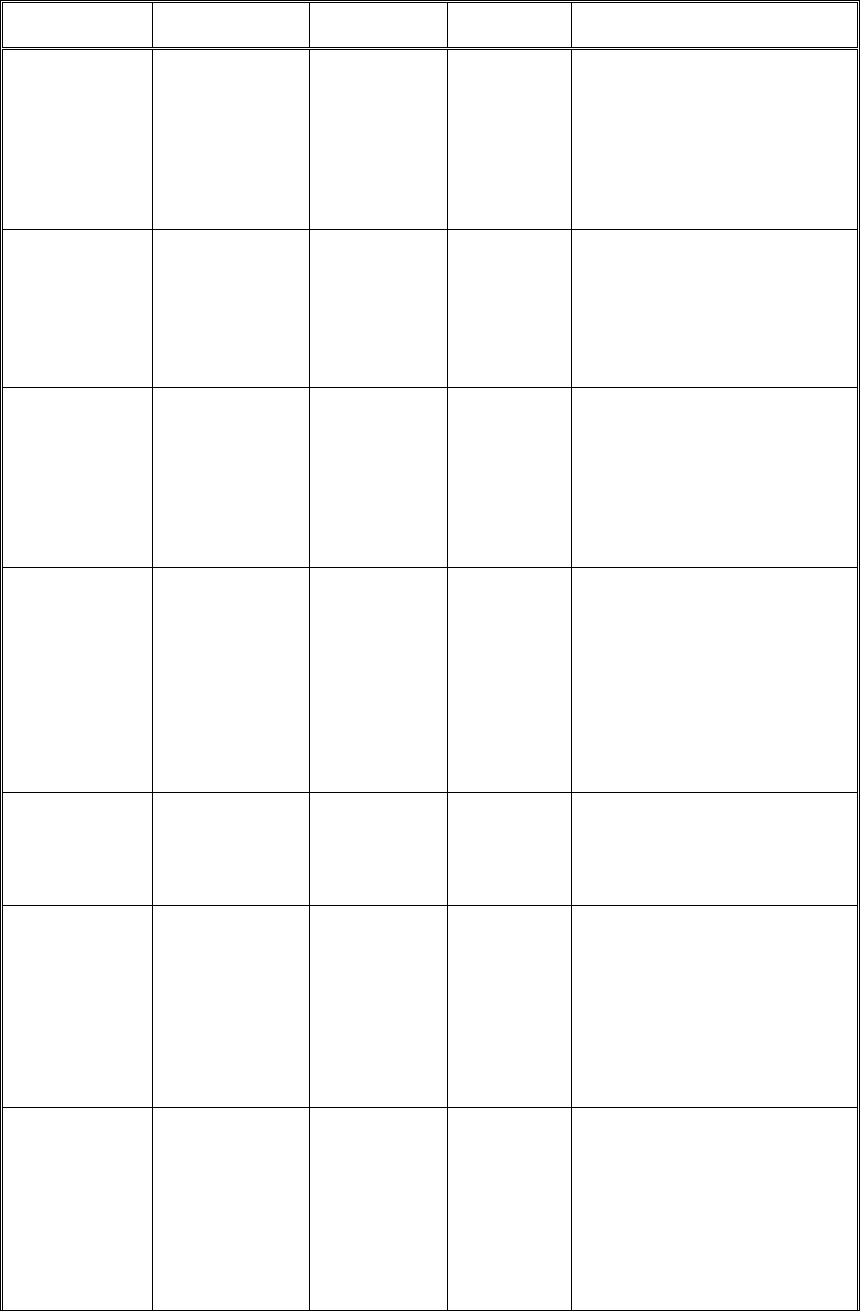

Goal

Date to Complete

Now consider your short

-

term goals. Are they in alignment with your long

-

term goals? Each

short

-

term goal should be a brick

used to build a

long

-

term goal.

Rogue Real Estate Investor

-

6

-

The most famous e

xample of a study done on goals was completed on the 1954 graduating

class at Yale. The study concluded that the 3 percent of the students who had written goals

earned m ore money than the other 97 percent combined, who either lacked goals or had not

formal

ized them (Zig Ziglar, 1995).

Comedy genius Jim Carrey ha

donehugegoal:

to become an actor. He was so convinced

he

would achieve

this that he wrote his goal as a check to himself in the amount of 1 million dollars.

As it turned out, he received his fi

rst m ovie role for that amount just before t he date on his

check. Now that's a goal you can "take to the bank."

Ihavereadmanybooksthatstresstheimportanceofformalizedgoals;however,veryfewever

get to the heart of the purpose of goals. Stephen

Covey's book

The 7 Habits of Highly Effective

People

(1990) has a great discussion on creating a personal mission statement. Many

businesses, in fact, have mission statements. A personal m ission statement simply describes

your purpose. Let me share with y

ou part o

fmypersonalmissionstatement:

My mission is to live a complete and satisfying life, loving others

and loving myself, inspiring others and challenging myself, giving

to

others and satisfying myself.

My hope is that in some small way

my presence

makes a positive difference in the w orld.

Ihavealsoidentifiedpersonalmissionstatementsforvariousaspectsofmylife,suchasbeing

afather,husband,friend,professional,etc.Mygoalsshouldalwaysbeinalignmentwithmy

personal mission state

ment.

Step

2: Get Your Personal Finances

in

Order

If you are thinking about any form of hands

-

on real estate investing, such as buying a home to

fix up or purchasing a rental property, you will quickly find out that you must get your personal

finances i

norder.

Check your credit history

Bank

s

and mortgage companies will check your credit history. Wouldn’t it be nice to know

yourself what’s going on? Even if you have excellent credit, the credit bureaus

often

will have

mistakes on your credit profile.

According to the Fair Credit Reporting Act, you may be entitled to receive a free copy of your

personal credit report if you have been

denied

credit, employment or housing in the last 60

days, or if adverse action has been taken against you in the last

60 days. Some state laws

require free reports or even a reduced fee for consumers in their states.

You are also entitled to receive a free annual credit file from each of the national credit reporting

companies. For more information, call (877) FACTACT o

rvisit

http://www.annualcreditreport.com

.

There are three major credit bureaus to check:

1.

Experian (formerly TRW)

–

http://www.experian.com

.Foronly$

15.00

you

can check

your credit profile

and credit score

online, print it or save it to your computer.

It is quite

interesting to see what you’ve b een up to and what the credit bureaus see. You may be

able to receive a free copy, so check that first by calling this

number:

(866) 200

-

6020

.

Rogue Real Estate Investor

-

7

-

Otherwi se, contact Experian by phone at

(888

)

397

-

3742

or by postal mail at

475 Anton

Boulevard, Costa Mesa, CA 92626 or 955 American Lane, Shaumberg, IL 60173

.

2.

Equifax

–

http://www.equifa

x.com

.

You can order your personal credit profile

plus your

FICO (Fair Isaac Corporation) credit score

online for a $

1

5

.95

service fee

.

To use

Equifax’s self

-

service line, contact them by phone at (800) 685

-

1111. A request by postal

mail can be sent to Eq

uifax

Credit

Information Services,

Inc.

,P.O.

Box 740241, Atlanta,

Georgia 30374.

3.

TransU

nion

–

http://www.transunion.com

.Likeitscompetition,youcanorderafullcredit

report

,includingcreditscoreandde

bt analysis

.TorequestacopyofyourTransUnion

credit rep

ort by phone, call

(800)

888

-

4213. You may also order your credit report b

y

mailing your request t o TransU

nion, P.O. Box 2000, Chester, Pennsylvania 19022.

Note:

You can also purchase a

three

-

in

-

one

credit report

that contains reports from a

ll three

c

redit

b

ureaus for approximately $30

to $40. All three credit bureaus now offer mo nthly credit

monitoring as well.

Now, what happens if you find a mistake? Contact the credit bureau by certified lette

rand

explain what the discrepancy is. Be sure to attach a copy of the disputed report. The credit

bureau will then respond within approximately 30 days

.If

the item is a mistake, then the bureau

must remove it from your report.

For legitimate problems

that remain on your credit report, prepare a typewritten response that

you can provide when applying for a loan. For example, if you missed a few payments because

of a death, divorce, bad business loan, etc., be honest and explain what happened and why it’

s

not a problem now.

For more advanced m ethods of achieving superior credit or helping others with credit education,

visit

http://www.rogueinvestorcrediteducation.com

.

Set up a personal fili

ng system

Iknowthissoundsalittleobsessive,butyouwon’tbelievehowmuch

the following

has helped

me

to

maintain my personal finances over the last 1

2

years.

Purchase several

folders and label

each according to major categories of expenses or other

important information. Place the

folders in a file box or cabinet. You will need a separate f older for each account, such as bank

accounts, utilities, mortgages, credit cards, tax information, automobile expenses, loans,

warranties, investments, etc. Star

tfresheachyearsoyouwillhaveyourpersonalfinancial

details by year and category.

Instead of looking in a drawer or box, I

can look up my utilities in 2000

if I need to. I can check

my Visa account for 1998 if someone has a question. Of course, mos

timportantlyyouwillneed

access to your tax information.

With affordable business and accounting software available, now may be the time to automate.

Calculate your net worth

N

ext

,

figure out how m uch money you have and how much you are in debt. A fa

ncy term for this

is called “net worth.” G ather your c redit rep orts and your latest statements from banks, creditors

and others. The simplest way to think about it is to divide your life into what you

own

and what

you owe:

Rogue Real Estate Investor

-

8

-

What You Own (Assets) =

Persona

lProperty+CashandSavings+RealEstate

What You Owe (Debt

or Liabilities

)=

Loans + Credit Card Debt + Real Estate Mortgages

Net Worth =

What You Own

–

What You Owe

What you own includes personal property such as available cash on hand, pennies

in jars,

furniture, jewelry, appliances, electronics, kitchenware, tools, lawnmowers, clothes, blankets,

toys, etc. Think about what you have in terms of replacement. In other words, if a fire or natural

disaster wiped out your home, what would you lose? Y

ou may be surprised. To be fair, you

should really use a fair market value or discounted value of what your personal property is

worth.

If you have any vehicles, find their “blue book” value. You can visit your public library and ask to

see the

Kelley B

lue Book

,oryoucancheckonlineby

visiting

http://www.kbb.com

.

Next

,

look at any and all savings accounts, checking accounts, mutual funds, stocks, bonds and

other saving instruments. Find your latest statement and

record how much you have saved.

Finally, if you o wn a house, rental properties, time

-

shares or any interest in real estate,

determine a fair market value using one of the methods shown in Chapter 4. If you only own a

percentage, be sure to account for tha

t. For married couples, you will usually include both

spouses’ property and calculate one net worth.

Of course, the sobering truth comes when you calculate what you owe. First, go through all of

your personal property, including vehicles, and write down

all of your loan balances. Now take

all of your credit card debt and other credit lines or loans and jot down all of your latest

balances. Finally, find out the payoff balance on your house

and/

or any other real estate.

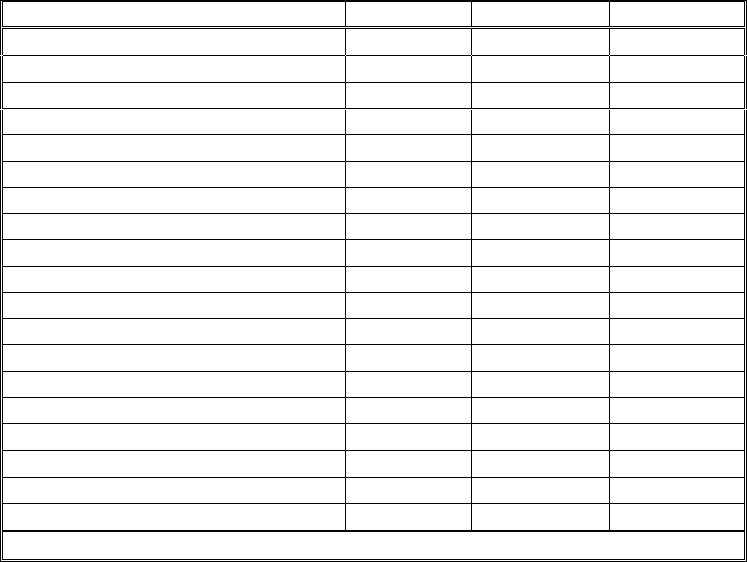

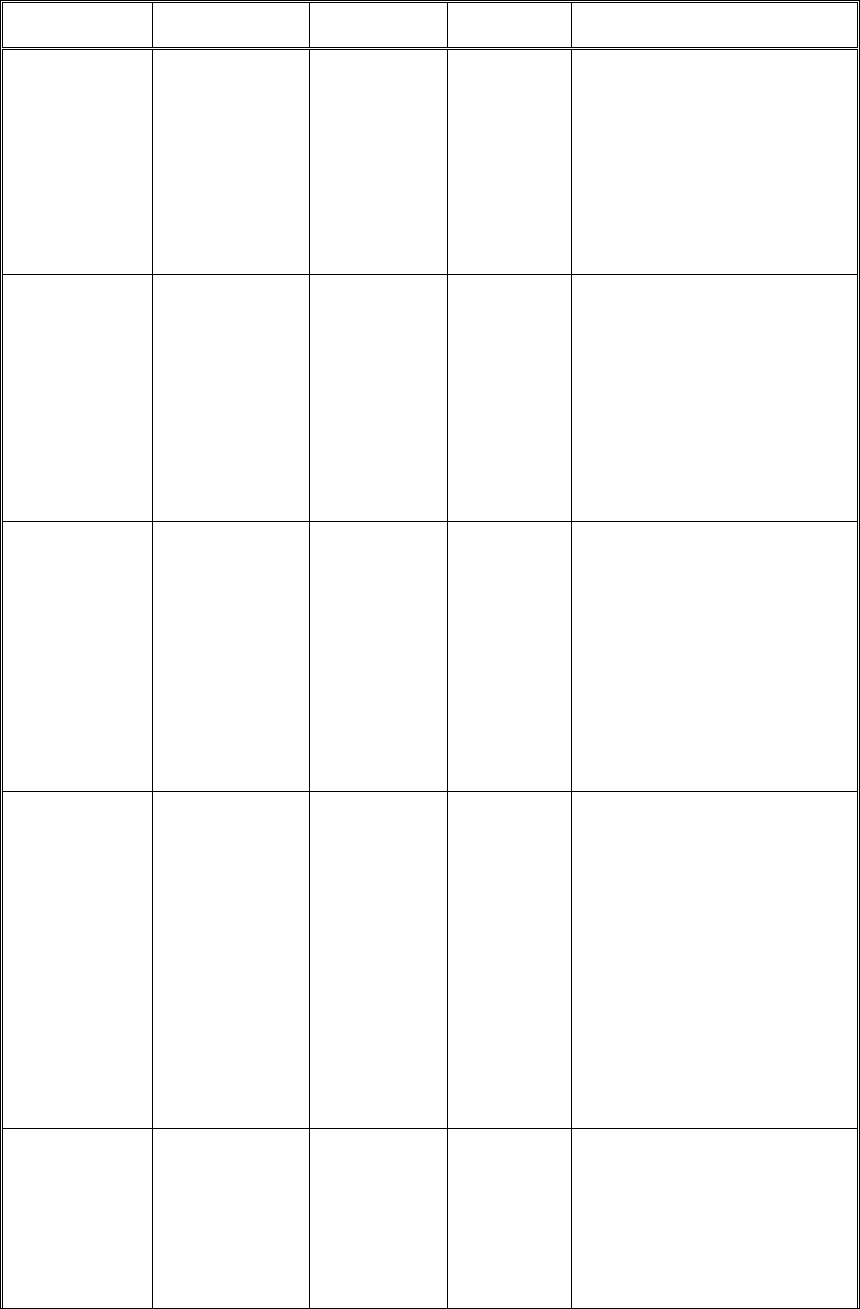

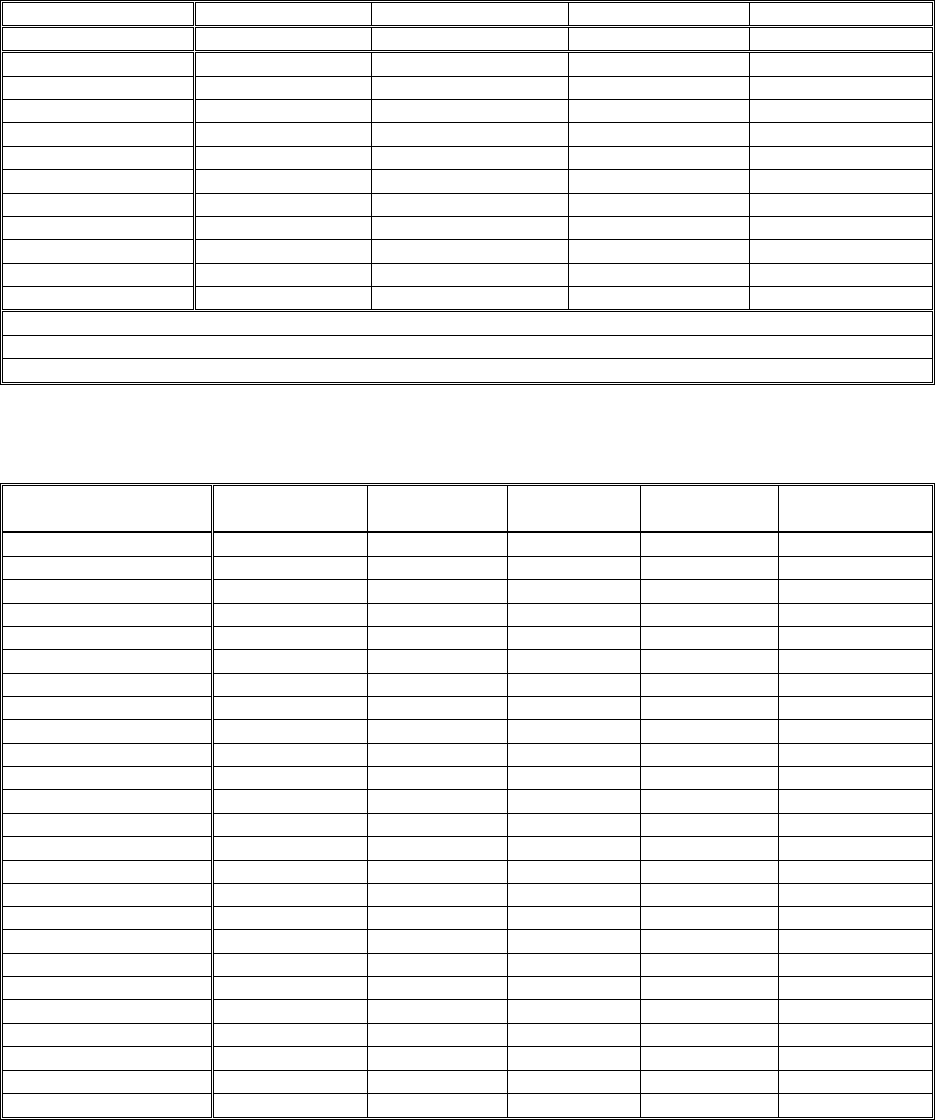

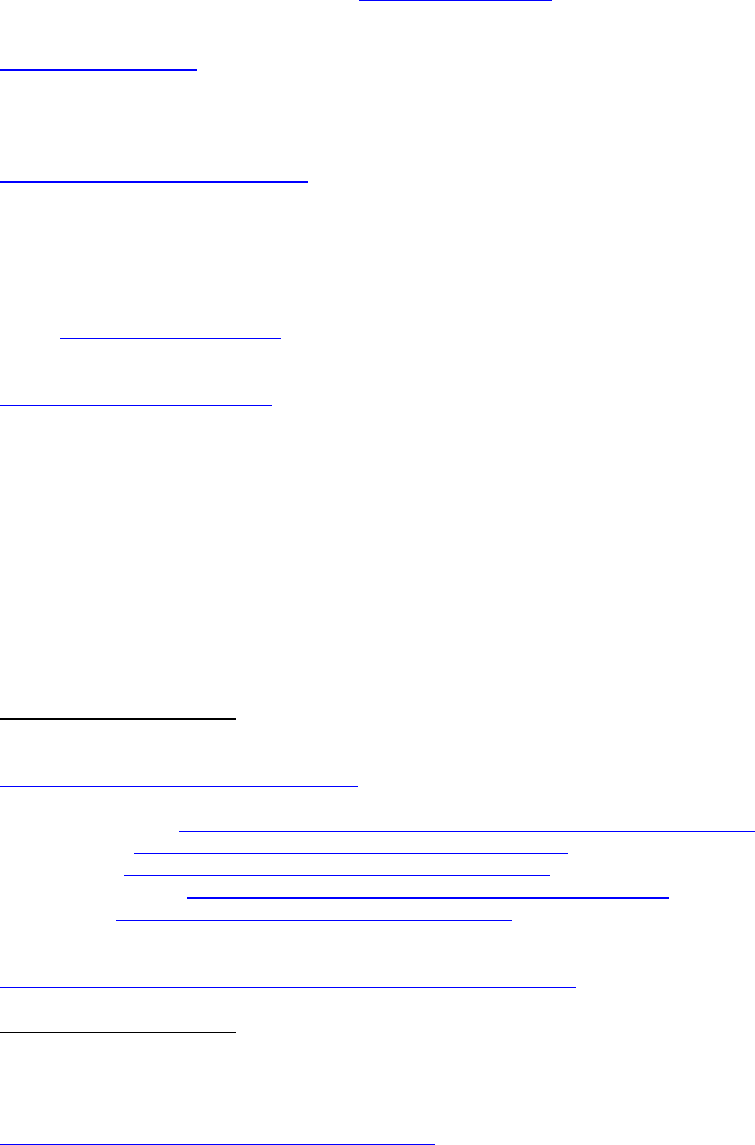

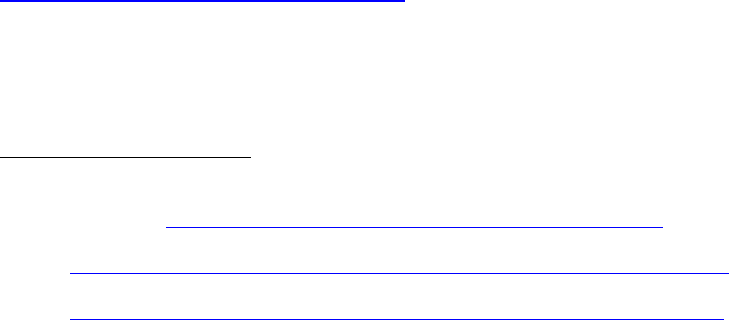

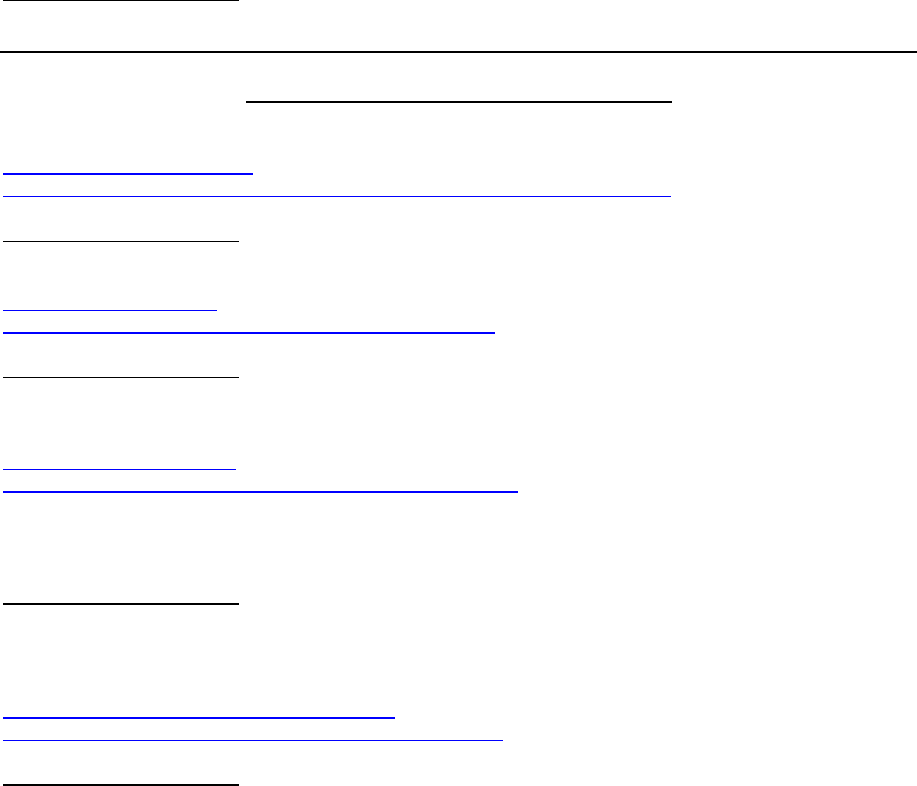

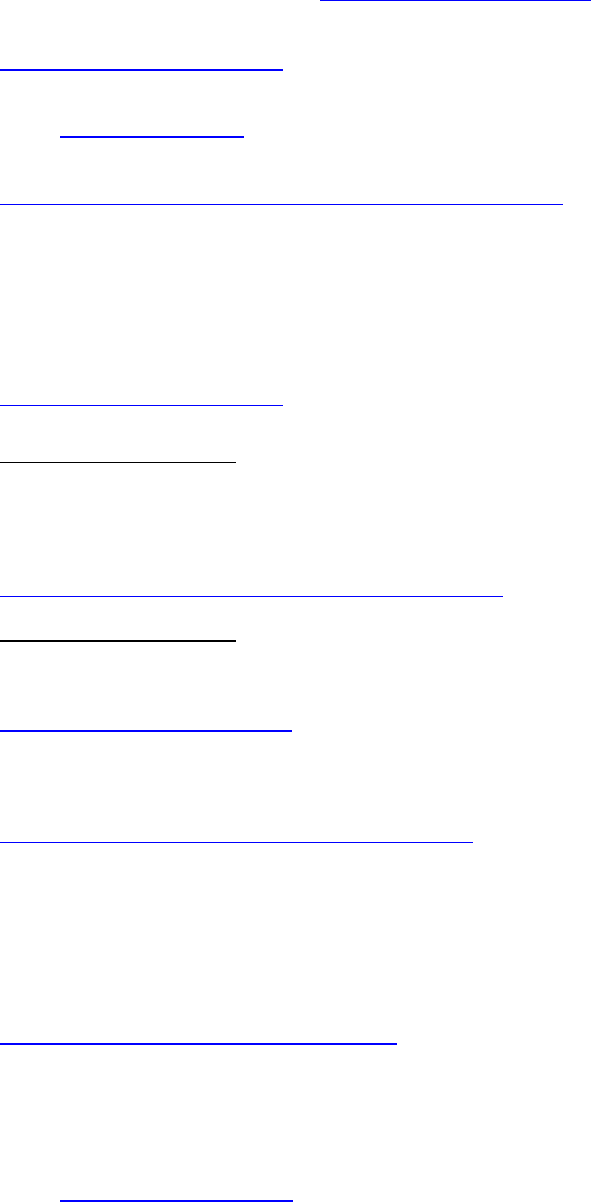

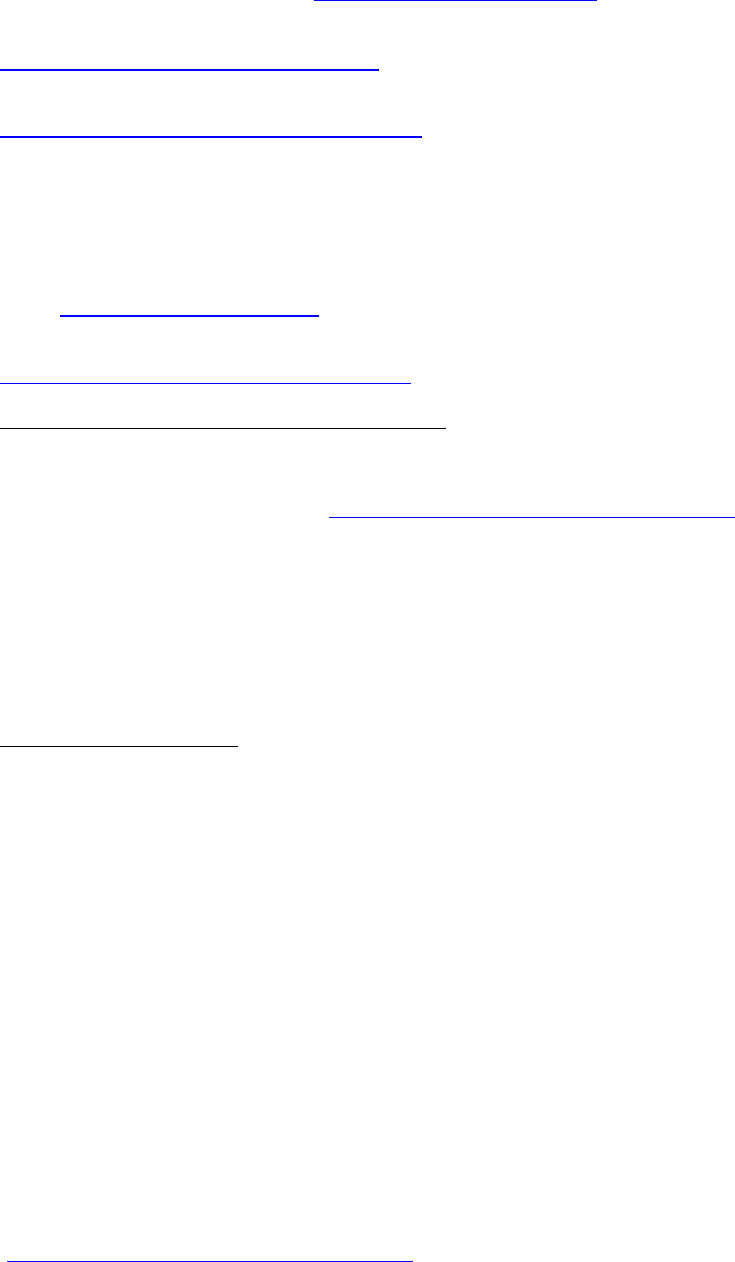

Here is an example of an easy way

to calculate your own net worth using a spreadsheet. You

can also do this on paper very easily. First

,

itemize

all of your

assets

and

liabilities

i

non

e

column.

For each item, input the value of what you own

(asset

)

or the value of

what you owe

(debt

or li

ability

)

in separate columns

.Subtractthe

assets

column from the

liabilities

column to

come up with the net value of each item. Finally, add all of the items in t he net value column to

come up with your net worth. Notice that some items will be negative (

this is especially true with

credit card debt).

Rogue Real Estate Investor

-

9

-

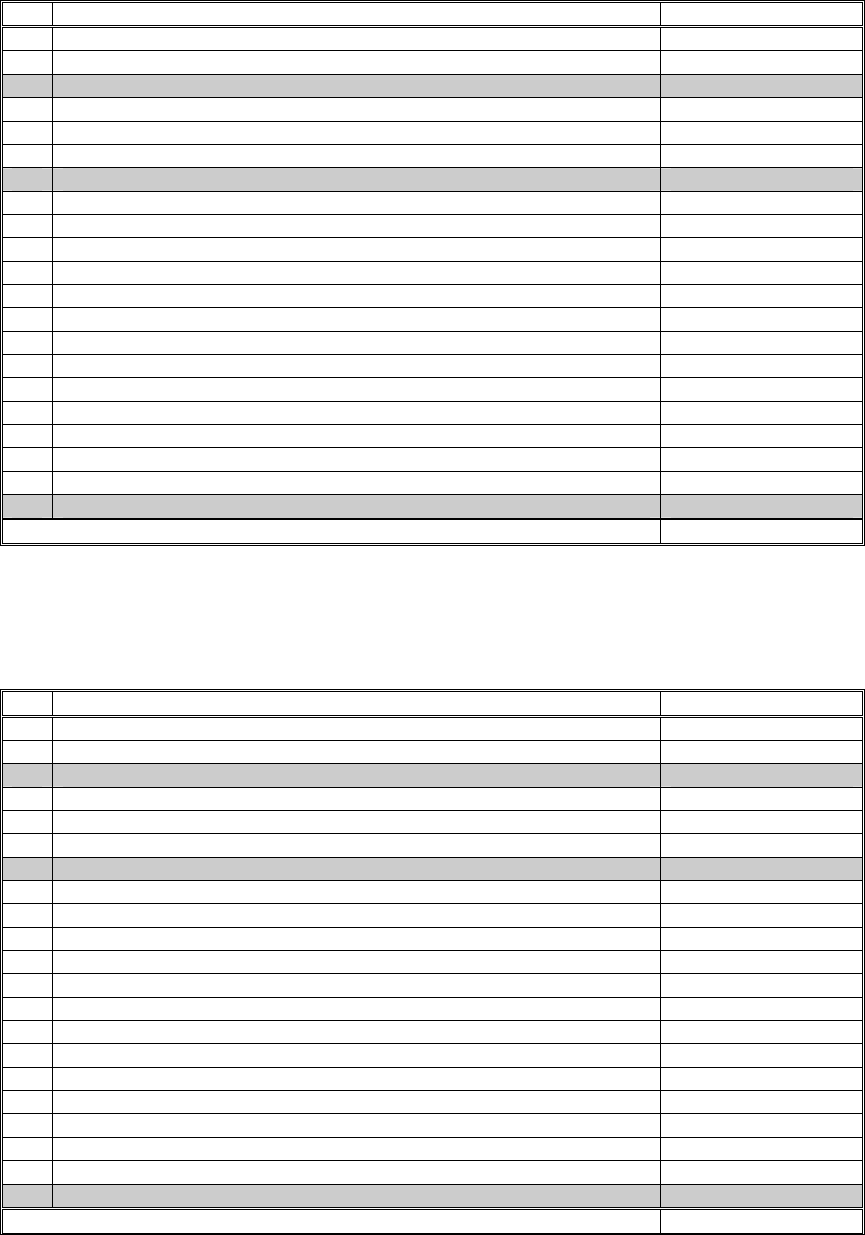

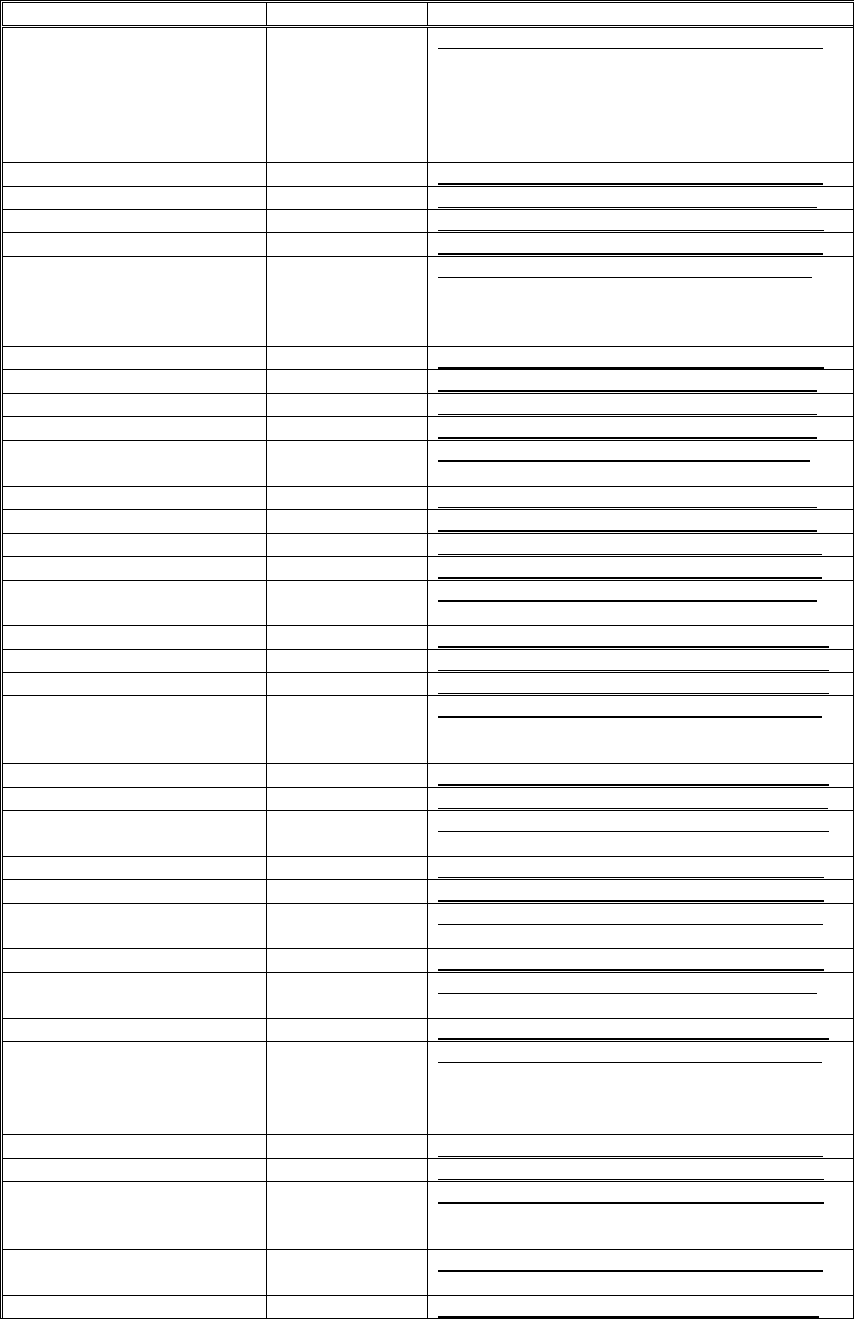

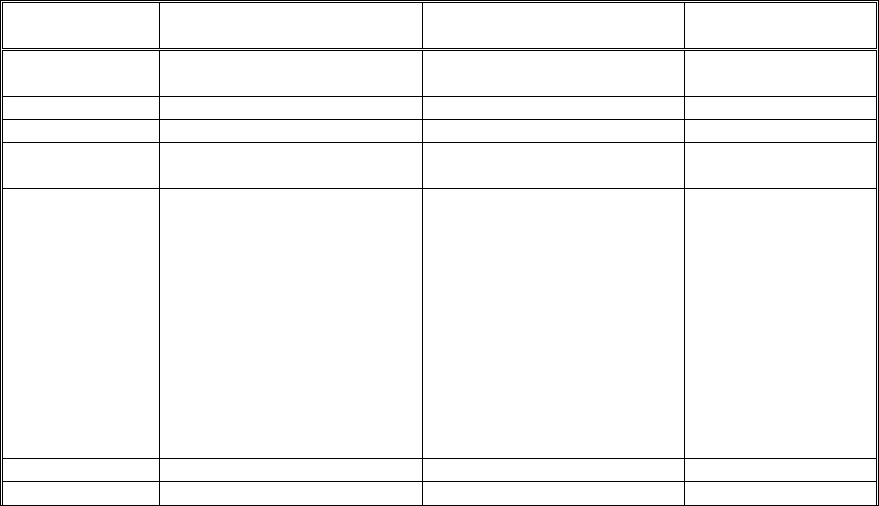

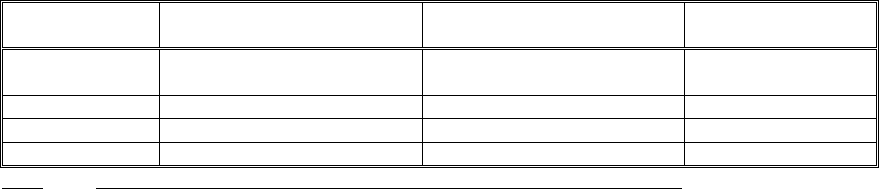

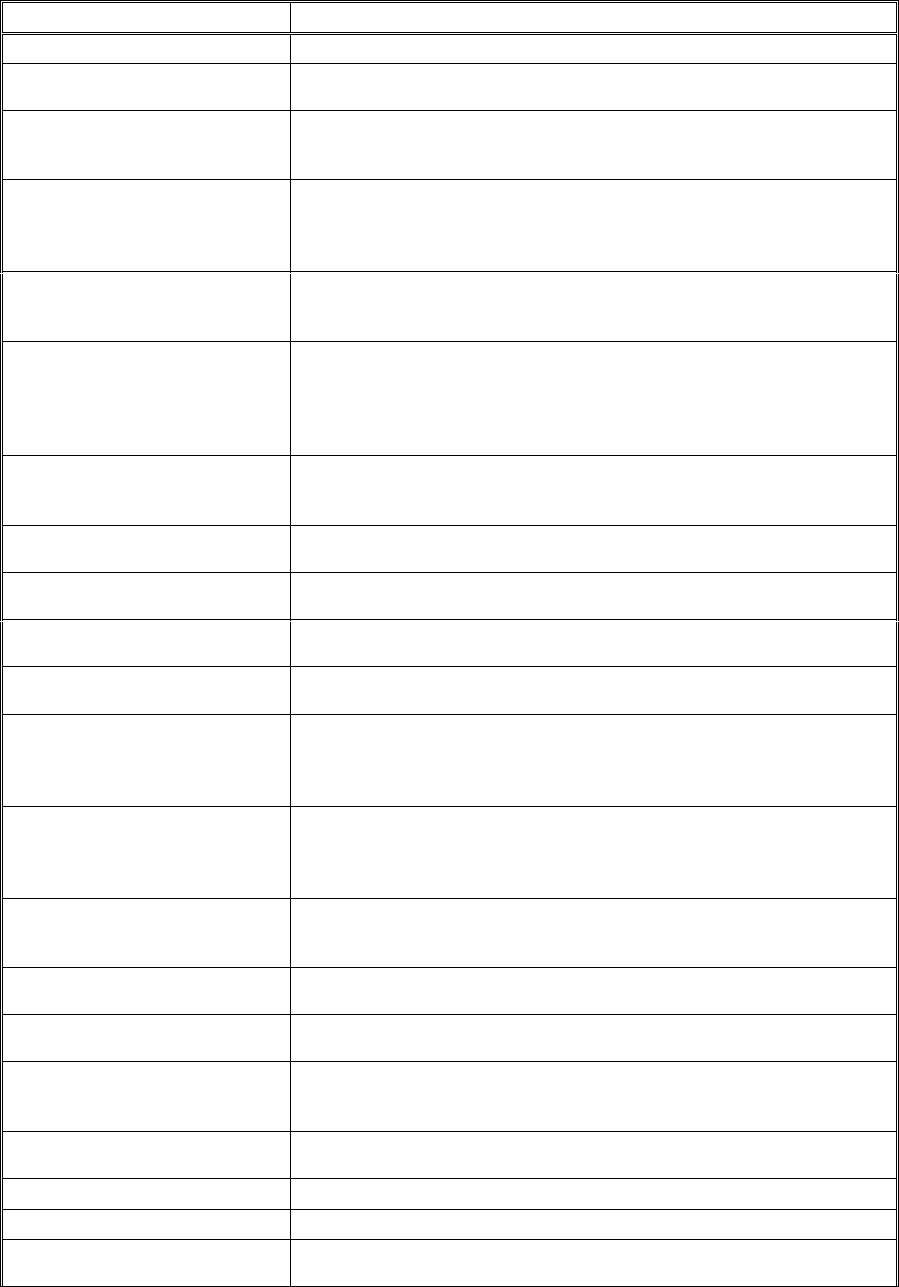

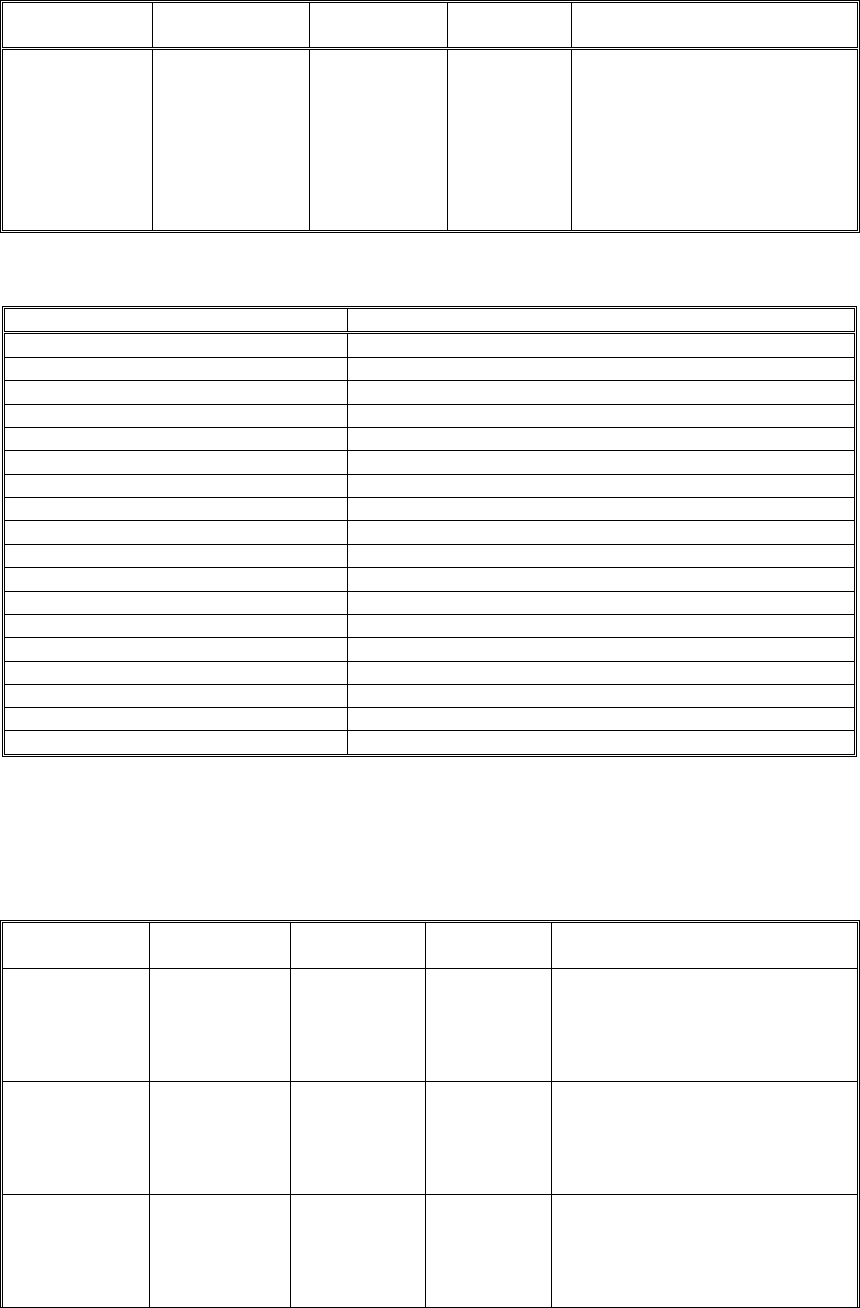

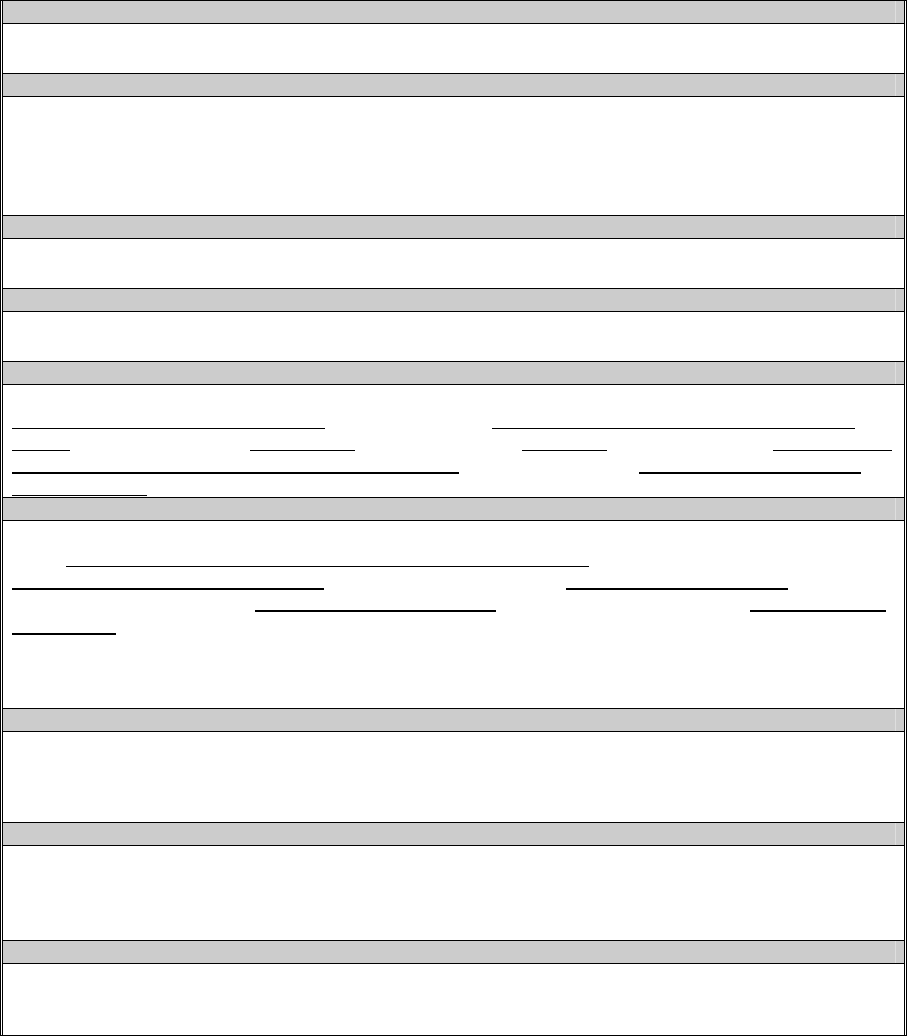

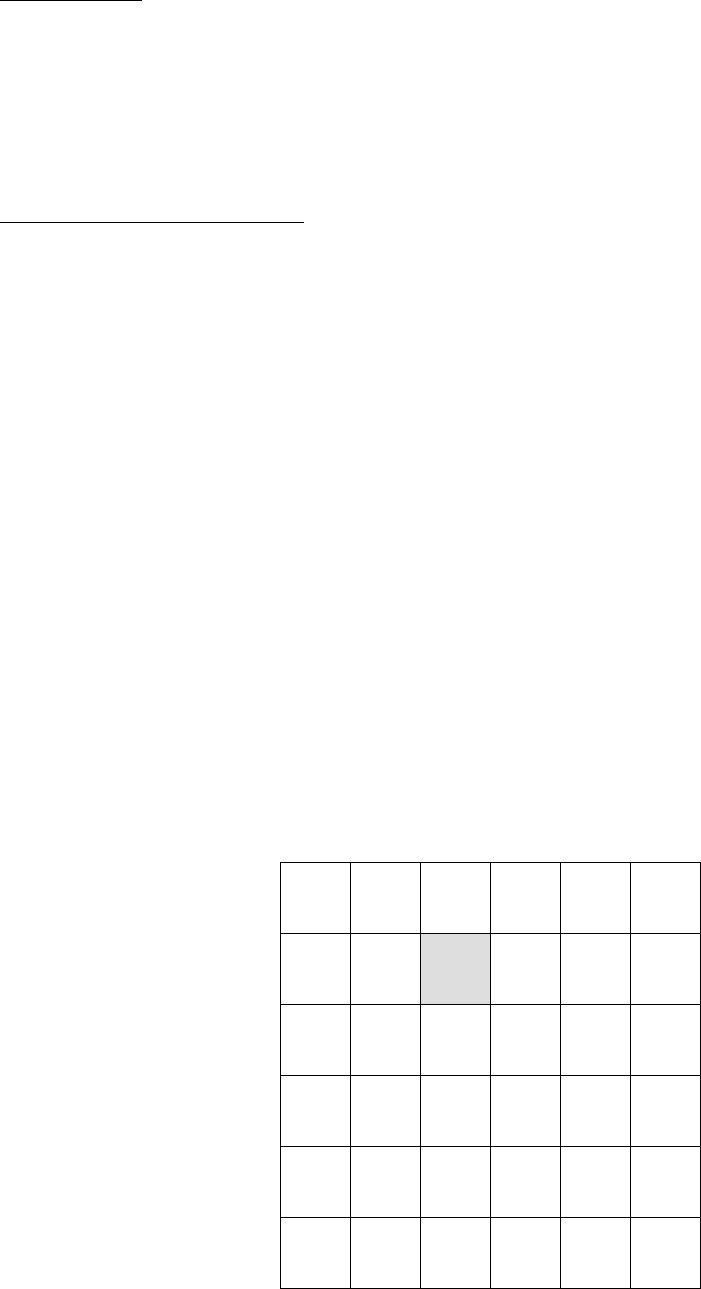

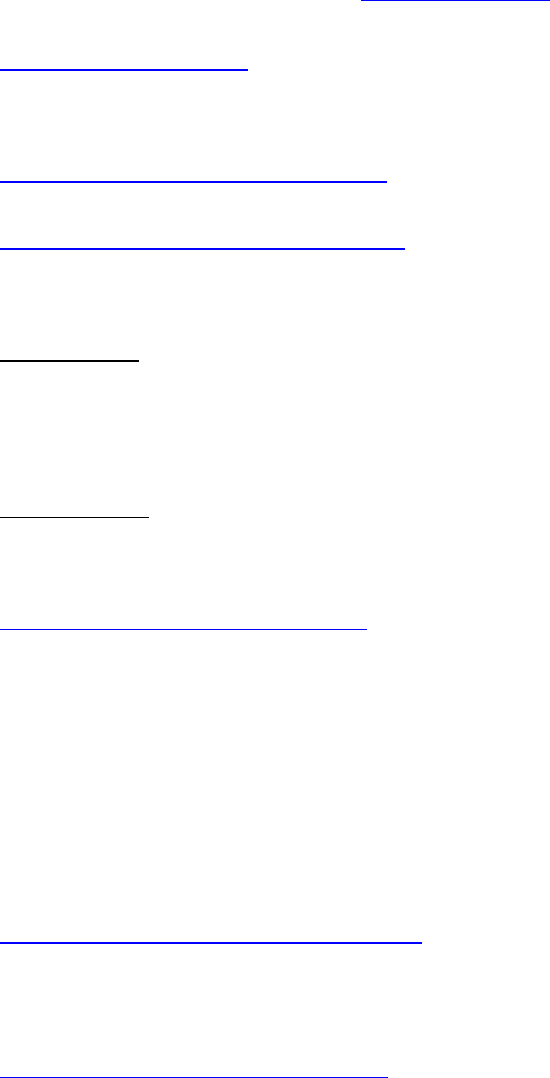

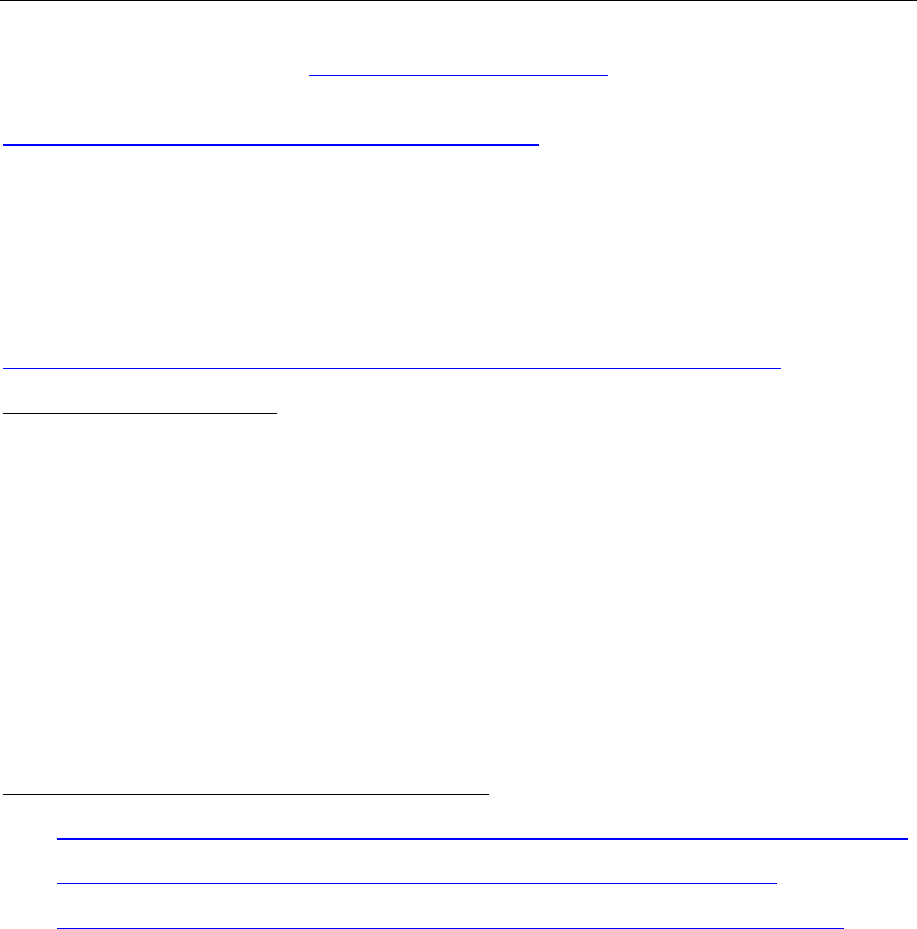

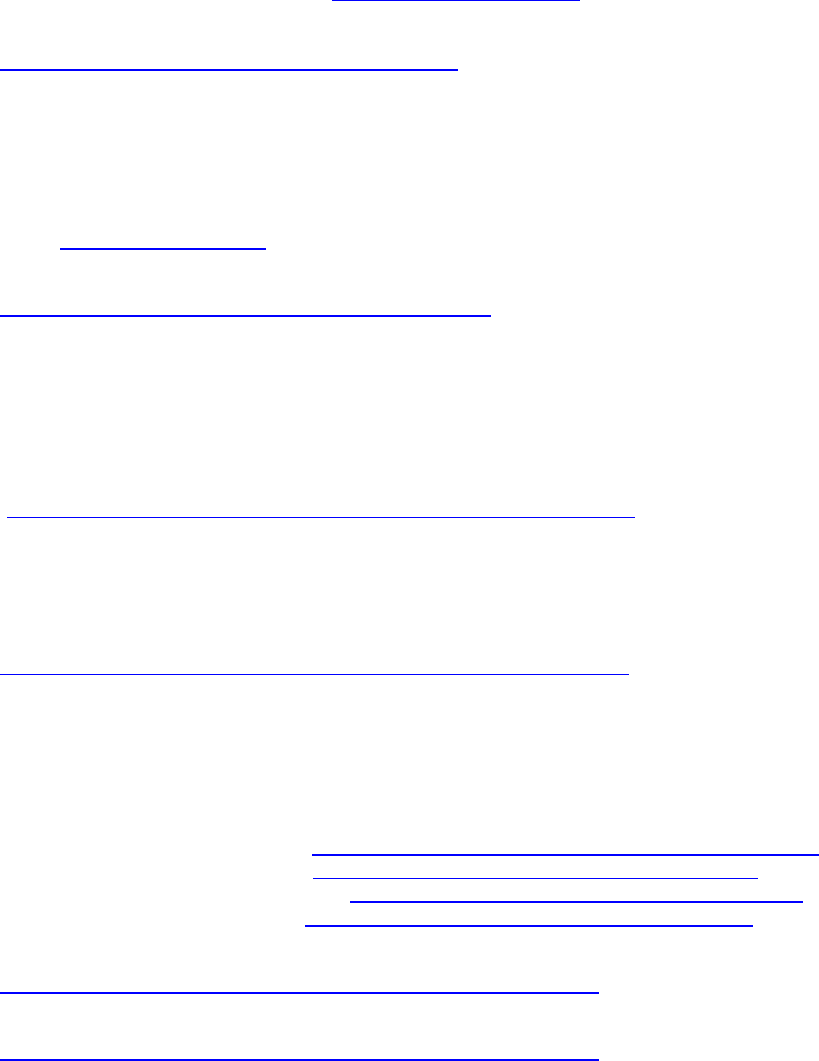

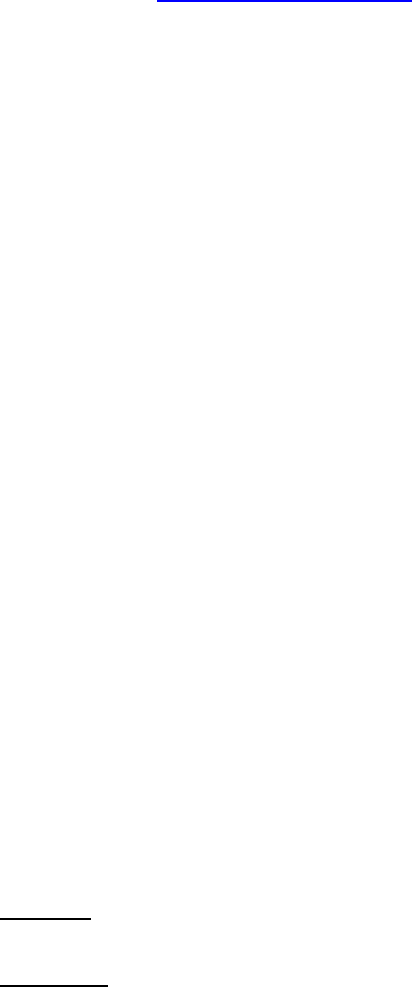

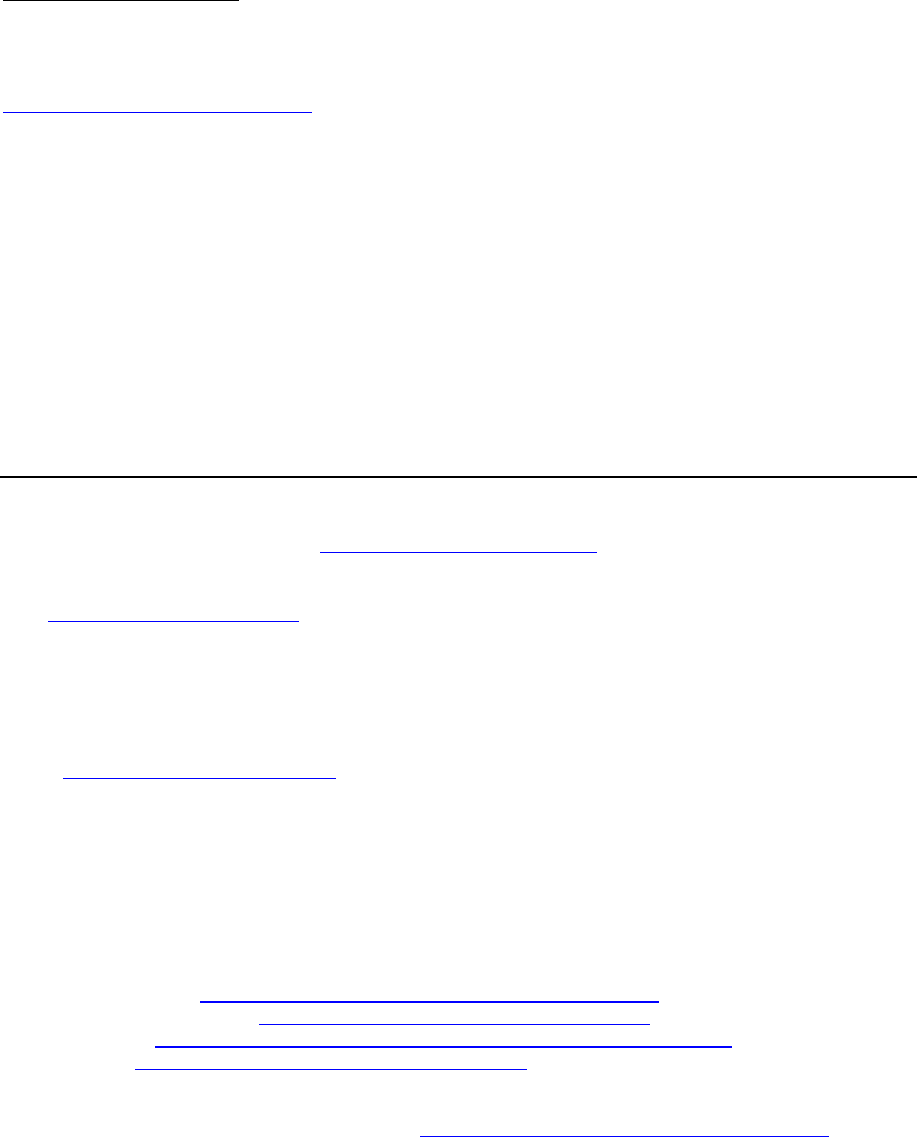

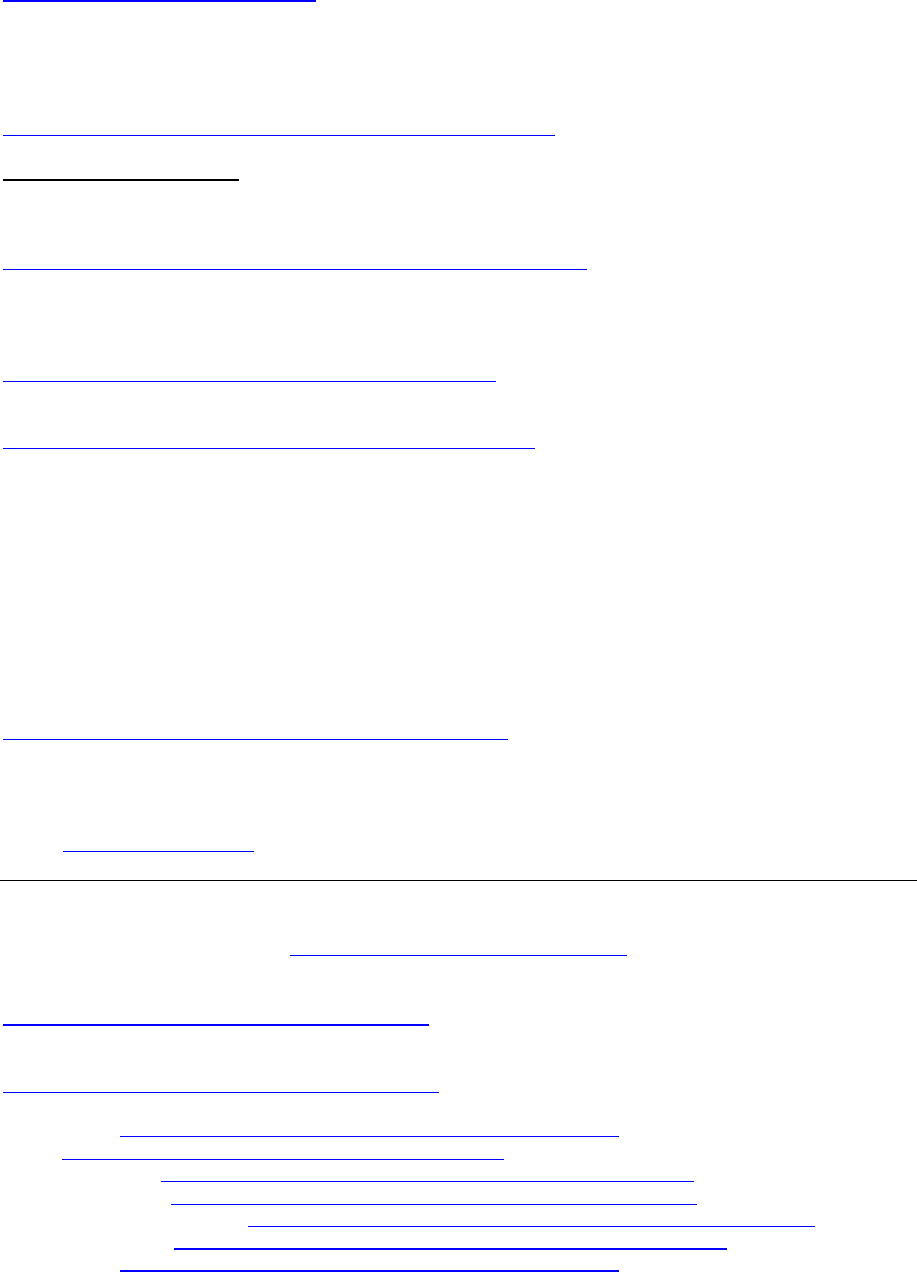

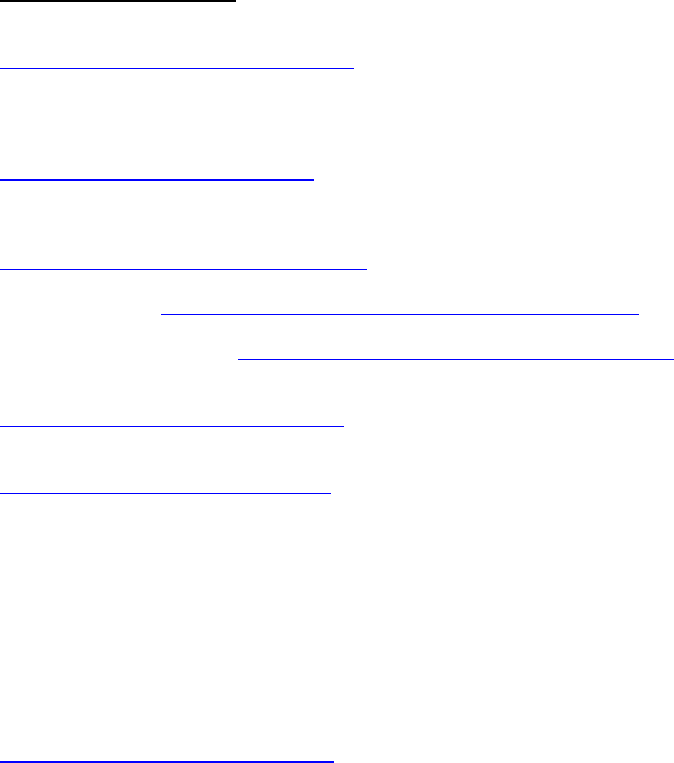

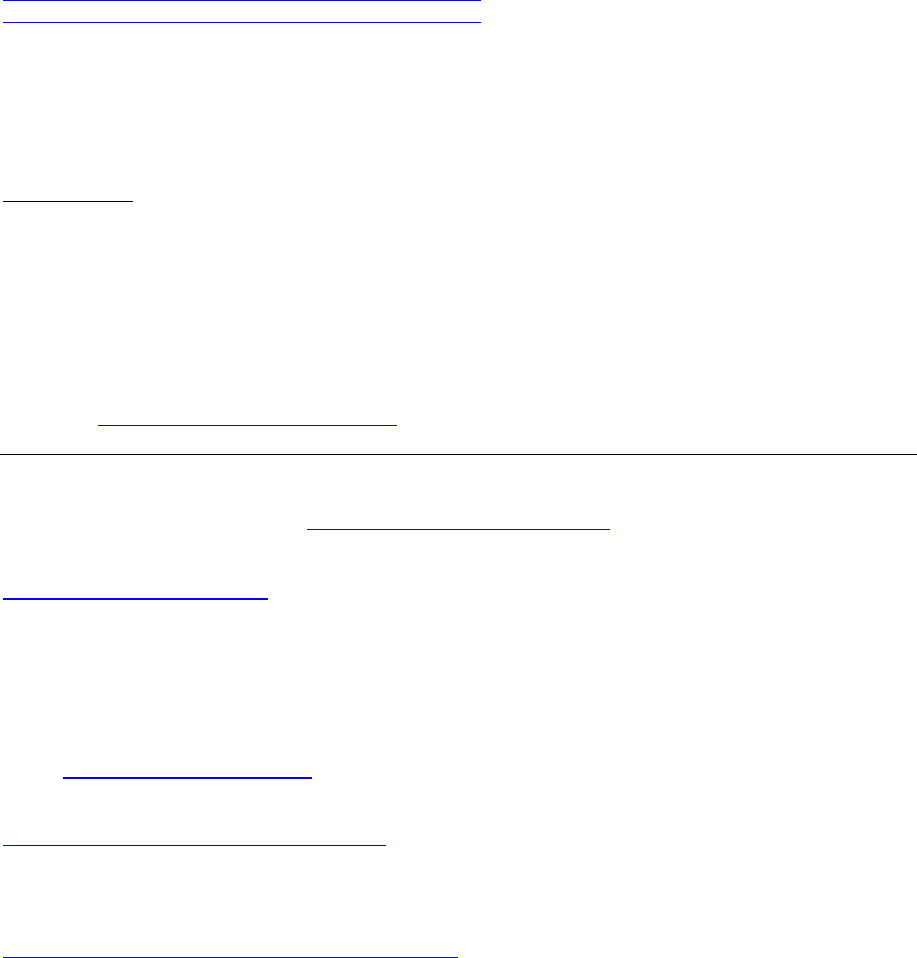

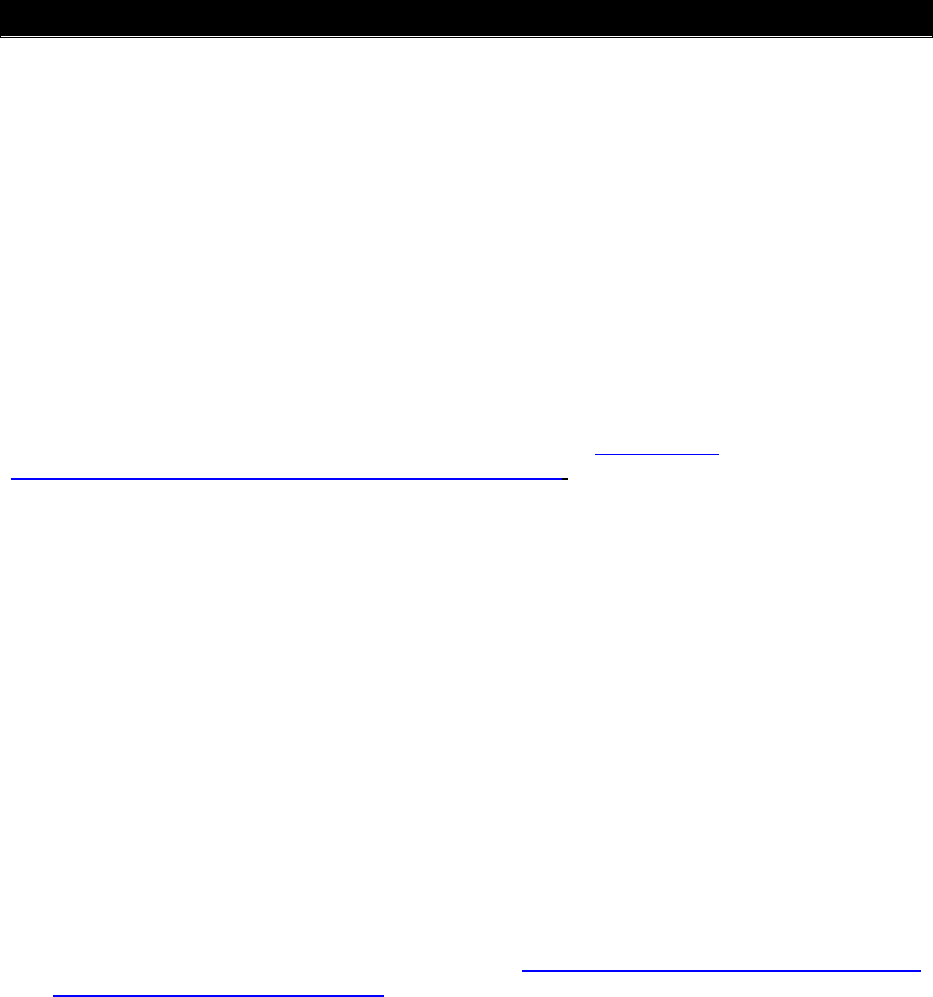

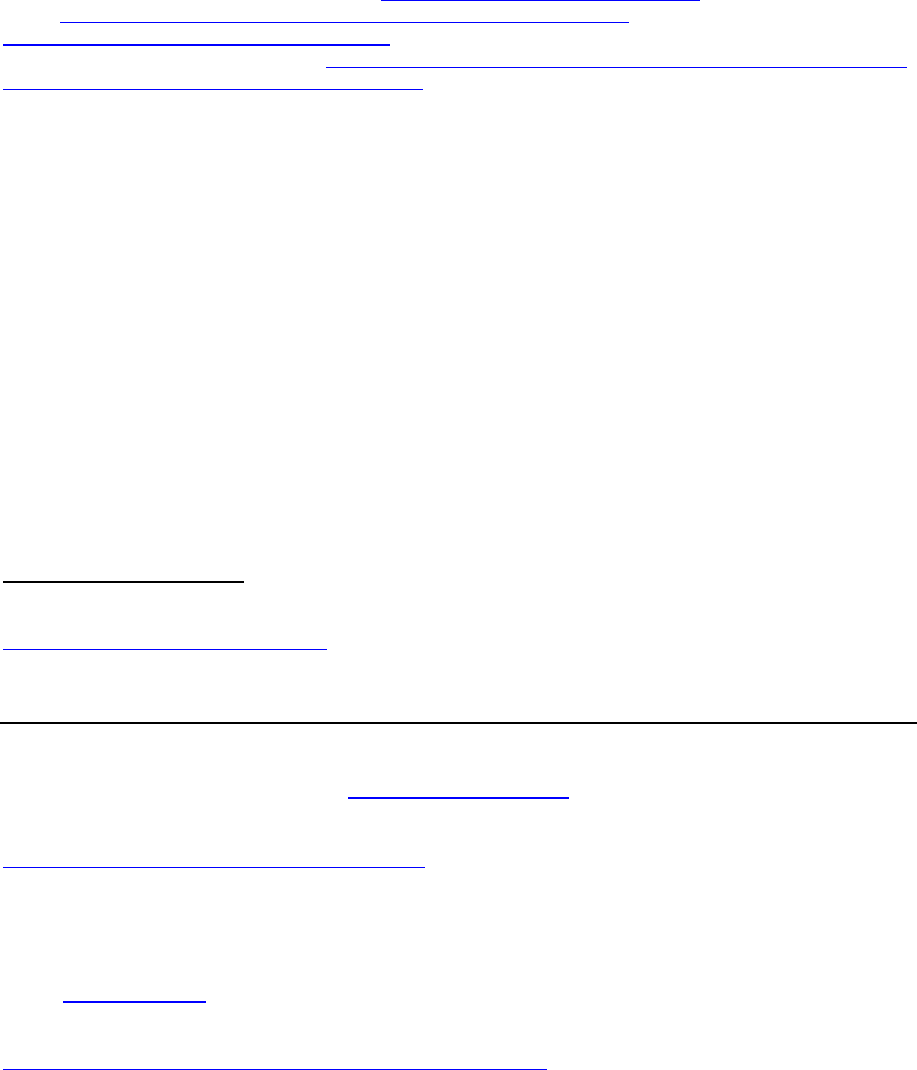

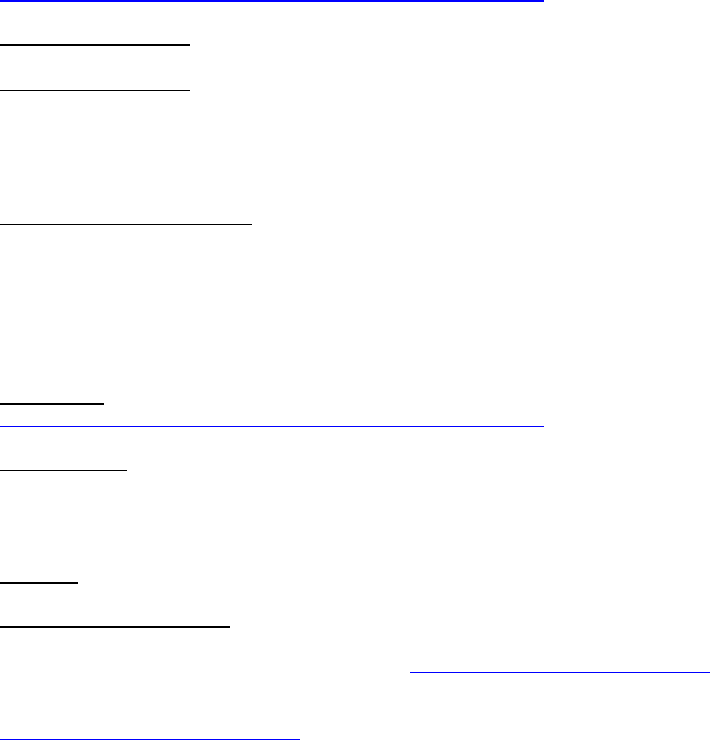

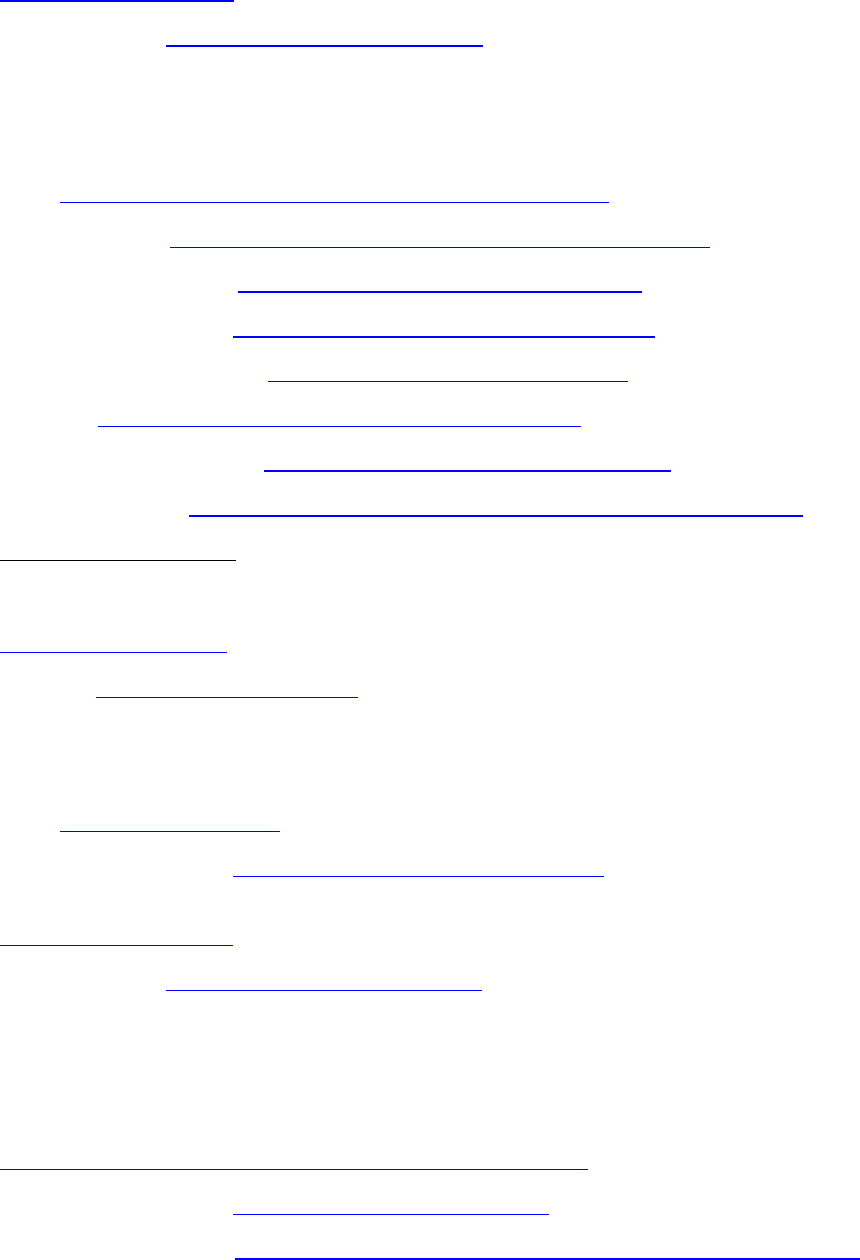

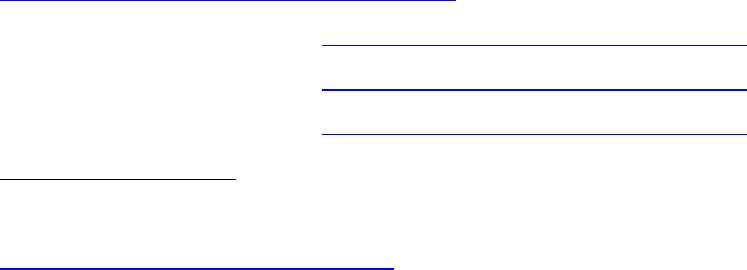

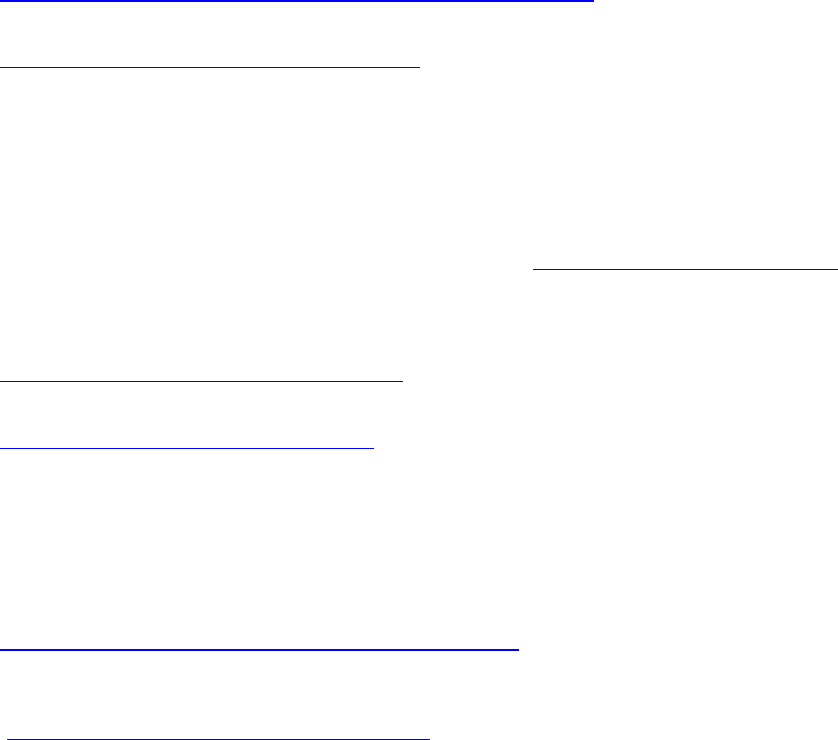

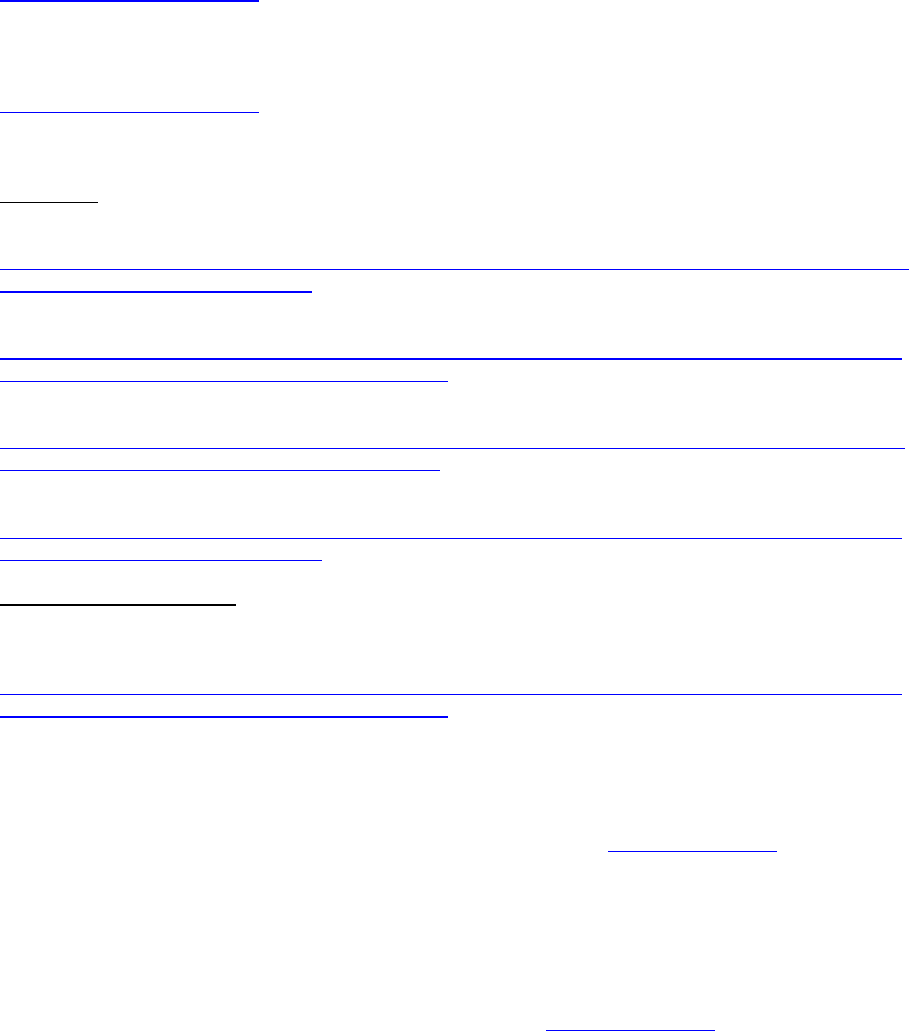

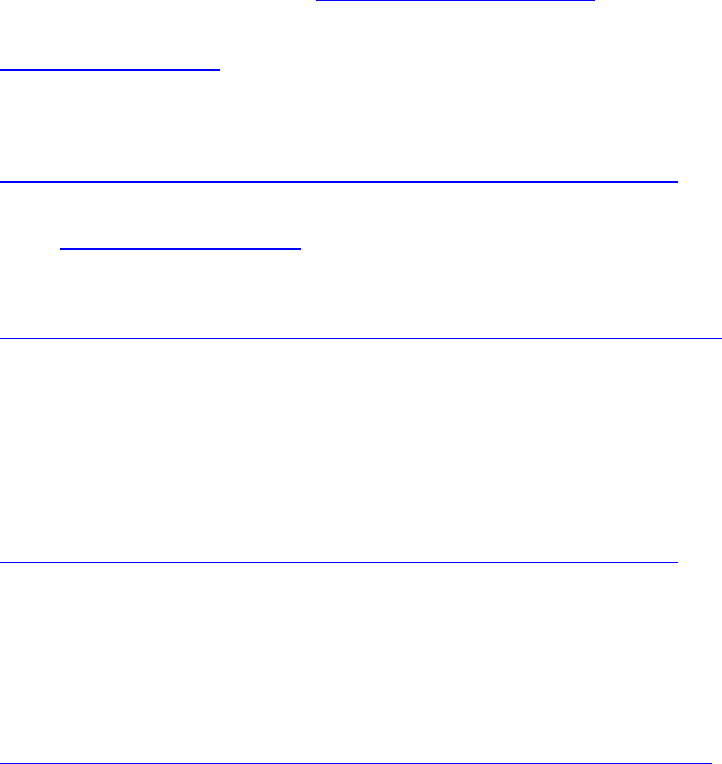

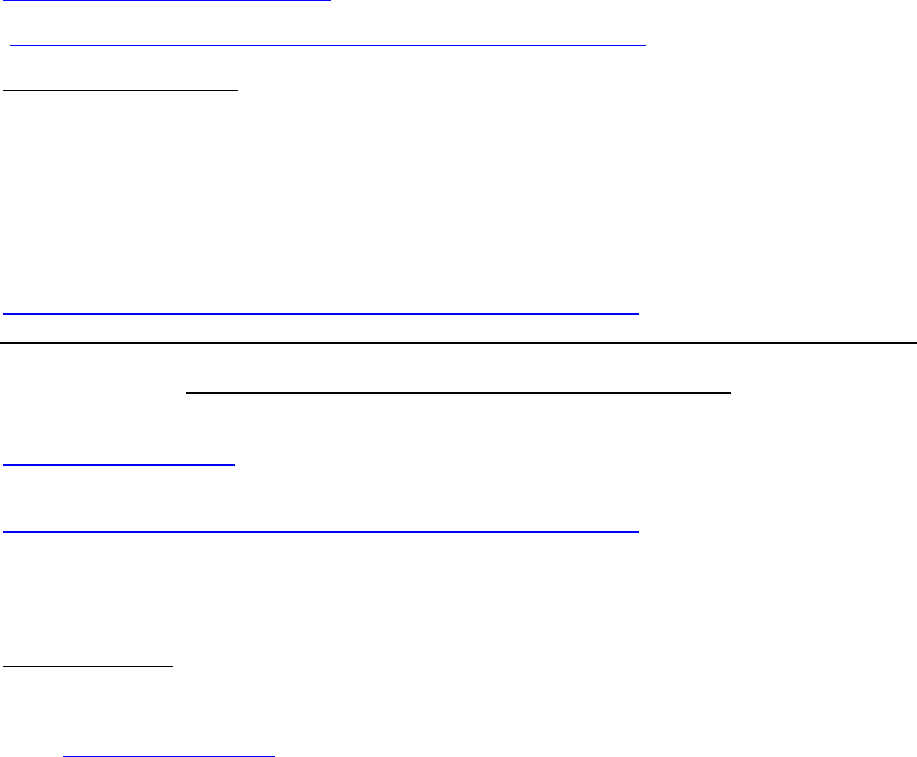

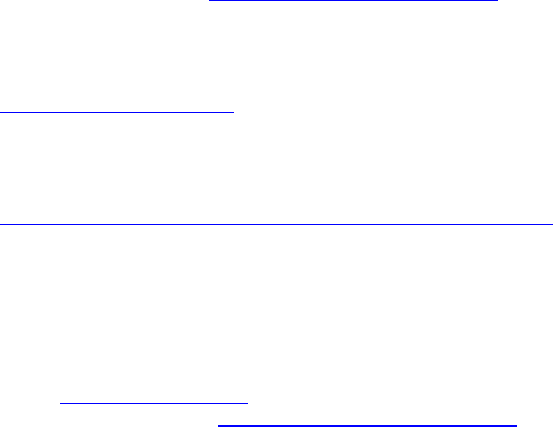

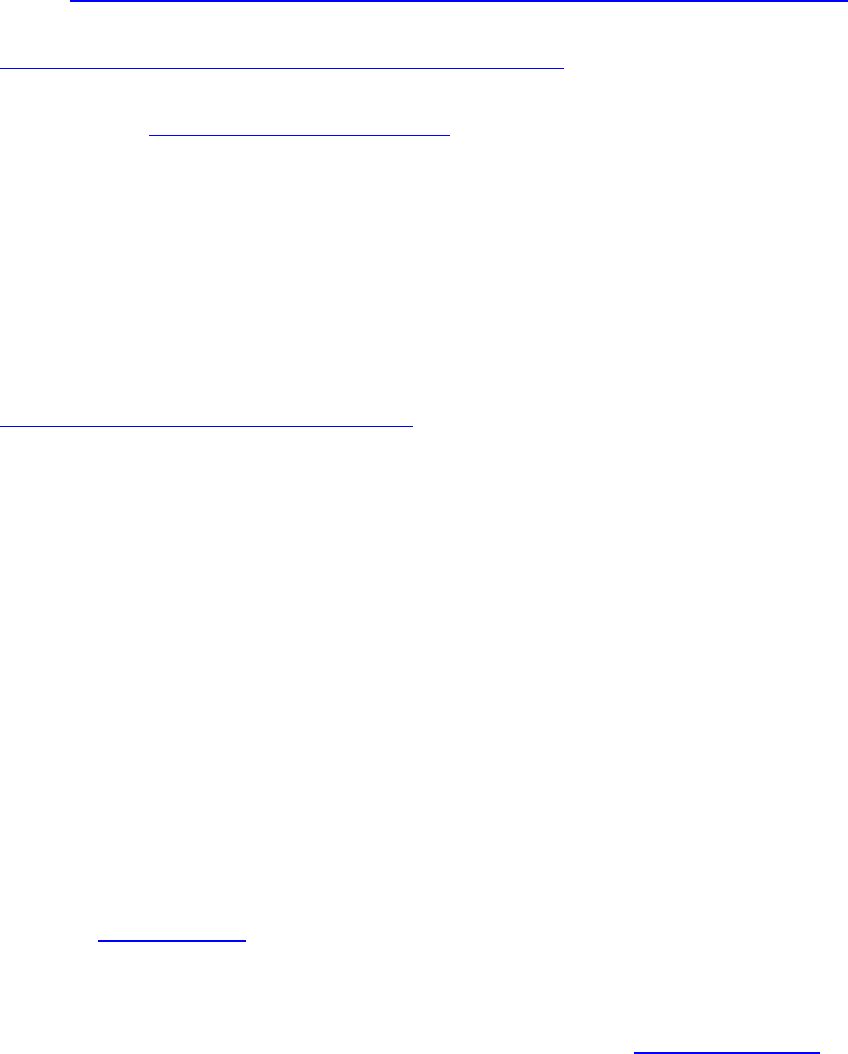

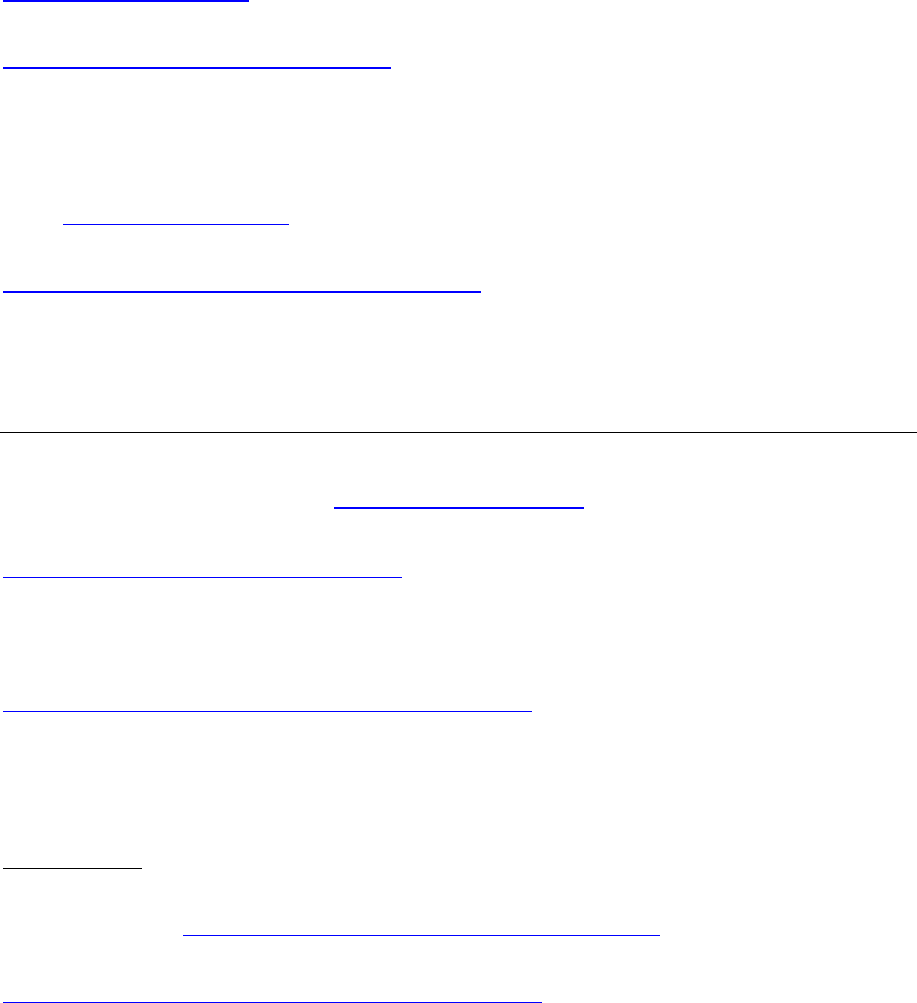

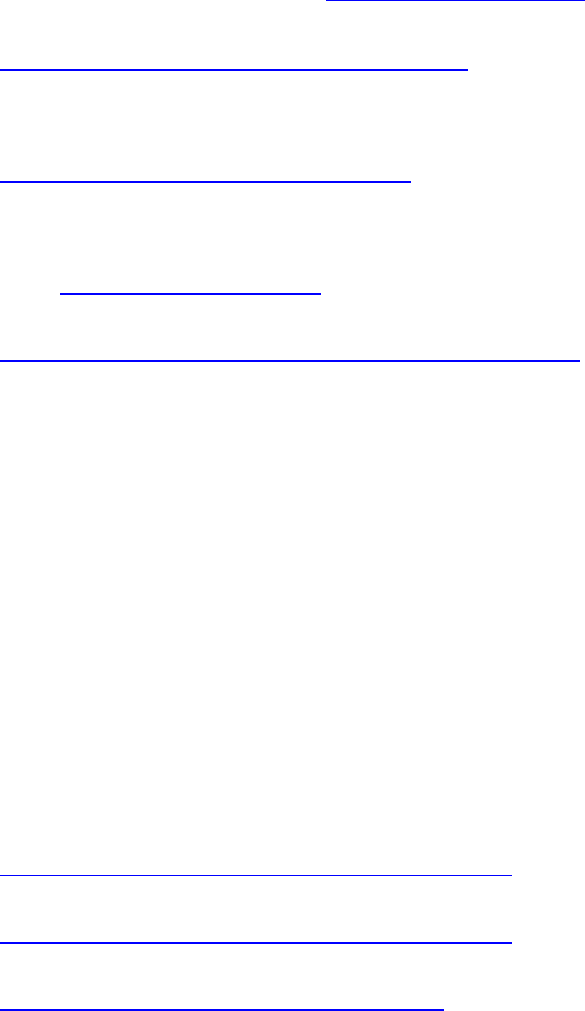

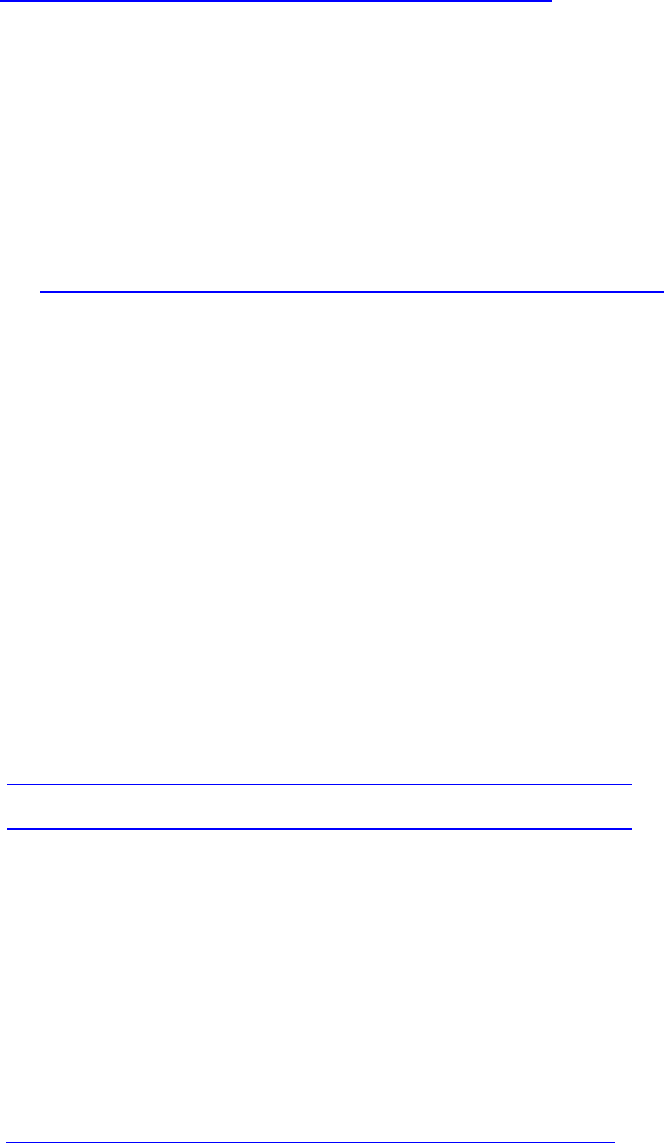

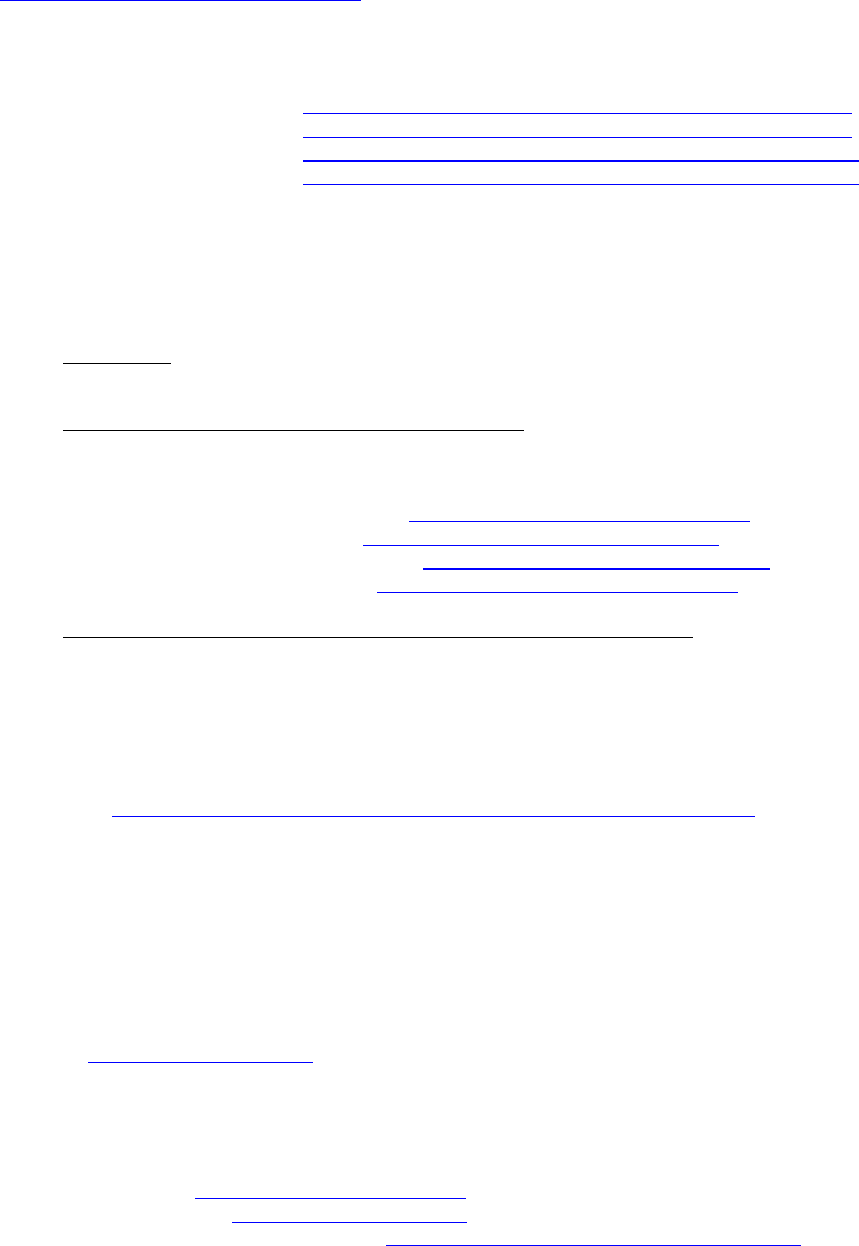

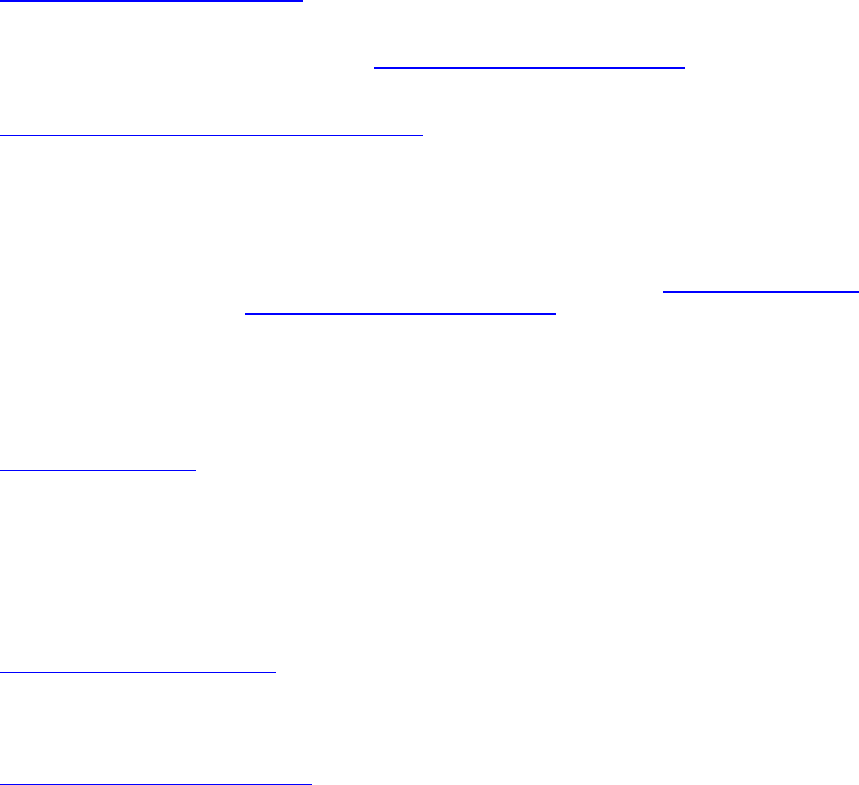

Net Worth Example

John and Shelly Heineman

Item

Assets

Liabilities

Net Value

Cash

$200

$0

$200

Jewelry

$2,500

$495

$2,005

Furniture

$3,000

$2,450

$550

Tools

$1,000

$0

$1,000

Riding Lawnmowe

r

$2,250

$925

$1,325

Motorcycle (Yamaha 850)

$500

$0

$500

Ford Explorer

$17,750

$16,950

$800

Honda Civic LX

$16,690

$17,250

-

$560

Dell

Laptop

$1,650

$0

$1,650

Kitchenware

$3,000

$0

$3,000

Appliances

$2,500

$0

$2,500

Stereo System

$5,000

$0

$5

,000

Visa Accou nt

$0

$3,995

-

$3,995

Student Loans

$0

$7,269

-

$7,269

MasterCard

$0

$2,125

-

$2,125

House

$132,500

$95,000

$37,500

Checking Account

$525

$0

$525

Savings Ac count

$2,148

$0

$2,148

Company 401

(

k

)

P

lan

$5,250

$0

$5,250

Net Worth =

$

50,004

L

ooking over John and Shelly’s net worth

,

it is interesting to note that more than half of their net

worth is related to real estate. If you are still renting, you might think twice about it now. Owning

your own home is one of the best ways to sta

rt building a positive net worth. Imagine combining

the net worth of your own home with that of other property and real e state investments.

As long as we are getting our personal finances in order, let’s talk about debt. I think everyone

reading this know

swhatdebtis,butdoyouknowthattherearetwotypesofdebt

–

good debt

and bad debt? This is open for debate, but I believe that it is important to distinguish between

the two.

Real estate is the best example of good debt that I can t hink of. In fac

t, if you are not willing to

take on some good debt, then your chances of financial independence will be severely limited.

Your only other option is frugality and years of patience. Other ty pes of good debt include

student loans, home equity credit lines,

supplier credit lines and personal signature loans.

Now, let’s talk about bad debt. As you can imagine, the worst t ype of debt is revolving debt or

credit card debt. Credit cards are not inherently bad, but how you use them can be devastating

to your abil

ity to succeed financially. In addition to their high interest rates (some as high as 24

percent), credit cards often have annual fees, late charges and credit limit fees. If you are

seeking ways to become financially free, pay off your credit card debt. I

fyouhaveequityina

house, consider obtaining a home equity loan to pay off the credit card debt.

Having said that, you should have at least one major cred

it card. In today’s society, it i

salmost

impossible to live without using a credit card. I use

aVisadebitcardforgroceries,hardware,

retail shopping, gasoline, restaurants and just about everything I do. Check with your bank

about obtaining a debit card. For personal vacations and certain large purchases, I use a

Rogue Real Estate Investor

-

10

-

different credit card. For bus

iness, real estate and business travel, I use another card. As a

bonus, the Visa card that I use gives me cash back.

Why use a credit card? First, as long as you pay the balance off each month

on time

,itislike

borrowing money for 30 days. Another reas

on to use a credit card is to establish your credit

profile. Purchasing by credit card is also a great way to keep tr ack of your purchases each

month. It is especially valuable during tax season to have a nice record of your expenses.

Finally, there is act

ually power in purchasing through a credit card. For example, if you purchase

an item

using

acreditcardandaproblemarises

,

and a retailer is not willing to

solve the

problem through an exchange or by giving you

your money back, you can actually call y

our

credit card company and place a dispute. The credit card company will then contact the

merchant and they must provide proof to substantiate their claim or you will be given your

money back. It’s a powerful and free ally.

Auto and personal loans probab

ly rank second on the bad debt list. Automobiles, although

necessary, are a depreciating asset and not an investment, except for a few vintage cars. If you

are looking t o free up cash flow for real estate investing, consider carefully what you are dri ving.

Maybe the SUV is not really necessary for the bad weather that only occurs once or twice a

season. Perhaps the extended cab truck is not really necessary to haul lumber once a year,

when you can rent a pickup at U

-

Haul, Home Depot or Lowe’s. Remember that

the car loan is

just one part of the total automobile cost; there are als o

fees for

insurance, inspections, re p

airs,

sales tax and licensing

.

Step 3: C onsider Your Business Structure

Each and every business has a structure. You have probably seen or hea

rd of businesses that

are incorporated. For example, our compan

ies are

called Mind Like Water, Inc.

and Rogue

Investor, LLC.

If you are just starting off, you will be working as a sole proprietor. All that means

is that you and the

business are the same. I

fyouare

married, most likely your household (i.e.,

husband and wife) and the business are the same.

Asoleproprietorshipistheeasiestbusinessentityavailable.Youreallydon’tneedtodomuch

of anything except keep track of your profit and loss

so it can be included on your personal

income tax return. You can even use your own checking account or set up a separate account

and fill out paperwork to use a “doing business as” or DBA name. An example would be JBK

Real E state Investing. Notice that yo

ucannotlegallyuseadesignatorlikeInc.,Corp.,LLC,etc.

Sole proprietorships have one major drawback. Not only does the money flow back and f orth

from your personal accounts, the liability or risk also flows back and forth. That is why as a

busine

ss progresses, it is often set up in another structure to limit the personal li ability of the

owners.

Some small business structures to consider i nclude the following: Subchapter S Corporations,

Chapter C Corporations,

Limited Liability Companies (LLCs)

,LimitedLiabilityPartnerships

(LLPs), general partnerships, and other structures.

Limited

liability c

ompanie

s

For real estate investors,

one of

the best option

s

is a Limited Liability Company. LLCs are

similar to C hapter S corporations, except

that

they can exist for a defined period of time.

Owners receive the t ax advantages of a partner ship, while also receiving the protection of a

corporation. To make it even better, all states except Massachusetts allow an LLC to be formed

with one person.

Rogue Real Estate Investor

-

11

-

LLCs m

ay be formed for most businesses, except some professional businesses that require

licensing for protection of the public. Ge ner ally, doctors, lawyers, accountants and other

professionals cannot use an LLC to practice. There are some other businesses that

are exempt,

but as far as real estate investing

goes

,you’vefoundthejackpot.

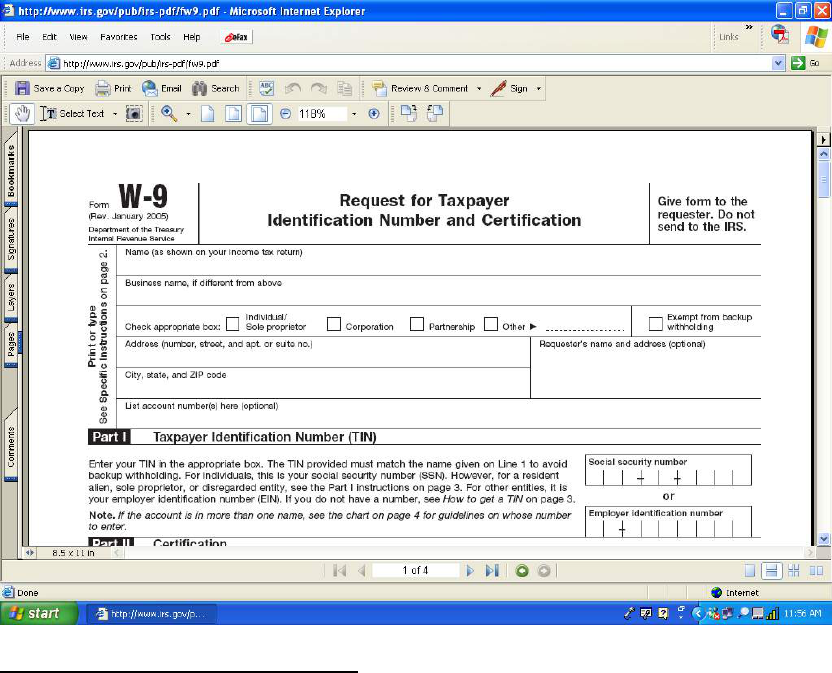

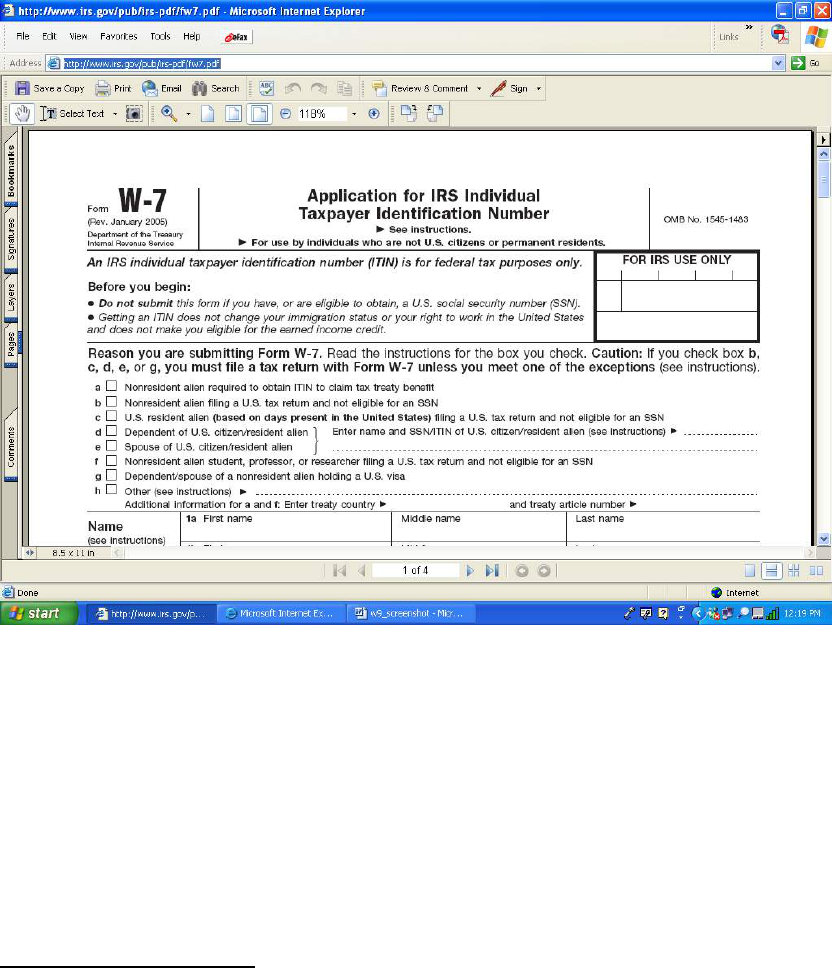

Another reason to set up an LLC is that some states and other governm ent agencies require

either a U.S. social security number or a federal tax I.D. number to invest in f orecl

osed

properties. W ith an LLC, even non

-

U.S. citizens can apply for a federal tax I.D. number.

Summary of LLC benefits:

x

Allows for partnerships with limited liability.

x

Protects personal assets of owners or m embers.

x

One owner/member allowed in all states,

except Massachusetts.

x

May

not requi

re an annual s hareholder meeting

,likeChapterCandScorporations.

x

Favorable tax status

–

can be set up and taxed at owner’s tax rate (default) or as a

company (requires filing other paperwork).

How does an LLC work?

First, decide whether you will be setting up th

eLLCyourselforwhetheryouwill

contact an

attorney or accountant . If you are planning to do it yourself, then decide where you will set it up.

You do not have to set up an LLC in the state that you reside

in; however, it may be easier. If

you plan on setting it up in another state, you will probably need an agent or representative who

lives in that state to act on your behalf. There are companies that will gladly do this for a small

fee.

Decide on t he str

ucture of the LLC. There are two main types of LLC

s

.Oneiscalledamember

-

managed LLC and t he other is called a manager

-

based LLC. A member

-

managed LLC

essentially says that all owners (“members” in LLC lingo) are equally r esponsible for

managem ent of th

eLLC.Amanager

-

based LLC say s that

certain members (the “

managers

”)

are given authority to run the LLC.

The manager

-

based LLC can get complicated if you offer ownership to others. The U.S. Internal

Revenue Service (IRS) and states could perceive the LL

Cassellingsecurities,inwhichcase

you would fall under U.S. Securities Exchange Commission (SEC) regulations. To avoid this,

make sure you only offer membership to a limited group of people, especially people whom you

know or have dealt with, and keep

the total membership under 35.

Decide on a name. Check your state’s requirements. Usually the name must incorporate “LLC,”

“Limited Liability Com pany,” or some other variation. An example would be Apex Properties,

LLC. C heck with the state to make sure

the name has not been taken, before filling out the

paperwork.

To set up an LLC, you

really only need to fill out an Articles of Organization; however, you

should also have an Operating Agreement that specifies the details of ownership,

compensation, voti

ng rights, etc.

After you have set up your LLC, don’t forget insurance. You will need to obtain commercial

liability insurance to cover losses. Please consult with an i nsurance agent.

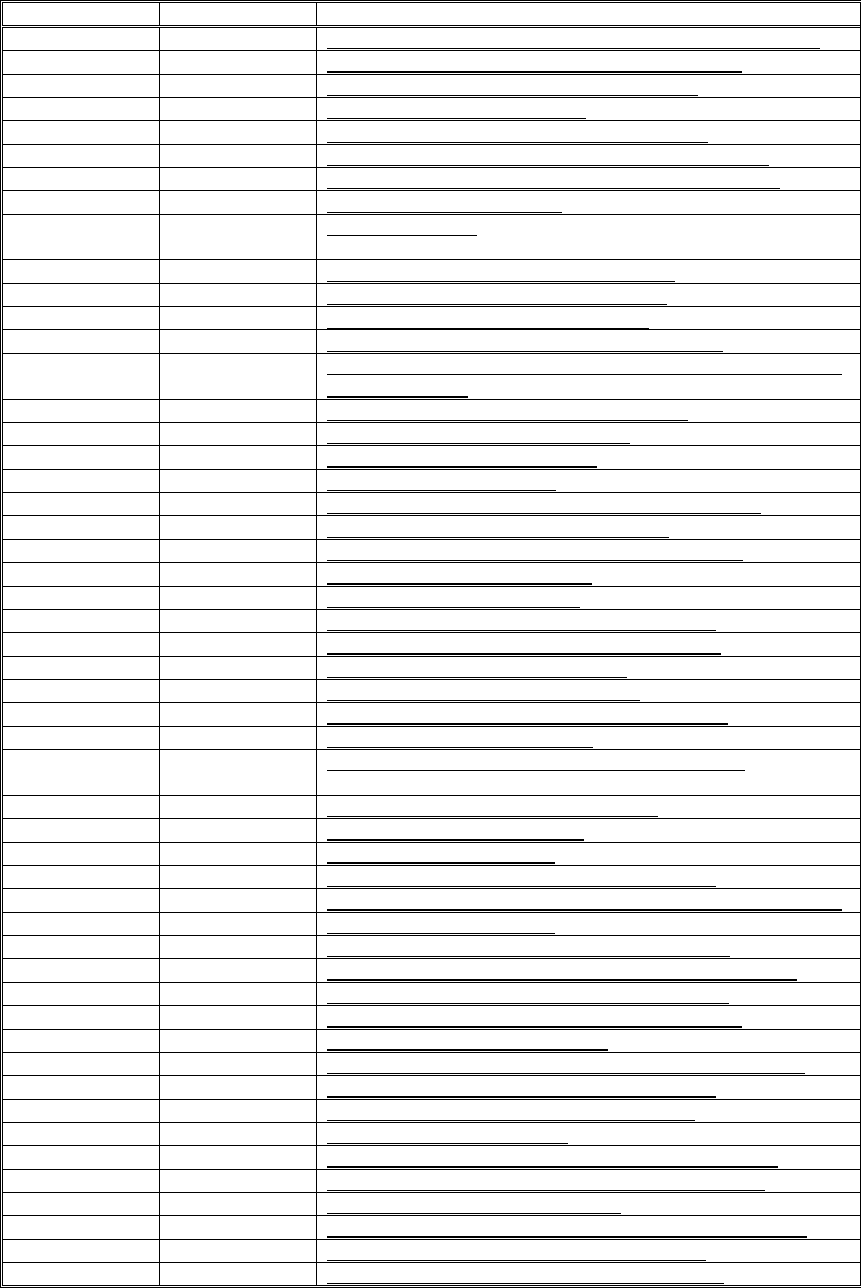

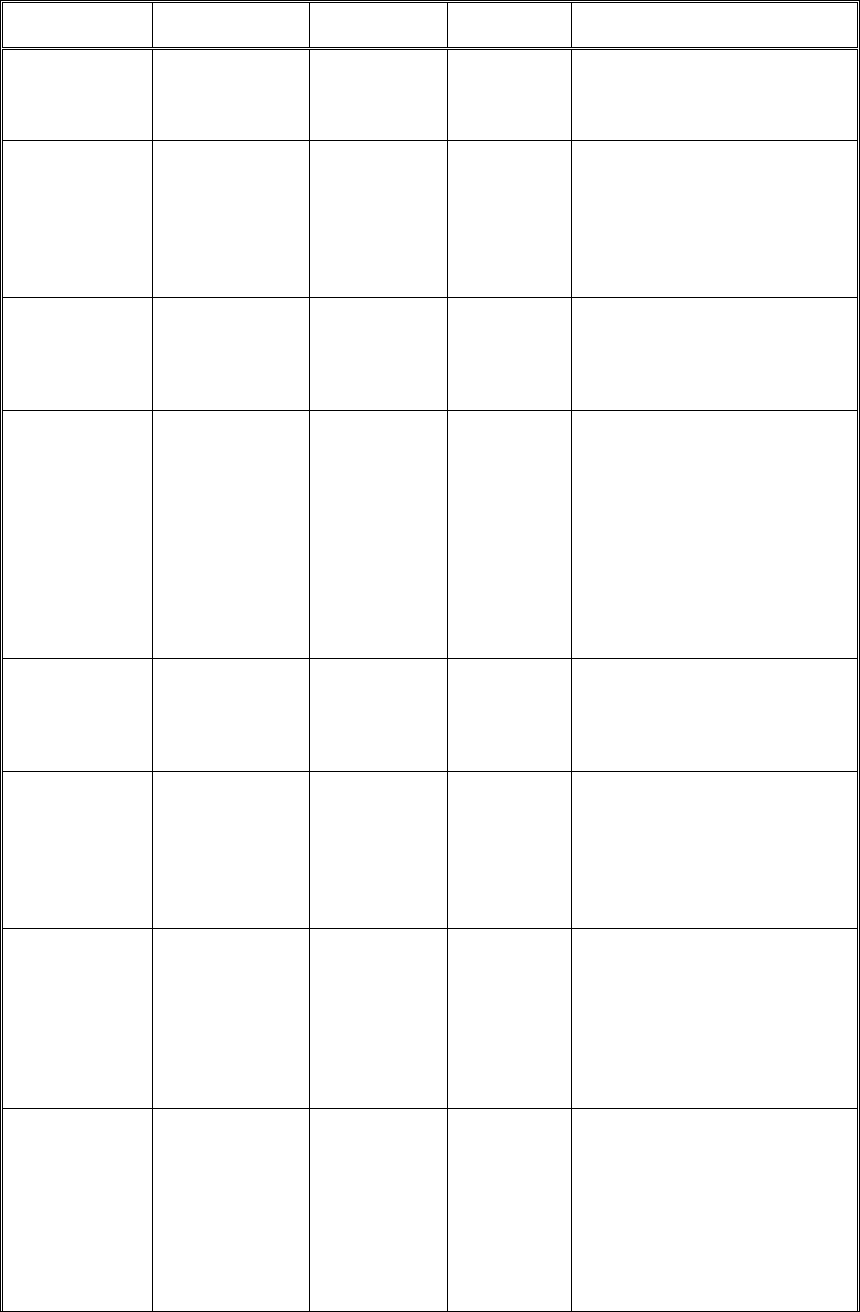

To help you find out more information about setting up a business in

aparticularstate,the

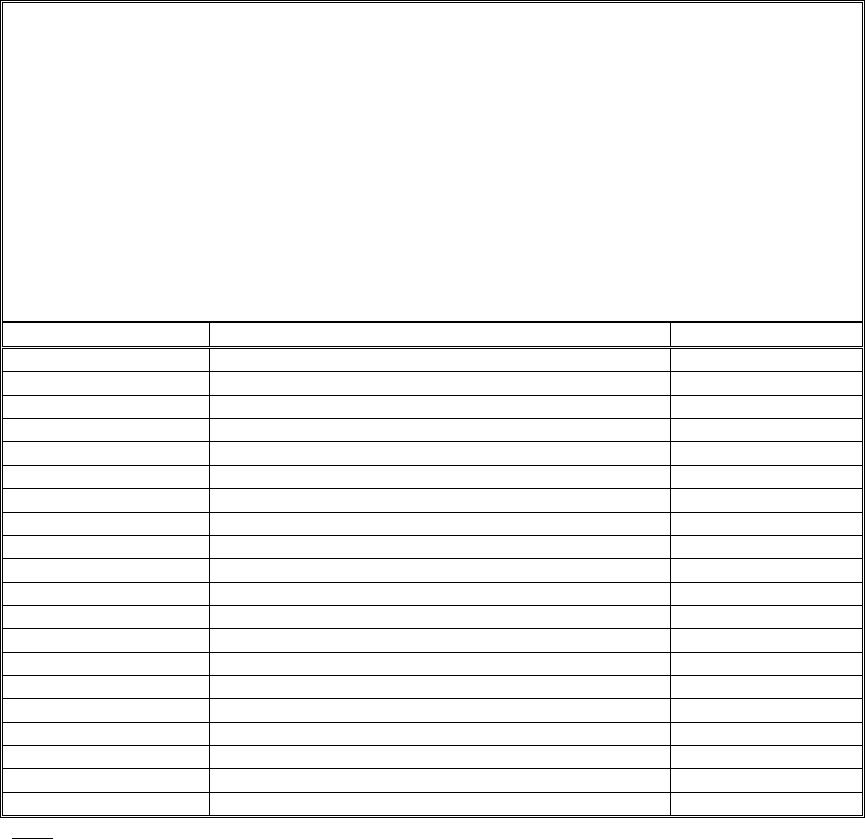

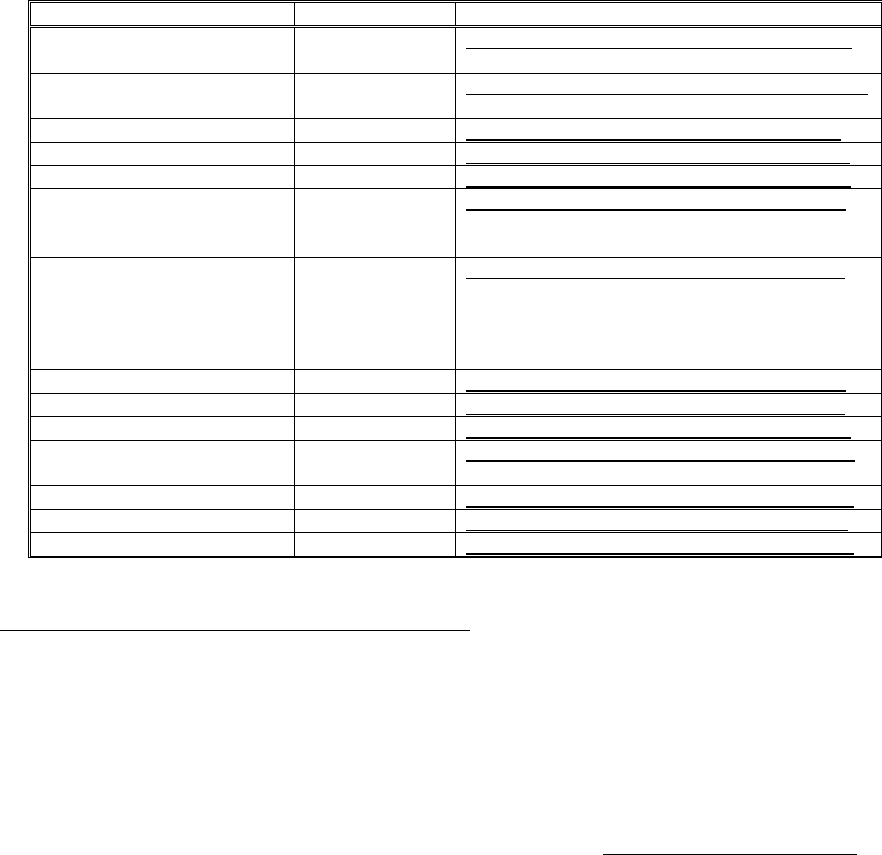

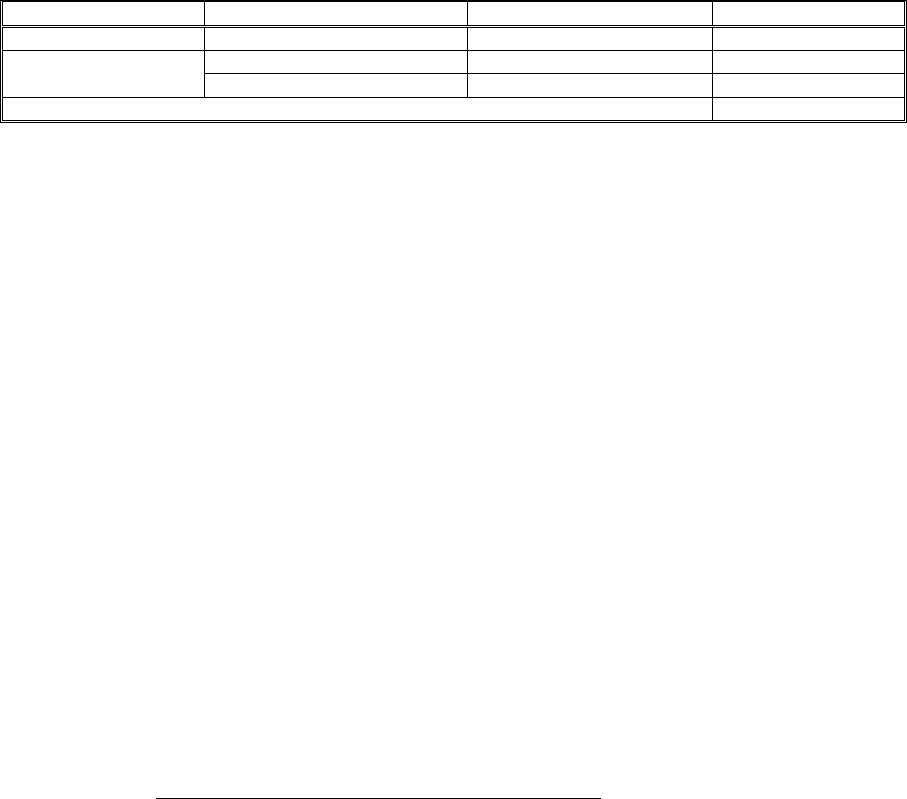

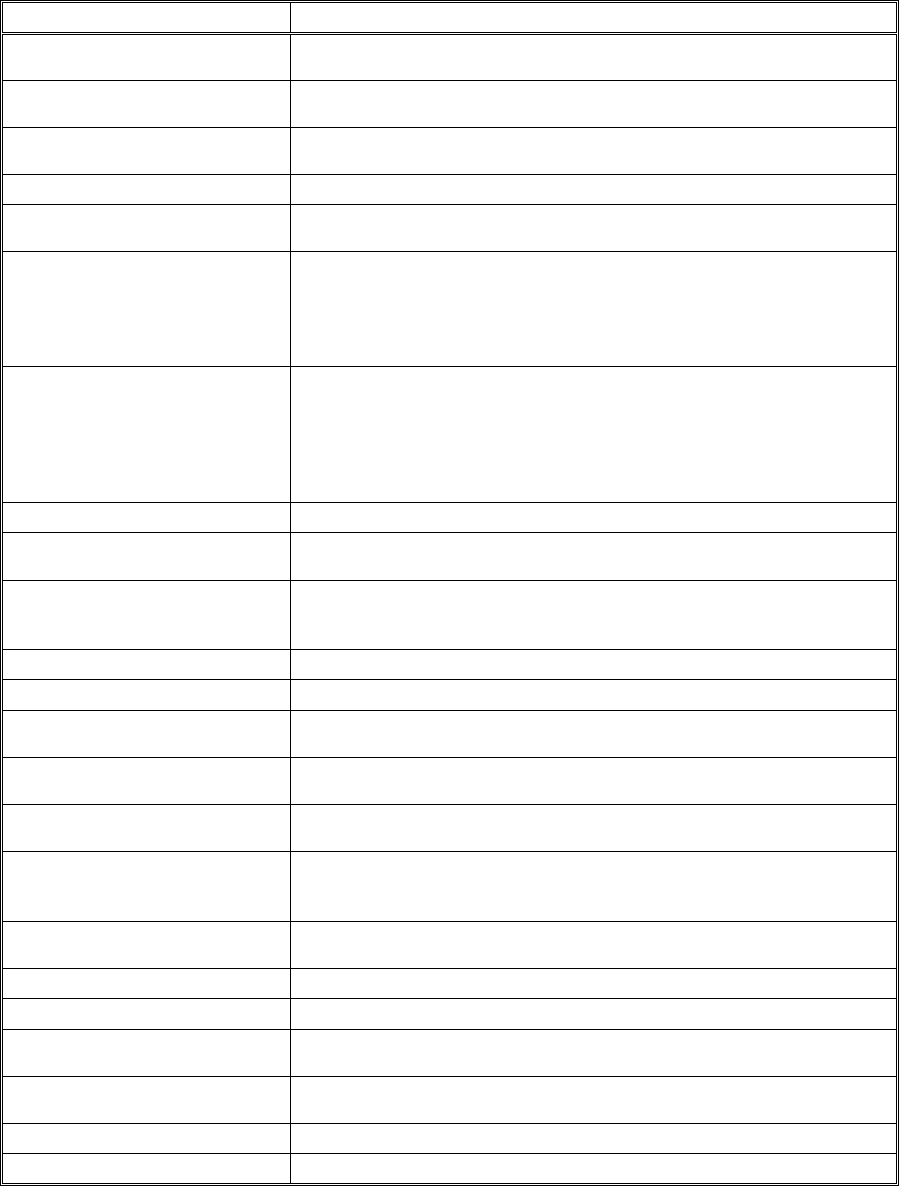

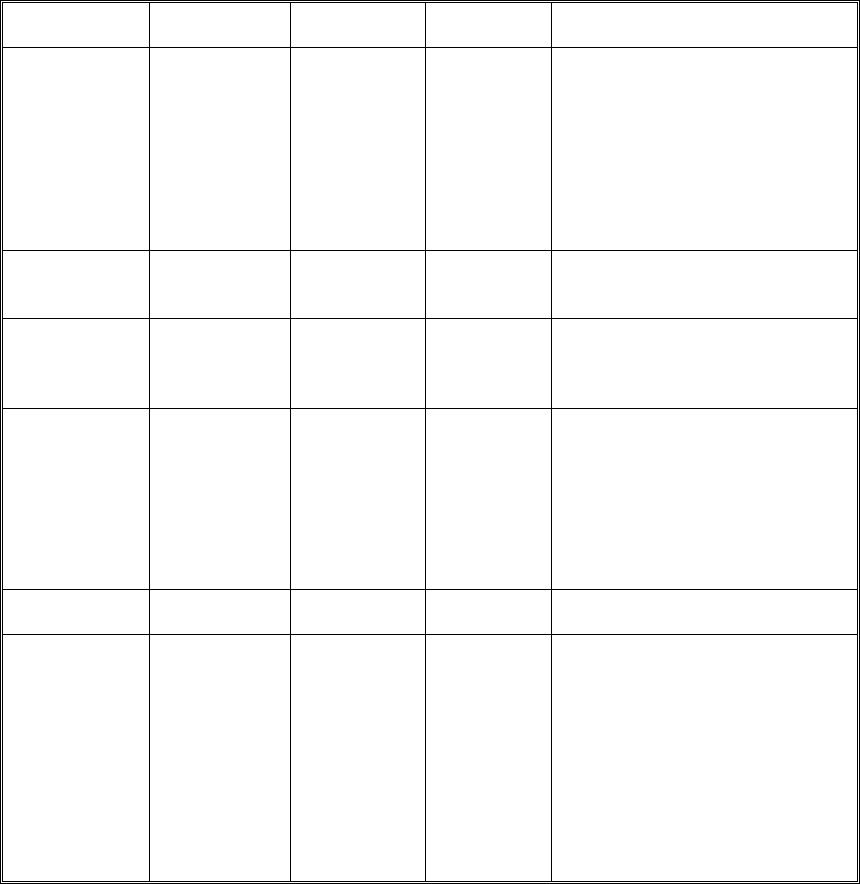

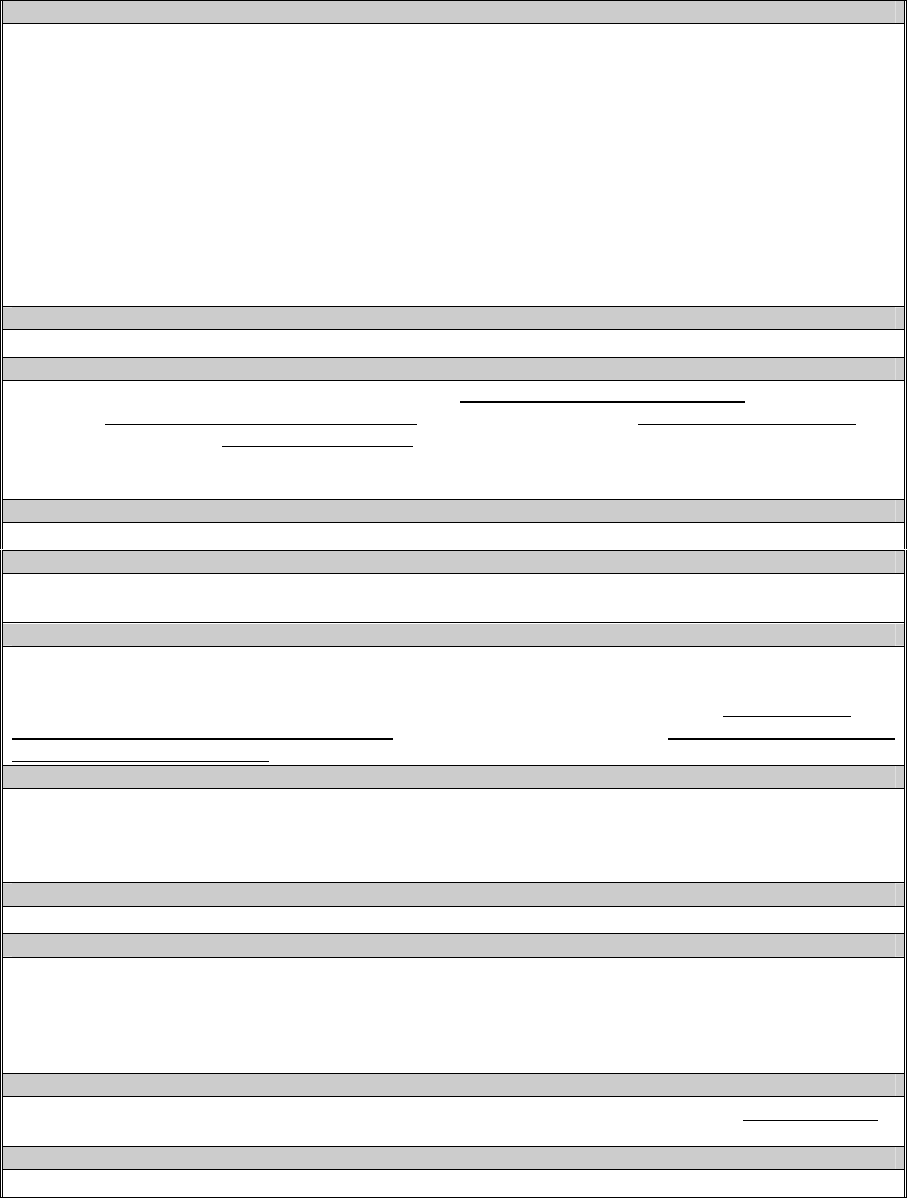

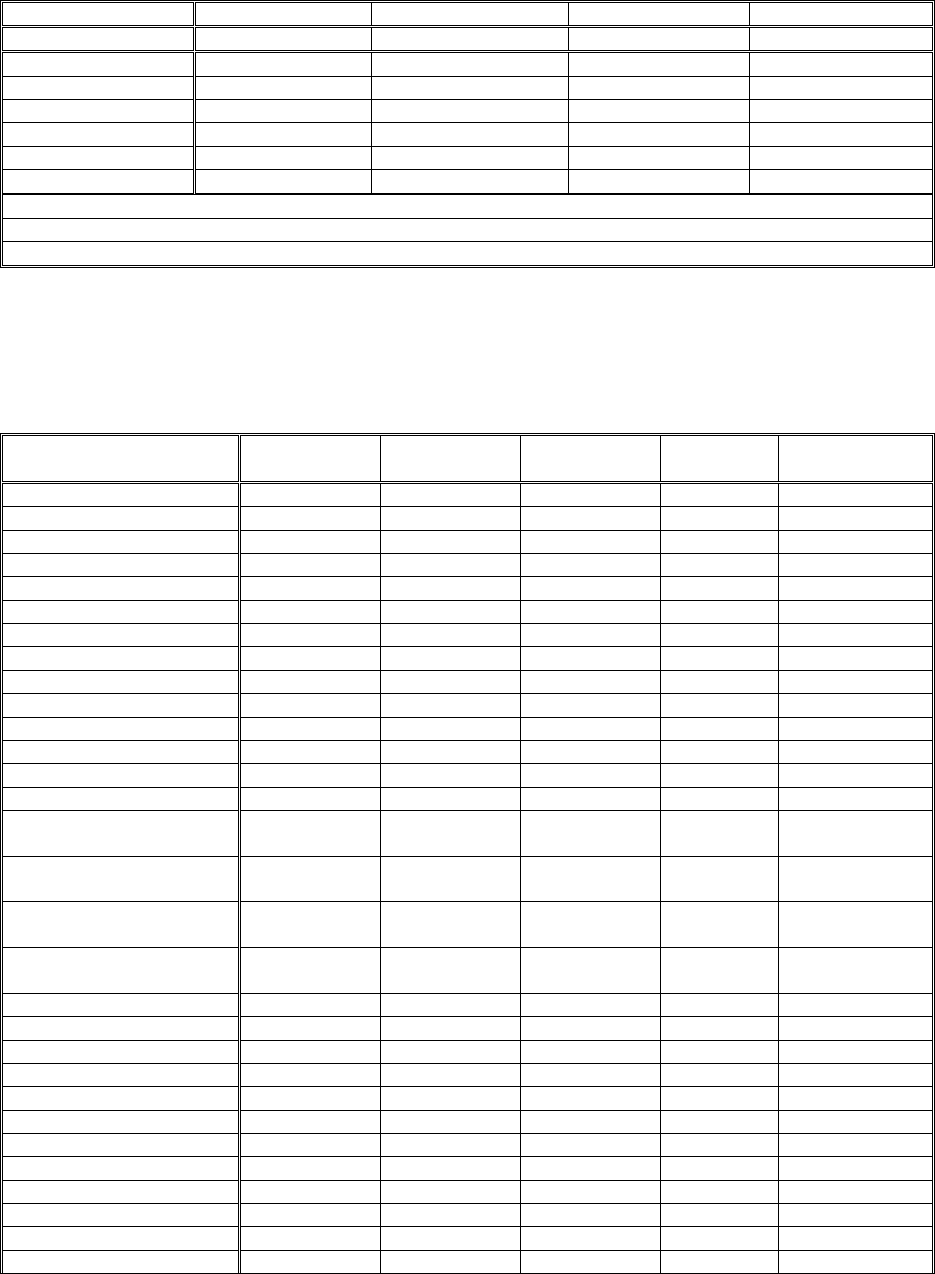

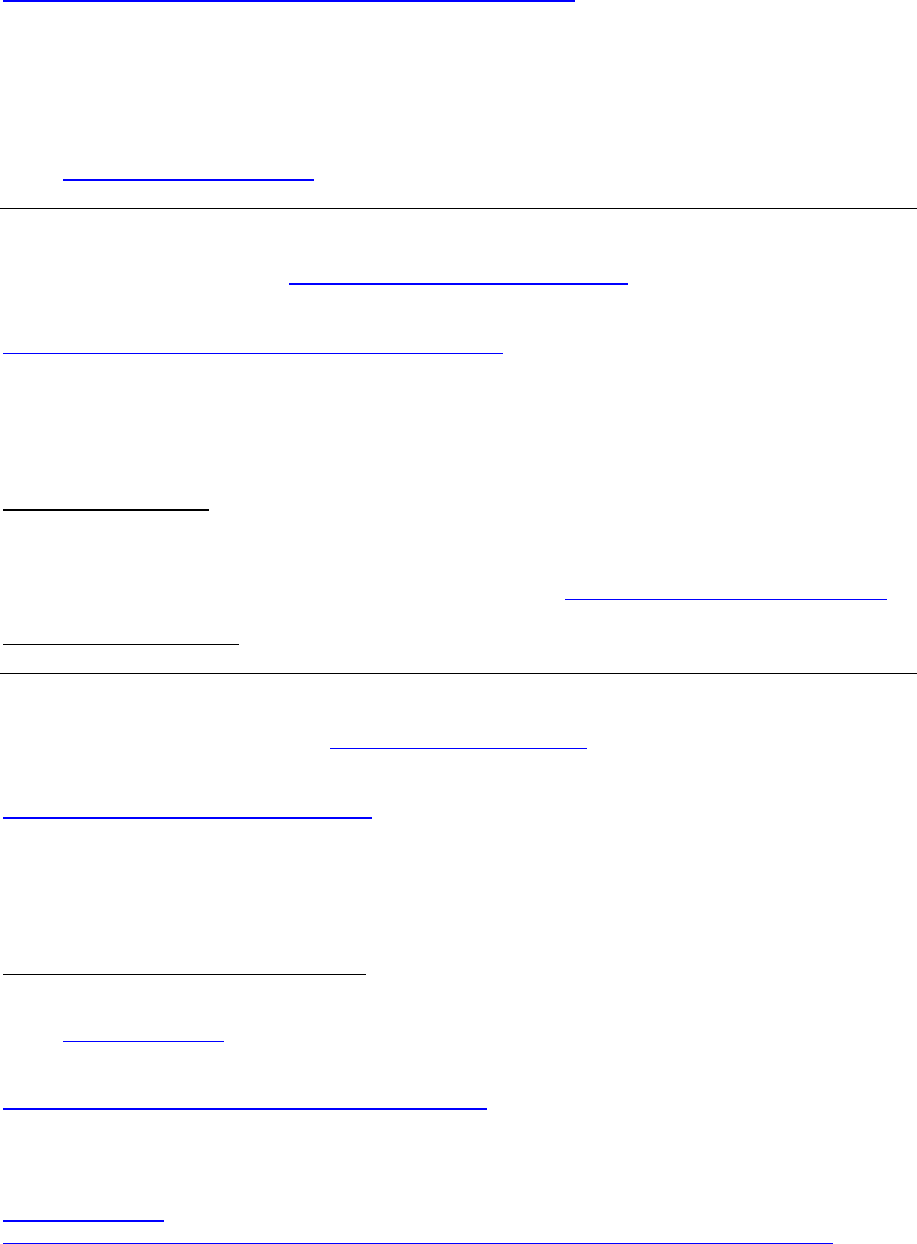

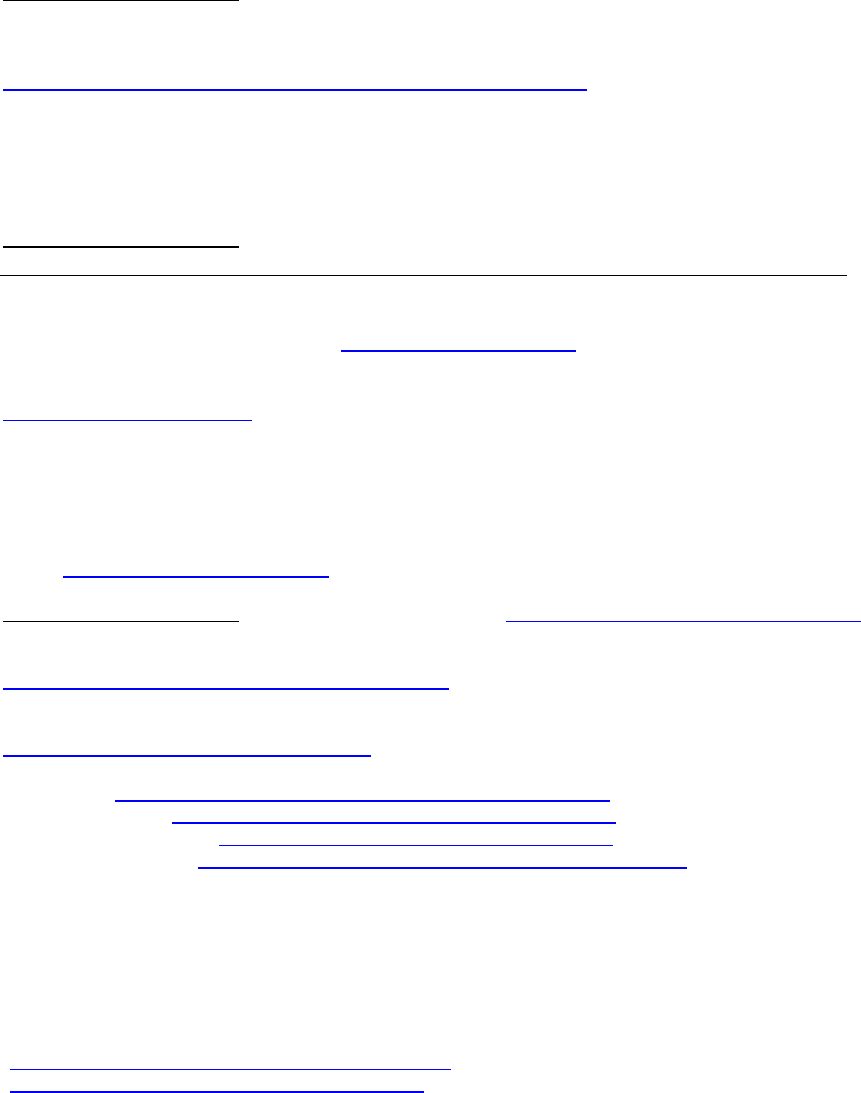

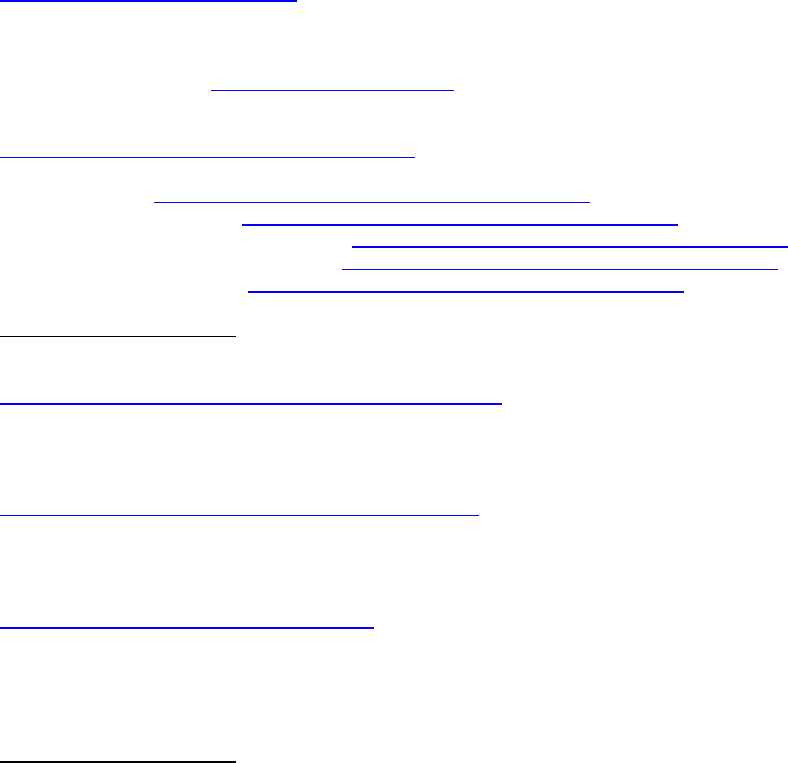

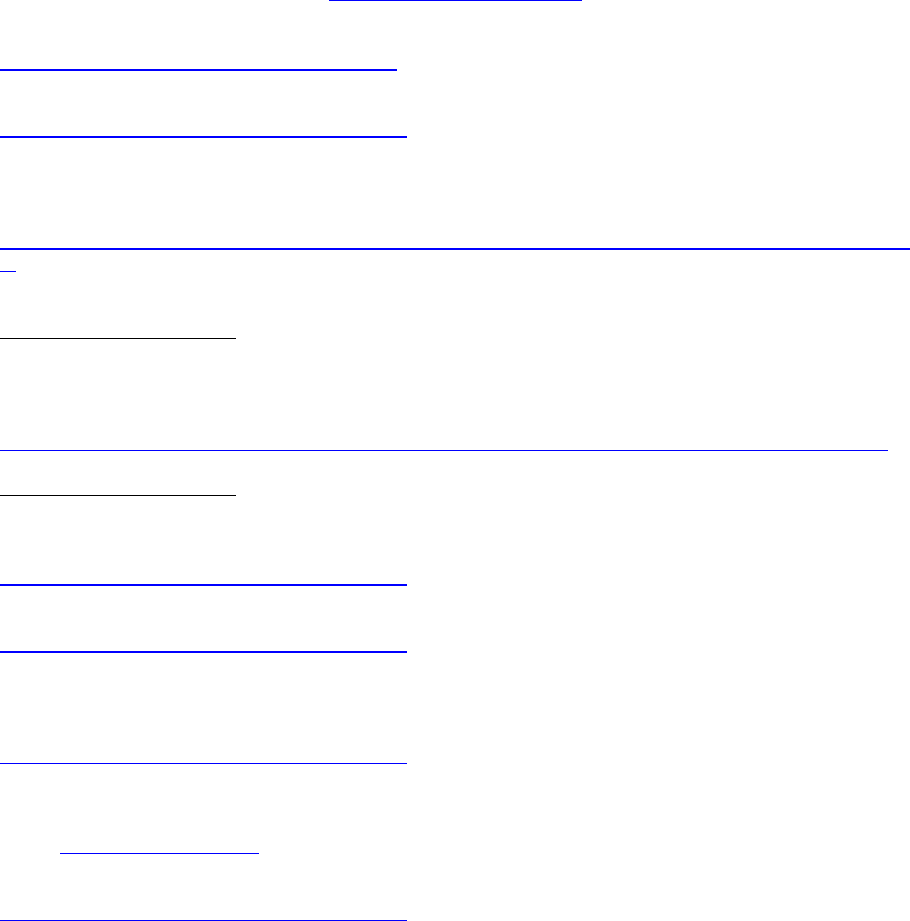

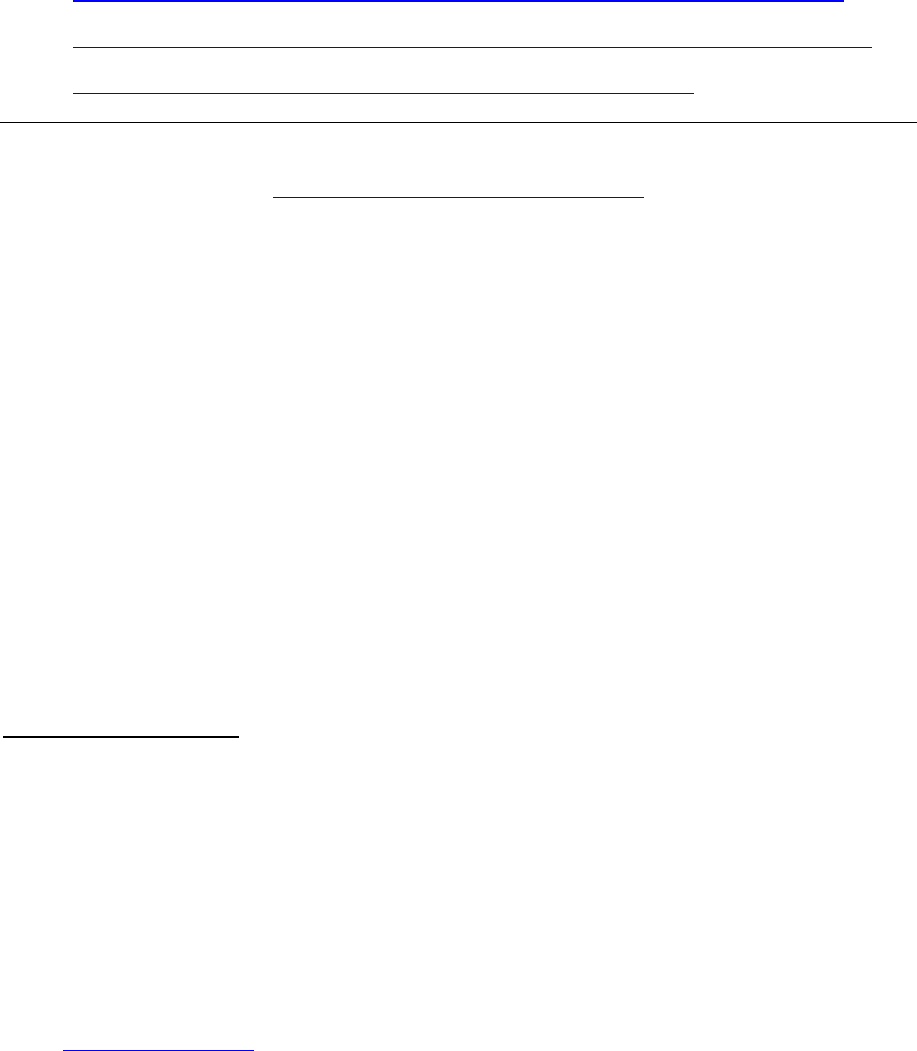

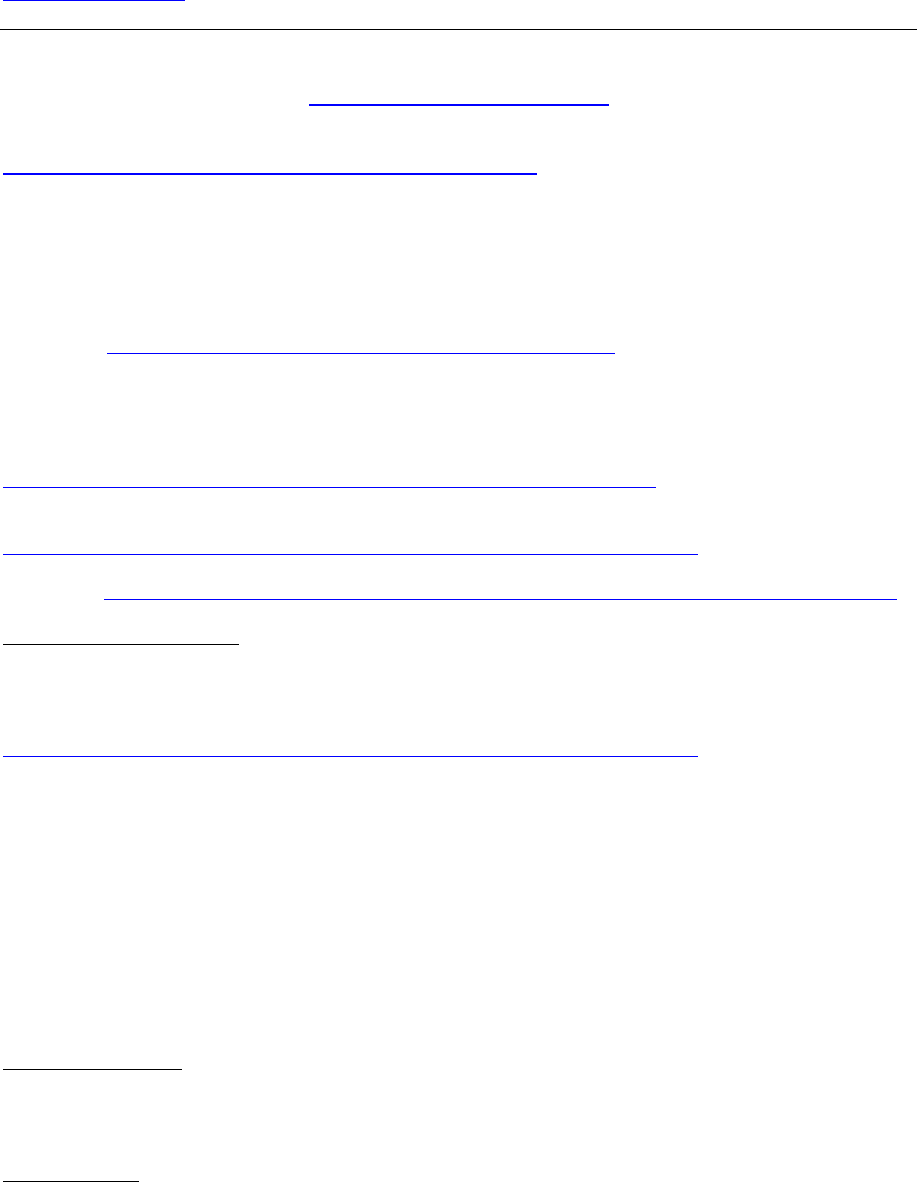

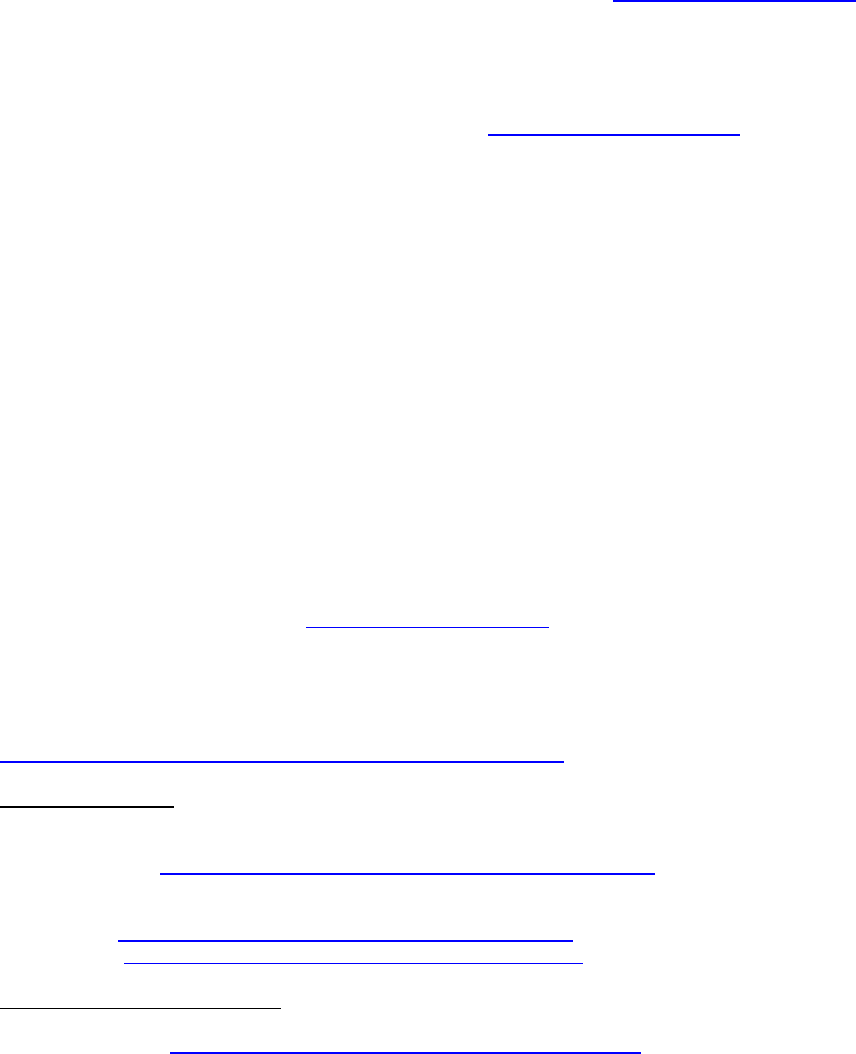

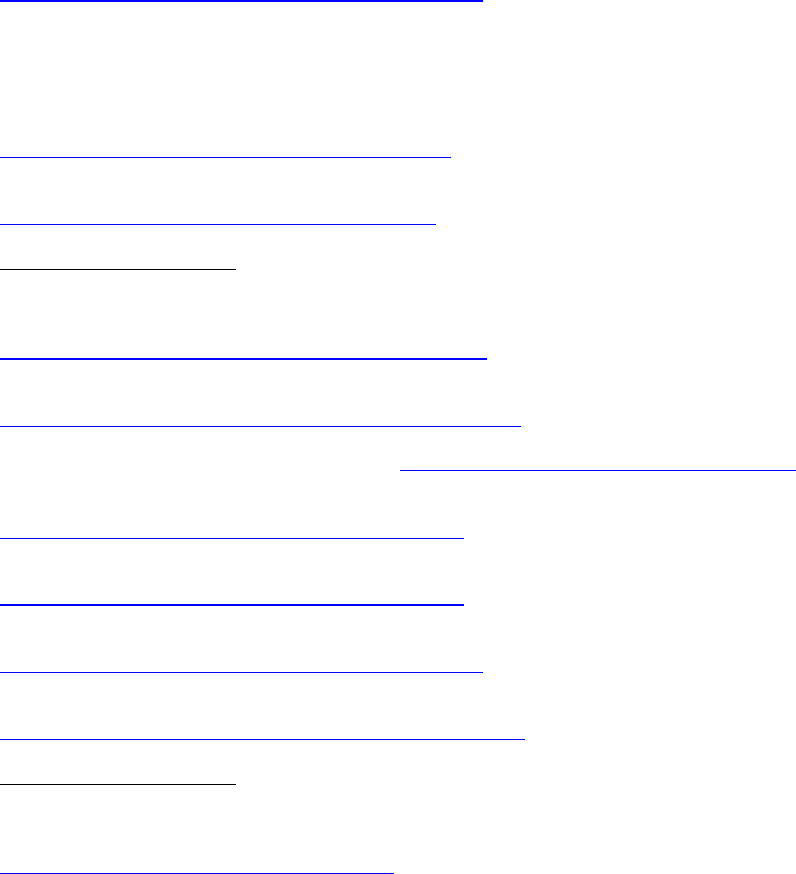

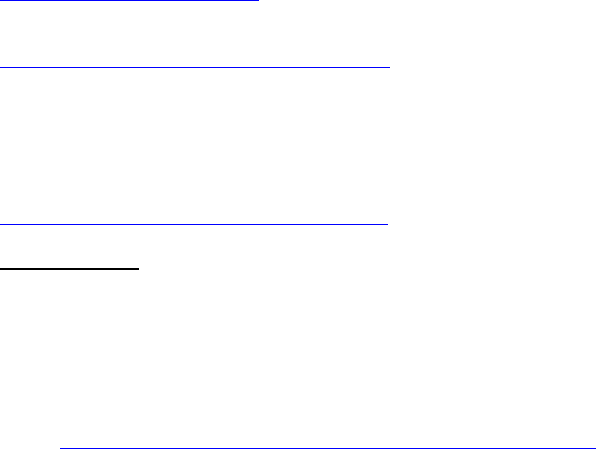

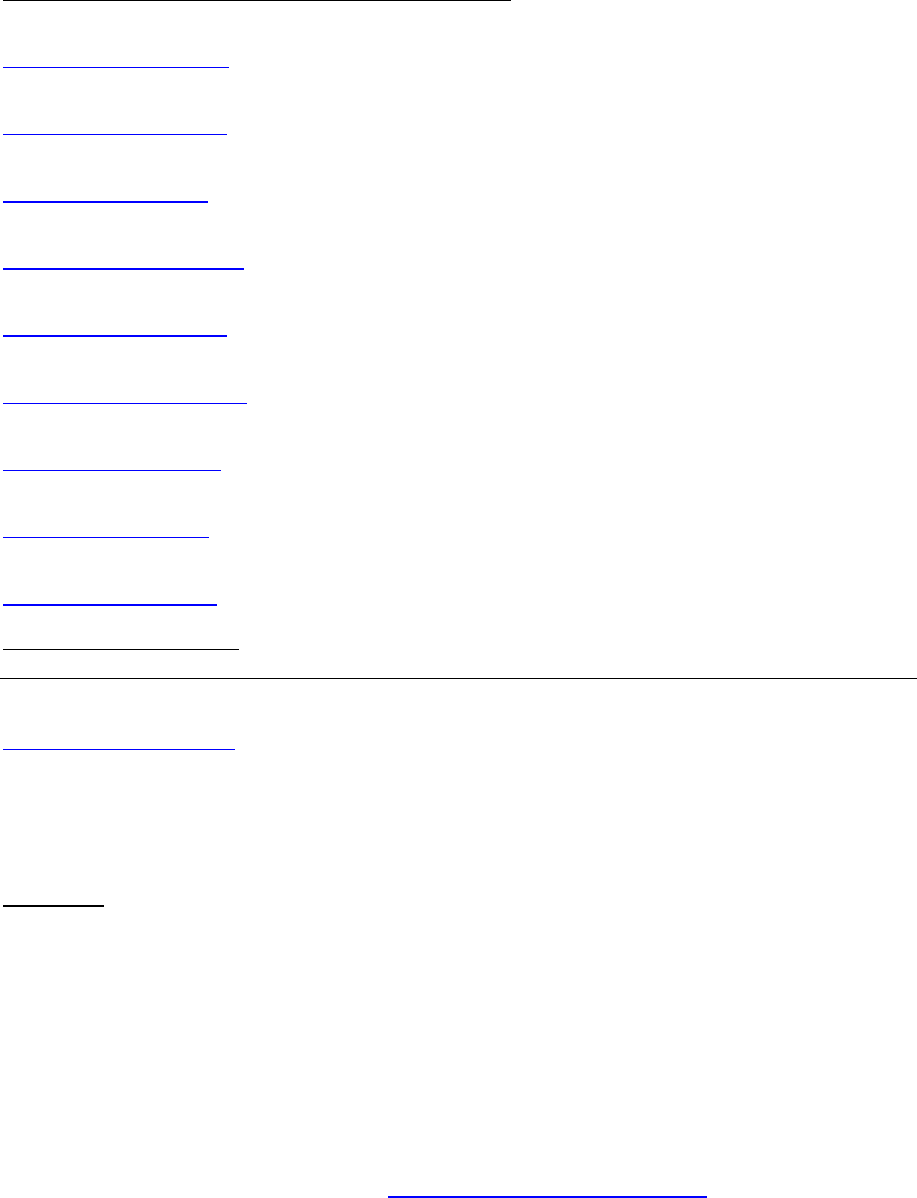

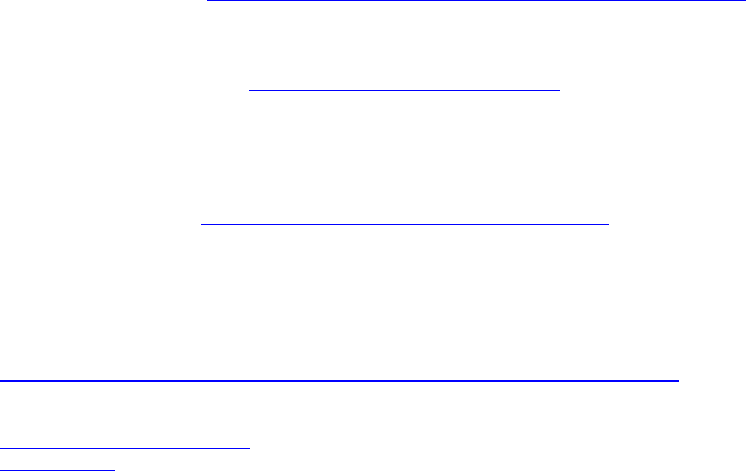

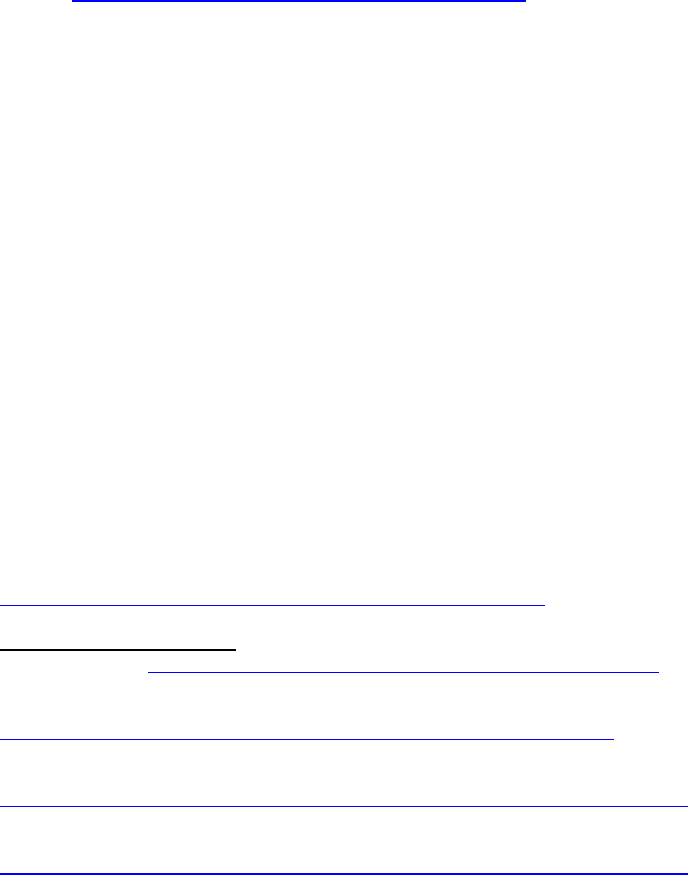

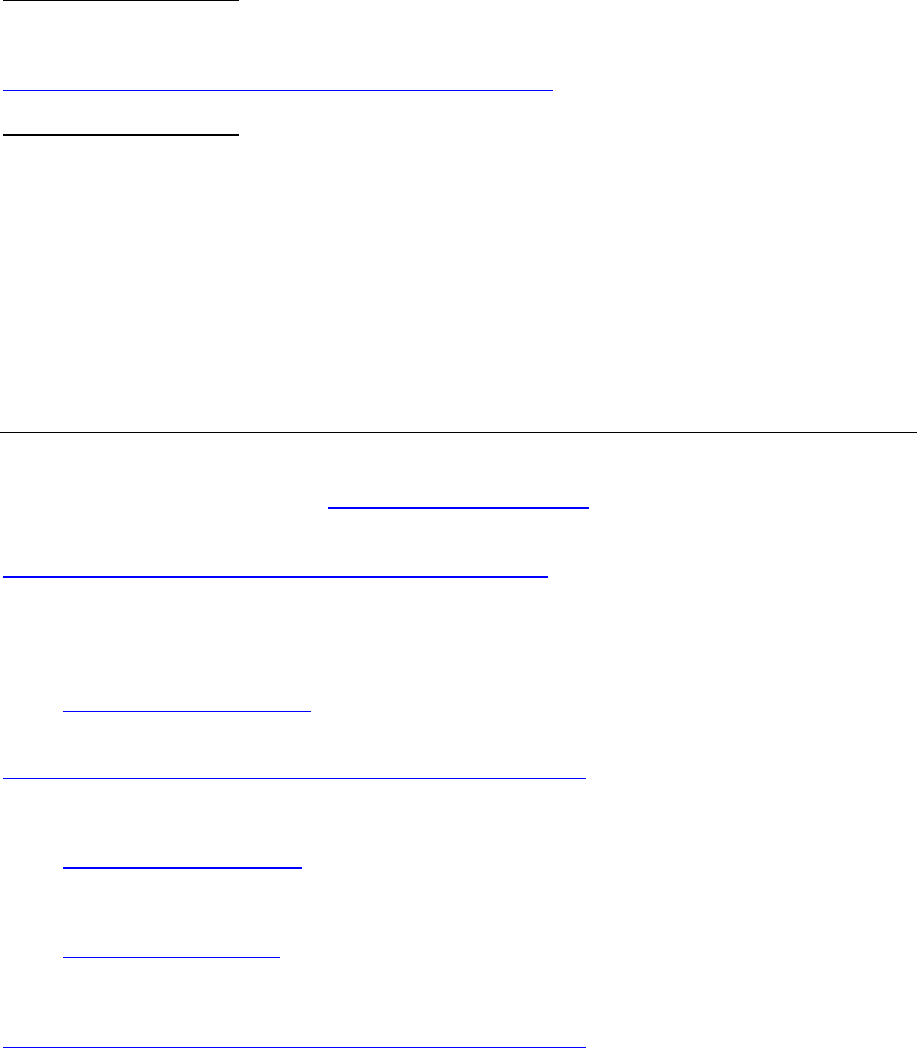

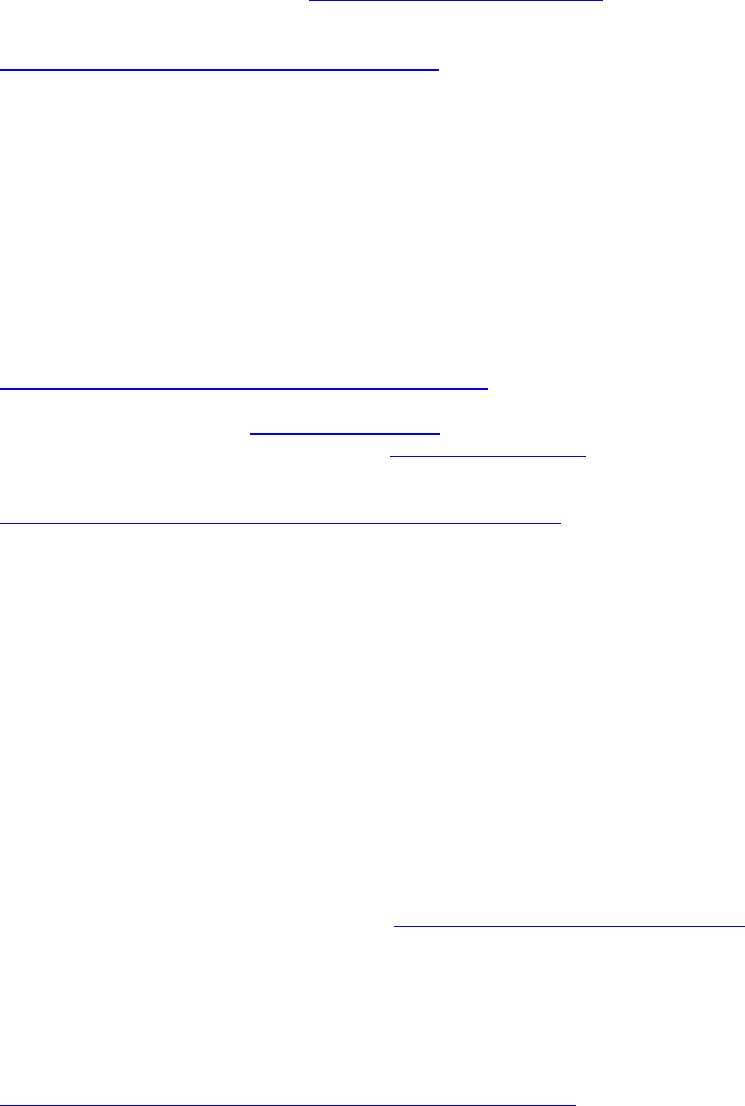

following table provides relevant phone numbers and website addresses for all of the states:

Rogue Real Estate Investor

-

12

-

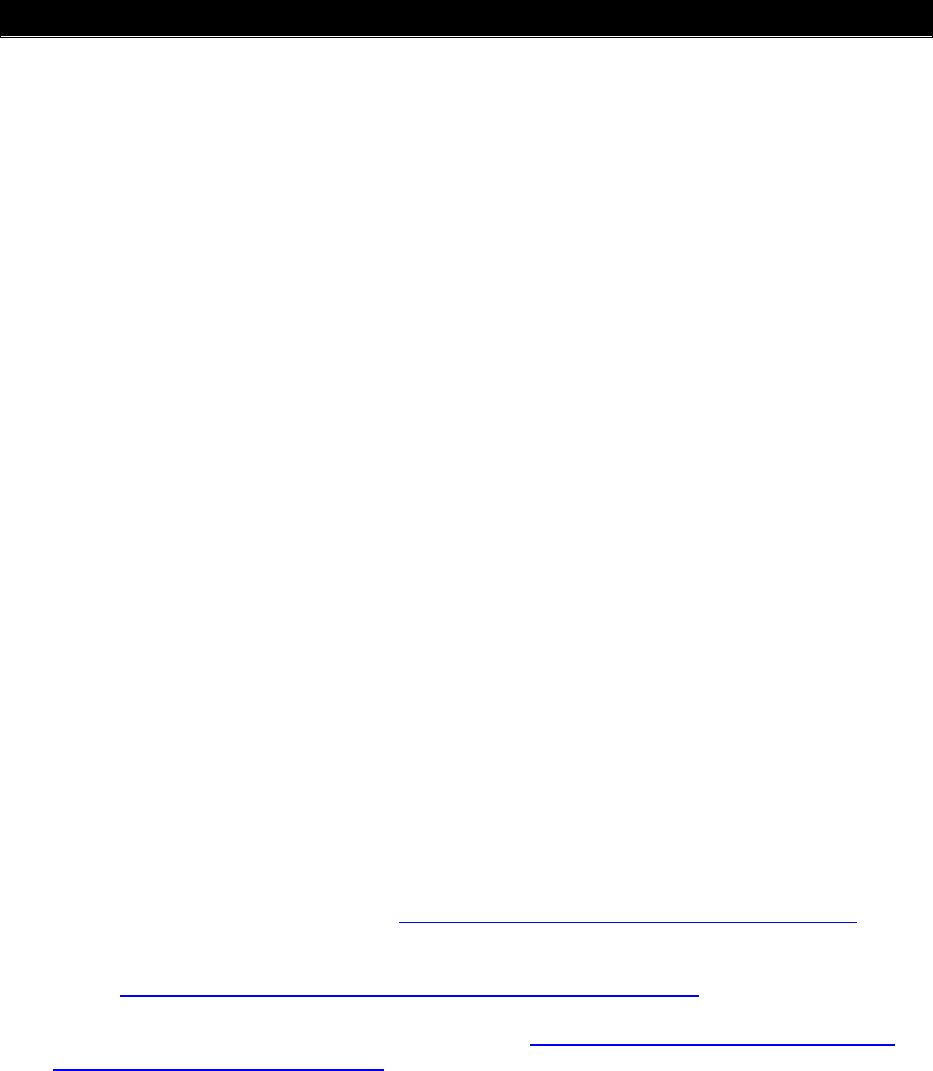

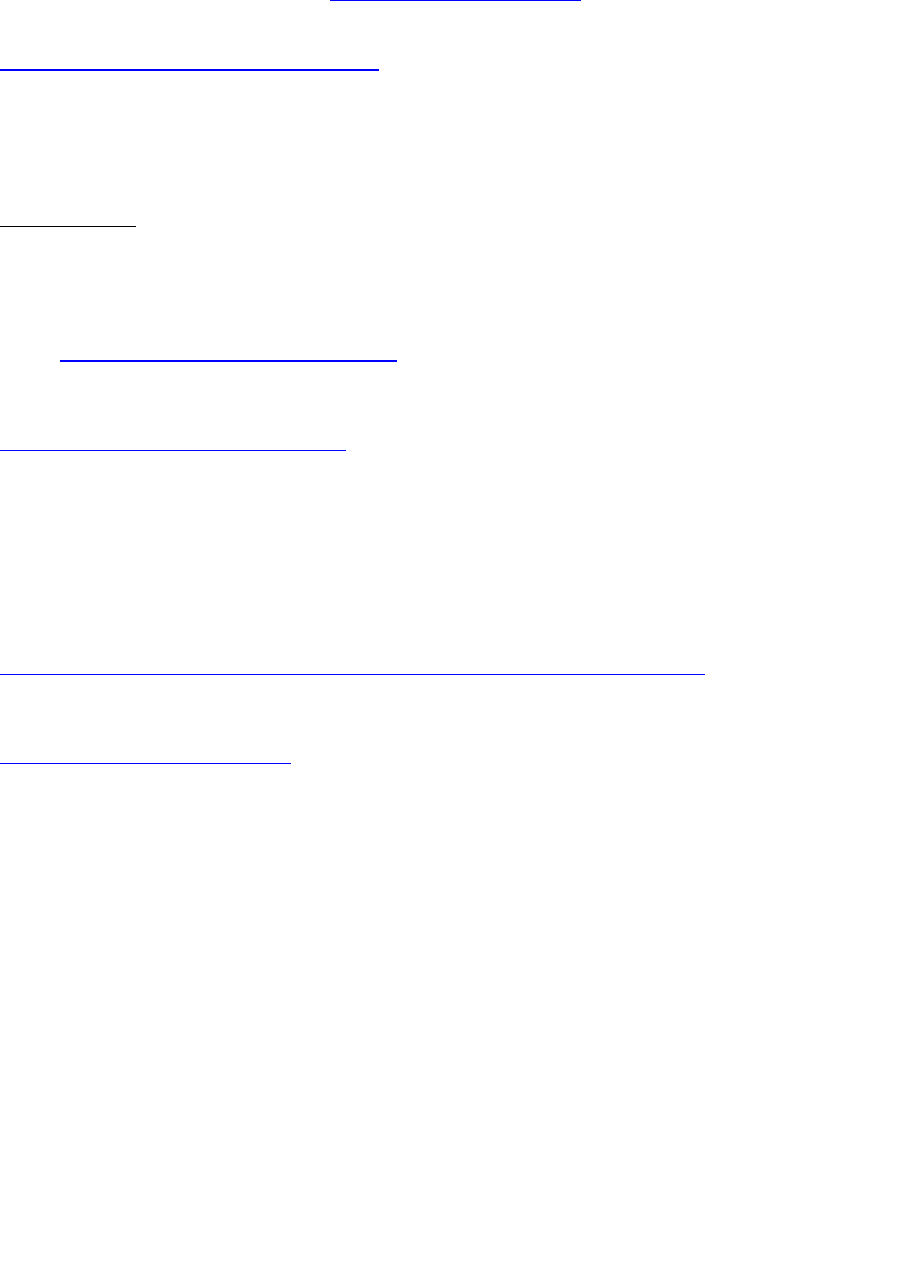

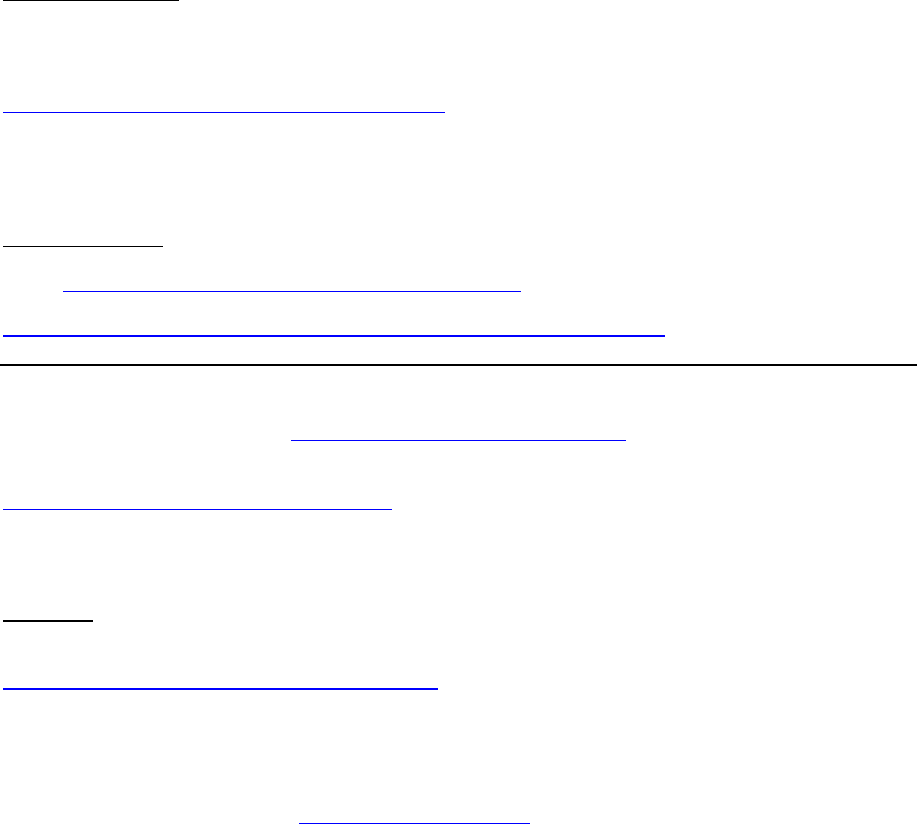

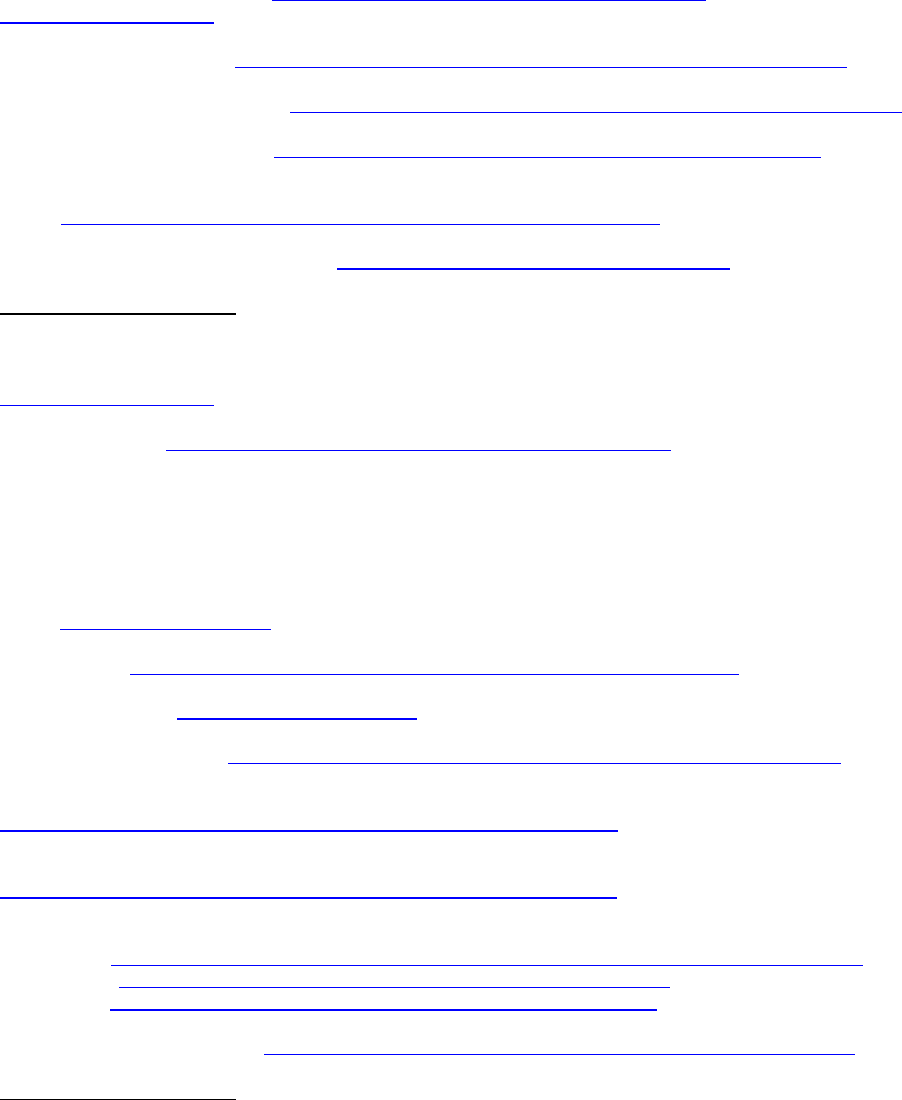

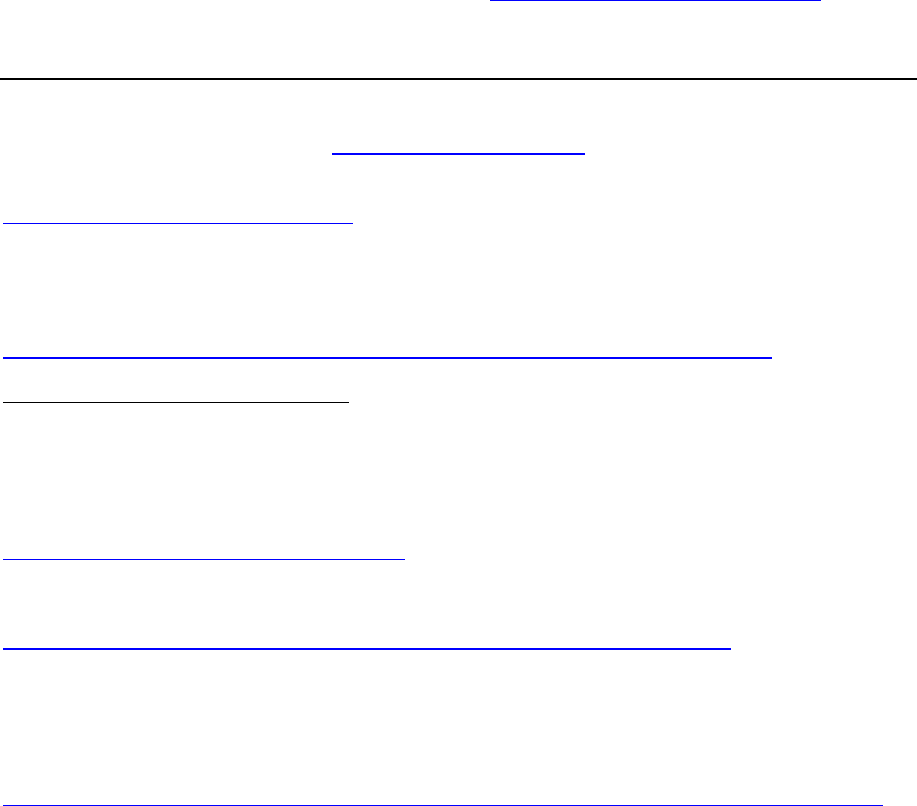

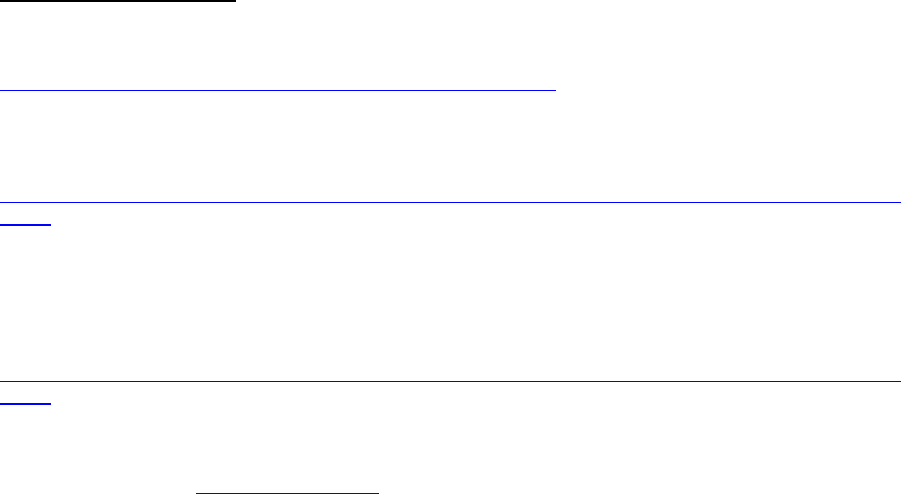

State

Phone No.

Website Address

Alabama

334

-

242

-

5324

http://www.so

s.state.al.us/BusinessServices/Default .aspx

Alaska

907

-

465

-

2530

http://www.commerce.state.ak.us/occ/home.htm

Arizona

602

-

542

-

3521

http://www.azcc.gov/divisions/corporations/

Arkansas

888

-

233

-

0325

http://www.soswe b.state.ar.us

California

916

-

657

-

5448

http://www.ss.ca.gov/busin

ess/business.htm

Colorado

303

-

894

-

2200

http://www.sos.state.co.us/pubs/business/main.htm

Connecticut

860

-

509

-

6151

http:/

/www.concord

-

sots.ct.gov/ CONCORD/index.jsp

Delaware

302

-

739

-

3073

http://www.state.de.us/corp

District

of

Columbia

202

-

442

-

4432

http://dcra.dc.gov

Florida

850

-

245

-

6051

http://www.dos.state.fl.us/doc/index.html

Georgia

404

-

656

-

2817

http://www.sos.state.ga.us/corporations

Hawaii

808

-

586

-

2727

http://www.businessregistrations.com

Idaho

208

-

334

-

2301

http://www.idsos. state.id.us/cor p/corindex.htm

Illinois

217

-

782

-

6961

http://www.cyberdriveillinois.com/departments/business_ser

vices/home.html

Indiana

317

-

232

-

6531

http://www.in.gov/ sos/business/in

dex.html

Iowa

515

-

281

-

5204

http://www.sos.state.ia.us/business

Kansas

785

-

296

-

4564

http://www.kssos.org/main.html

Kentucky

502

-

564

-

3490

http://sos.k y.gov/business/

Louisiana

225

-

925

-

4704

http://www.sos.louisiana.gov/tabid/66/Default.aspx

Maine

207

-

624

-

8400

http://www.state.me.us/sos/cec/cec.htm

Maryland

410

-

767

-

1184

http://www.dat.state.md.us/sdatweb/charter.html

Massachusetts

617

-

727

-

9640

http://www.state.ma.us/sec/cor

Michigan

517

-

241

-

6470

http://www.michigan.gov/dleg

Minnesota

800

-

627

-

3529

http://www.revisor.

leg.state.mn.us/stats/322B

Mississippi

601

-

359

-

1633

http://www.sos.state.ms.us/busserv/in dex.asp

Missouri

573

-

751

-

4153

http://www.sos.mo.gov

/Default.asp

Montana

406

-

444

-

3118

http://sos.state.mt.us/BSB/index.asp

Nebraska

402

-

471

-

4079

http://www.sos.state.ne.us/business/corp_ser

v

Nevada

775

-

684

-

5708

http://sos.state.nv.us/business/

New

Hampshire

603

-

271

-

3244

http://www.state.nh.us/sos/corporate/Forms.html

New J

ersey

609

-

292

-

9292

http://www.state.nj.us/njbgs/index.html

New Mexico

888

-

427

-

5772

http://www.nmprc.state.nm.us

New York

518

-

474

-

4752

http://www.dos.state.ny.us

North Carolina

919

-

807

-

2225

http://www.secretary.state.nc. us/corporations

North Dakota

800

-

352

-

0867

http://www.nd.gov/sos/businessserv/registrations/index.html

Ohio

877

-

767

-

6446

http://www.sos.state.oh.us

Oklahoma

405

-

521

-

3912

http://www.sos.state.ok.us/forms/FORMS.HTM

Oregon

503

-

986

-

2200

http://www.sos.state.or.us/corporation/f orms/index.htm

Pennsylvania

888

-

659

-

9962

http://www.dos.state.pa.us/dos/site/default.asp

Rhode Island

401

-

222

-

3040

http://www3.sec.state.ri.us/divs/corps/index.html

South Car

olina

803

-

734

-

2158

http://www.scsos.com/forms.htm

South Dakota

605

-

773

-

4845

http://www.sdsos .gov/busineservices/corporations. shtm

Tenn

essee

615

-

741

-

2286

http://www.state.tn.us/sos/bus_svc/index.htm

Texas

512

-

463

-

5555

http://www.sos.state.tx.us/corp/index.shtml

Ut

ah

877

-

526

-

3994

http://corporations.utah.gov/

Vermont

802

-

828

-

2386

http://www.sec.state.vt.us/tutor/ dobiz/llc/llchome.htm

Virginia

866

-

722

-

2551

http://www.state.va.us/scc/division/clk/fee_bus.htm

Washington

360

-

725

-

0377

http://www.secstate.wa.gov/corps/

West Virginia

304

-

558

-

8000

http://www.wvsos.com/business/services/formindex.htm

Wisconsin

608

-

261

-

7577

http://www.wdfi.org/corporations/

default.htm

Wyoming

307

-

777

-

5333

http://soswy.state.wy.us/corporat/corporat.htm

Rogue Real Estate Investor

-

13

-

Contact your state and find out what forms are necessary. An excellent resource for information

on LLCs is

the Nolo law guide entitled,

Form Your Own Limited Liability Company

(

Mancuso,

2007

).

Step 4: Purchase Umbrella Liability Insurance

When you first start investing, you may be too busy to deal with a business structure other than

asoleproprietorship;

therefore, it i s important to limit your liability as cheaply as possible. One

way is to purchase an umbrella liability policy. Umbrella

liability i

nsurance is extremely cheap,

usually only a fe

whundreddollarsperyearforone

million dollars worth of co

verage.

Most policies will make you bump up your current limits for your automobiles and house before

they will issue an umbrella policy. A s you purchase rental units you a lso

will

need to inform your

insurance company so that each one can be added on you

rpolicy.

If you haven’t

done so

already, you should consider consolidating all of your insurance to one

company and requesting a discount. That’s what I have done. That way you will be dealing with

the same company.

Here is why liability insurance is

im

portant. What if you purchase a property with a current renter

and the next day an ice storm causes one of your tenants to fall and break an arm? The tenant

may have the right to sue you for not clearing the walkway. A good umbrella policy

,

in

combination

with your property insurance

,

should cover you. By all means, speak with an

insurance specialist and read your policy in depth.

Step 5: C onsider the Tax Implications of Everything You Do

You’re a business now

,

so it’s time to reap the rewards that Congre

ss has established for

business owners. It basically boils down to this

:yo

ucanoffsetincomebyconsideringall

allowable expenses. For some of you, this will be a new way of thinking.

First and foremost, buy one or mor

eblankjournalbooksandkeepthe

m

in any vehicle that yo u

are going to use to look for, purchase and maintain

your

real estate

investments

.Writedownthe

starting date and mileage of your car. This will be the date that it was “put into service.” Now,

every trip, and I mean every trip,

that is related to your real estate business gets recorded.

Why? Because you can take a mileage deduction for all mileage related to your real estate

business. There is also an automobile deduction, which can be taken instead of mi

leage, but for

now it is

easier

to just use the standard mileage deduction. This changes,

but as of January 1,

2008, the standard mileage rate for business miles driven is 50.5 cents per mile

.Besureto

record the following trips:

x

Looking for properties

.

x

Meeting someone to look

at a property.

x

Visiting a bank or mortgage company.

x

Going to the library or bookstore f or research material.

x

Visiting the courthouse.

x

Buying supplies at a hardware store.

x

Buying marketing supplies.

x

Buying office supplies.

x

Meeting with a partner to discuss

arealestateventure.

Do not feel guilty about recording even the most mundane real estate activity.

Rogue Real Estate Investor

-

14

-

Next, keep track of all receipts related to your real estate

business

,suchasbooks,office

supplies, calculator, computer, hardware, tools, advertis

ing, marketing, professional fees

(attorneys, accountants, etc.). An easy way to do this is to set up a separate checking account

and use a separate credit card. Be careful,

because

some items may require keeping track of

usage, such as a computer used f or

both personal and business activities. Your tax specialist or

accountant will be able to help you or you can learn it as you go.

Step 6: Marketing

Like any business, you will need to spend some time developing or having someone develop

business cards,

logos, flyers, advertising copy and even magnetic signs for your car. You may

even want to develop a website to showcase propert

ies

that you have for sale.

If you are lacking

in ideas,

try

reading

Marketing Outrageously

by Jon Spoelstra ( 2001).

Real esta

te investing is a business, so you should treat it like one.

Once you get started, the

best form of marketing will be by word of mouth

,

so be sure to stand behind everything you say

and do.

Step 7:

Setting Up Your Business at Home

The final step in becom

ing a business is to set up an office or ar ea in your home or apartment to

use for conducting business. Since you will be placing a lot of phone calls and receiving a lot of

responses, make sure that you have an answering m achine or voice mail. Depending u

pon the

impact of the phone calls on your family, you might consider getting a separate phone line,

mobile phone or both. You will have to judge this on your own, but remember the object is to

make money not spend it. Try to balance being frugal with being

professional.

Most of you

who are

reading this already

own

acomputer,butifyoudon’t,

the majority of

public

libraries now offer computers with online access. With the Internet, research is just a few clicks

away.

Here is some other

office equipment

to consider as the need arises

:faxmachine,

scanner or

small copier, file cabinets and a desk. One way around some of the added expenses is to use a

local mail and copy shop, such as Mail Boxes Etc.

,UPS

Store

or

FedEx

Kinkos.

You can even

set

up a postal

mailing address to help eliminate some of the added junk mail or to m ake sure

you are able to separate your business activities from your family life.

Step 8: B uy Your Own Home First

Probably the single most important investment decision you’ll ever mak

eistobuyyourown

home. You’ve probably heard i t before and you may be saying it yourself, “Yeah right, I can

barely afford groceries.” If you don’t buy a house, you’ll never feel comfortable enough t o use

the real estate strategies I’m discussing. If y

ou don’t buy a house, you are making someone

else rich off of your sweat. If you don’t buy a house, you are less likely to build a substantial nest

egg. If you don’t buy a house, you’ll be paying Uncle Sam more in taxes than you have to.

Iknow

that

the m

ost common reason for not buying a house is

not being able to come

up with

the down payment. Believe me, it is possible if you set your goals, save

,

and use some of the

information contained in this book. My wife and I were a ble to buy our first house thro

ugh a

Federal Housing Administration (FHA) first

-

time homebuye r program with on ly 3 percent down

plus some closing costs. I was then able to borrow against my 401(k) plan at work for t he d

own

payment for a near no

-

money

-

down proposition.

Rogue Real Estate Investor

-

15

-

Owning your own

home is not a walk through dreamland. There will be maintenance, painting,

stopped toilets, water heaters to replace, air conditioners to fix and even the occasional large

expense of a new roof or driveway, but it’s your property. There is a sense of prid

ethatcomes

with owning a piece of the world.

If you are thinking about buying a house, I recommend contacting a good real estate agent who

works in the area you are interested in. Have the real estate agent act as your “buyer’s agent”

and she will be hi

ghly motivated to find you a property. You do know what areas you are

interested in, right? I hate to use this cliché, but I feel compelled to r emind you about the three

most important things in r eal estate: (1) location, (2) l ocation and (3) location. Wha

tthisreally

means is finding an area where housing is appreciating (going up in value), with good schools,

parks and police. M ake sure it is not too far from a metropolitan center or area of employment.

As a side benefit of buying your first house, you

will get a quick education in the real estate

industry. You will encounter numerous real estate agents and brokers. You will learn how to

evaluate a house, m ake an offer and a counter offer. You will get to sign a contract, and work

with a title company, a

swellasstructuralandmechanicalengineers/inspectors.Inotherwords,

you will see the whole real estate industry in action. If you p

lan on building a house, there is

even more to consider, such as architectural plans, soil testing, environmental surve

ys, general

contractors, subcontractors, and “a partridge in a pear tree.”

Step 9: Learn the Industry

As I have alluded to, real estate is not unlike any other profession. Each profession has i ts own

set of rules and language that you must learn. If you

are old enough to have worked in any

industry, you know that there are thin gs you do and say t hat only apply to where you work.

My f irst job at age 16 was working as

a

busboy. Perhaps you have heard some restaurant lingo,

like “86ing” something, which m ea

ns to get rid of it.

In the environmental field, where I worked

for over 15 years

,

acronym

-

speak is so prevalent that you might think another l

anguage was

being spoken. Here i s

an example: “In reviewing the Phase I, I noted that most of the BTEX

compounds

were ND.” If you understood that, then you must work in the field. The point is that

real estate is the same and you must learn the lingo. I even have a dictionary of real estate

terms. Appendix A of this b ook contains a list of what I believe are some of

the most important

terms, acronyms and abbreviations.

Spend at least a couple of minutes going through Appendix A. Occasionally we add new real

estate definitions on our

web

site at

http://www.rogueinvestor.com/definitions/real_estate_investing_definitions.html

.

Make sure you are comfortable with the real estate lingo. Here is a quick assignment for you

(hint, the answers are given at the end of this chapter

):

1.

What is the difference between real estate and real property?

2.

What is a deed and how does it differ from a mortgage?

3.

The difference between what someone owes on a mortgage and what a property is

worth is called what?

4.

What does FSBO stand for?

5.

What is t

he M LS?

6.

The value of most residential property is determined using the CMA process, which is

what?

7.

Name at least one method for estimating the value of real estate.

8.

Is a fixture, l ike a ceiling fan, personal property or real property?

Rogue Real Estate Investor

-

16

-

9.

An agreement between

two or more competent and legal parties is called what?

10.

Arealestateagentwhoworksforabuyeriscalledwhat?

11.

Arealestateagentmustworkfora________?

12.

Moving a first mortgage to a second mortgage is called what?

13.

What is the best type of deed?

14.

Ofte

ntimes, one divorcee will use a ________ deed to remove his/her i nterest in a

property.

15.

True or false? Contractors are allowed by law to place a lien on a property if the owner

fails to pay their fees.

16.

Most conventional lenders require at least 20 percent

down or PMI must be obtained.

What is PMI?

17.

What does PITI stand for?

18.

What is an ARM?

Step 10: Know Your Investing Options

What are your investing options? First, you have to decide if you want to be a hands

-

on or

hands

-

off real estate investor. There ar

eobviouslybenefitsanddownsidestoeachone.Many

real estate packages focus only on hands

-

on investing, such as buying and selling houses or

investing in rental property. While this is a great way to build a substantial net

worth, it may not

be what yo

uarelookingfor.Ifyouare

looking for a more passive way to invest in real estate,

consider the following options.

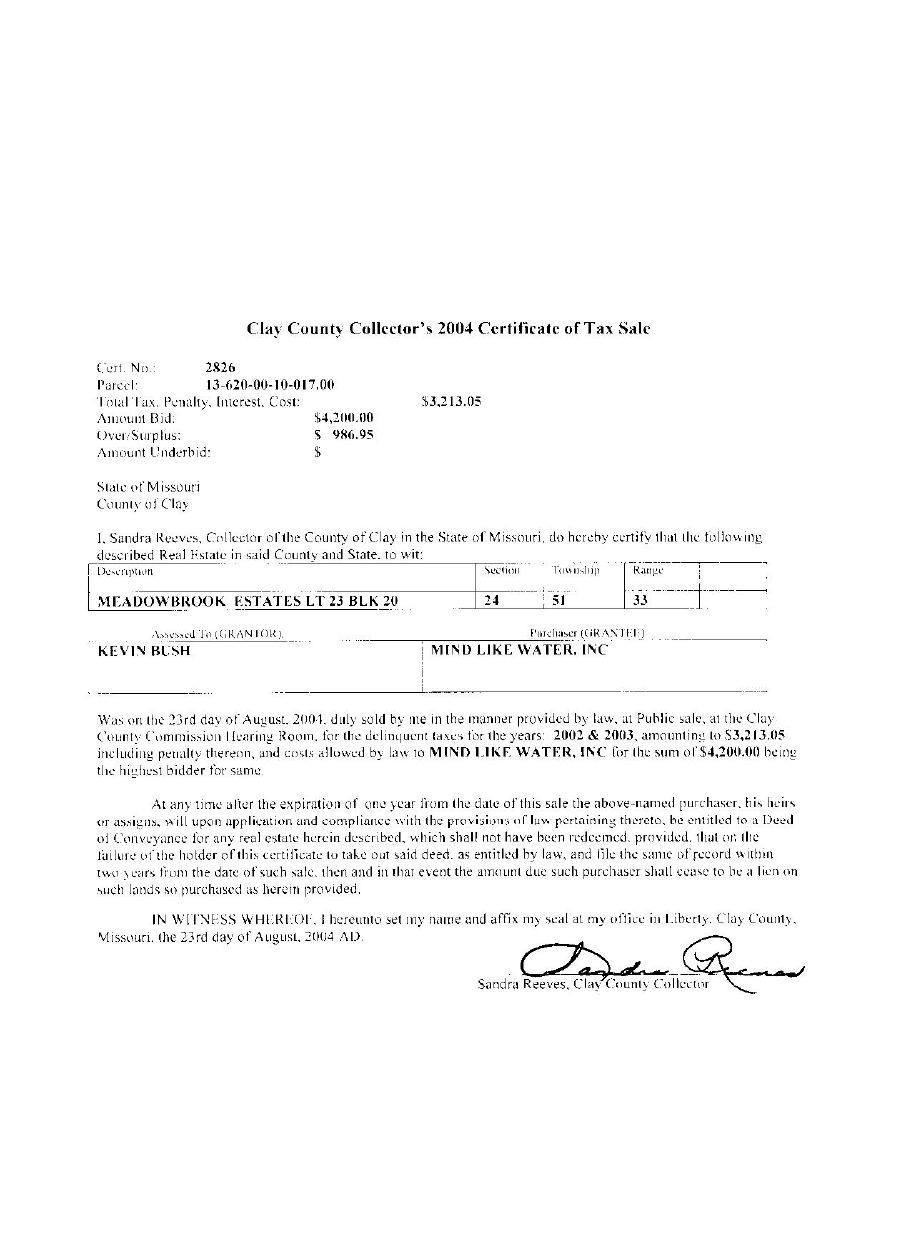

Tax lien certificates

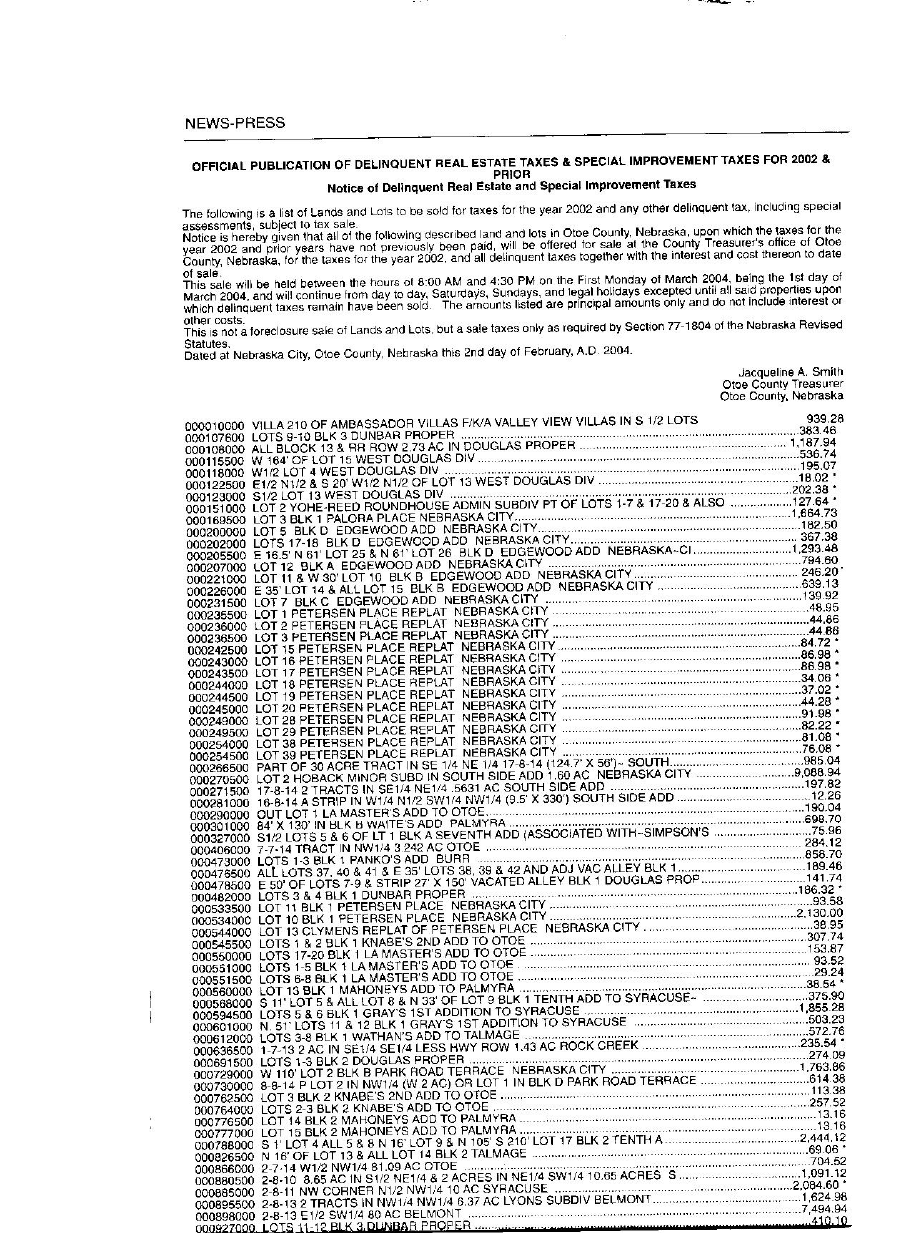

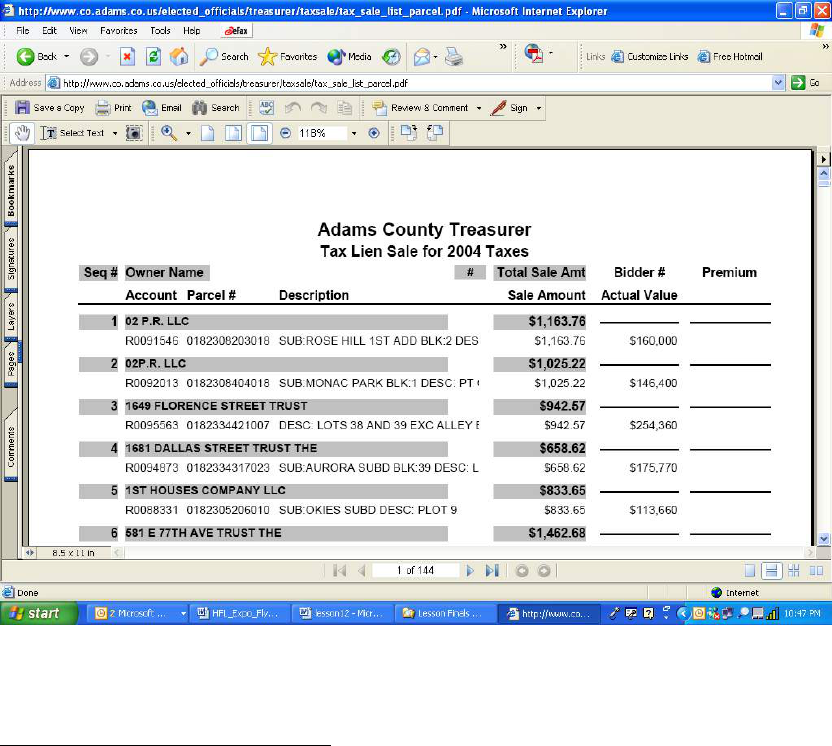

Tax liens result when real estate owners fail to pay their property taxes. County and municipal

governments rely

heavily on tax revenue

;

and rather than fight with property owners in court,

they have devised a revenue collection method that allows them to be paid, res ults in penalties

to property owners

,

and enables investors to make some serious money. Every state a

nd

county is different, but essentially an investor can bid on a tax lien certificate, which allows him

or her to have control of the lien. Property owners must pay off the lien holder (investor) with

interest or face possible foreclosure.

To make it eve

nbetter,theinterestratesareoftenhighanditisasafeinvestmentthatis

backed by a local government entity. What kind of returns can you expect? Here is a sampling:

x

Nebraska

–

14%

x

Arizona

–

16%

x

Florida

–

18%

x

Illinois

–

18% for six months

x

Iowa

–

2

4%

.

Tax deed sales

Some states and Canadian provinces foreclose on the tax liens and take possession of the

property’s deed. The deeds are then auctioned off and you

can

bid on possession of the

property. In many cases, you can pick up real estate for 20

to 30 percent of its value. In

essence, you are buying into a lot of instant equity. T ax deeds are one of the most exciting and

profitable ways to invest in real estate.

For instance, imagine finding a lake front lot in a prestigious community with a nea

rby golf

course and all the amenities. Now consider that the property values for lake front lots in this

area are $90,000 to $125,000. What if I told you that because the owner failed to pay his taxes

Rogue Real Estate Investor

-

17

-

the county took possession of the property and offered

it for sale for around $14,000, which

included the m inimum bid, taxes and fees? Imagine you have to bid a little bit higher to make

sure you win, let’s say by roughly $2,000. This

is not a

hypothetical example

,

it

is true!

Real estate investment trusts

Briefly, REITs are trusts that pool r eal estate properties together and allow investors to own a

small portion, just like stocks or mutual funds. REITs have some very specific guidelines to

follow, such as pa ying out 95 percent of their profits to their sh

areholders

through distributions

.

This often results in high dividend yields, with relatively low risk.

REIT dividend payouts are sometimes huge. I purchased a REIT a few days before the

company issued its normal dividend, plus a special dividend. In les

sthanonemonththe200

shares I purchased paid out 2.6 percent or $98.50 from my $3,815.95 initial investment. On a

n

annual basis that’s

more than a

50 percent return, even taking into account t he $12 trading fee.

What’s even better is that REITs issue d

ividends four times per year, not just once. The final

icing on the cake is that the stock price has gone up a bout $1 per share, so that’s an extra $200

or 5 percent.

Discounted mortgages/notes

Another little known investing option is to invest in mort

gages or notes. As y ou will see in

Chapter 5, it is possible to m ake creative financing arrangements in part by using promissory

notes. A promissory note is essentially an IOU or a loan. It has an amount, interest rate and

length of term.

Anotecanbe

purchased fr om a homeowner or other investor by simply discounting the note to

present value and purchasing the note. This is possible because there is a time value

associated with money. In other words, $1,000 is more valuable today than it is in 20 years

.

That only makes sense, right? In 20 years, $1,000 won’t buy as much stuff due to inflation.

The opposite is also true. For example, let’s say Betty has a $15,000 note with an interest rate

of 9 percent. It is amortized over 10 years. Plugging these nu

mbers into my handy calculator,

the present value of the note is $6,119.06. Therefore, you could explain to Betty that she can

either wait or have her money now. Betty, who is elderly and wants nothing more than to go on

acruise,mayacceptyouroffer.Me

anwhile, you have a wonderful, low

-

risk investment that

yields 9 percent interest and is secured by real estate. You can even use the purchased note to

buy other real estate. Of course, you’ll use the f ull value of the note, or $15,000.

If, however, you a

re feeling a little m ore adventurous and would rather see a physical product

than a piece of paper, you are re ady for hands

-

on real estate investing. There are essentially

three types of property to co nsider: land, commercial p ro perty and residential real

estate.

Land

Have you ever caught yourself saying something like, “I should have bought some land t here

years ago?” This usually happens after you see a new strip mall or housing addition being built

on virgin land. Well, it’s t rue that they’re not makin

ganymoreofit,landthatis,butbecarefulif

you are thinking about investing in land, especially if you are planning on paying retail prices.

Why? Even if you are good at predictions, you may have to wait 20 to 30 years for land to

appreciate to a l

evel that makes it worth your while. In the meantime, you will be paying taxes,

Rogue Real Estate Investor

-

18

-

assessments and m aintenance fees. You also can’t depreciate land; therefore, you might miss

out on some lucrative tax advantages.

According to Carleton Sheets (1994), the aver

age annual cost of owning vacant land runs

between 15 and 20 percent of what you paid for it. Using a common investing trick called the

Rule of 76, your l and would need to doubl e in value every four to five years t o m ake it

a

worthwhile investment.

Now ha

ving said that, purchasing land at sharp discounts, such as those found in foreclosure

s,

tax sales or some international locations,

can be highly profitable. Imagine paying approximately

10 to 20 percent of the market value of residential lots or acreage.

Idon’tneedtoimagine.

Commercial property

Commercial property is what I would consider speculative real estate investing. The gains can

be substantial and the risks are not for the faint of heart.

Why?

Commercial real estate is tied closely to the

business environment. Consider the recent Internet

bubble that essentially ended at the turn of the century. At the peak of absurdity, business r ents

skyrocketed and property owners were smiling all the way to the bank. Now, vacancies have

soared again wit

hmanycompaniesgoingoutofbusiness.Manycommercialpropertyowners

are scrambling to find business tenants.

Commercial properties come in all sizes and shapes

;

and if there’s one nice thing about owning

commercial real estate it’s the lease terms, wh

ich are usually a minimum of three to five years.

Commercial property leases also require much more of the tenant, such as maintenance and

repairs.

W

ith the rece

nt downturn in the economy, it’

salsoagoodtimetopickupcommercialproperty

for very attr

active terms. If you are looking for business space, now is also a great time to

negotiate inexpensive leases with good terms.

If you are considering commercial property, be sure to do your homework. Read Chapter 10 on

managing environmental risk.

Reside

ntial real estate

The real “bread and butter” for most real estate investors, including m yself, is residential

property. Residential properties include single

-

family homes, duplexes, x

-

plexes (x = any

number) and apartments.

This is the “bread and butte

r” of investing because we all need to live s omewhere, regardless of

where we work or whether we are in school. Young, old, poor and wealthy all live in some

dwelling that either they or someone else owns.

First, let’s distinguish what I consider the tw

oprimarytypesofresidentialrealestate

investments. The first type of property is a growth property, or a property tha t appreciates in

value either due to its wonderful location or your sweat equity or both. The second type of

property is an income pro

perty. An income property may or may not be located in a good

location, but the rents provide you with positive cash flow income, similar to a stock dividend.

Rogue Real Estate Investor

-

19

-

Again, r ealize that you d on’t just sit back and watch the m oney f low in. You have to work for i t

occasionally.

You will encounter both types of property. Just like other types of investing, it is a good idea to

diversify and own both income and growth properties.

Now, on with the search.

But first, here are the answers to the questions presented ea

rlier in this chapter:

1.

Although very similar, real property actually contains a bundle of ri ghts in addition to the

real estate. Rights may include mineral, water, air or a number of other things.

2.

Adeedisalegaldocumentusedtotransferrealestate.A

mortgage is a promise to pay

aloansecuredbythedeed.

3.

Equity.

4.

For Sale By Owner.

5.

The Multiple Listing Service.

6.

Competitive Market Analysis uses comparable properties to estimate the value of real

estate. It is usually used for single

-

family homes.

7.

Rep

lacement Cost or Income Method.

8.

Aceilingfanispersonalpropertyuntilitisattachedtotheproperty,atwhichtimeit

becomes r eal property.

9.

Contract.

10.

Buyer’s agent.

11.

Broker.

12.

Subordination.

13.

General warranty deed.

14.

Quitclaim deed.

15.

True. They can place a m

echanic’s lien on a property.

16.

Private mortgage insurance.

17.

Principal, Interest, Taxes and Insurance.

18.

Adjustable rate mortgage.

Rogue Real Estate Investor

-

21

-

THREE

The Search Begins:

Looking for and Evaluating Real Estate

“The business that we love we rise betime,

and g

otoitwithdelight.”

–

Shakespeare

Iconsidersearchingforattractiverealestateasfun

,

and you should

as well

.It’salmostagame

or perhaps a puzzle. Every week new li stings can be found in the classified section of your local

newspaper and in the

Multiple Listing Service (MLS). With the proliferation of the Internet, many

of these same listings are available online. With all of these options, you may be asking, “

W

here

should I start?”

Search M ethods

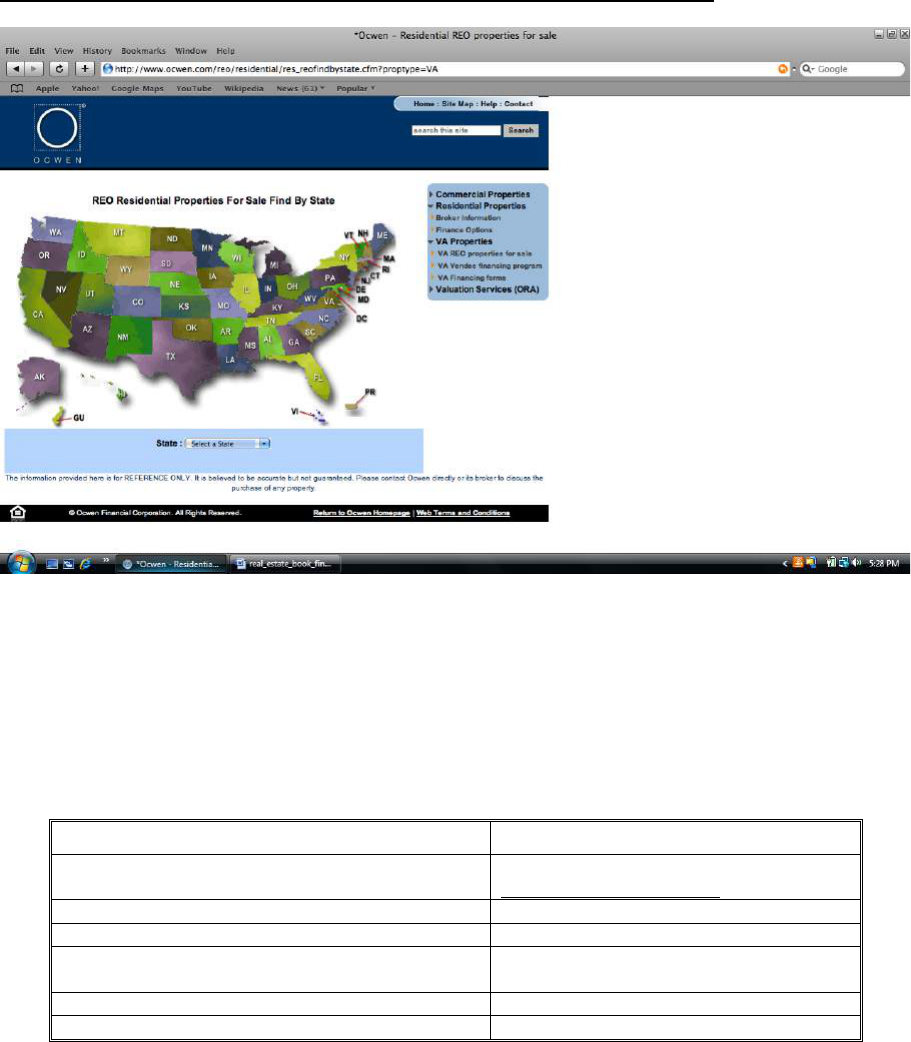

Online real estate w

ebsites

The Internet cont

ains an almost inexhaustible supply of information, and real estate is one

industry that is perfectly suited for profiling listings online. After all, the MLS is really just a

database of information. T his same type of information can be easily presented o

ndynamically

generated websites, which can m ake

your search

for real estate even easier.

If you are not familiar with using a search engine or directory, open up your computer’s browser,

which might be Internet Explorer or Netscape Navigator or AOL’s own

unique browser. Type in

the Web address of one of the maj or search engines or directories. He re are a fe w:

x

http://www.google.com

x

http://www.yahoo.com

x

http://www.msn.com

x

http://www.aol.com

x

http://www.ask.com

x

http://www.alltheweb.com

x

http://ww

w.altavista.com

x

http://dmoz.org

.

There are many others, but start with these. Once you are on the site, use the site directory

structure or look for a search box. Type in your request and be as specific as possible. F or

example, don’t expect much out of the term “ real estate.” Try a more specific term like “bank

foreclosures in Missouri.”

Rogue Real Estate Investor

-

22

-

In the meantime, here are a few of my favorite free, online resources for real estate investing:

x

http://www.hud.gov

–

U.S. Department of Housing and Urban Development

x

http://www.ginniemae.gov

–

Government National Mortgage Association

x

http://www.freddiemac.com

–

F

ederal Home Loan Mortgage Corporation

x

http://www.fanniemae.com

–

Federal National Mortgage Association

x

http://www.narei.com

–

National Association of Real Estate Investors

x

http://www.realtor.com

or

http://www.realtor.org

–

National Association

of Realtors

x

http://www.nareit.com

–

National Association of Real E

state Investment Trusts

x

http://www.buyo wner.com

–

for sale by owner

properties

x

http://www.forsalebyowner.com

–

for sale by owner properties

x

http://www.realestatebook.com

–

real estate

listings in all states (also

available

by

requesting their

free real estate books)

x

http://www.foreclosurefreesearch.com

or

http://www.foreclosure.com

–

foreclosure

search engine (fee required).

Newspaper classifieds

The Sunday classified section is still

agreat

place to find real estate. Read through the

classified advertisements once or twice an

dcirclepotentiallistings.Lookforkeyphrases

such

as

:

x

Owner anxious

x

Possible owner/seller f inancing

x

Lease option

x

Investment property

or investors

x

Needs TLC

x

Fix up and save

x

Needs update, carpet and paint

x

Investors

x

Good investment

x

Duplex, triplex, 4

-

pl

ex, apartment.

Of course, realtors know all of these phrases too, so be a little cautious. For hands

-

on investing,

you are looking for income properties that will produce positive cash flow and that are in an

acceptable location. For growth properties, yo

uarelookingforpropertiesthatareundervalued

and that, with a little painting,

new

shrubbery and cleaning, could be resold for a profit or rented

for a positive cash flow. Growth properties should be located in an area that is appreciating.

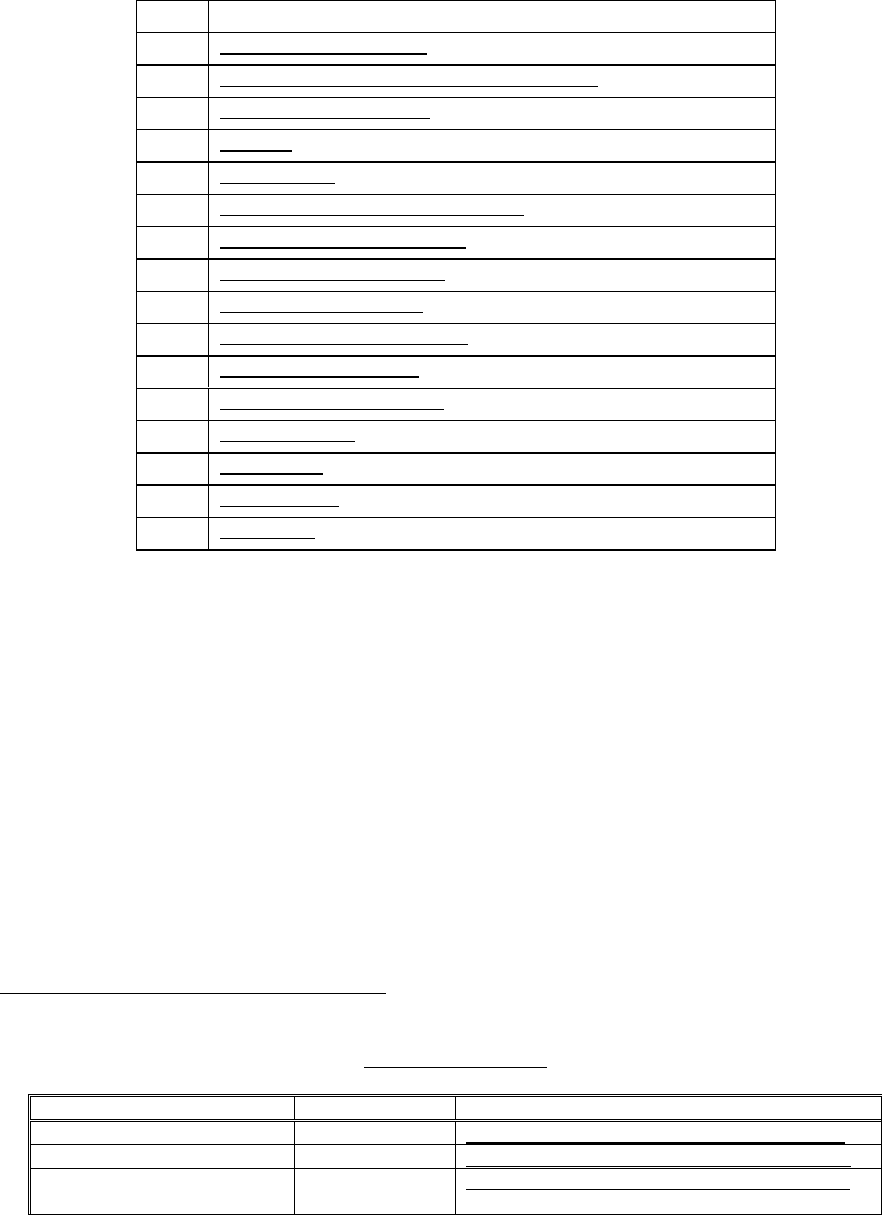

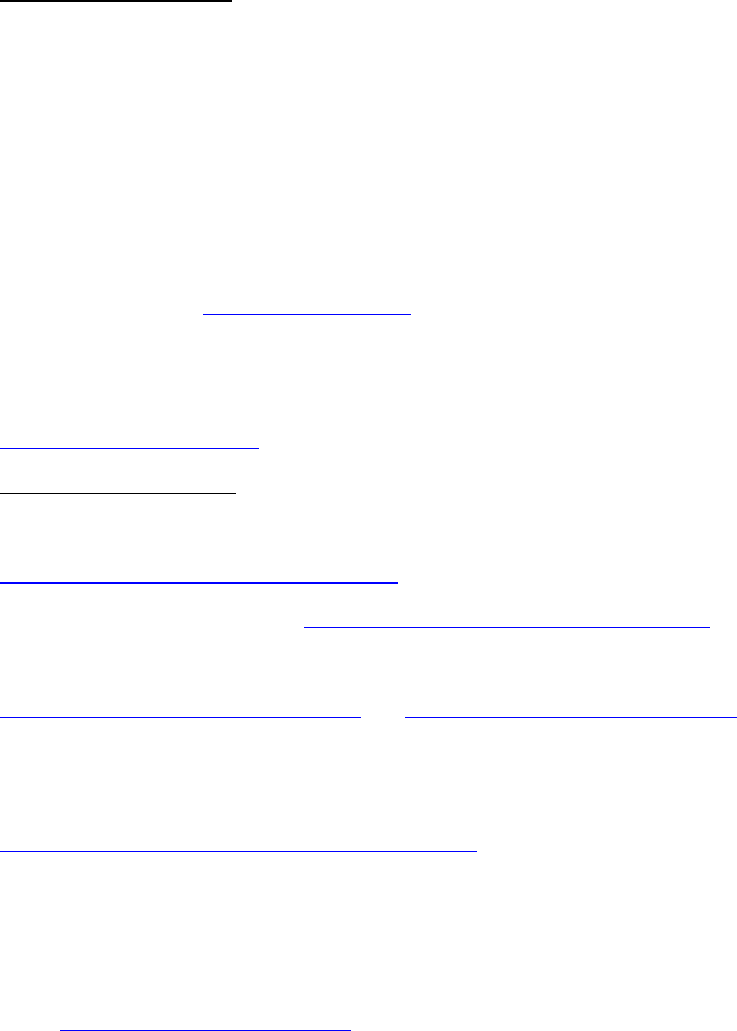

The

follow

ing Real Est ate Phone

-

Screening Guide

can

be used to hel

pwithyourclassified

searches:

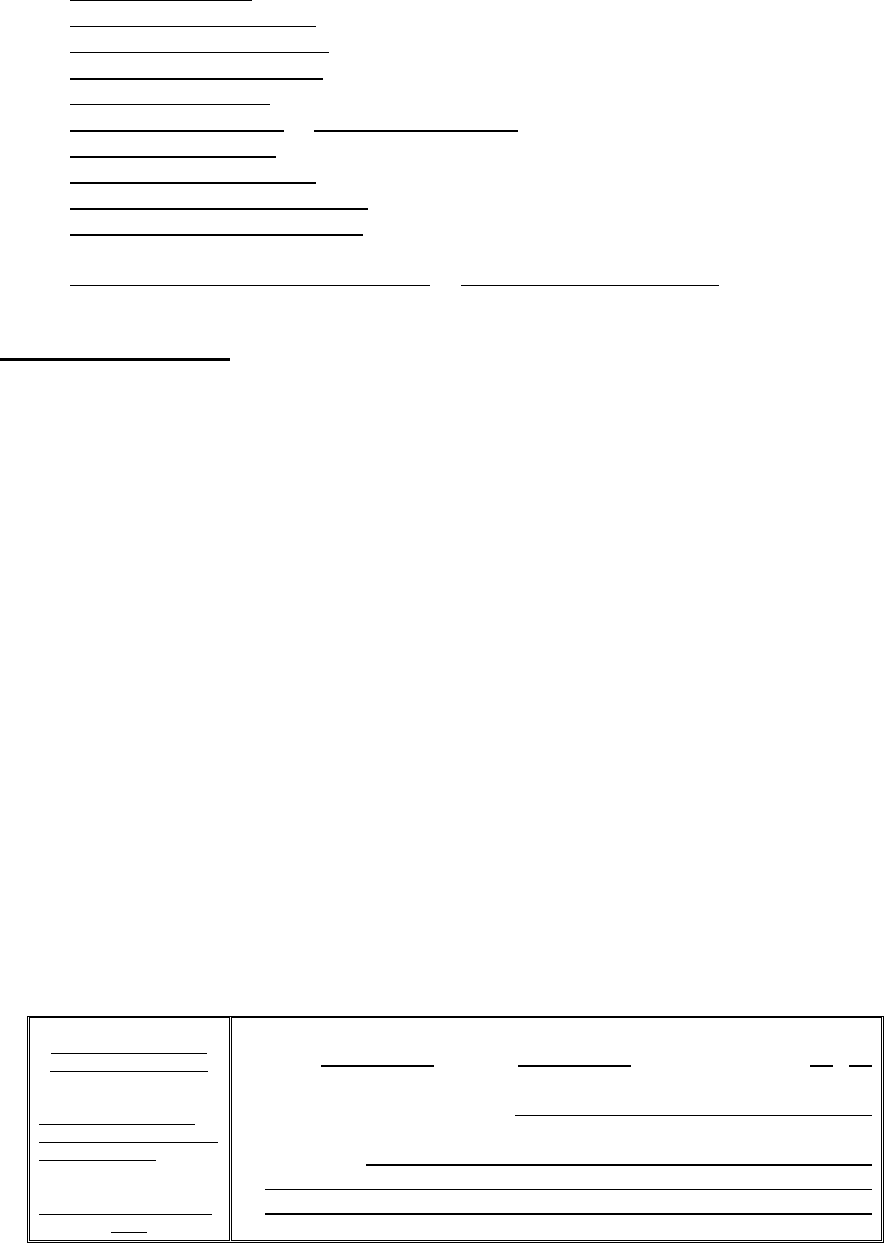

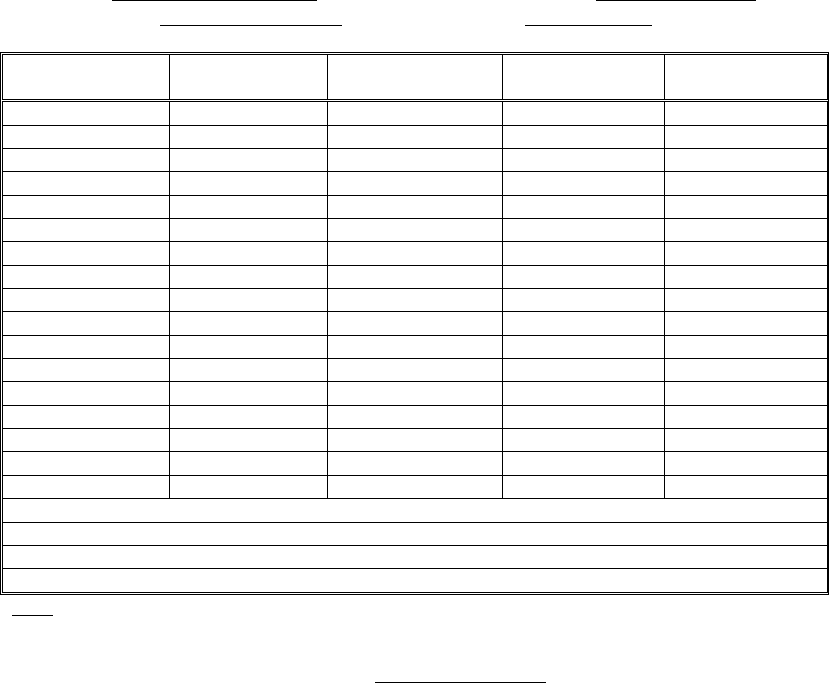

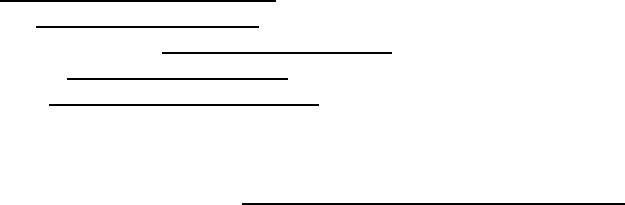

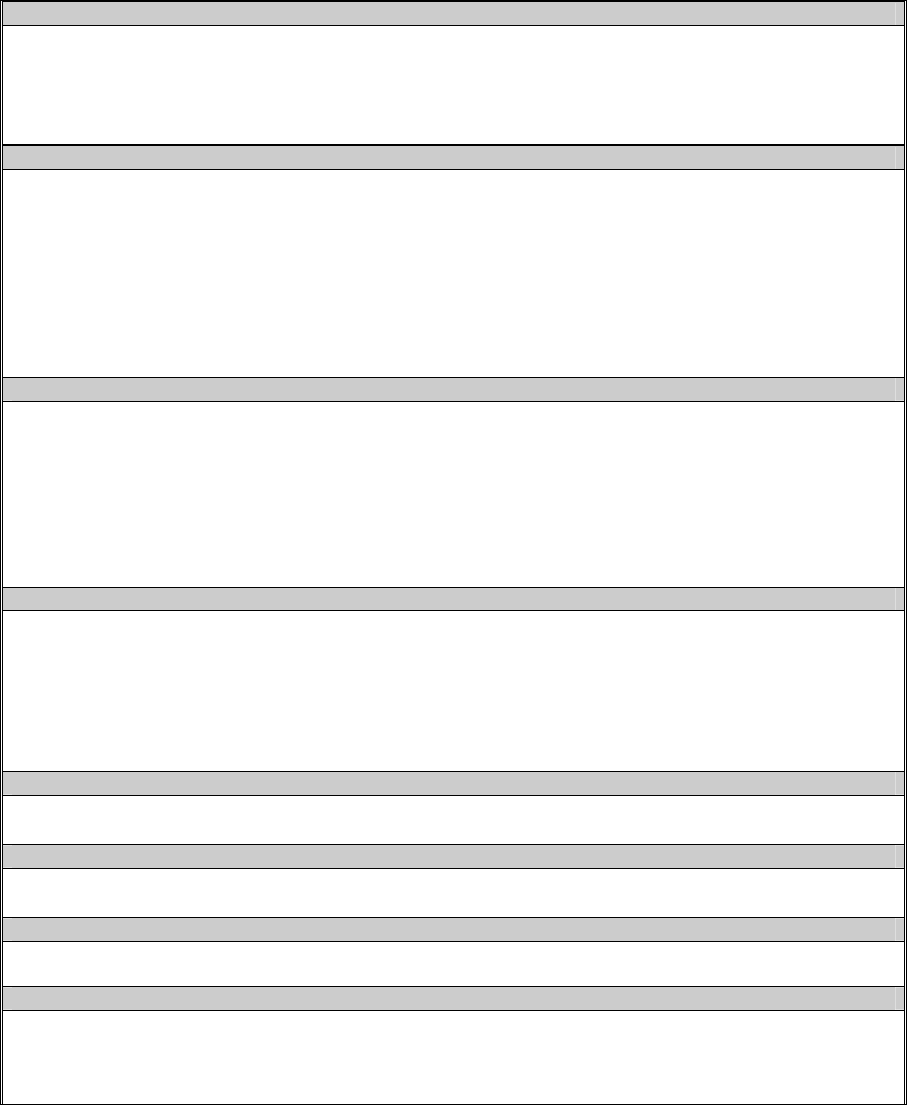

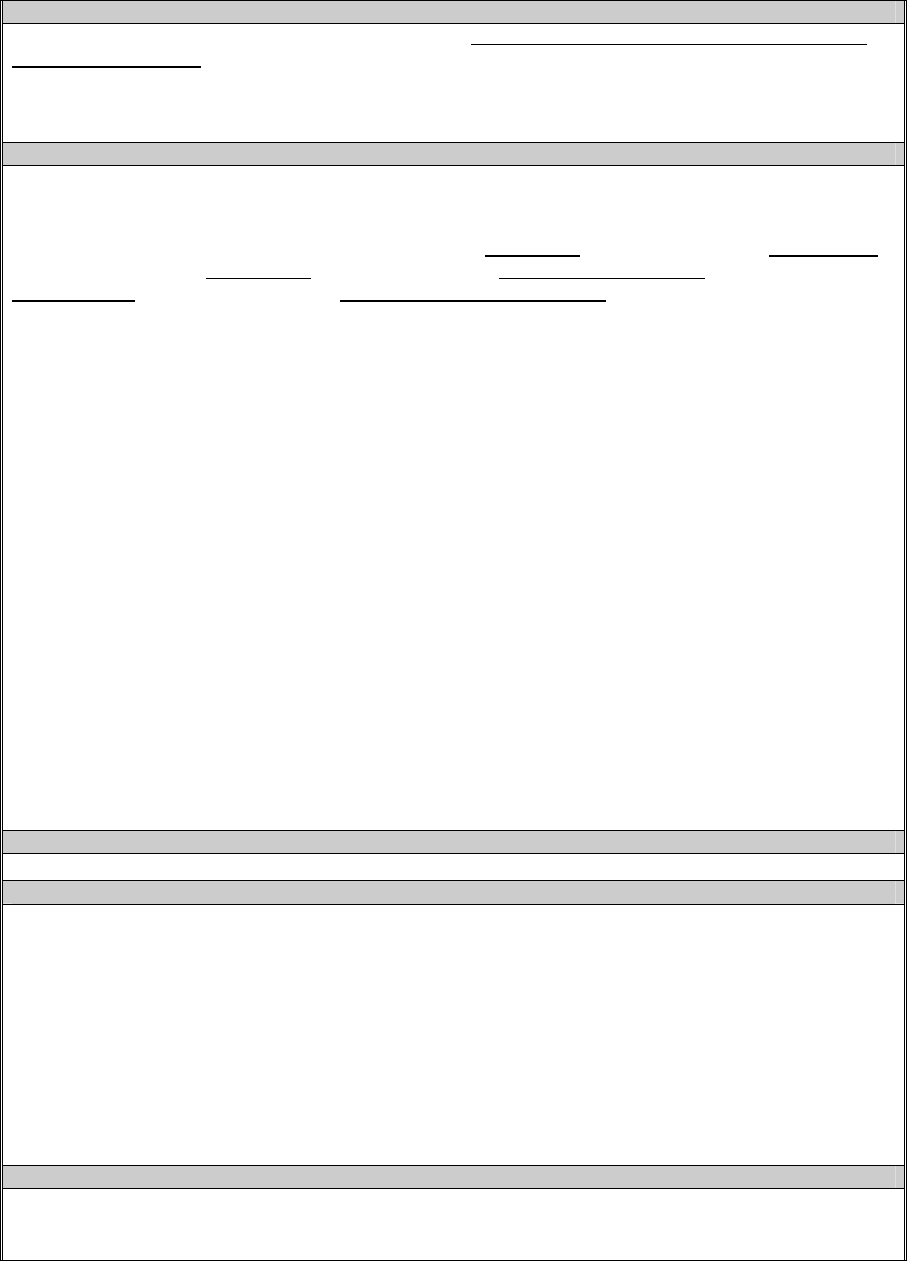

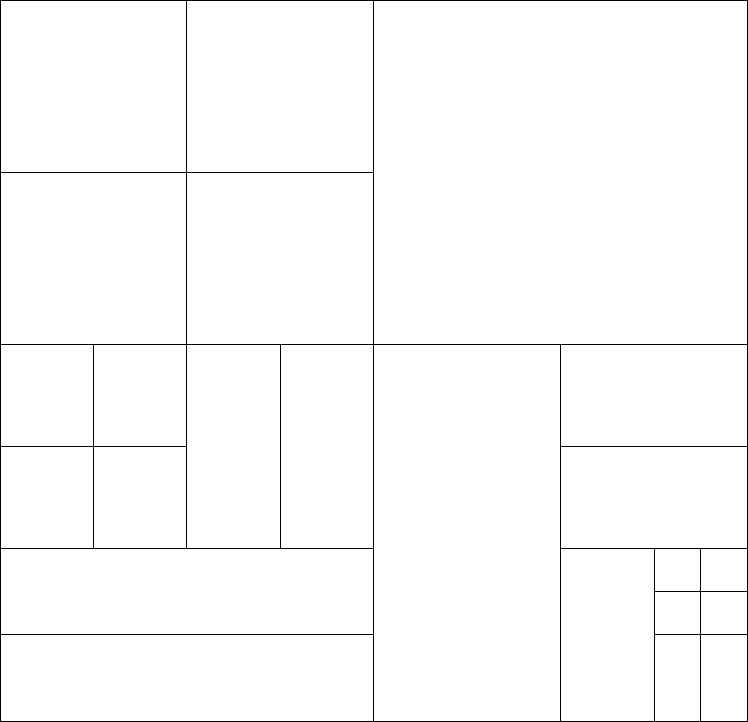

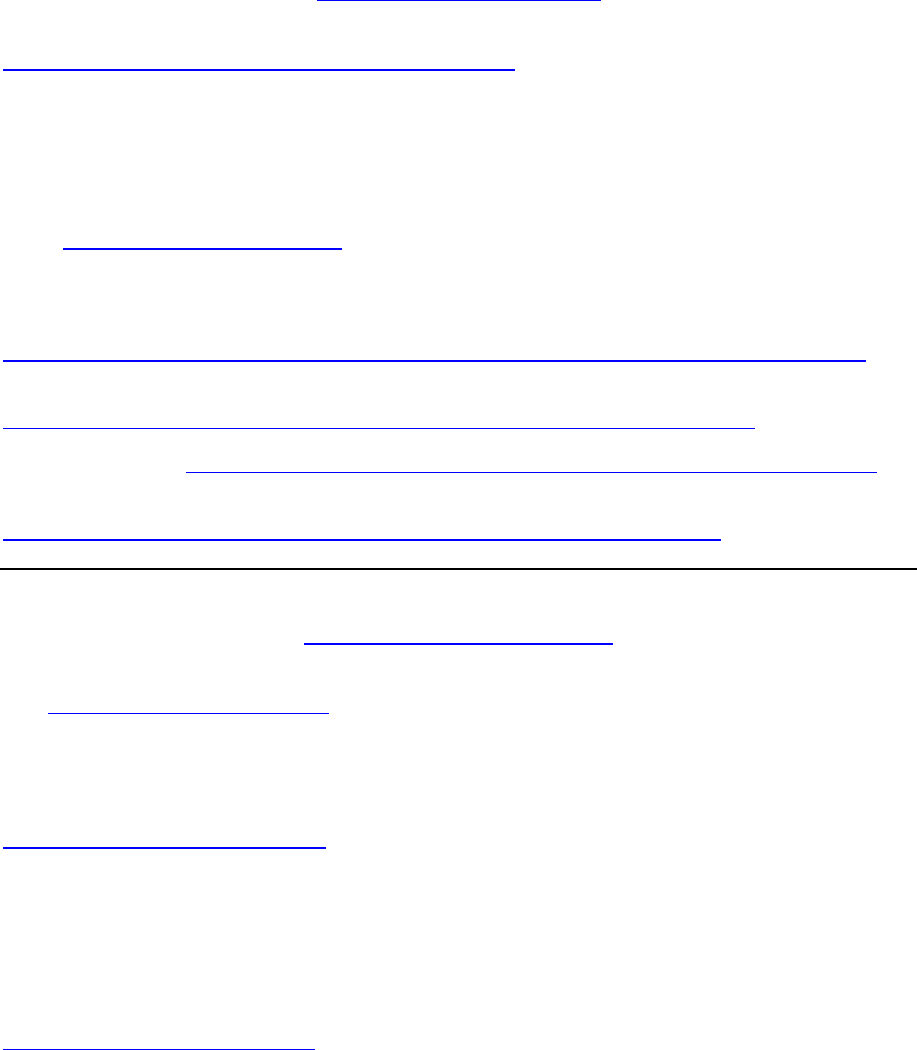

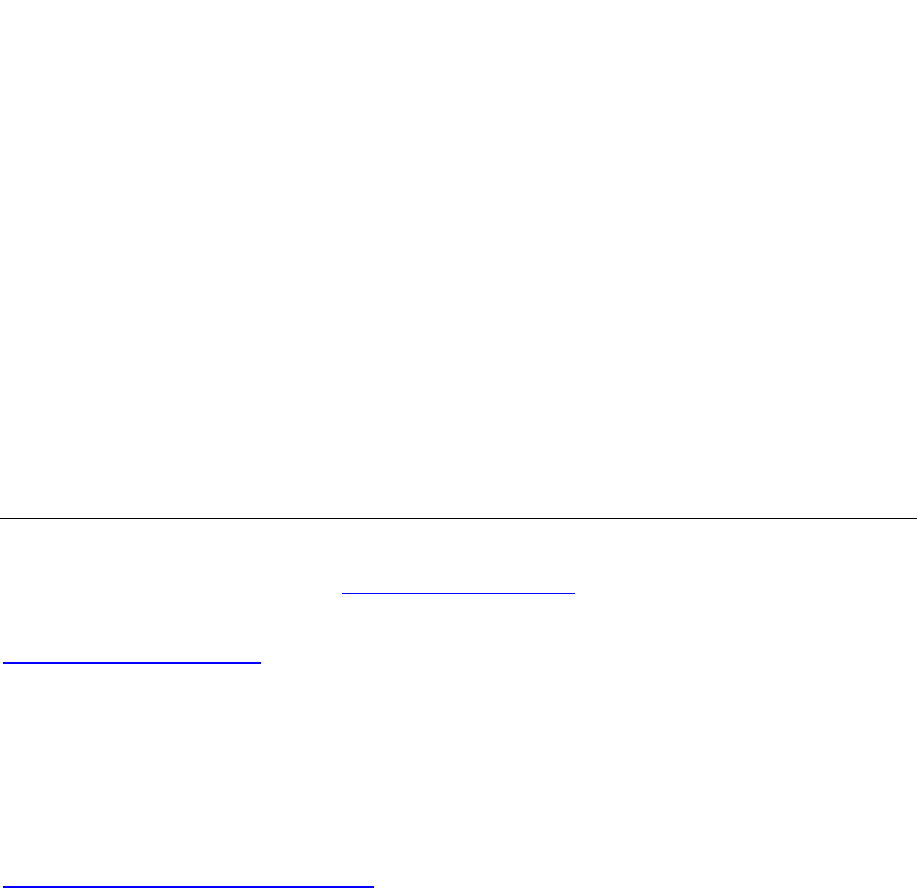

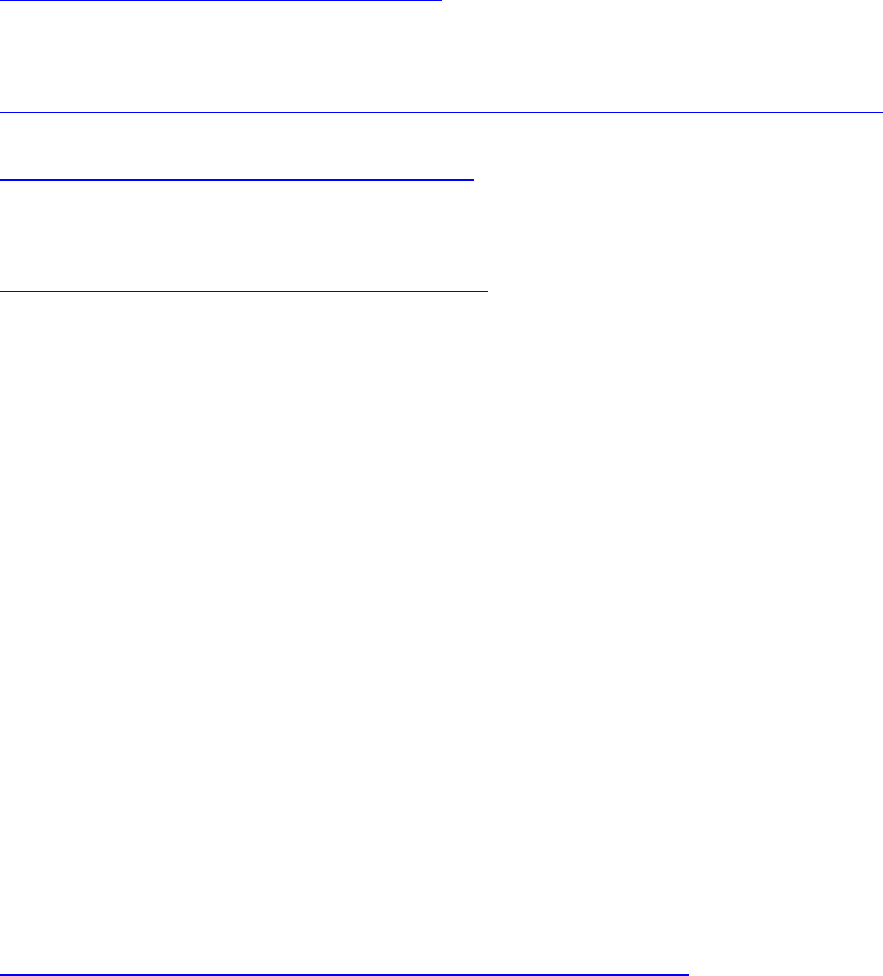

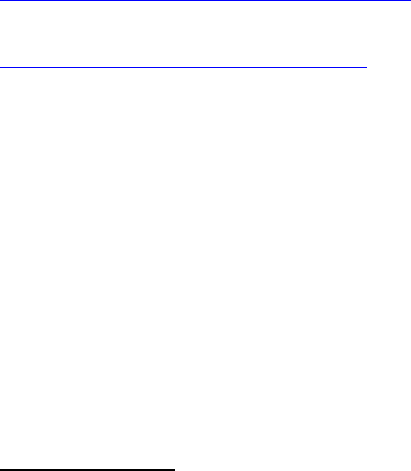

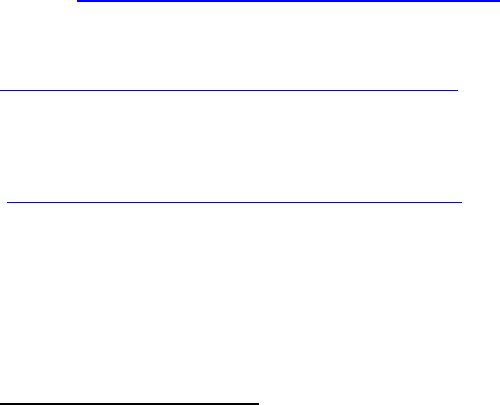

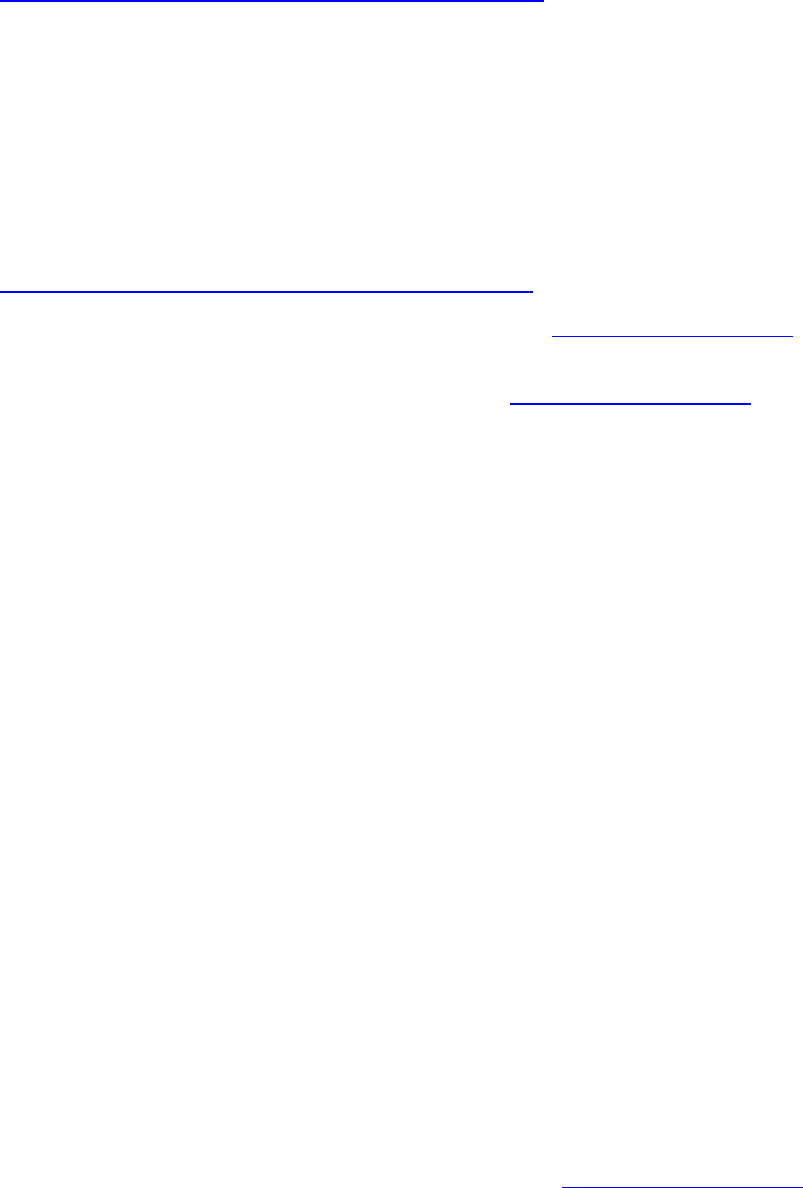

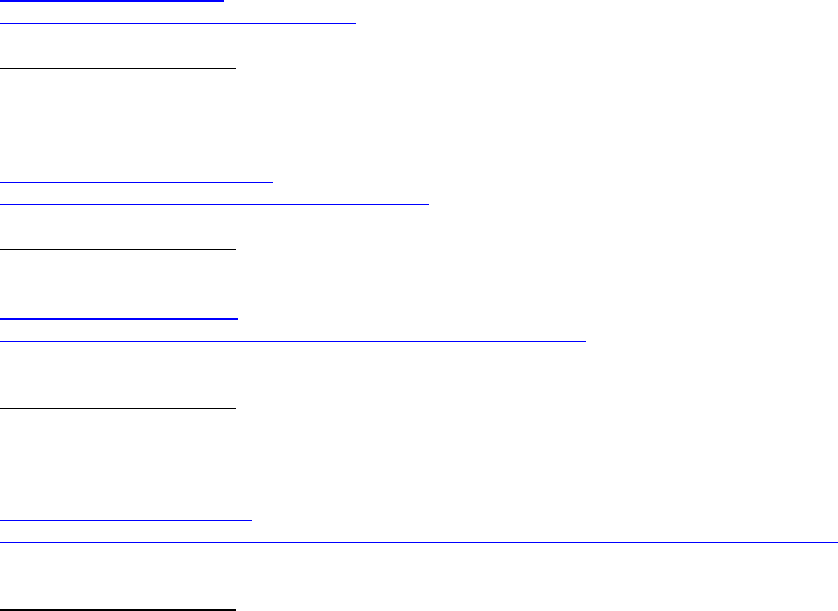

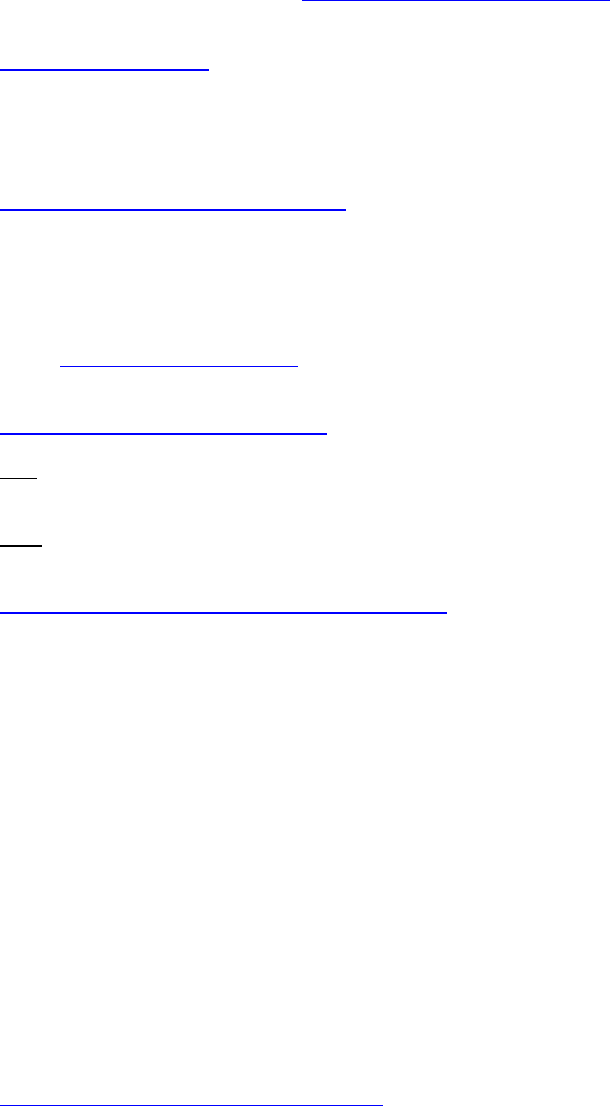

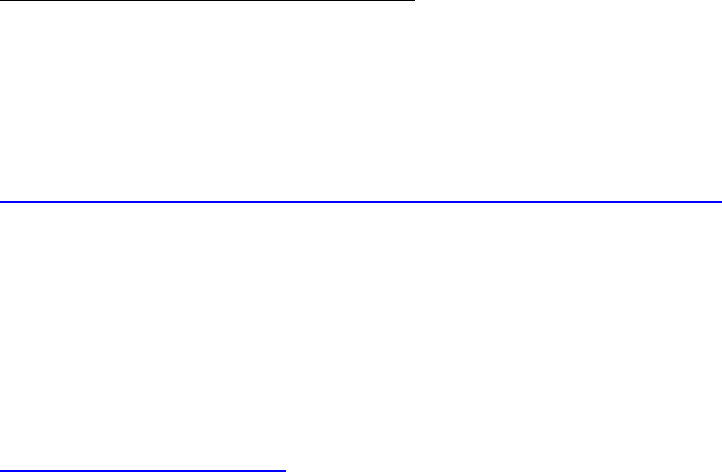

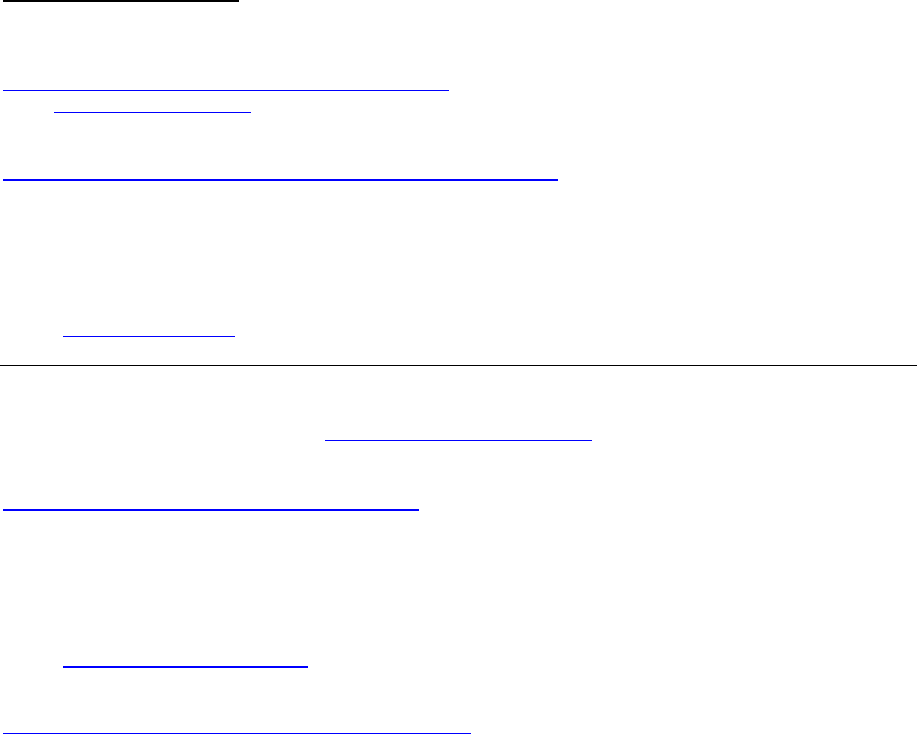

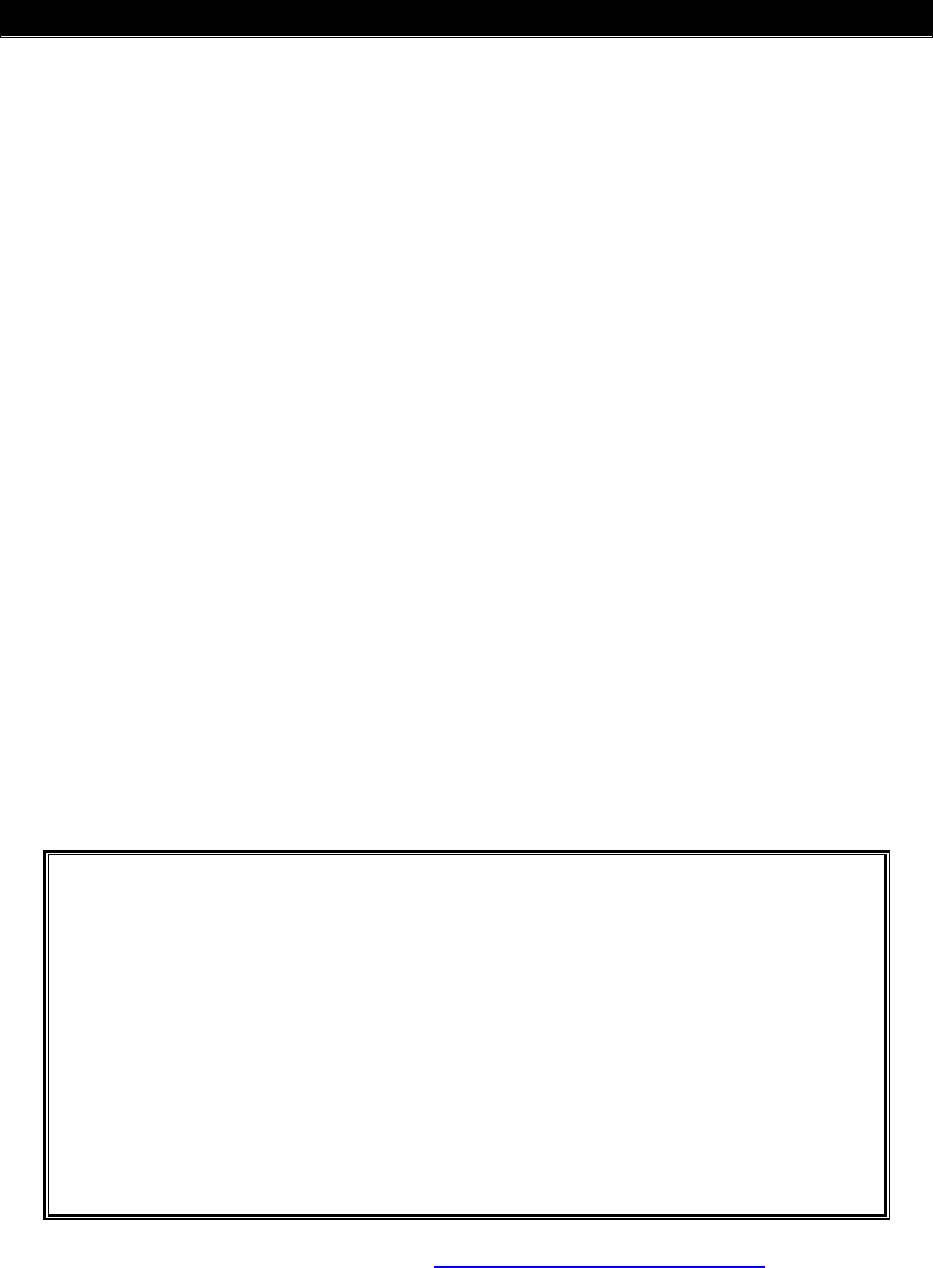

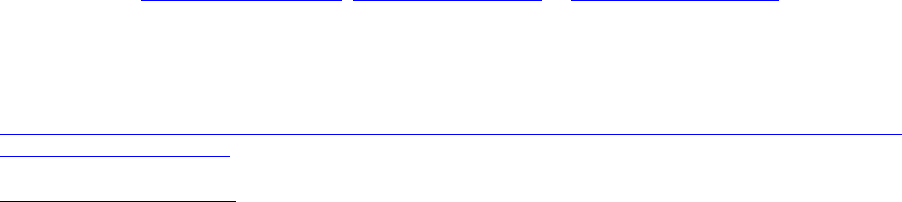

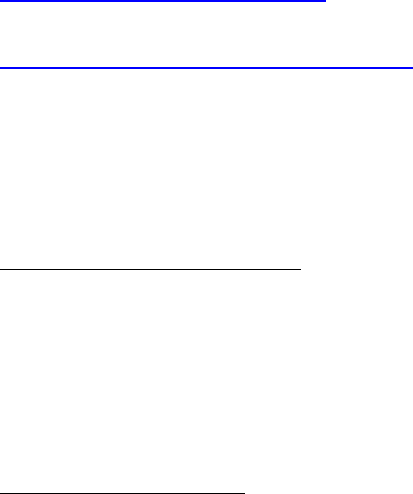

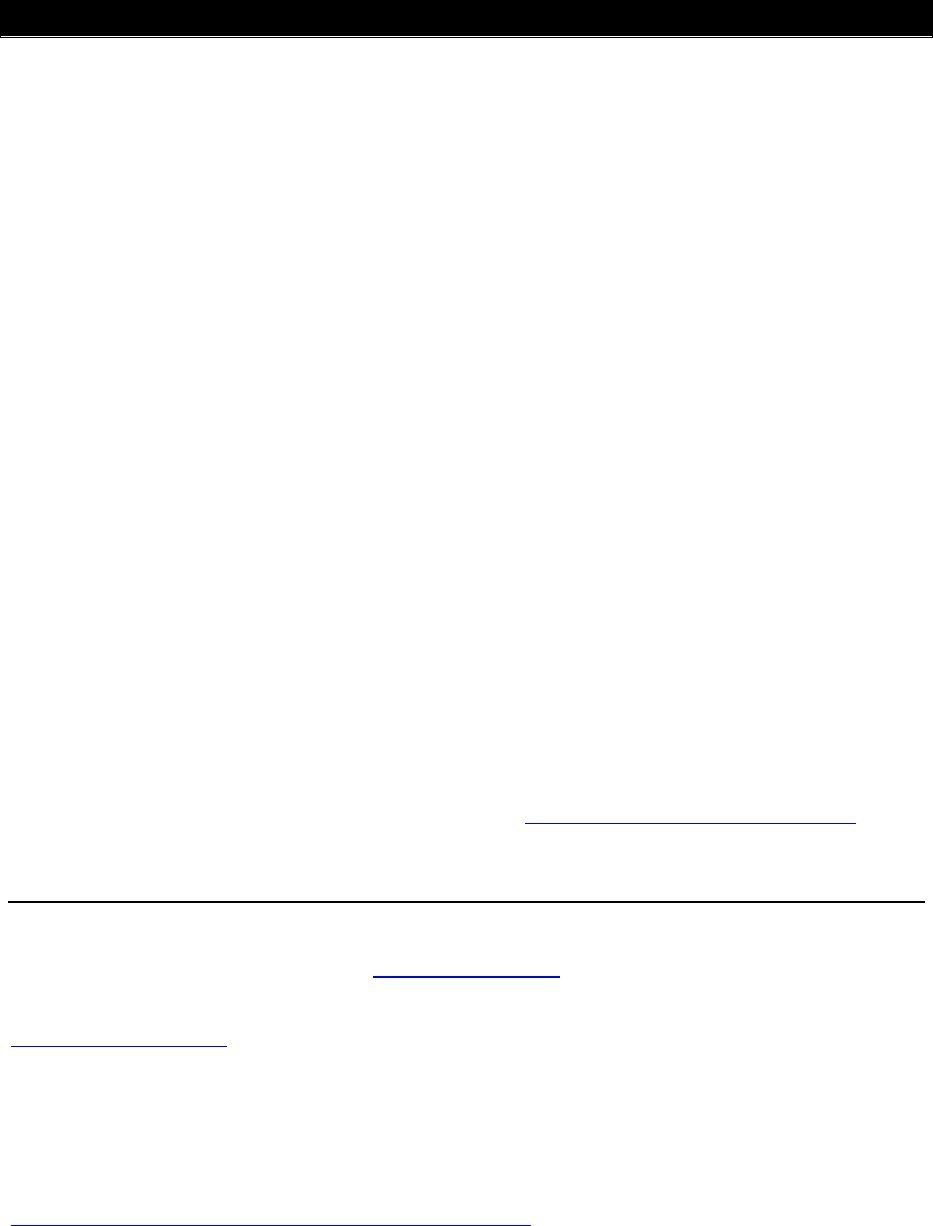

Real Estate Phone

-

Screening Guide

__________________

(Section in Classifieds)

Tape or glue classified

advertisement information

here, if available.

____________

________

Price

Date:

_________

_Time:

_________

_LeftMessage:Y

__

N

__

Property Name/Address: _

______________________________

Directions:

__________________________________________

___________________________________________________

________________

___________________________________

Rogue Real Estate Investor

-

23

-

Owner’s Name:

________________

_Owner’s P hone Number:

__________________

Real E state Agent’s Name:

_____________________

Company:

_______________

Agent’s Phone Number(s):

__________________________________________

_____

Property Description:

___________________________________________________

_______________________________________________________________

_______________________________________________________________

Roof (type, how old?, does it leak?):

_______

___________________________

Basement/Structural (any water leakage/damage?):

______________________

Plumbing (type

of

water lines, sewer line problems

?

):

___

______

___________

HVAC (ty pe and age of furnace and air conditioner):

_____________________

Termi

tes:

_______________________________________________________

Income/Gross Rents: ___________________________________________________

Mortgage (1st) Type (e.g., FHA, VA, conventional, assumable): __________________

Balance/Amount Owed: __________________

__________________________

Other Mortgages/Liens/Judgments on Property (explain): _______________________

____________________________________________________________________

Seller’s Equity: ________________________________________________________

E

xpenses (note if monthly or annual)

:

Taxes: _________ Insurance: ________ W ater: ________ Sewer: __________

Electric: _________ Gas: ________ Heating Oil: ________ Propane: ________

City Fees: ______

_

___ H omes Association: ________ Garbage: __

__________

Other: __________________________________________________________

Is the Owner W illing to Help with Financing? _________________________________

Why is the Owner Selling? _______________________________________________

Other

I

nformation: __

____________________________________________________

__

______________________________

__

____

__________________________

_

____

______________________________________

_________________________

_

_____

Note

: Refer to the data CD that accompanies this book fo

r a copy of the Real Estate Phone

-

Screening Guide that you can print and use.

Get a real estate agent working for you

How would you like to call up a professional, like an attorney, and tell him to start working for

you

;

and if you like what he

does

,you

’ll have the person on the other sid

eofthetablepayhis

services?

Sounds great,

right

?Well,youcando

this

with real estate agents.

Find one or more motivated real estate agents and get them working for you. First of all, they

can do searches on th

eMLSdatabaseand,givencertaincriteria,comeupwithalistof

properties that match what you are looking for. You can even request that they help you

evaluate a property’ s value, but be sure to do your own valuation and understand the process.

Rogue Real Estate Investor

-

24

-

Of cour

se, the downside here is that once you locate a property, they will be involved in the

process and will be paid a commission. This could limit certain

types of

creative financing, but it

could also speed up the paperwork. In addition, they can help with sh

owing up for appraisals

and inspections if you are too busy.

Run y our own classified advertisement

Classified advertising may not be your first choice, but as you grow in the world of real estate

investing, you might try it and see what kind of r esponse

you get. Of course, the downside here

is that classified advertisements (a ds) are not free. T h e other problem is that it m ight take two or

three ads before you have it pulling the potential sellers that you want.

Here is an example for pulling one type of

seller:

I buy all types of houses,

a

ny condition considered.

Call Mike at 555

-

1212.

Here is a different approach:

Serious real estate investor

has cash

.

Looking for single

family homes.

555

-

1212.

Remember, access to cash can be through a partner,

equity in your house or a good

relationship with a bank.

Visit your county courthouse

Depending on where you live, y

our county courthouse may be a treasure

trove

of foreclosed

properties, upcoming auctions or tax lie

nproperties

.Makeaphonecallort

wo and at least plan

on visiting the courthouse, if for no other reason than your own education.

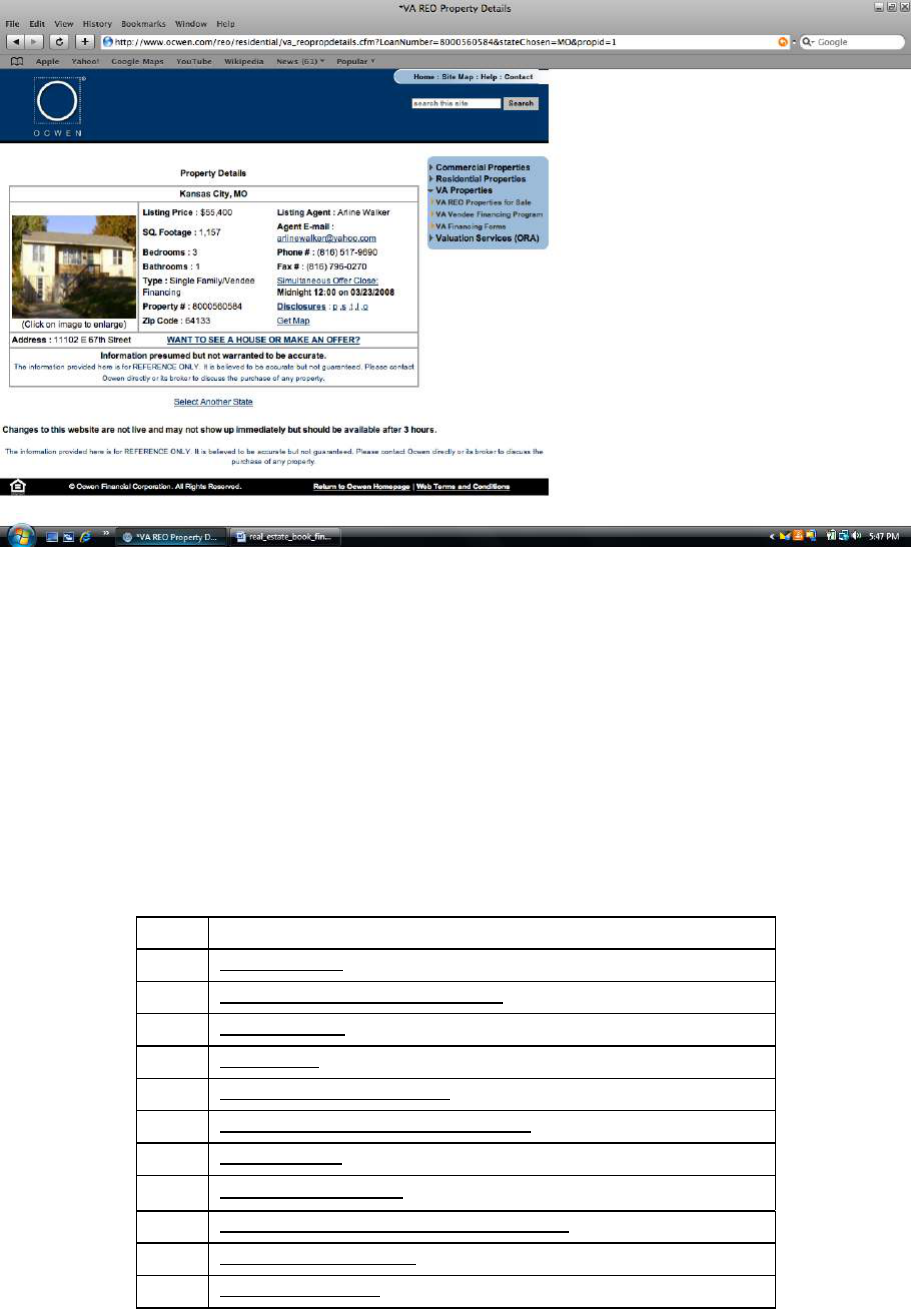

Call banks, savings and loans, and mortgage companies

Banks and lenders are more than happy to send you their list of foreclosed properties,

sometimes called

REOs (r eal estate owned)

or nonperforming assets

.I

recently called

a

community bank loan officer and he immediately sent me an E xcel file showing a list of 13

properties ranging from a $10,000 bungalow to a $2,210,000 apartment complex and everything

in

between.

Treat these properties like any other except that you may be able to negotiate better financing

terms directly with the loan officer, who would love nothing more than to get the property off of

his balance sheet.

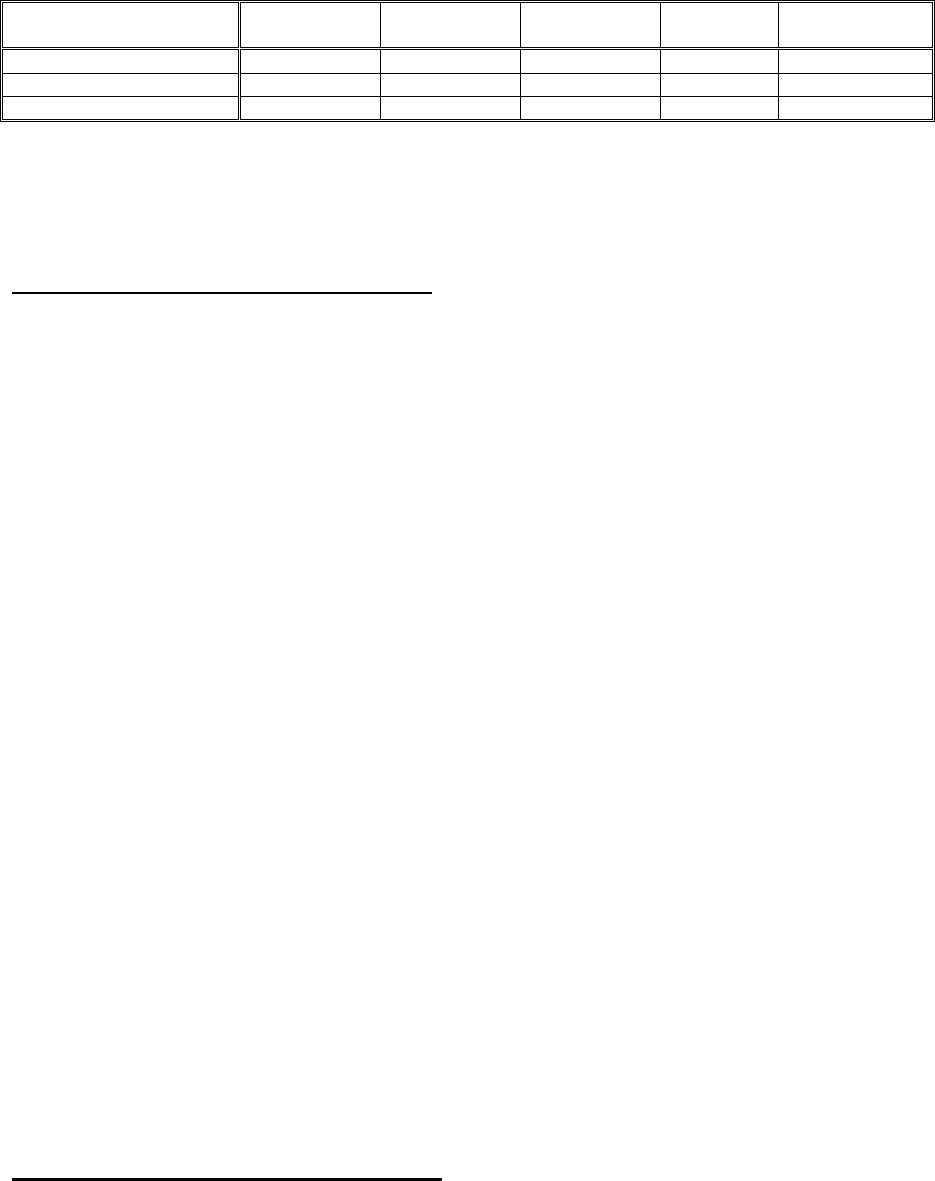

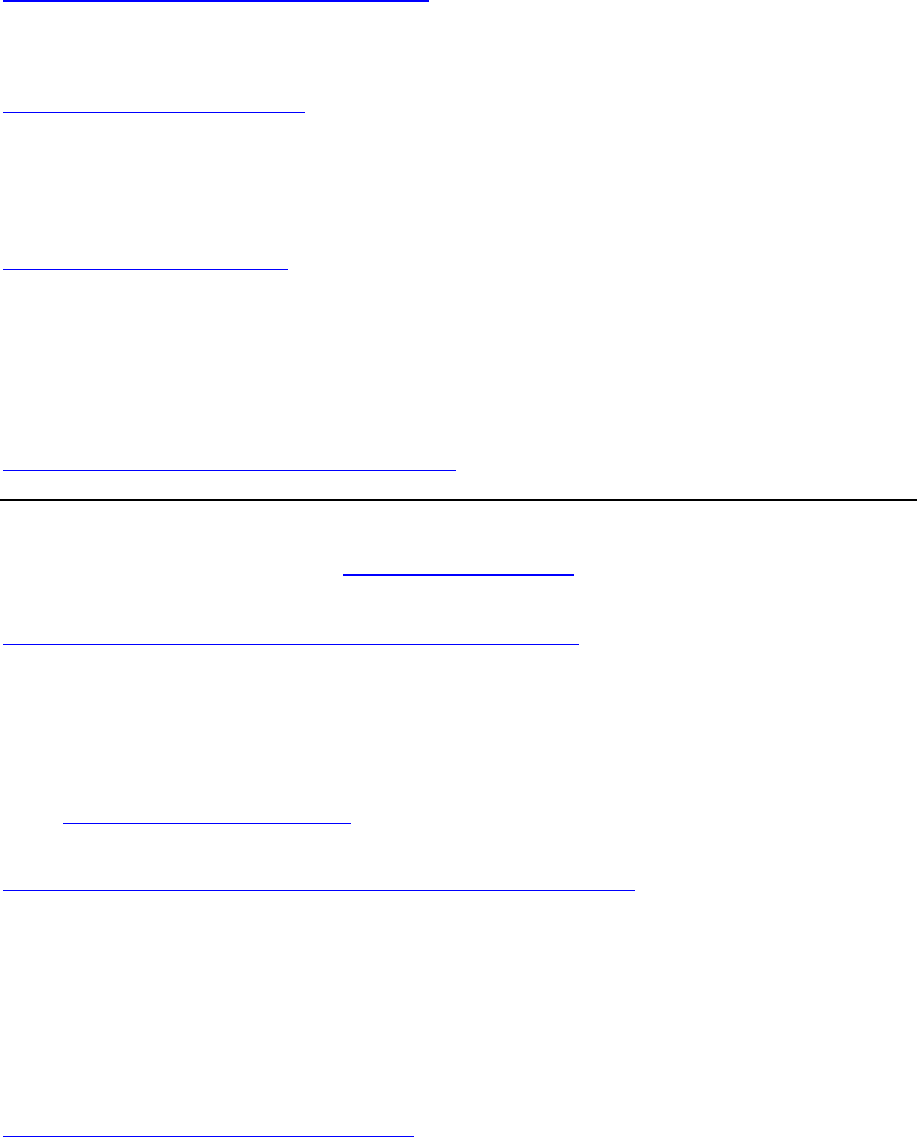

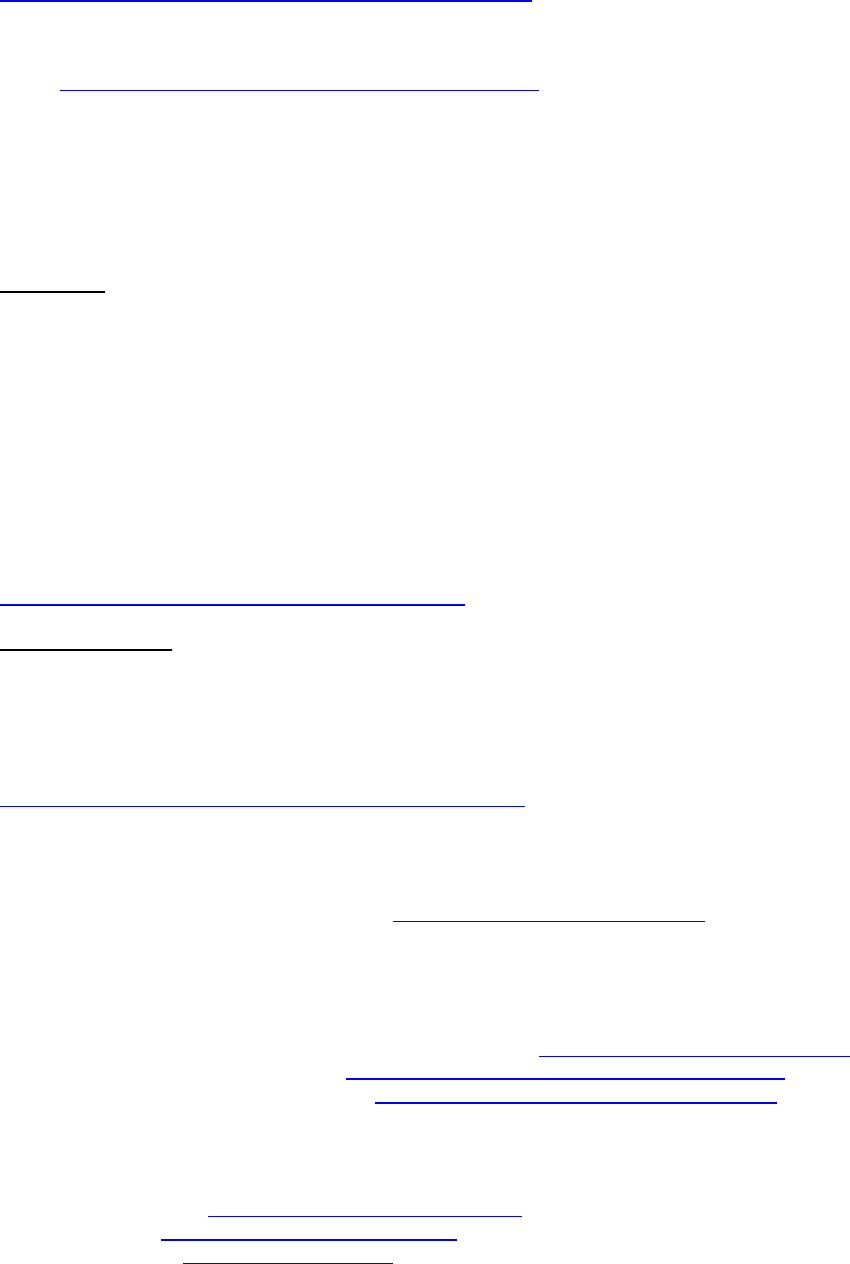

Financial Analysis

Okay, y

ou ha

ve found a bunch of potential properties. Before spending your valuable time

driving all over looking at

them

,youshouldperformapreliminaryfinancialanalysisusingthe

following income pr operty screener

as a guide

.Inotherwords,makesurethatthen

umbers

work out and you can make some money.

Rogue Real Estate Investor

-

25

-

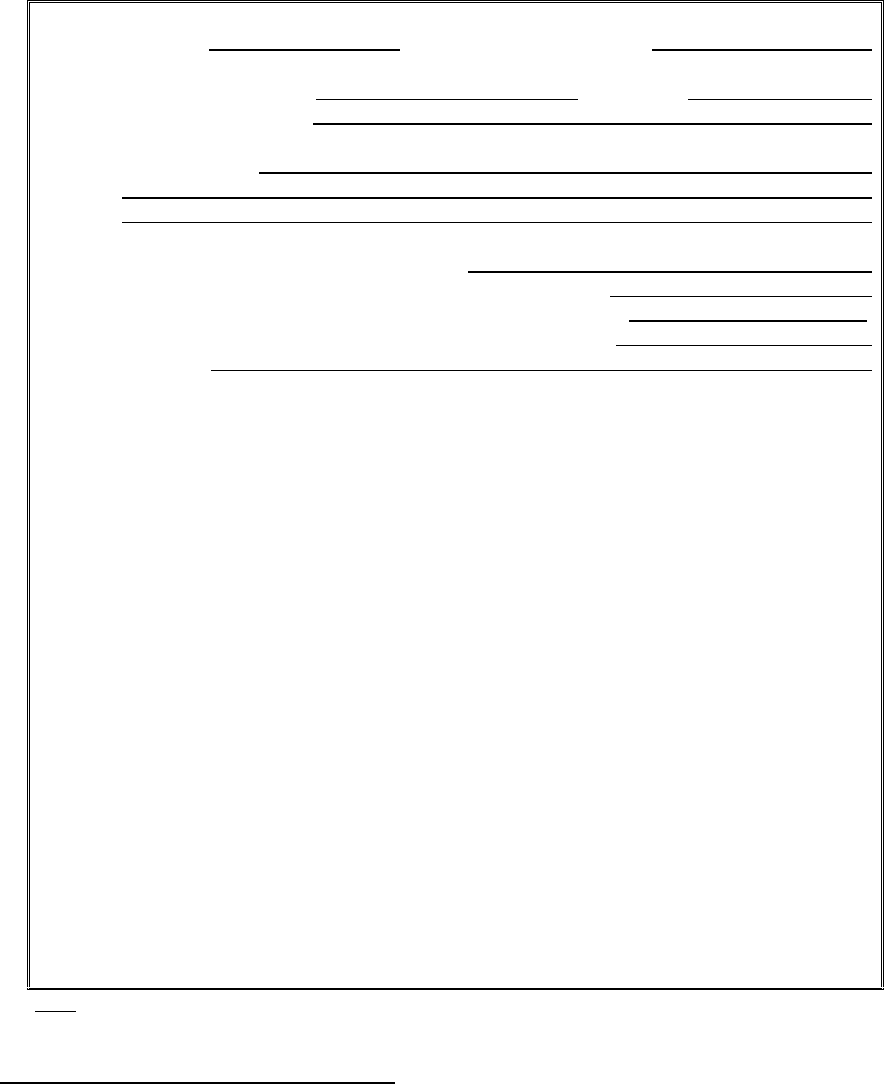

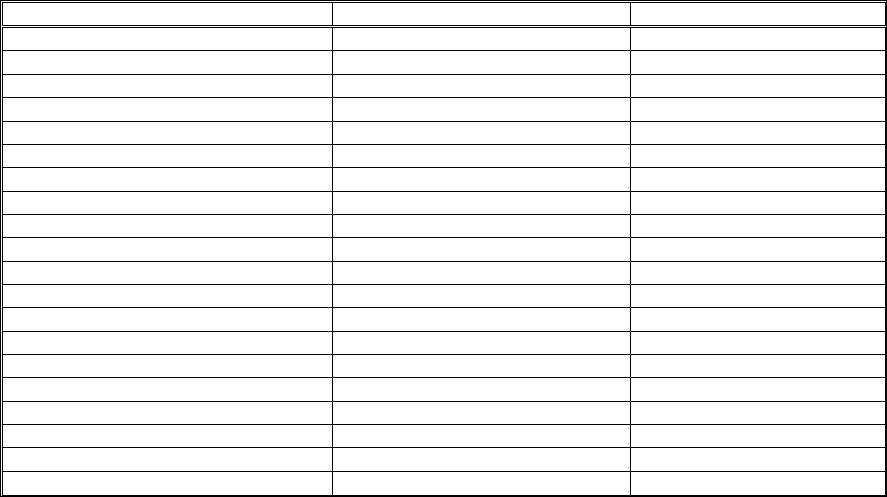

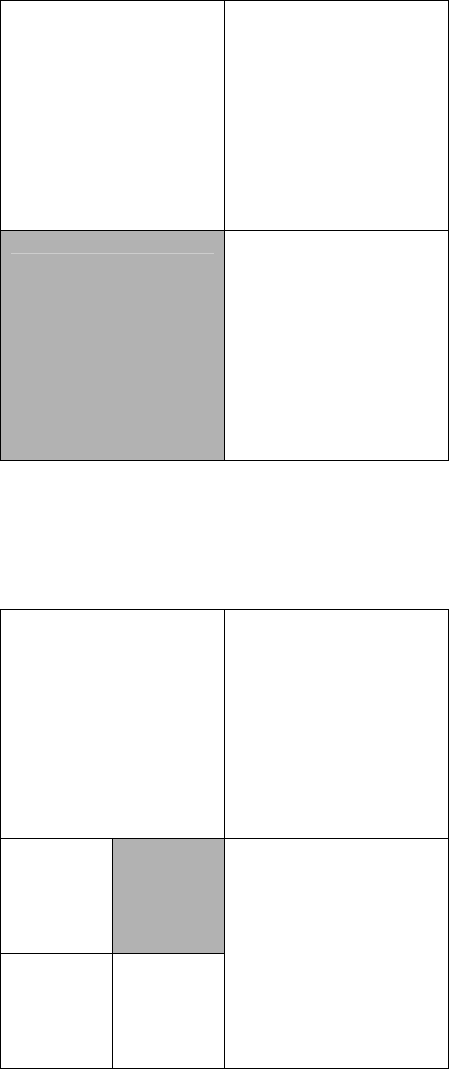

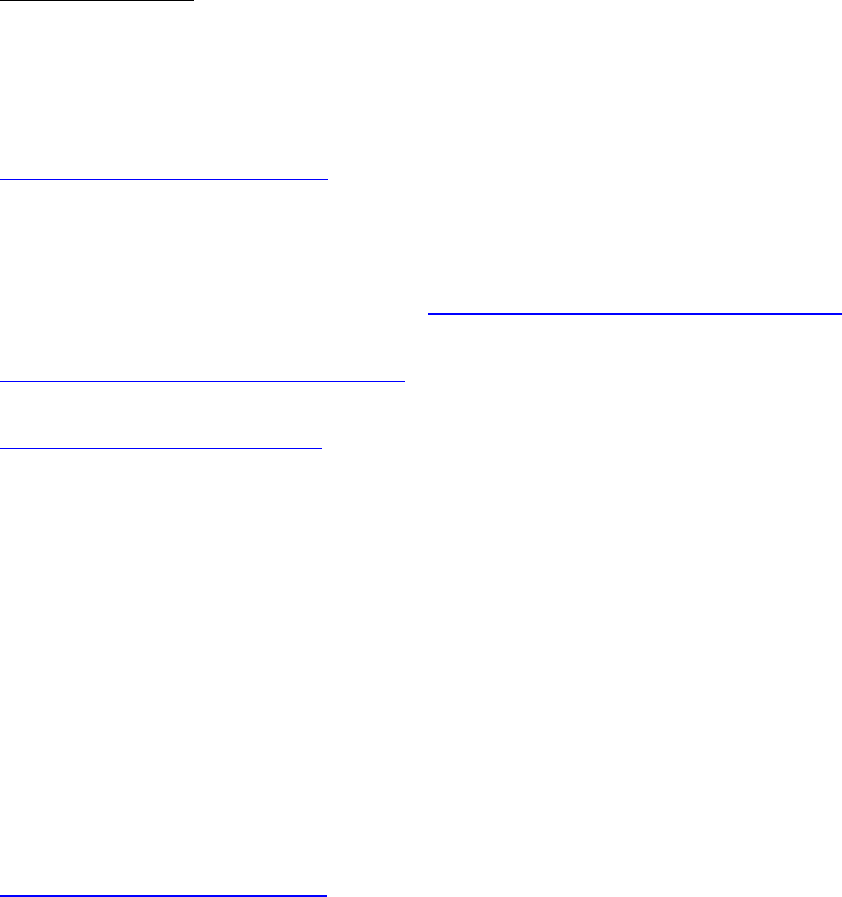

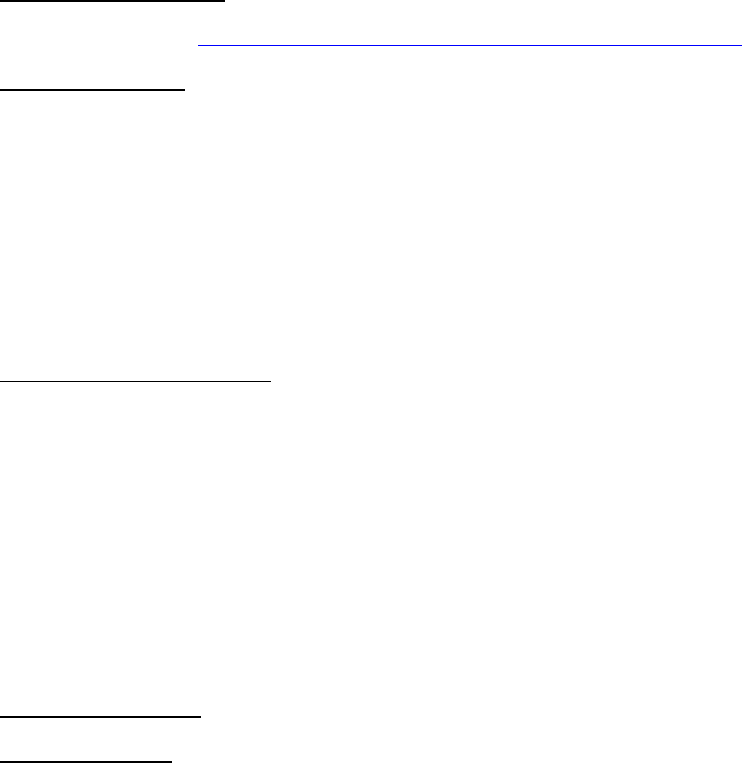

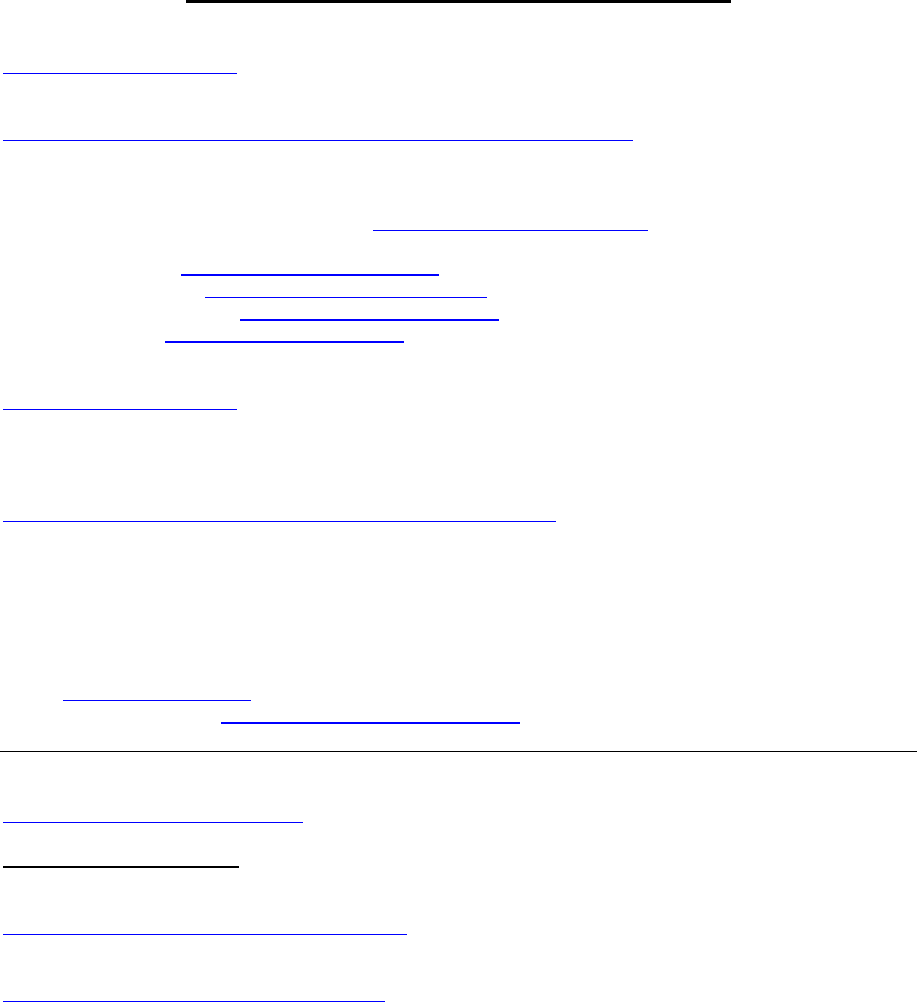

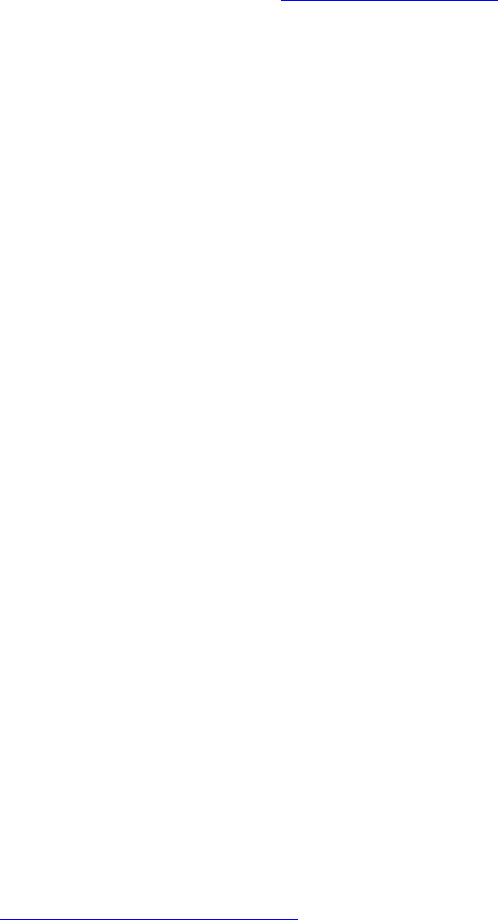

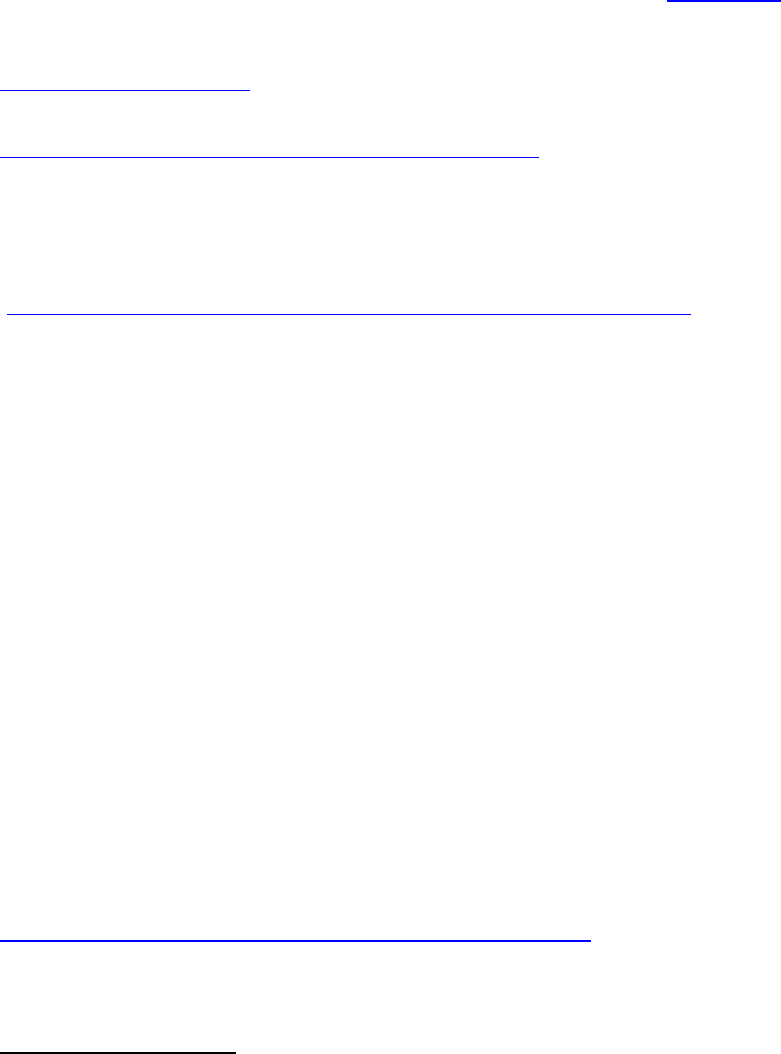

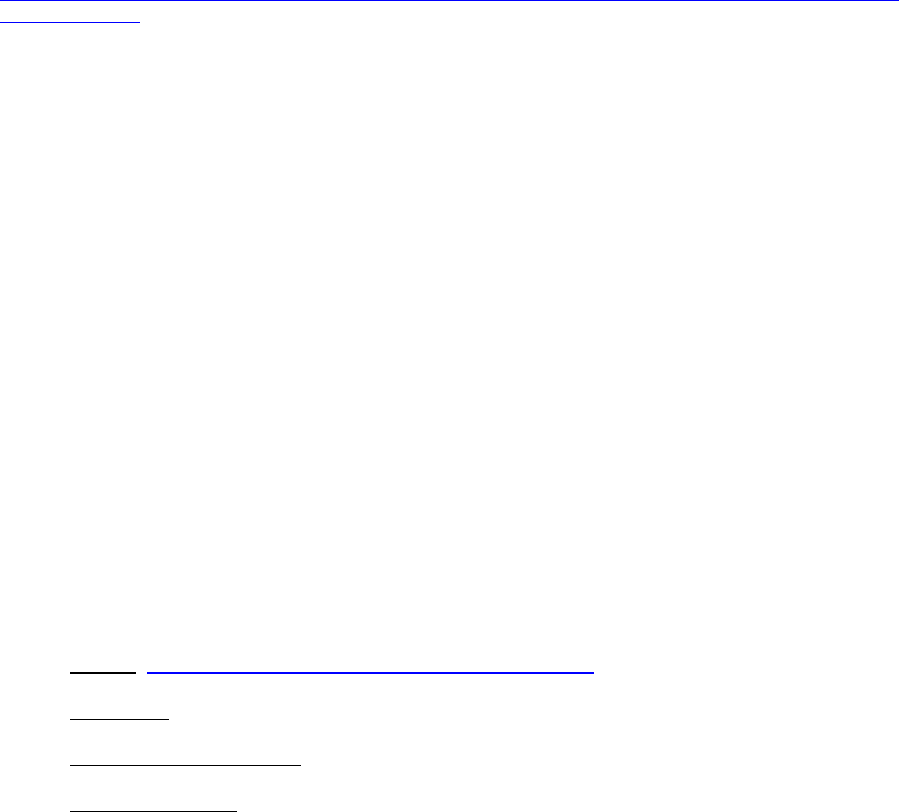

Income Property Screener

Monthly Income/Expenses

Amount

1.

Gross Rents

2.

Other Property Income

3.

Subtotal (1+2)

4.

1st Mortgage Principal an d Interest (PI)

5.

2nd Mortgage PI/Seller Financing

6.

Other Mortgage/Financing PI

7.

Subtotal (4+5+6)

8.

Taxes (ask the property owner/agent)

9.

Insurance (call your own ins urance agent)

10.

Water

11.

Gas

12.

Electricity

13.

Heating Oil/Propane

14.

Garbage

15.

Homes Association

16.

Cit

y Fees

17.

*Property Management (7 to 10% of income)

18.

**Repairs (actual amount or assume 5 to 10%)

19.

Supplies (actual amount or assume 1%)

20.

Miscellaneous (actual amount or assume 1%)

21.

Subtotal (8+9+10+11+12+13+14+15+16+17+18+19+20)

T

OTAL (3

-

7

-

21)

*Optional if you plan on managing the property. Percentages are based upon gross monthly income.

**Assume 5% if you plan on doing most of the repairs and up to 10% if you will hire out.

Using the Income P roperty Screener, let’s take a look

at a property that I recently evaluated. It is

a9

-

plex located in a suburb of Kansas City.

Monthly Income/Expenses

Amount

1.

Gross Rents (with all units rented)

$3,525.00

2.

Other Property Income

$0.00

3.

Subtotal (1+2)

$

3,525

.00

4.

1st Mortgage Principal an d Interest (PI)

$1,076.12

5.

2nd Mortgage PI/Seller Financing

$308.48

6.

Other Mortgage/Financing PI

$0.00

7.

Subtotal (4+5+6)

$1,384.60

8.

Taxes (ask the property owner/agent)

$185.00

9.

Insurance (call your own ins urance

agent)

$140.00

10.

Water

$150.00

11.

Gas

$300.00

12.

Electricity

$175.00

13.

Heating Oil/Propane

$0.00

14.

Garbage

$50.00

15.

Homes Association

$0.00

16.

City Fees

$0.00

17.

Property Management ( for now, I will manage it)

$0.00

18.

Repairs (

assum

e

10%)

$353.00

19.

Supplies (assume 1%)

$35.00

20.

Miscellaneous (assume 1%)

$35.00

21.

Subtotal (8+9+10+11+12+13+14+15+16+17+18+19+20)

$1,423.00

TOTAL (3

-

7

-

21)

$717.40

Rogue Real Estate Investor

-

26

-

As you can see, I am anticipating a positive cash flow of $717.40

amonth

,evenaf

ter including

repairs, supplies and all associated fees. T he numbers look good enough for me to set up a

meeting to view the property and discuss it with the current owner i n m ore detail. If I were to hire

apropertymanagementcompany,thecashflowwould

drop to $364.00, which is not quite as

enticing, but worthy of consideration.

Now, since this unit is an income producing property with over f our units, it is possible to

calculate a

property

value based upon the income (this will be discussed in greater

detail in

Chapter 4). Using the Cap Rate method and knowing the annual net operating income (NOI)

and assuming a high cap rate of 14 percent, the value of the property equals the NOI divided by

the cap rate:

Value of Property = NOI / Cap Rate

Value of P

roperty = $25,224 / .14 = $180,171

Since t he property is priced at $160,000, that’s a potential $20,000 in equity. To be fair, the

property co

uld use some sprucing up, so I’m

assuming that the price is in the correct ballpark.

For growth properties, a sl

ightly different tactic is tak en. One method is to buy and h old, while

the other is to buy low and sell high. Gee

,

that sounds a lot like stock investing. Anyway, the

difference here is that you have to learn t o look past an ugly exterior or blemishes and

find

properties that require simple fixes to improve the

ir

value.

One thing to consider that I feel is missing in most real estate books and programs i s what

happens in between purchasing a property, fixing it up, listing it and eventually selling it. Wel

l, I

can tell you one t hing that happens is that the mortgage loan has t o be paid. It is possible,

though unlikel

y, that you could do all of the above

in a matter of 30 to 45 days and not have to

make a mortgage payment.