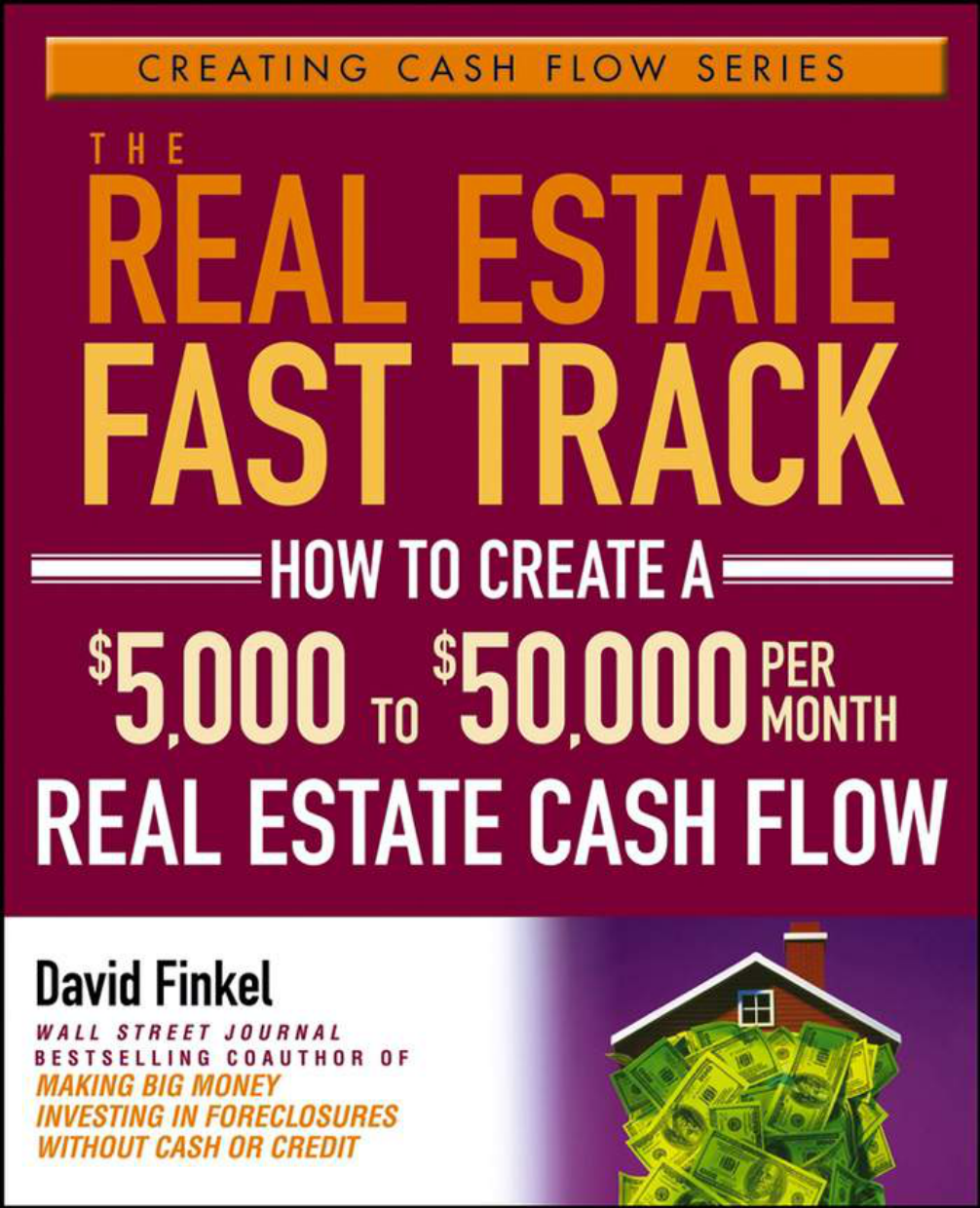

The Real Estate Fast Track

THE

REAL ESTATE

FAST TRACK

HOW TO CREATE A

$5,000TO $50,000MONTH

REAL ESTATE CASH FLOW

David Finkel

John Wiley & Sons, Inc.

PER

CREATING CASH FLOW SERIES

THE

REAL ESTATE

FAST TRACK

THE

REAL ESTATE

FAST TRACK

HOW TO CREATE A

$5,000TO $50,000MONTH

REAL ESTATE CASH FLOW

David Finkel

John Wiley & Sons, Inc.

PER

CREATING CASH FLOW SERIES

This book is printed on acid-free paper. ∞

Copyright © 2006 by David Finkel. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form

or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as

permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior

written permission of the Publisher, or authorization through payment of the appropriate per-copy fee

to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax

(978) 646-8600, or on the web at www.copyright.com. Requests to the Publisher for permission should

be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ

07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions.

The following trademarks are the exclusive property of New Edge Financial LLC and are used with

permission in this book: Fast Track Map™, Investor Fast Track Program™, Deal Structuring Wizard™,

Deal Quick View™, Due Diligence View™, Closing View™, Deal Evaluation Wizard™, Wealth Learning

Map™, Success Accelerators™, Hypnotic Negotiating Patterns™, and Hypnotic Negotiating Markers™.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts

in preparing this book, they make no representations or warranties with respect to the accuracy or

completeness of the contents of this book and specifically disclaim any implied warranties of

merchantability or fitness for a particular purpose. No warranty may be created or extended by sales

representatives or written sales materials. The advice and strategies contained herein may not be

suitable for your situation. You should consult with a professional where appropriate. Neither the

publisher nor author shall be liable for any loss of profit or any other commercial damages, including

but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact

our Customer Care Department within the United States at (800) 762-2974, outside the United States

at (317) 572-3993 or fax (317) 572-4002.

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print

may not be available in electronic books. For more information about Wiley products, visit our web

site at www.wiley.com.

Library of Congress Cataloging-in-Publication Data:

Finkel, David.

The Real Estate Fast Track : How to Create a $5,000 to $50,000 Per Month Real Estate Cash Flow /

David Finkel.

p. cm.

ISBN-13: 978-0-471-72830-6 (pbk.)

ISBN-10: 0-471-72830-6 (pbk.)

1. Real estate investment. 2. Real estate business. 3. Cash flow. I. Title.

HD1382.5.F565 2006

332.63’24—dc22

2005031914

Printed in the United States of America.

10987654321

To my lifelong partner, love, and best friend—Heather.

You are my forever.

CONTENTS

FOREWORD How Two Escapees from Corporate America Built

a Highly Profitable Real Estate Business

(and How You Can, Too!) Stephen Wilklow xi

ACKNOWLEDGMENTS xiii

INTRODUCTION 1

The Eight Major Business Success Factors 3

The Three Investor Levels—Your Proven Pathway to Real

Estate Success 8

Quick Overview of the Creating Cash Flow Series 16

The 16 Key Concepts from Buying Real Estate without Cash or Credit 17

An Overview of What You’ll Learn from Reading The Real Estate

Fast Track 27

PART ONE

The Advanced Investor Workshop

Section I: E

ARLY STAGE LEVEL TWO INVESTING—

DEVELOPING THE FIVE CORE INVESTOR SKILLS

CHAPTER ONE The Big Picture of Taking Your Investing Business

to the Next Level 34

The Seven Keys to Working Smarter, Not Harder 45

CHAPTER TWO Your Fast-Track Map™ to Real Estate Riches 51

The Three Biggest Pitfalls for Early Stage Level Two Investors 55

CHAPTER THREE Core Investor Skill One: Creating a Deal

Finding Machine 59

The Seven Clues to a Seller’s Real Motivation 62

The Two Clues to Great Financing 63

vii

The Eight Clues to a Great Property and Location 64

Seven More Techniques to Find Great Deals 66

Leveraged Strategies and Systems for Finding Motivated Sellers 68

The Mechanics of Tracking Your Marketing 71

CHAPTER FOUR Core Investor Skill Two: Structuring Highly

Profitable Win-Win Deals 75

The Three Most Important Terms Deal Acquisition Strategies 79

The Deal Structuring Wizard™—Two Simple Steps to Determine the

Right Way to Structure the Deal 82

21 Advanced Deal Structuring Strategies to Unstick Even the

Toughest of Deals 88

CHAPTER FIVE Core Investor Skill Three: Negotiating Magic—

Getting the Other Side to Say Yes 101

The Instant Offer System: A Simple Five-Step System for

Closing Deals 102

The Three Foundational Negotiating Strategies Every Investor

Must Know 103

14 Advanced Negotiating Secrets 110

Five Questions Your Real Estate Agent Will Ask That You Should

Never Answer 125

Three Questions to Ask Every Lender or Mortgage Broker You

Work With 129

CHAPTER SIX Core Investor Skill Four: Running the Numbers—

How to Know You’ve Got the Right Deal—Fast! 131

The Deal Evaluation Wizard ™ 135

The Ten Deadly Deal Analysis Disasters 140

CHAPTER SEVEN Core Investor Skill Five: Writing Up the Deal—

Understanding the Language of Real Estate 143

The Seven Essential Contract Basics 144

Protecting Yourself with Corporations and LLCs 149

viii CONTENTS

The Eight Key Contract Clauses When Buying an

Investment Property 151

The Ten Paperwork Pitfalls 157

Section II: MIDDLE STAGE LEVEL TWO INVESTING—

FINE-TUNING SKILLS AND LEVERAGING YOUR TIME

CHAPTER EIGHT First Steps to Building a Profitable

Investing Business 166

The Four Biggest Pitfalls for Middle Stage Level Two Investors 168

CHAPTER NINE How to Leverage Your Time as an Investor for

Maximum Profit 171

Leveraging Your Time as an Investor for Maximum Profit 174

23 Advanced Techniques to Leverage Yourself as an Investor 175

Section III: ADVANCED STAGE LEVEL TWO INVESTING—

BUILDING A PROFITABLE REAL ESTATE INVESTING BUSINESS

CHAPTER TEN The Key Perspective Shift That Will Make

You Wealthy 178

The Three Pitfalls of Advanced Stage Level Two Investors 180

What Stops Most Investors from Putting Their Investing Profits

on Autopilot 182

CHAPTER ELEVEN How to Build Business Systems That Work So

You Don’t Have To 187

The Seven Steps to Building Business Systems 189

The Five Key Areas of Your Investing Business 191

Taking Your Investing Business to the Next Level 196

Three More Core Investor Skills of Advanced Stage

Level Two Investors 197

CHAPTER TWELVE The Final Session of the Advanced Training 199

Contents ix

PART TWO

The Real World—12 Months

Building Your Investing Business

CHAPTER THIRTEEN Month 2—Tim Tests a Leveraged Deal

Finding Strategy 205

The Four Bottom Lines to Networking with Real Estate Offices 209

CHAPTER FOURTEEN Month 3—Vicki Feels the Pressure 211

The Three Keys to Protecting Yourself from a High-Pressure Closing 215

CHAPTER FIFTEEN Month 5—Mark Gets Coaching on How Best to

Leverage His Time 219

CHAPTER SIXTEEN Month 8—Leon and Mary Learn Tenant

Management Systems and Secrets 223

How to Make Sure You Get Paid Your Rent Each Month—On Time! 225

CHAPTER SEVENTEEN Month 12—Final Mastermind Meeting

on Their One-Year Investing Anniversary 229

PART THREE

Your Turn—Turning This Book into Cash Flow

CHAPTER EIGHTEEN Six Success Stories to Light Your Path 237

CHAPTER NINETEEN Creating Your Wealth Learning Map™ 243

CHAPTER TWENTY Closing Thoughts on Your Wealth Building 253

APPENDIX A The Investor Fast Track Program™—

Your FREE $2,495 Gift from the Author 257

APPENDIX B The Creating Cash Flow Series! 265

INDEX 267

ABOUT THE AUTHOR 273

x CONTENTS

FOREWORD

How Two Escapees from

Corporate America Built a Highly

Profitable Real Estate Business

(and How You Can, Too!)

Ican’t begin to tell you how proud and

excited I was when David asked me to share my story as the Foreword to this book.

You see, over the past five years David has been a very important friend and men-

tor to me and my wife Susan. In fact, David has been one of the most important

wealth mentors we’ve had and we’re living proof that the ideas and strategies con-

tained in the pages of this book work. They worked for my wife and me, and I

know that they will work for you, too.

When we first met David and Peter at a real estate workshop almost five years

ago, my wife Susan and I were trapped in the rat race of corporate America. Susan

was a CPA and I was a sales executive for a large corporation. Don’t get me

wrong—we were grateful for the comfortable living we were earning; but we felt

trapped all the same.

You see, Susan had always dreamed of balancing her career with the flexibil-

ity and freedom to be fully engaged and raise our kids. She wanted to volunteer at

the school, watch all the soccer games, and be home when they got home from

xi

school. And I—well, let’s just say I dreamed of having the time to be there to watch

my kids grow up, instead of being off working long hours for a large company.

So there we were, both working more than we wanted, and at the same time

wishing that we could spend more time at home, focused on our growing family.

That’s when we made the decision that for things to be different, we need to

make them different. So we took the plunge and joined David and Peter’s Mentor-

ship Program. And what a ride it has been!

The first year of our investing we completed 18 deals. While we made a

healthy profit from those deals, by far the greatest payoff was the learning we ac-

cumulated. By the end of our second year we had established profitable referral re-

lationships with several of the local banks, which to this day still continue to send

deals our way on bank-owned real estate that they want to sell quickly.

Over time our business developed into three areas. First, there is the foreclo-

sure business that we have created. This business is almost entirely systematized

right now, just like David teaches you how to do in this book. It generates an aver-

age of two to three houses a month that we buy and then fix up or flip. Our second

business is our rental portfolio of houses and small to medium-sized apartment

buildings. This is our freedom fund that generates a six-figure rental cash flow for

our family. And finally, there is the real estate development business that we have,

doing small to medium-sized developments in two states.

How did we accomplish all this in less than five years? Simple. We listened to

the best. And make no mistake about it, David is one of the best I’ve ever worked

with. When you master the strategies and techniques he has laid out in the pages

of this book you’ll literally propel your investing business to the next level. Over the

years I’ve read every book he has written and attended every course he has taught;

they have made me millions of dollars, and he can help you do the same thing.

But there is a catch here. You’re going to have to be the one putting in the

work turning the ideas in this book into cash in your bank account. No one can do

the work for you. All I can say is that I am so thankful that I listened and took ac-

tion. And I urge you to do the same. Read this book cover to cover. Devour it! Then

get out there and get to work. You can and will succeed, if you listen to the ideas

David so clearly lays out in the pages of this book.

S

TEPHEN WILKLOW

Past Mentorship Graduate and

Current Mentorship Coach

xii FOREWORD

ACKNOWLEDGMENTS

Creating real wealth is never a solo

job; it always requires the combined efforts of many people. I want to thank the

people who have made my life richer and fuller, and without whom the Creating

Cash Flow series would never have come to be.

First, I want to thank those people in my business life who have been instru-

mental in helping me to fulfill my mission to help generations of investors become

massively wealthy and to use that wealth to bless the world.

To the entire team at John Wiley & Sons, Inc. and Cape Cod Compositors—

you are great to work with, balancing your professional skill with a deep commit-

ment to produce meaningful projects that touch people’s lives. I am proud to be

associated with you.

To my Maui Mastermind friends and team: Diane, Scott, Amy, Monica, Gabe,

Meagan, Morgan, Aaron, Elizabeth, Michael, Beverly, Blake, the other Michael,

Stephen, Susan, and the very special Maui participants. You inspire me to be more

of who I truly am. Thank you.

Thank you to my friends at Mentor Financial Group (MFG): Peter, Paige,

Amy, Gayla, Beth, Dennis, Marilyn, Angela, Jeff, Christina, Kim, Laura, Alex,

Brian, Thomas, the other Thomas, Elizabeth, Deb, Bob, Lourdes, Larry, Aubrey,

Michelle, Stephen, Cheryl, Scott, John, Rob, Emily, and Nate. You will always be

family to me. My deepest appreciation also to all the clients and students of

MFG—past, present, and future. You have let me into your lives, and while you

may never know this, you have given me more than I can ever repay by taking ac-

tion and living the ideas in this book.

Thank you also to the other business friends who have contributed so much

over the years: Lee, Robert, J.P., Terry, Chris, the other Lee, Clay, Bill, Ann, the

other Bill, and Todd.

Finally, to those people who have made me truly wealthy—my friends and

xiii

family—thank you for your presence in my life: Heather, Alex, Laurie, Stacey,

Mom and Bill, Dad and Karen, my grandparents—Morey and Gerry, Arthur and

Jillian, Daniel, Miranda, Gail, Mark and Trish, Darcy, Eric and Luz, Karimjeet,

Jean and Phillip, Daryl and Dara, Margie, Martin, Jonathon and Kirsten, Gratia

and Bill, Lydia, Jillian, Ethan and Jen, Edson, Sharon, Grant and Jana, Nancy and

Ysa, Madeleine and Claira, Ted, and the list goes on.

xiv ACKNOWLEDGMENTS

INTRODUCTION

What if there was a way for you to cre-

ate $5,000 to $50,000 per month of real estate cash flow? And what if, instead of

having to work 40, 60, 80 hours each week to earn this money you could build your

investing business so that in five to seven years you could go passive in your invest-

ing and enjoy the cash flow without the day-to-day work? And finally, what if you

could do it in a way that would make your cash flow secure—so that no matter

what some bigwig at some large corporation decided, your income streams still

flowed to you month after month, year after year?

That probably seems impossible, or maybe too good to be true. But just for a

brief moment, imagine it were truly available to you.

How would it feel to know that you have the freedom to do what you want,

when you want, with whom you want, the way you want? Imagine you are in total

control of your financial life with a myriad of choices laid out before you each and

every day. The freedom can make you light-headed, giddy, perhaps a little dizzy!

Welcome, my friend, to the world of real estate investing. When done the

right way, investing in real estate can create for you an inflation-proof cash flow

that will take care of you and your family forever.

Before I begin, I want to make one thing abundantly clear—this is going to

take work. If you think you can just get started with your investing and wake up to-

morrow morning a multimillionaire, you need to think again. Using the ideas I am

going to share with you, working part-time, it may take you as long as 10 years to

build your real estate cash flow to the point where you can retire and live comfort-

ably on that cash flow for the rest of your life. If you are a full-time investor, it may

take you five to seven years to achieve this degree of financial freedom. But wouldn’t

it be worth it to work hard and smart for five to seven years and at the end of that

time be in a position to comfortably retire with your income stream secure? Think

about it. Most people spend 40-plus years working to build other people’s busi-

nesses, and in the end over 95 percent of them end up either dead or dead broke,

1

depending on the government or other people for their financial survival. These

aren’t my numbers, they’re the federal government’s! Does spending 40 years of

your life for a 5 percent chance of success seem like a good bet to you? It’s probably

clear to you where I stand on the matter!

Instead I suggest that you take a fraction of that same energy and effort and

redirect it into yourself—building your own investing business so that you can take

care of yourself and your family the way that, in your heart of hearts, you know

you deserve. The road will be harder than you ever imagined, but the rewards will

be sweeter than you could ever have anticipated. And the best thing of all is that

once you build your profitable investing business the right way, it’s a straightfor-

ward process to turn that business into a hands-off moneymaker for you.

That’s the real power of real estate—it’s a business in which an average person

can earn extraordinary income because of the nature of the business.

My Story

Indulge me for a moment, if you will, as I give you a quick snapshot of how I got

started with my investing and what I’ve been able to accomplish. You deserve to

know more about the person who will be mentoring you in building your investing

business. In fact, later in the book I talk about why you should never listen to

someone’s advice unless that person has what you want in the area of life that he or

she is talking about.

I started out as an athlete, training to play in the Olympics. My sport was field

hockey and I played on the United States National Team for about seven years. As I

was gearing up to play in the Olympics, I started having severe back pain and nerve

problems in my left leg. By the time the doctors and I finally figured out what was

going on over a year later, it was too late for me to play in the Olympics. (It turned

out that I had a small tumor—benign—in my hip, growing on my sciatic nerve.

The surgeon removed the tumor and I am fully healed, although too late to play in

the Olympics.)

As you can imagine, I was deeply saddened by that lost opportunity. But

out of the darkest of events equivalent or greater good fortune comes. In my

case it was in the form of my real estate mentor and business partner for many

years—Peter Conti.

2 THE REAL ESTATE FAST TRACK

When we met at a wealth workshop we were both attending, we hit it off

from the start. Peter had been very successful investing in Colorado, and he

wanted to start teaching investing to others. The problem was that while he was a

savvy investor, he wasn’t much for teaching. I, on the other hand, had supported

myself through my playing career by teaching and coaching. He had the real es-

tate know-how, and I had the ability to break skills down and teach them in a way

that transferred that knowledge fast. Within 12 months of working together I had

put together dozens of deals and was on my way to building a sizable real estate

portfolio of my own.

Over the years, I’ve built investing businesses that invested in single family

houses, condos, and apartment buildings. I’ve bought everything from small, one-

bedroom condos to huge apartment complexes.

But by far the biggest thing I have learned is exactly how to help new and sea-

soned investors alike make a ton more money with less time and effort. Over the

past decade, my clients have literally bought and sold over a billion dollars of real

estate. Again, I’m not sharing this to impress you, but rather to impress upon you

how doable real estate really is. I started out as a 26-year-old athlete, with no real

business experience and no knowledge of real estate, and within six years I was a

multimillionaire. If I can do it, you can too. In fact, it’s my belief that there is no

better vehicle for creating and enjoying your wealth than real estate. It is just such

a simple, yet powerful wealth-creating force that the average person can become

incredibly successful investing.

The Eight Major Business Success Factors

Real estate lets you automatically harness the eight biggest business success fac-

tors in a way to consistently produce big cash profits. Let’s look at all eight now.

Business Success Factor One: Leverage

Real estate lets you leverage yourself into the property using other people’s money.

Over the years that I have mentored several thousand students in launching their

investing businesses, my students typically have less than 5 percent of the value of

the property in the deal as their cash and over 95 percent of the funding coming

Introduction 3

from outside sources. That means they have a leverage multiplier of over twenty-

fold! The best part of real estate leverage is that you can use what’s called upside

leverage to get the benefits of the magnifying return of leverage without the down-

side risk that’s normally associated with it.

Business Success Factor Two: Appreciation

In very few businesses do the assets of that business appreciate in value year after

year. In fact, in most businesses, the capital assets depreciate every year—that is, go

down in value. Real estate is one of the few capital assets that a business can own

that goes up in value over time. What this means is that at the same time your real

estate business is generating cash flow month in and month out, the underlying as-

sets, the real estate itself, are going up in value and adding to your net worth.

Business Success Factor Three: Tax Savings

In almost no other business are your profits so potentially shielded from the

wealth-diminishing effects of taxes as they are when investing in real estate. The

government wants investors to provide housing and commercial real estate, and it

incentivizes them with powerful tax advantages that even the smallest of investors

can tap into.

Business Success Factor Four: Simple to Sell or Rent

The biggest challenge for most businesses is to find their customers. In fact, for

many businesses this is the single greatest challenge they’ll ever face—to establish

the customer base to generate the cash flow to support their business.

But with real estate, this is much easier. Take the case of an average rental

house that rents for $1,500 per month. When you find one renter for that house

who lives there for a year, your real estate business will generate $18,000 of gross

income from the rents that year. And what if you are able to keep that tenant hap-

pily living in that property for three years? That means that one tenant will gener-

ate $54,000 of gross income for your business. All that income from leasing out

one property!

Now multiply that by 10 houses and you have a simple part-time rental busi-

4 THE REAL ESTATE FAST TRACK

ness that generates $180,000 per year of gross income, or over $1.8 million of gross

income over 10 years. In very few other business can the average person generate

that type of sales volume without an expensive and highly skilled sales team. But

with real estate it’s a simple and straightforward process. Why? Because there is al-

ways a ready market for quality real estate. And this is true whether your goal is to

rent out a property, sell it to a retail buyer, or put a tenant buyer in your property

on a rent-to-own basis.

Or, if you prefer the route of buying low and selling high, in what other busi-

ness can you so easily make a $400,000 sale like selling a house? Or have highly

skilled sales agents fighting to get the rights to sell your house for you for such a

small sales commission? I think you get the idea.

Business Success Factor Five: Inflation-Proofed

By its very definition, inflation means that the purchasing power of a dollar is di-

minished because the cost for staples like food, shelter, and clothing has increased.

Built into the very formula by which inflation is measured is the assumption that

as the cost of living increases, with it goes the cost, whether it be sales price or

rental amount, of real estate. This means that as you build your cash flow–generat-

ing investing business, your profits are inflation hedged because your real estate

will rise with the tide of inflation. While over the short term this may not seem to

matter, over 20 to 30 years it will make a huge difference to your quality of life be-

cause your cash flow will have more than doubled as it keeps pace with inflation.

Plus, the underlying equity you have, which is a large component of your net

worth, will have also gone dramatically higher.

Business Success Factor Six: Forced Appreciation

One of the best things about real estate is that it exists in an imperfect market-

place. There is no absolute determiner of value because personal circumstances,

market conditions, and individual skill and expertise have a dramatic influence

on the price and terms with which you can acquire a property. This means you

can buy a $400,000 property for 30 to 40 percent below value, and the very mo-

ment you buy the property, because your circumstances are different, that prop-

erty is instantly worth $120,000 to $160,000 more! Remember, value does not

Introduction 5

exist independently of the owner’s context. This makes real estate one of the

fastest pathways to building great wealth.

When I look at all the ways my students have literally made hundreds of

millions of dollars, the simple truth is that forced appreciation was the single

most important profit generator for them in the early years of their investing.

Over time, the appreciation and cash flow from their portfolios outpaced forced

appreciation in importance, but never underestimate the power of personal cir-

cumstances and the specialized skills and knowledge you are acquiring to help you

make hundreds of thousands of dollars in the early years of your investing.

Business Success Factor Seven: Easy to Autopilot

Real estate is one of the easiest businesses to put on autopilot. By building your in-

vesting business the right way, you are able to transition out of the day-to-day over-

sight of your investing company, and into the passive role of a hands-off investor

who works a few hours a day or less overseeing his or her investing business.

Business Success Factor Eight: Cash Flow

By far the biggest benefit that the typical investor craves from real estate is the

cash flow it can generate because this cash flow means freedom. Freedom from

working for a boss or company that doesn’t value you. Freedom to be in control of

your own life.

There are essentially four types of real estate cash flow. First, there is the

monthly cash flow that is derived from the spread between the monthly income a

property generates and the monthly expense of owning it. This positive cash flow is

what most investors think of when they talk about real estate cash flow. But it is

only one of the four sources of income from a property.

Second, you have up-front cash flow that comes from the larger chunks of

up-front payments your buyers or tenant buyers pay you for the property. For ex-

ample, if you put a new tenant buyer in one of your homes on a rent-to-own basis*

6 THE REAL ESTATE FAST TRACK

*To gain immediate access to a FREE ebook on how to sell your property on a rent-to-own

basis, go to www.InvestorFasttrack.com.

and they give you a $10,000 nonrefundable option payment, this money in essence

is a form of up-front cash flow. In many ways this type of cash flow is even better

than monthly cash flow because you get it all up front instead of having to wait

every month for it. Another example of up-front cash flow is a student of mine who

found a motivated seller with a property he wanted to unload fast. My student

locked up the property using my standard “Agreement to Buy Real Estate” con-

tract, and within three weeks he had sold his contract (i.e., the right to buy that

property for such a discounted cash price) to another investor for $15,000 cash!

Not bad for a month’s work—part-time!

The third type of cash flow is re-fi cash flow, which comes when you refi-

nance a property that you own that has gone up in value, in order to tap into the

equity and pull out money from it. This type of cash flow is tax-free since it’s a

“loan” and not actual “profit”; still, it is spendable and investable. The key to intel-

ligently using this type of cash flow is to make sure the property still rents out com-

fortably for more than the real cost of maintaining it, which includes the new

mortgage payments from the refinance, so that you have a safety buffer built into

the deal in case the rental market cools. In my opinion, the very best reason to tap

into re-fi cash flow is to invest the money into another property. This way you get

the profits from two properties instead of only the one you had before!

And the final type of cash flow is the back-end cash flow that comes when

you resell a property. For example, I have many students who buy 6 to 12 new

properties every year, and sell 2 to 4 of their existing portfolio. They earn a few

thousand dollars a month or more from the monthly cash flow, but they earn an-

other $150,000 or more each year from the back-end cash flow they get from sell-

ing a few of their properties each year. One other benefit of this type of cash flow is

that this income is often taxed as long-term capital gain versus ordinary earned in-

come. This saves you about 60 percent on your tax bill! I strongly urge you to hang

on to all of your real estate that you can over the long term, but there is nothing

wrong with pruning your real estate portfolio and selling off some of your proper-

ties each year for cash flow, provided you are acquiring even more properties than

you are selling each year. In a way, this lets you upgrade your portfolio as you sell

off the trouble properties and keep the very best of the best over time.

If the other seven Business Success Factors form a solid foundation upon

which you can build your real estate fortune, then factor eight—cash flow—is the

fuel that you’ll need to reach your destination. Ultimately you will want your real

Introduction 7

estate business to generate all four types of real estate cash flow to fuel your jour-

ney on the Real Estate Fast Track.

The Three Investor Levels—

Your Proven Pathway to Real Estate Success

Over the years of working with thousands of investors I created a model to explain

the progression every investor must make on his or her path from launching an in-

vesting business to becoming financially free. I call this powerful model the Three

Investor Levels.

Level One

Level One investing is about belief. It’s about proving to yourself that not only

does real estate work for other people, but it works for you! How do you prove

this to yourself? By doing a few deals and making a significant profit. As a Level

One investor you have the certainty that real estate will be your proven path to fi-

nancial success. Yes, you know you still have a lot to learn, but you’ve seen for

yourself how lucrative and possible it really is. The key for Level One is getting

yourself into action.

Level Two

Level Two is all about mastering the five core skills of real estate investing and

building an investing business to support your real estate portfolio. At first Level

Two is about building your knowledge base of investing strategies, tools, and tech-

niques, but later it’s about building a real estate investing business.

Why is this so important for you? Because ultimately, if you don’t learn

how to leverage yourself through building a strong business infrastructure of

systems and people, you will be limited in two critical ways. First, you will be

limited in the scale of projects and profits you can earn. You just can’t do big

deals without the infrastructure there to make the deal stand. Second, unless

you build an investing business, you’ll be limited in your potential to create the

8 THE REAL ESTATE FAST TRACK

time and freedom you truly want. That’s why it’s so important to learn to build

an investing business.

In the end, it’s this investing business that will help you step into Level Three

investing and enjoy a Level Three lifestyle. While Level Two investors create

healthy cash flows for themselves and increase their net worth significantly every

year, they are still actively tied to their investing business. They are the heart and

engine that drives that investing business forward. Without them, their investing

businesses will fizzle and die.

Level Three

Level Three is about mastering the art of building an investing business that works

so you don’t have to. If Level Two investors are the heart, pumping the business

forward, Level Three investors are the brain, directing the big picture of the busi-

ness and enjoying the consistent profits from that business, without getting caught

up in any of the day-to-day activities for the business. Imagine having built your

real estate mini empire in such a way that you earn massive income without hav-

ing to be involved in the day-to-day oversight of the business. Level Three investors

earn at least as much as Level Two investors, but they do it passively. This means

Level Three investors work less than 10 hours per month. Their property portfolio

and real estate business works without them needing to be there to run things.

Level Three investors know how to do big real estate deals on commercial real

estate, how to convert excess cash into passive streams of income through joint

venturing and lending, and how to build a stand-alone business to support their

real estate empire in a way that creates time freedom.

The bottom line is that Level Three investors have learned to put their in-

vesting on autopilot so they don’t just make money, but they create passive

streams of income.

In the beginning, you’ll have to front-load your effort as you develop as an in-

vestor. It will take you hundreds of units of effort to succeed as a Level One in-

vestor and get your first few paydays. Later, as a Level Two investor, it will take you

10 to 20 units of effort to get your paydays. And finally, as a Level Three investor, it

may only take one or two units of effort to enjoy a lifetime of paydays. But you’ve

got to pay your dues at the start.

Introduction 9

The Unvarnished Truth about Creating a $5,000

to $50,000 per Month Real Estate Cash Flow

Imagine what it would mean for you if you were able to build your investing busi-

ness to the point where it generated $5,000 to $50,000 per month, every month.

Now take it one step further. What if it only took you 20 hours or less per week to

run your investing business? How would it impact your family now that you have

this freedom and control over your time? What would you be able to do with your

time now that you have the security of knowing that each month $5,000 to $50,000

of cash flow will be streaming into your bank account—month after month, year

after year, decade after decade?

Let’s be candid here, the average investor never reaches this degree of free-

dom. The average real estate investor gets wealthy very slowly, and over 30 or 40

years creates a large net worth. They do this by buying 5 or 10 rental properties

that they care for and nurture over their lifetime, and in the end these rental prop-

erties are their retirement security. This is a solid plan, and it works for hundreds

of thousands of mom-and-pop investors around the world.

But what if you don’t want to wait 30 years or longer? What if you want it to

happen faster?

Accelerating the Process—Building Wealth

So just how fast can you make it happen? How long will it take you to reach your

real estate dreams? Well, years back when Peter first got started with his investing

he didn’t know anything about real estate. In fact, he started out as an auto me-

chanic because that’s what he had always been good at. He came from a family of

seven kids, and he was the one who was expected to struggle all his life. For many

years he lived up to this expectation. Yet even during those times there was a part

of him that hungered for something more.

All the time he was working for five dollars an hour as a mechanic, he paid

close attention and studied what wealthy people were doing. Again and again he

watched how so many of those who had started out with nothing had been able to

create great wealth investing in real estate.

Sometimes you need to hit rock bottom before you decide to make a change.

Fast

10 THE REAL ESTATE FAST TRACK

For Peter this day came when he was working in an auto repair shop. It was win-

tertime and the owner was trying to save money by turning off the heat in the

garage. It was so cold that his fingers were turning numb as he worked on the cars

lined up around him.

He saw the shop owner walk out of the heated office with a steaming mug of

coffee. It looked so good he rummaged through his tool box for his mug and went

into the office to pour himself a cup, more to wrap his hands around for warmth

than anything really.

Just as he was walking out of the office to go back to work, the owner stopped

him and said, “Peter! That coffee is for customers only!” As you can imagine, Peter

felt about two inches tall as he turned and went back to work. It was at that mo-

ment, right then, that he made the decision that he would take the leap and start

his investing. He vowed that never again would he or his family be financially de-

pendent on anyone else. He would create the financial freedom to take care of his

family and live the life he always knew waited for him.

I wish I could tell you that it was easy, that he made his millions overnight.

But he didn’t. It was plain hard work. Back when Peter got started, there weren’t

any structured Mentorship Programs he could join to take him by the hand and

show him exactly how to do his investing. He had to figure most of it out by him-

self. He did invest heavily on home study courses and real estate workshops—to

the tune of over $20,000 his first few years in the business—but he said that since

he never went to college, he just called that “tuition” for his “Real Estate Degree.”

And after all, he did earn it all back in his very first year of investing, on his first

two real estate deals. Isn’t that the way all education should be, paying for itself in

12 months or less?

His next real hurdle came as his real estate portfolio grew so big that he was

completely wrapped up in managing it. In fact, at its peak he was so busy dealing

with tenants and toilets that he went for a two-year stretch without picking up

even one more property. You see, he hadn’t learned the difference between being a

real estate investor and building a real estate investing business. He was stuck at

that point in his life in the landlord trap of tenants and toilets, struggling to keep

his head above water. Yes, he was making a lot of money, but he had to work long

hours to keep the properties going.

In the end it took Peter close to 10 years to figure out how to build a real es-

tate investing business that worked hard so he didn’t have to, which allowed him to

Introduction 11

enjoy Level Three success. It’s pretty remarkable that he was able to do it at all,

since no one knew how to teach him this progression. Sure, there were plenty of

people teaching techniques for structuring deals or finding motivated sellers, but

no one who could show him how to structure his investing business so it worked

better without him in it. He had to figure this out all on his own.

Now I on the other hand had it much easier. Not because I was smarter or

had a background in real estate, neither of which was the case. Remember, I was

the ex-jock who had to give up on my dreams of playing in the Olympics because of

a serious injury. I started with no money, no credit, and no business experience of

any real kind. Heck, when I met Peter I was living in the attic of a converted garage

because that was all I could afford!

But I did have one powerful factor in my favor. When I first started learning

how to invest, I had Peter as my personal mentor. In essence, I was Peter’s first

Mentorship student and I got the benefit of Peter’s years of experience. It only took

me five years to reach Level Three success with my investing. What was the differ-

ence? I had Peter as my mentor and reached Level Three 100 percent faster!

Over the past decade of mentoring new investors to succeed building a prof-

itable real estate business, we’ve gotten better and better with every generation of

students we trained. We’ve had students blaze through the program and reach

Level Three success in less than three years (the current record is 22 months), al-

though the average time it takes for most Level Three students to get there is closer

to five to seven years.

So how long will it take you? The answer depends on you. Are you going to

listen and follow my instructions? Are you going to get yourself to work consis-

tently to build your investing business, even when you hit moments of frustration

where you just want to throw in the towel? Then I think you can do it in five years

or less. I believe this is truly possible for you. But let’s get real here. What if it took

you twice as long? Wouldn’t it be worth investing 10 years to create financial free-

dom for yourself and your family for the rest of your lives? Most people work at

jobs for over 40 years and never reach financial freedom. I’ve never had a student

who stayed the course who didn’t succeed in a quarter of that time! And most did it

much faster than that.

That’s exactly what this book is going to help you do—to get on the Real Es-

tate Fast Track to building a profitable investing business so that you can create a

$5,000 to $50,000 per month real estate cash flow, and do it in five years or less.

12 THE REAL ESTATE FAST TRACK

The road won’t always be easy. If it was, then it would be congested and you’d

get stuck in the traffic jam of the scared and lazy masses. At times it will seem like

the slope is just too steep and the surface just too rocky. But if you persevere, and

listen to the coaching and guidance of those who have traveled that road already, I

guarantee you can make it to the end. And I know the end is completely worth it

for you. Remember, I’ve made the journey myself and have helped thousands of

clients do it too.

In fact, for the first time ever I’ll be sharing my advanced real estate business

building system with the masses. Normally clients pay me tens of thousands of dol-

lars for this information, and they consistently tell me it was worth every penny. And

why not? They’ve turned the information I’m about to share with you in this book

into a cash flow–creating investing business that yields them and their families hun-

dreds of thousands of dollars every year! And you can do the same thing yourself.

This means you won’t have the guesswork and months of wasted effort of

struggling to figure out the big picture of how to build your investing business.

You’ll be empowered with technique after technique, strategy after strategy, short-

cut after shortcut, to help you build your real estate cash flow as fast as possible.

In essence, the Real Estate Fast Track will allow you to tap into the two most

powerful wealth-creation forces on this planet—OPE and OPS.

Tapping into the Power of OPE—

Other People’s Experiences

OPE stands for “other people’s experiences.” I want to be clear here that the experi-

ences that matter most to you are those of people who have built what you want to

build and who enjoy what you want to enjoy. You need to make sure that the peo-

ple you listen to concerning real estate investing have done it themselves.

The simple test is to ask yourself, has this person successfully done what I

want to do in the area they are advising me in? If they have, then and only then do

they have something of value to share with you.

And when you find these people—hang on their every word! Their wisdom is

more precious than gold because it will save you years of effort and struggle. Re-

member how I was able to succeed in my investing in half the time that Peter did,

because he was my mentor? That’s the power of tapping into OPE.

Introduction 13

Leveraging OPS—Other People’s Systems

The second great wealth accelerator is OPS—other people’s systems. A system is

simply an organized process that you can apply to generate consistent results in a

specific area of your investing business. Build the right systems for your investing

business, and not only will you make a fortune, but you’ll be able to free yourself

from the day-to-day operation of your investing business. Learn the right systems

from other people, and you’ll save years of effort and struggle.

In this book you’ll learn all kinds of real estate systems to successfully build

your profitable investing business from the start. In addition, you’ll learn the mas-

ter system of building business systems that autopilot specific parts of your invest-

ing business so that they consistently generate excellent results. In truth, you are

leveraging your investing by letting me hand you all these powerful business sys-

tems upon which to build your profitable investing business. That’s how you’ll be

able to build your investing business to generate a $5,000 to $50,000 real estate

cash flow so quickly.

By tapping into OPE and OPS, you will quickly earn the financial freedom

and security you’ve always dreamed of having. What’s more, right from the start

you’ll know that you’re on the right track—the fast track—to creating wealth.

So what exactly is this “Real Estate Fast Track” we keep talking about?

The Real Estate Fast Track is the proven path that leads new investors

from their beginning at the start of Level One, and takes them all the way to

Level Three success. It’s what I’ve been helping investors do for years, and now

it’s your turn. Are you ready to make this journey?

I’ll be giving you a detailed road map of where your investing business will

need to go, both in the beginning and as you grow it, so that you have a clear and

accurate picture of the end towards which you are working, and the milestones

and markers along the way.

Not only will you get the Fast Track Map™, but you’ll also get to watch six

“Early Stage Level Two” investors work to follow that map in the real world as they

apply the very same strategies, techniques, and lessons you’ll be learning in this

book to reach Level Three success.

You’ll see where they get stuck so you can safely sidestep those pitfalls. And

you’ll learn how they troubleshoot problems as they come up, to make your profits

and success assured.

14 THE REAL ESTATE FAST TRACK

The Series

This book is the second in the three-book Creating Cash Flow series. This series is de-

signed to teach you everything you need to know, not just to make money investing in

real estate—that part is easy—but to put your investing business on autopilot and cre-

ate passive cash flow so that you can enjoy the freedom and lifestyle of a truly wealthy

investor. This progression of residualizing your real estate income is one that most in-

vestors miss. They never learn how to take themselves out of the “doing” and, as a

consequence, they are always working hard to care for and manage their real estate

portfolio. Hence they either fall into the landlord trap of tenants and toilets, or they

are constantly scrambling to find their next great deal so that they can sell it for a fast

profit. Or they give up all together, saying real estate takes just too much work.

What they don’t know, in fact aren’t even aware is possible, is that there’s a

better way. There is a way to invest in real estate so that over the course of several

years you build your investing business into an independent entity that can not

only look after itself but, better still, can produce consistent cash flow and equity

buildup—month after month, year after year. That’s what the Creating Cash Flow

series will be teaching you. This three-book series will take you through each of the

three levels of investing success.

In the first book of the Creating Cash Flow series, Buying Real Estate without

Cash or Credit, you learned everything you needed to know to get started investing

and do your first deal in 90 days or less.

Here in book two, you’ll learn how to build a $5,000 to $50,000 per month

cash flow as you succeed as a Level Two investor. You’ll learn how to master the

five core investor skills:

1. Marketing—Finding great deals in any market.

2. Structuring—How to structure win-win real estate deals.

3. Negotiation—How to get the other party to say yes to the deal you want.

4. Analysis—How to determine if a deal is good in five minutes or less.

5. Contracts—How to write up moneymaking real estate deals.

Plus you’ll learn how to build a profitable investing business that consistently

grows your profits and free time.

Creating Cash Flow

Introduction 15

Read the Series in Any Order—Each Book Stands Alone

Now you may be wondering whether you need to read the series in order. You

don’t. Each of these books has been carefully designed to stand on its own. I do

recommend that you ultimately read all three books because the strategies and

techniques they share complement each other, but you can do it in any order.

Quick Overview of the Creating Cash Flow Series

Book One: Buying Real Estate without Cash or Credit

Focus: On giving beginning investors the critical information they

need to get started making money investing in real estate in the next 60 to 90

days. The book takes you by the hand and shows you step-by-step, action-by-

action, strategy-by-strategy the fastest way for you to successfully get started

with your investing.

Investor Level: Primarily for Level One investors who are just getting started

with their investing, it’s also designed for Level Two and Three investors who

want to cherry-pick powerful investing strategies and techniques to

immediately put to work in their investing businesses.

Book Two: The Real Estate Fast Track: How to Create a $5,000 to $50,000

per Month Real Estate Cash Flow

Focus: On giving you a clear, proven pathway from where you are to Level

Three success as an investor. You’ll learn the five core investor skills and how

to leverage yourself to make more money with your investing with less time

and effort. You’ll also learn about the difference between merely being a real

estate investor and building a successful real estate investing business. You’ll

also get the clear action steps you need to take to build your own profitable

investing business.

Investor Level: Designed for all three investor levels. Level One investors will

learn more strategies and techniques to help them get started with their

investing. Level Two investors will get the all important Fast Track Map™ to

follow to enjoy the real success they are after. And finally, Level Three

investors will again get powerful concepts and techniques that they can pick

and choose from to immediately upgrade their already thriving investing

businesses.

16 THE REAL ESTATE FAST TRACK

(continued)

S

U

M

M

A

R

Y

Quick Overview of the Creating Cash Flow Series (continued)

Book Three: Advance Secrets to Building Your Real Estate Cash Flow

Focus: To show you how to put your investing business on autopilot and create

passive cash flow so that you can enjoy the freedom and lifestyle of a truly

wealthy investor. This book is designed to help you take that final step up into

Level Three success where you transition yourself out of the day-to-day

operation of your real estate business so that you can truly enjoy the freedom

and security you have worked so hard to earn. The book will focus on how you

can take your new time and freedom and invest it in larger deals on

commercial real estate, and how to take the profits your real estate is

generating and convert them into passive streams of income.

Investor Level: While Level Two and Level Three investors will get the most

from the solid how-to part of the book, Level One investors may get even more

from the book as it inspires them with exactly what is possible and clearly lays

out the end toward which they are working, in vivid and totally practical detail.

A Brief Review of

For those of you who have already read Buying Real Estate without Cash or Credit,

use the following review to remind yourself of some of the key lessons of that book.

For those of you who are starting the Creating Cash Flow series with this book, The

Real Estate Fast Track, you can use this review as a summary of the critical lessons

you will learn later when you eventually read it.

The 16 Key Concepts from

Key Concept 1: The Paradox of Playing It Safe

In today’s world of a globalized economy and rapidly changing business environ-

ment, the most dangerous thing you can do is to “play it safe.” Playing it safe is

tantamount to choosing known failure. Instead, if you want things to be different

or Credit

Buying Real Estate without Cash

Estate without Cash or Credit

Buying Real

Introduction 17

Buying Real

for you and your family, you are the one who is going to have to make it different.

The days of depending on a benign corporation or government to take care of you

are over. That’s why real estate investing is so exciting. It gives you a simple vehicle

to build financial security and freedom for yourself. But to take advantage of this

financial vehicle, you’ve got to take some calculated risks. Considering that your al-

ternative is known failure, the odds when you take that leap are considerably in

your favor!

The thing that scares most people back into playing it safe is information

overload. When people get confused they tend to freeze, just like a deer in the

headlights of an 18-wheeler! That’s why Buying Real Estate without Cash or Credit

was all about cutting through the blizzard of data and leaving you with the essen-

tial core you needed to know to get started with your investing and successfully

complete your first deal in 90 days or less.

Key Concept 2: The Foundation of All Winning Real Estate Deals

Every profitable real estate deal has as its foundation a motivated seller. One of the

best parts of real estate is that it exists in an imperfect market where personal cir-

cumstances dramatically affect the value of any piece of property at any given mo-

ment. One owner with a specific circumstance may value a property at $400,000;

another owner with that same property but a different set of circumstances may

value it at $500,000.

This is important to you because as a real estate investor you are getting paid

to bring value to the table, and one of the biggest ways you create value is by solv-

ing a motivated seller’s real estate problems. You build value into the deal on your

side by helping the seller deal with challenging times, and you earn a fair and

healthy profit to the degree you are able to accomplish this. The key is that all

great real estate deals start with a motivated seller. Which brings us to the next

key concept.

Key Concept 3: The Winning Deal Formula

The general wisdom that real estate is all about location, location, location is flat

out wrong. In the real world of investing, real estate is first and foremost about the

motivation of the seller; secondly, it’s about the price and terms with which you

can acquire a property; and then and only then about the location of the property.

18 THE REAL ESTATE FAST TRACK

In fact, the Winning Deal Formula goes on to define the exact proportion of these

three key ingredients for all winning real estate deals.

■ Sixty percent of the deal is dependent on the seller’s motivation.

■ Thirty percent of the deal is dependent on the financing.

■ Ten percent of the deal is dependent on the location and property itself.

When you really let this key lesson sink in it changes the way you structure

your investing business. No longer do you look for the perfect property in the per-

fect location. Instead, you focus your early efforts on finding motivated sellers, the

more the better—which brings us to the next key concept.

Key Concept 4: How to Find Motivated Sellers Over the Phone in Two Minutes

or Less

Once you understand how every profitable deal starts with finding a motivated

seller, the next critical lesson is how exactly to find and qualify sellers over the tele-

phone. This is where the “Quick Check Scripts” came into play. These simple

scripts showed you exactly what to say and, more importantly, how to say it, so

that you could easily qualify any seller over the telephone in two minutes or less.

You also learned about how to preempt the two most common objections

when talking with sellers over the phone, and how to avoid the three most com-

mon mistakes new investors make when dialing for deals.

The bottom line is that, used properly, the telephone is one of your most pow-

erful deal-finding tools available. And since nearly every method you have to gener-

ate leads will ultimately require you to talk with the seller over the phone, to

qualify them as to their motivation and situation, the faster you can get fluent with

this critical investor skill the better.

Key Concept 5: The Five Fastest Ways to Find Your First (or Next) Deal

While there are literally over 100 different marketing techniques to find motivated

sellers and profitable real estate deals, there are five that are the most important

for you to test out first.

1. Do your dials. Outbound calls you make to “for sale” and “for rent”

classified ads in your local paper are the first and most important early

Introduction 19

technique for finding motivated sellers. Not only is this the fastest way

to get lots of practice talking with owners of properties, but it is also

one of the cheapest ways!

2. Place your “I Buy Houses” classified ad. Getting sellers to call you who

are more strongly motivated is one of the keys to a sustainable, successful

real estate investing business. Classified advertising in papers that sellers

are likely to look at works wonders. This is a way to leverage the money

for the ad to save you time finding deals. With one phone call you can have

your ad out there 24/7, finding you deals.

3. Put out your “I Buy Houses” signs. Dollar for dollar, your tacky, ugly “I

Buy Houses” signs are one of the best lead sources you can get working for

you. Make sure you check with local ordinances in your area regulating

their use, but seriously consider adding them to your marketing mix. I

suggest a minimum of 50 signs per week on a regular and consistent basis.

4. Test direct mail. Once you’ve had some practice talking with sellers on

the phone and have met with at least 10 sellers, test two simple direct mail

campaigns to generate leads of motivated sellers. The first is a postcard

campaign to out-of-town owners. The second is a postcard campaign to

landlords.

5. Spread the word that you have started to invest in real estate and

generate referral business. The easiest form of leverage to find great

deals is to get other people who you know or meet to help you find deals.

Your referral network is a critical piece of your long-term investment suc-

cess. I have found my best deals from referrals. The only question is

whether you will have the courage and discipline to consistently build

your referral network.

Key Concept 6: The Big Picture of Structuring Real Estate Deals—

The Winning Deal Decision Tree

There are two main ways to buy a property and make a conservative profit. Either

you buy the property for cash at a deeply discounted price, or you buy the property

with attractive terms of financing that allow you to make your profit due to the

great financing with which you acquired the property.

20 THE REAL ESTATE FAST TRACK

Key Concept 7: The Cash Price Formula

When you are buying for cash, the reason for the big discount is that as an investor

your cash is a valuable commodity—one that most sellers want. It is also a limited

commodity. Once it’s committed by being invested in real estate, you lose out on

the ability to quickly access it to purchase your next screaming good deal. Because

of this, you need to always value your cash highly and use it to maximum effect.

This means if a seller requires an all-cash purchase, you require a deep cash dis-

count to move ahead with the deal.

When you are buying for cash, never pay more than 70 percent of the as-is

value, and you’ll be taking one of the most important steps to guarantee yourself a

profit in your real estate deals. This is known as the Cash Price Formula.

So if you have a house that, if it were in great showing condition, would sell

for $450,000 but conservatively needs about $50,000 of repairs to get it in that con-

dition, then the as-is value of that house is $400,000. As long as the maximum you

pay for that property is $280,000, with less being your goal, you’ll conservatively

come out of the deal with a fair profit.

Key Concept 8: The Three Most Important Terms Acquisition Strategies

In Buying Real Estate without Cash or Credit, you learned about all three of the

most important Terms Acquisition Strategies: lease options, buying subject to the

existing financing, and using owner-carry financing.

A lease option is when you lease out a motivated seller’s property with a set

purchase price at which you have the option of buying during the term of your

lease agreement. Typically, the longer the period you lock in your option to pur-

chase the property, the more money you’ll end up making when you eventually re-

sell or refinance the property.

Buying a property subject to the existing financing means you buy the

property and leave the old seller’s loan in place, secured as a mortgage against the

property. You own the property, but your ownership claim is “subject to” the exist-

ing loan(s) in place. Since you are not formally assuming the underlying financing

you technically have no liability on the loan, but as an ethical investor you are re-

sponsible to make sure that the mortgage payment gets paid each month. You usu-

ally accomplish this by renting the property (as a simple rental or a rent-to-own)

for an amount greater than your monthly costs to maintain the property.

Introduction 21

Owner-carry financing means that the seller you are buying from takes

a significant portion of the money you owe in back in the form of a seller

loan. You can structure this seller carryback with monthly interest payments, or

with all the interest accruing for you to pay as a lump-sum payment due down

the road.

Key Concept 9: The Six Best Sources to Fund Your Deals

1. The Seller. Any terms deal that you negotiate with the seller, whether it be

a lease option, a subject-to deal, or an owner-carry deal, is in essence the

seller funding part or all of the deal. The seller can lend you some or all of

his equity, or the seller can let you tap into the existing financing against

the property by accepting monthly payments from you. Either way, it is

still really the seller funding your deal.

2. The Buyer. There are two main types of buyers who can help fund your

deal. The first is a retail buyer—someone who wants to buy the property

so that he or she can move in and live there. A retail buyer can fund the

deal using their cash in the form of a down payment or option payment,

their credit in the form of a new bank loan, or a combination of the two.

The second type of buyer who can help fund your deal is another in-

vestor—also known as a wholesale buyer. You can quickly “flip”—that is,

sell—your deal to another investor for a fast cash profit, and let this other

investor use his or her money to fund the deal.

3. Private Money. After you have gotten a bit more experienced with your

deals, you’ll start to meet people who are willing to lend you money for

your deals as long as they can have the loan secured by a first mortgage

on the property. Often these private lenders are average people who pre-

fer to earn market interest rates for a first mortgage versus the poor earn-

ings of a CD at their local bank. The key for a private lender is that the

loan be safe.

4. Your Cash or Credit. While I don’t recommend you use your money to

buy a property unless the first three sources of funds don’t work for you, if

the deal is a good one, and if you have the money, or if you have the credit

to get easy access to conventional financing, then funding a deal yourself

makes good sense.

22 THE REAL ESTATE FAST TRACK

5. Hard Money. Hard money comes from a third party lender, but whereas a

private money lender only wants market rates, a hard money lender is an

experienced investor who is willing to lend to you not based on your cred-

itworthiness or character, but based on the security of the loan. The main

difference between a hard money lender and a private money lender is in

the rate of interest and fees charged.

6. Equity Money Partner. Sometimes you turn to a private party to provide

the funding to make a deal work. When this person requires a share of the

deal rather than a rate of return, you have an equity partner. An equity

partner can put her own money into the deal, or she can agree to get a

conventional loan in her name to fund the deal.

Key Concept 10: The Five Most Important Exit Strategies

Once you’ve bought the property, what is it you plan to do with it to make a profit?

There are five main Exit Strategies you can tap into.

1. “Retail” the property. This means that you will sell the property for the

highest price you can on the retail market. This is how most homes are

sold, whether they are listed with a real estate agent or sold for sale by

owner. When you retail a property, your buyer borrows from a conven-

tional lender and almost always moves into the property to live there.

2. “Flip” the deal.* This is a fast-cash exit strategy where you lock up a

property under contract and then sell your contract to another buyer, typ-

ically another investor, who will pay you a cash fee to assign your con-

tract to them. The biggest benefit of flipping a deal is that it generates

instant cash.

3. Lease the property to a traditional renter. This is perhaps one of the

most common exit strategies of average investors. They buy a house and

put a traditional renter in it. This renter leases the property either on a

month-by-month rental agreement or a longer-term lease (typically for

one year).

Introduction 23

*To download the FREE ebook, Three Simple Steps to Flip a Deal for Fast Cash Profits, go to

www.InvestorFasttrack.com.

4. Offer the property on a “rent-to-own” basis. The rent-to-own exit strat-

egy comes extremely close to doing the impossible—it gives you all the

benefits of a traditional rental property, while minimizing the three major

downsides. The way this strategy works is that you find a tenant buyer

who wants to rent-to-own your property. This tenant buyer will lease your

property on a two- or three-year lease with a separate option agreement

that gives them a locked-in price at which they can buy the home at any

point over that two- or three-year term. As part of agreeing to give them

this fixed “option to purchase” price, your tenant buyer will pay you a non-

refundable option payment of 3 to 5 percent of the price of the property. In

many cases your tenant buyer will also be paying slightly higher than the

market rent because they aren’t just renting the property, they are renting

to own. This increased rent, when added to the option payment you collect

up front, really boosts your cash flow on the property. The best thing

about a tenant buyer isn’t this increased cash flow, in my opinion. To me,

the best part is that since you have an occupant with an owner mentality,

not a renter mentality, your tenant buyer will treat the property with much

more care and attention. I even get my tenant buyers to take care of all the

day-to-day maintenance and upkeep of the property!*

5. Sell with owner financing. This means that as a seller you take back some

or all of the purchase price as a loan that your buyer will pay you over time.

Key Concept 11: A Simple Five-Step System to Negotiate Any Real Estate Deal

This is where you learned the negotiating system called the Instant Offer Sys-

tem, which gave you the structure and scripting to effectively negotiate any real

estate deal.

Key Concept 12: The Three Investor Levels

This breakthrough model outlined the road all investors must travel to be success-

ful. In Buying Real Estate without Cash or Credit, I focused on how this unique in-

vestor map impacts Level One—beginning—investors.

24 THE REAL ESTATE FAST TRACK

*To download the FREE ebook, Seven Simple Steps to Sell Your Property on a Rent to Own

Basis, go to www.InvestorFasttrack.com.

Key Concept 13: How to Mastermind with Other Investors to Guarantee Success

Over time, investors who have the whole-hearted support and encouragement of a

core group of other investors will succeed at levels that far outpace the average in-

vestor. In the book you got to watch six beginning investors run two of their mas-

termind meetings, and you also got a step-by-step action plan for how you can use

the same idea in your investor circle to tap into the skills, contacts, and resources

of other investors.

Key Concept 14: The Real Difference between Speculators and Investors

Speculators are people who buy real estate at close to or even at full price as part

of a cash deal, and then they hope-pray-gamble that the market will rapidly appre-

ciate so they can resell the property at a profit. They are totally dependent on out-

side market conditions to produce a profit.

For example, a speculator might buy a $500,000 house as a cash deal for

$475,000 in a hot market, hoping that if the market stays hot the house will rapidly

appreciate and in one year he’ll be able to resell the house for $600,000 or more.

But what if the market cools off? The speculator always runs the risk of getting

stuck with a property that is a dog.

Investors are smarter than that. When they buy a property they do so know-

ing that they are guaranteed to make a profit because of the way they purchased it.

Either they have gotten great terms that make the property cash flow well, or they

have negotiated a discounted cash price that ensures a profit when they resell. The

key distinction is that speculators gamble on outside forces to create a profit

for themselves, while investors negotiate the price or terms they need to

build their profit in from day one—no matter what the market does in the

short run.

Key Concept 15: How to Successfully Launch Your Investing Business in the

Real World

It’s one thing to learn all the fancy ideas in books and at workshops, but it’s quite

another to actually take the ideas and put them into practice in the real world.

Many times the situations in the seminar seem to be unrecognizable when you

work to implement the ideas in the real world. That’s why the entire second half of

the book was focused on the efforts of six beginning investors who were struggling

Introduction 25

to apply exactly what you learned in the first half of the book in the real world of

their day-to-day investing. Sometimes the most important thing is not so much the

raw technique or information, but rather the exact way you are supposed to trans-

late that information into the world of your investing. Which leads us to the final

key lesson from Buying Real Estate without Cash or Credit.

Key Concept 16: Your 90-Day Action Plan

It’s not enough to just sit back and read. You need a game plan to turn that infor-

mation into tangible profit in your bank account! That’s why I shared with you the

detailed eight-step action plan to launch your investing business in 90 days.

1. Log onto the powerful online business planning tool. We offered this

valuable bonus to all readers of Buying Real Estate without Cash or Credit

to help them translate the ideas in the book into cash in their pockets.

2. Connect with your “burning why.” What are your driving motives to

make your investing work no matter what?

3. Clarify your dreams and goals. This was the simple three-step process to

gain total clarity about your investing goals.

4. Take stock of your starting point. This was the 19-question survey that

was strategically designed to help you identify your real estate strengths to

build from, and to uncover your real estate weaknesses so that you can

overcome them. This way you know exactly where to focus your energy

for maximum success.

5. Identify the specific obstacles standing in your way. You learned

which of the six investor obstacles were most impacting your investing

success.

6. Create and commit to your action plan. This is the key step to trans-

late intangible goals into a concrete game plan to help you achieve your

dreams. We ended this step with the three key action commitments all

successful real estate investors must make when they are first getting

started.